Living Benefit Riders to Life Insurance Policies: Pricing Considerations and Strategy

By Robert Eaton and Jennifer Howard

Product Matters!, June 2021

Introduction

The universe of living benefit riders to life insurance policies has expanded greatly in the past 15 years, both in the individual and worksite markets. Simpler living benefit riders allow policyholders to receive life insurance benefits before they die if they are terminally ill (i.e., they are expected to die within six to 24 months). Some insurance carriers offer chronic illness or long-term care (LTC) acceleration of benefit riders on life insurance policies, which allow policyholders to access their death benefits before they die in order to help pay for their LTC needs. Furthermore, some insurance carriers offer an acceleration of life insurance death benefits if a policyholder has a heart attack, a stroke, major organ failure, or other covered critical illnesses.

These living benefit riders to life insurance policies provide meaningful coverage for those who need it and, as riders, they usually do so at a relatively low cost. There are pricing synergies to offering life insurance products that feature any combination of these living benefit riders. In this article we provide a market overview of these three living benefit riders, discuss key product development and pricing considerations, explore the advantages of offering many living benefit riders on a single life insurance policy, and review considerations when filing these products for review and approval for entering the market.

Market Overview

Living benefit riders are attached to many life insurance policies including, but not limited to, term life, universal life, and whole life policies. The purpose of these riders is to provide an advance payment of the death benefit (or a portion of the death benefit) to an insured when the insured has an adverse health event. For instance, these health event benefit triggers provide a benefit if the insured is terminally ill or suffers a critical or chronic illness.

Not only are these riders attractive from a consumer perspective, but insurers enjoy how the benefits diversify their product offerings and increase potential profitability. Further, providing one policy with a pool of benefits to serve a variety of needs can reduce the risk of an insured anti-selecting coverage for one specific product feature. With the decline of traditional LTC coverage in the industry, these riders provide a more cost-effective way for insureds to protect themselves from the risk of catastrophic financial expenditures stemming from LTC events.

One important item to note is that life insurance policies with acceleration-only riders provide benefits from a single pool of available money; however, a number of insurers market riders that provide benefits that are richer than the underlying life insurance benefit. These riders may provide benefits after the death benefit is exhausted through acceleration, or the benefits may come from a separate pool of money. These riders are commonly referred to as extension of benefits riders or standalone riders. While these riders are important offerings in this market, we have limited the focus on accelerated benefits in this article.

Product Descriptions

Terminal Illness Riders

Terminal illness riders are ubiquitous in the life insurance industry, as the Interstate Insurance Product Regulatory Commission (IIPRC, or the “compact”) requires life insurers to offer them when chronic illness riders are included. Because terminal illnesses are defined as illnesses causing death within six to 24 months, life insurers have a clear expectation of the cost of the acceleration. In fact many insurers charge no extra premium for this benefit and offer the terminal illness acceleration as a loan, or discount the payment by the time value of money. Terminal illnesses may include advanced cancer diagnoses, neurological diseases (e.g., Parkinson’s), advanced heart disease, liver disease, and others.

Chronic Illness and LTC Riders

Chronic illness riders and LTC riders provide benefits to an insured if the insured is unable to perform some of their six activities of daily living (ADLs)—eating, bathing, dressing, transferring, continence, and toileting—or if they are severely cognitively impaired. Some chronic illness riders require that the illness be diagnosed as permanent.

The events that trigger this chronic illness or LTC need can be, but are not necessarily, medical in nature. An elderly person who is frail but otherwise in relatively good health may suffer a fall, which then requires them to seek help with these routine activities of daily living. Similarly, the onset of Alzheimer’s or other related dementias, or suffering a stroke, can trigger these chronic illness benefits for an insured.

Critical Illness Riders

Critical illness insurance products typically provide a lump sum indemnity benefit for the diagnosis of a covered condition. Depending on the target market, the covered conditions may vary from a few to a few dozen, but will typically include 1) invasive cancer, 2) heart attack, 3) stroke, 4) end-stage renal disease (ESRD), and 5) major organ failure. Most critical illness coverage is sold as standalone (i.e., not as a rider to an underlying base product) and filed as a health product.

Critical illness coverage is sometimes included as a rider to an underlying life product, in some cases providing an accelerated death benefit if a covered condition is diagnosed. Many carriers will elect to offer a critical illness acceleration benefit instead of a lump sum rider due to the effort and resources required for filing the lump sum (or standalone) rider.

Pricing Considerations

The acceleration riders provide value to the consumer prior to their death. While the morbidity risks for each rider can be evaluated independently, there are pricing similarities among them. Actuaries may find advantage in considering the interaction between these riders, insofar as they all accelerate only one available death benefit.

The comorbidities for a single insured—one person who suffers events that trigger benefits from more than one rider—will provide pricing synergies that a carrier may reflect in the development of the premium rates. Overlooking the nature of the coincident triggers can result in overly conservative premium rates, and leave a carrier at a market disadvantage.

Let us consider an insured who is having difficulty controlling their bowels, getting out of bed, and has begun to show cognitive impairment. The insured previously did not present any symptoms but began experiencing severe issues over a short period of time. As a result, the insured visits the local emergency room for an examination. Based upon the visit and diagnostic testing, the insured is diagnosed with stage 4 breast cancer. Furthermore, the testing reveals that the insured’s cancer has spread to distant organs, specifically the bones and brain. The insured is given three to six months to survive. The insured has the ability to accelerate the death benefit on their life insurance policy to help with the care they will need over the coming months.

In this scenario, the insured could qualify for any of the three acceleration riders:

- Terminal illness, as their life expectancy is six months or less.

- Chronic illness, as they cannot complete some of their activities of daily living.

- Critical illness, as they have been diagnosed with an invasive cancer.

The actuary developing pricing for a life insurance policy that has all three riders will want to consider how each could occur coincidentally.

We have performed data analysis utilizing Milliman Health Cost GuidelinesTM (HCG) data. Based upon our analysis the results show that, of the population diagnosed with a terminal, chronic, or critical illness, a substantial portion will qualify for more than one of these acceleration riders. From the perspective of most insurance companies offering living benefit acceleration riders, they will never pay out more than the death benefit. The pricing actuary is interested in these insured morbidities for at least two reasons: estimating morbidity and estimating disabled life mortality.

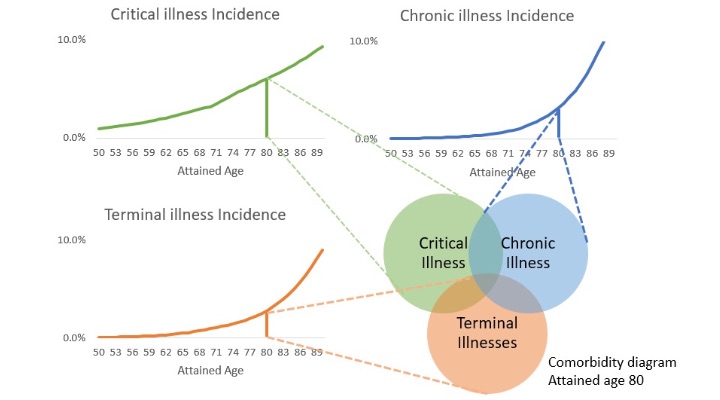

As an example, at age 80 let us make a high-level approximation that 3% of insureds may have a chronic illness, 2% of insureds may be diagnosed with a terminal illness, and 6% may have a critical illness (defined as one of the five events discussed above). An insurance carrier that includes all three acceleration riders with an underlying life insurance policy should expect that no more than 11% of policies (i.e., the sum of each portion above) will elect to accelerate at age 80. Based on our analysis, we anticipate that the portion may be significantly lower. Figure 1 illustrates hypothetical incidence rate curves.

Figure 1

Total Risk of Riders

While there are many ways in which an insurance carrier may project cash flows to price these acceleration riders, a common approach is to apply the first-principles approach of separating active and disabled lives, and to project these lives using active and disabled life mortality rates. The disabled life mortality rate for an insurance carrier offering many acceleration riders can be estimated using a blended mortality reflecting each of the respective elected acceleration riders.

In performing our data analysis, we reviewed commercial and senior population medical data, tracking unique policyholders and their underlying medical diagnoses. This involved mapping a defined set of medical codes to conditions that are associated with triggers of critical, chronic, and terminal illnesses. We quantified the potential pricing synergies of these riders based on this analysis and estimated the portion of policyholders who experience one of the permutations of illnesses. Our conclusion from this analysis confirms that pricing these riders in a vacuum and ignoring potential synergies produces overly conservative results.

Filing Strategy

The IIPRC adopted standards[1] by which living benefit riders to life insurance policies may be filed and approved. The IIPRC and some state jurisdictions external of the IIPRC have historically allowed living benefit acceleration riders that are triggered on certain events such as chronic or critical illnesses (as described above), or terminal illness. Terminal illness riders are required if a company submits an individual life insurance policy through the IIPRC.

The IIPRC requires that living benefit riders meet certain actuarial criteria, namely that the rider benefits in relation to the base life insurance policy benefits must be 10% or less on a present value basis. This is often referred to as the "incidental value test." A similar test applies to premiums.

When a company stacks many living benefit acceleration riders onto a single life insurance policy as we have described in this article, but treats them as separate riders, then any single rider may pass the test independently. The IIPRC has not historically required that the combination of all acceleration riders pass the incidental value test. The pricing actuary may account for the reduction in a single rider’s benefits given the reality of comorbidities among chronic, critical, and terminal illnesses. The actuary can allocate the available accelerated amount to a specific benefit, perhaps depending on the company’s chosen payout order. In addition, each riders’ premium could be lowered as a result of the lower expectation of morbidity. This stacked-rider strategy increases the likelihood of each of the individual riders passing the incidental value test.

Conclusion

Life and health insurance coverages meet in hybrid policies, including these living benefit riders. Better understanding morbidity, and the ability to cover additional diseases at incremental costs, can help insurers maintain competitiveness and allow the market to expand to other coverages.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

Robert Eaton, FSA, MAAA, is a principal and consulting actuary for Milliman. He can be reached at robert.eaton@milliman.com.

Jennifer Howard, FSA, MAAA, is a consulting actuary for Milliman. She can be reached at jennifer.howard@milliman.com.