Rethinking the Product Development Process to Fuel Insurers’ Growth

By Paul Ricard and Chris Whitney

Product Matters!, August 2021

Insurers spend an average of 90-days to re-price products and upwards of one-year to create new ones[1] and are struggling to keep pace with rapidly changing economic conditions, customer needs and regulation. We at Oliver Wyman believe there is an opportunity for many insurers to generate more customer value and fuel their growth by rethinking their approach to Product Development.

To that end, we have recently engaged with Product Development teams at several leading companies (both within and outside of Insurance), tapped into our extensive knowledge base and leveraged our CustomerFirst playbook[2] to better understand the core Product Development challenges faced by insurers today, and identify opportunities to address them. This article contains a few highlights from this effort.

An Industry Canvas: Approaches to Product Development

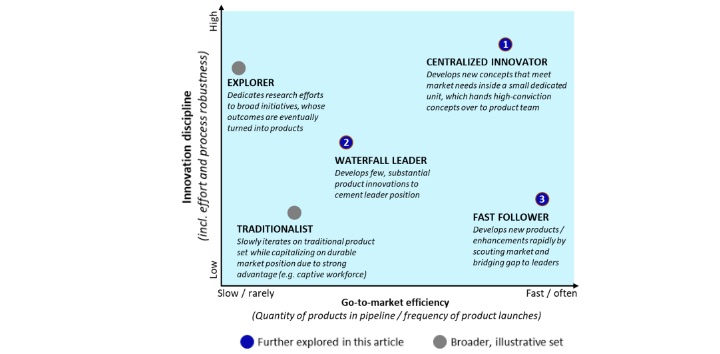

We have observed a range of Product Development approaches, which we abstracted into archetypes with varying degrees of innovation discipline and go-to-market efficiency (see Figure 1). These archetypes reflect different philosophies and overall objectives.

Figure 1

Product Development Archetypes as Observed Within and Outside of the Insurance Industry (non-exhaustive)

The archetypes were selected to provide a range of practices and are representative of those we observed in the insurance industry.

-

Centralized Innovator

A centralized innovator develops new concepts that meet market needs inside a small dedicated unit and hands concepts over to the product team for development.

Innovation consumes a large amount of time, with a dedicated team responsible for the creation and initial vetting of new product ideas. This dedicated innovation (or product design) team tends toward a flexible yet well governed approach, with clearly defined criteria for promoting new ideas to development. It uses a set of metrics around obtaining concrete customer feedback (end-consumer, advisor or other) and alignment with internal stakeholders (e.g., to inform “go vs. no-go” decisions).

Product Development consumes less time, as ideas are well formed and field-pressure-tested by the time they are promoted to development. The Product Development team follows a systematic approach, which primarily consists of iterative testing to finalize the ideas created by the innovation team.

-

Waterfall Leader

A waterfall leader develops few, substantial product innovations to cement a previously formed market leader position.

Innovation consumes a smaller amount of the team’s time compared to the prior archetype, as the focus is on high-premium potential opportunities which primarily take the form of enhancements to well established product offerings that have a clearly defined and understood value proposition.

Product Development consumes more time, as a robust ‘tried-and-true’ process is employed, that is governed to balance the needs of various stakeholders (e.g., distribution, finance, underwriting). The Product Development team will typically produce several “built-out” variations of new products to allow the stakeholders to determine which version best meets their differing objectives.

-

Fast Follower

A fast follower develops new products or enhancements to existing products by rapidly scouting the market and bridging gaps to market leaders.

Innovation is primarily driven by a heavy emphasis on market intelligence, with a dedicated team closely monitoring the market and determining what is required in product offerings to establish market share. This team also determines what differentiating factors could be used to take market share from previously established market leaders.

Product Development consumes less time, as ideas are typically well formed by the intelligence team and do not require significant iteration. The streamlined Product Development process is enabled by well-defined acceptance criteria, in the form of competitive-positioning and profit targets.

Challenges Faced

We have observed a set of common challenges across all archetypes, which can limit insurers’ ability to keep pace with rapidly changing conditions.

Lack of structure around idea funneling process: The majority of insurers have no shortage of new ideas, however they tend to lack a well-defined mechanism to prioritize and move forward with them. Some insurers spend large amounts of time discussing new ideas in group settings, while others tend to focus on building a consensus amongst a much smaller group of stakeholders, resulting in sometimes overlooking initiatives with high potential.

Difficulty pivoting: Many insurers acknowledge the difficulty in de-prioritizing or changing the shape of initiatives once initial conviction is built. This is often driven by the significant time associated with determining system requirements once initial prototyping and design work is completed—making it difficult and costly to change direction as new challenges are discovered during the pricing and implementation phases.

Length of implementation: The amount of time required to launch new products is a universal pain point, which is primarily driven by the “long pole” around implementation into insurance systems (e.g., administration, illustration, compensation), but tends to be further exacerbated by the aforementioned challenges.

Potential Solutions for the Journey Ahead

While there is no one-size-fits-all approach to Product Development, we have identified a few opportunities that can help Product Development teams get started on their journey forward.

Lack of Structure around Idea Funneling Process

Employing a disciplined process to manage the “idea funnel” can help develop a robust, yet actionable pipeline of new ideas.

Maintaining an overarching strategy for each market segment can help determine if ideas should be further investigated or placed into a “backlog” for future consideration; this strategy should be revisited at some frequency (e.g., annually). Having a set of guidelines for the level of robustness of initial analysis and testing allows for a right-sized effort and approach to the initial assessment of new ideas.

Cataloging all ideas, even those not considered, to capture key information such as “under what conditions would this idea work,” ensures a flush pipeline of ideas that can be assessed and used in the future. This can also cut down on the effort to assess ideas as they are revisited, as information from prior assessments of similar ideas can be reused.

Difficulty Pivoting

Having clear criteria to guide the decisioning process and increasing the number of decision-making opportunities via frequent product leadership touchpoints can create a tactical mechanism to revisit the practicality of in-flight initiatives.

Early engagement with stakeholders that will be charged with upcoming activities can serve to increase visibility and solicit feedback on potential roadblocks.

Length of Implementation:

Revisiting the sequencing of/approach to systems implementation may help identify ways to commence lengthier activities sooner in the process.

Involving IT and systems teams early in the product development process can allow them to provide potential considerations, in the form of existing capabilities or prior work that could be leveraged.

In addition, the IT and systems teams can articulate what types of information they require to commence various pieces of the implementation effort (e.g., “Can ‘dummy’ rates and values be used to perform some portion of initial systems implementation?”).

The Path Forward

The Product Development process employed by insurers tends to be catered to the primary product set and is heavily tied to legacy technology and a functionally-oriented sequence of tasks. The ever-changing regulatory and market landscape requires quicker decisioning and speed-to-market and is putting immense pressure on this process.

Insurers must embrace new ways of working and technological improvements in order to increase collaboration, the pace of decisioning, and the leverage gained from prior initiatives. Successfully doing so can allow for them to effectively and efficiently respond to market needs, take advantage of opportunities and confidently march down the growth path.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

Paul Ricard is a partner in the Insurance & Asset Management practice of Oliver Wyman and leads the CustomerFirst platform for Insurance. He can be reached at Paul.Ricard@OliverWyman.com.

Chris Whitney, FSA, MAAA, is a partner in the Actuarial practice of Oliver Wyman. He can be reached at Christopher.Whitney@OliverWyman.com.