Biosimilars, Part 3: Humira Biosimilar Launches

By Gregory Warren and Tony Pistilli

Health Watch, November 2023

This article has been edited and updated since its original publication on the Axene Health Partners website.

Parts 1 and 2 of this article provided an introduction to the field of biosimilars and an overview of how their growth is changing the pharmaceutical market, respectively. In this issue, Parts 3 and 4 examine the effects of biosimilar launches for one of the most widely used brand-name drugs and the financial impact such launches may have.

This is the year! The big event of 2023 is the launch of multiple Humira biosimilars, which began in January with the arrival of Amgen’s Amjevita on the market. The launch of Amjevita kicks off the process of changing the specialty drug marketplace in the United States. The expectation of the full impact of this big event is very hopeful, but there is still uncertainty several months after its beginning.

The Big Event: Humira

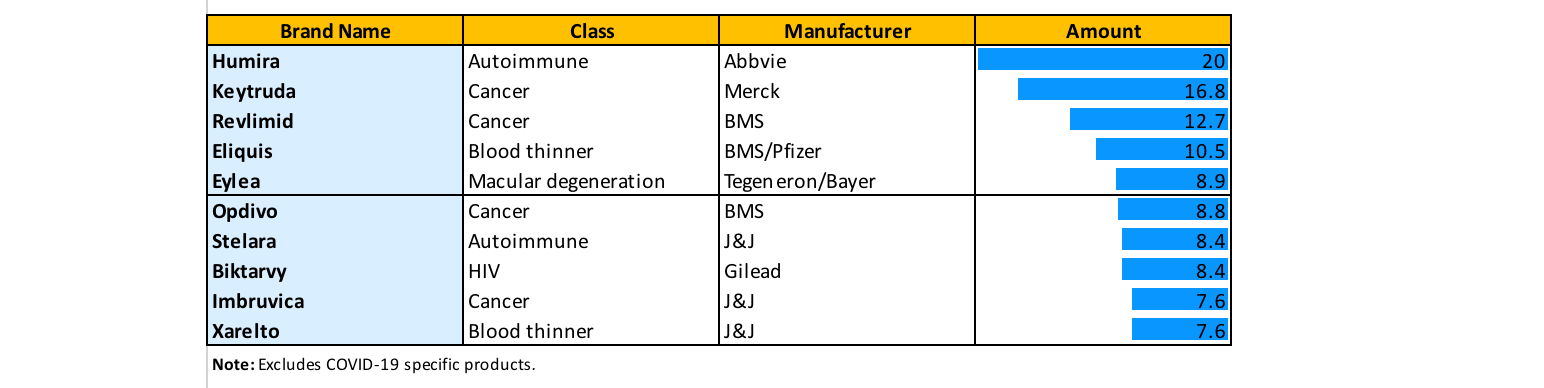

Humira is the highest-selling drug in the world and has been since 2013 (Figure 1)—except for when COVID-19 projects temporarily surpassed it. The world is eagerly awaiting the launch of multiple biosimilar drugs to compete with Humira and hopefully bring more competitive pricing to the benefit of payers and patients everywhere.

Figure 1

Projected Biggest Selling Drugs in 2021

Source: Data from Evaluate Pharma database, Evaluate Ltd., 2023.

The Many Indications for Humira

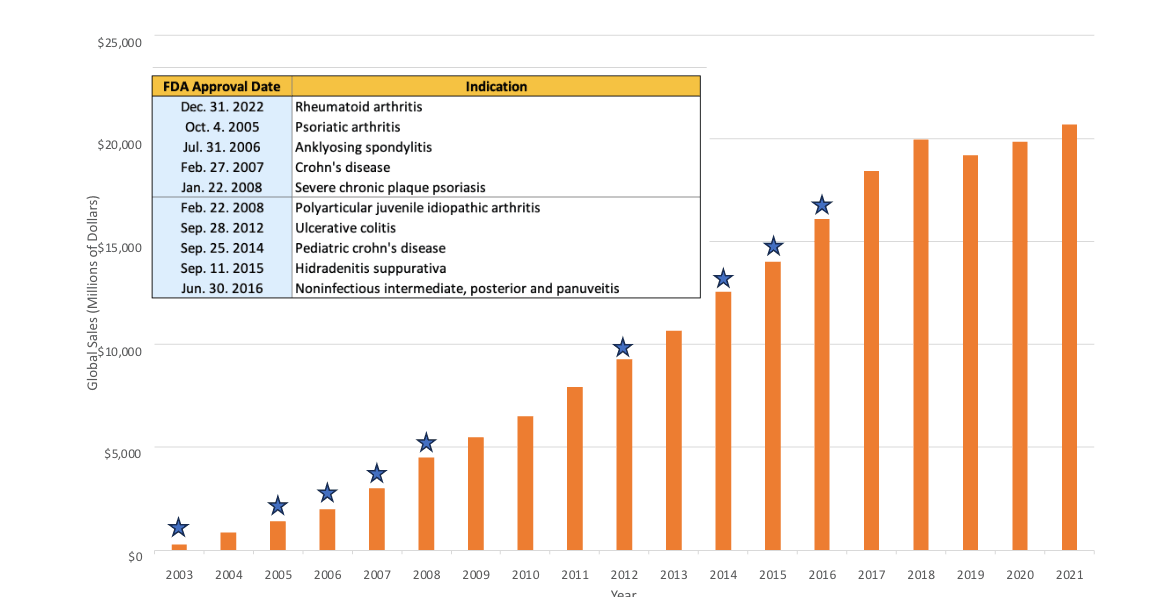

Humira’s exponential sales growth has been driven in part by its approval for multiple indications over the years. Some have called it the “wonder drug” because of all the diseases it has been approved to treat (Figure 2).

Figure 2

Global Sales of Humira Since Late 2022 US Approval

Sources: Data from AbbVie annual reports 2003–21; FDA approval data 2003–21.

Humira’s broad applicability has solidified it as a brand-name drug that is a necessary inclusion in formularies so patients can have the care access they need. To remove Humira from your formulary, you would need to cover all these indications with other prescription drugs. That gives Humira a lot of market leverage.

Several Humira Product Changes

In 2018, Humira launched a citrate-free version. Citrates are inactive ingredients that act as stabilizers. Some patients reported that the citrates originally found in Humira caused pain or a burning sensation during injection, so removing the citrates was aimed at improving the patient experience.

Humira made some other changes as well. A thinner needle was implemented, thereby again potentially improving the patient experience and possibly lowering discontinuation rates. The concentration was doubled so that twice as much Humira was received per injection, the result being that patients might then need only half as many shots.

A fascinating aspect of this is that some of the biosimilars that are launching in 2023 were already in development, perhaps had already even received FDA approval, when Humira’s citrate-free version entered the market. So they were developed to compete directly (with interchangeability once that is approved) with a version of Humira that many people are no longer taking as they’ve moved to the newer versions.

Humira Pricing

As we consider Humira’s pricing, another interesting aspect of the drug’s new versions (citrate-free, high-dosage form, thinner needle sizes) is that each new version was assigned a new National Drug Code (NDC) number. The 340(b) “penny pricing” rules impose a limit on list price increase applicable to 340(b) entities at the rate of general inflation, but because the new NDC has a new initial price, the 340(b) pricing rules effectively reset to that new initial price. The previous versions of Humira saw significant historical list price increases, so this had a significant effect on Humira’s revenue generation.

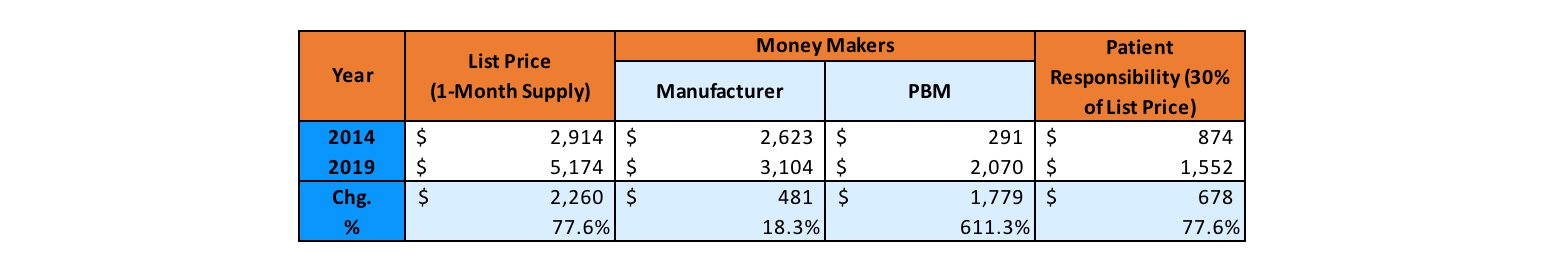

Without the application of the 340(b) penny price, traditional commercial coverage for Humira has seen its list price inflate significantly in recent years, though the net price of the drug has remained relatively level because of equally significant increases in the rebates paid. Humira alone can represent upward of one-third of all rebate dollars received for a pharmacy benefit manager (PBM) or health plan. This has increased the “spreads” that PBMs and health plans can sometimes keep on rebates paid by Humira for formulary access, while the list price inflation has increased the coinsurance and other cost-sharing amounts patients need to pay for their Humira prescriptions (Figure 3).

Figure 3

Anatomy of a Drug Price: Humira

Source: Drug Pricing in America: A Prescription for Change, Part II (full committee hearing), United States Senate Committee on Finance, Feb. 26, 2019, https://www.finance.senate.gov/hearings/drug-pricing-in-america-a-prescription-for-change-part-ii?eType=EmailBlastContent&eId=6a8b68dc-5f42-465c-a18b-eb2f5d77bc0f.

The magnitude of these pricing increases and their impact on plan sponsors and patients further highlights the great anticipation for the launch of biosimilars in 2023.

The Extent of the Big Event

So, what is included in this big event, how many biosimilar launches are coming and with which of the various versions of Humira will they be “similar”?

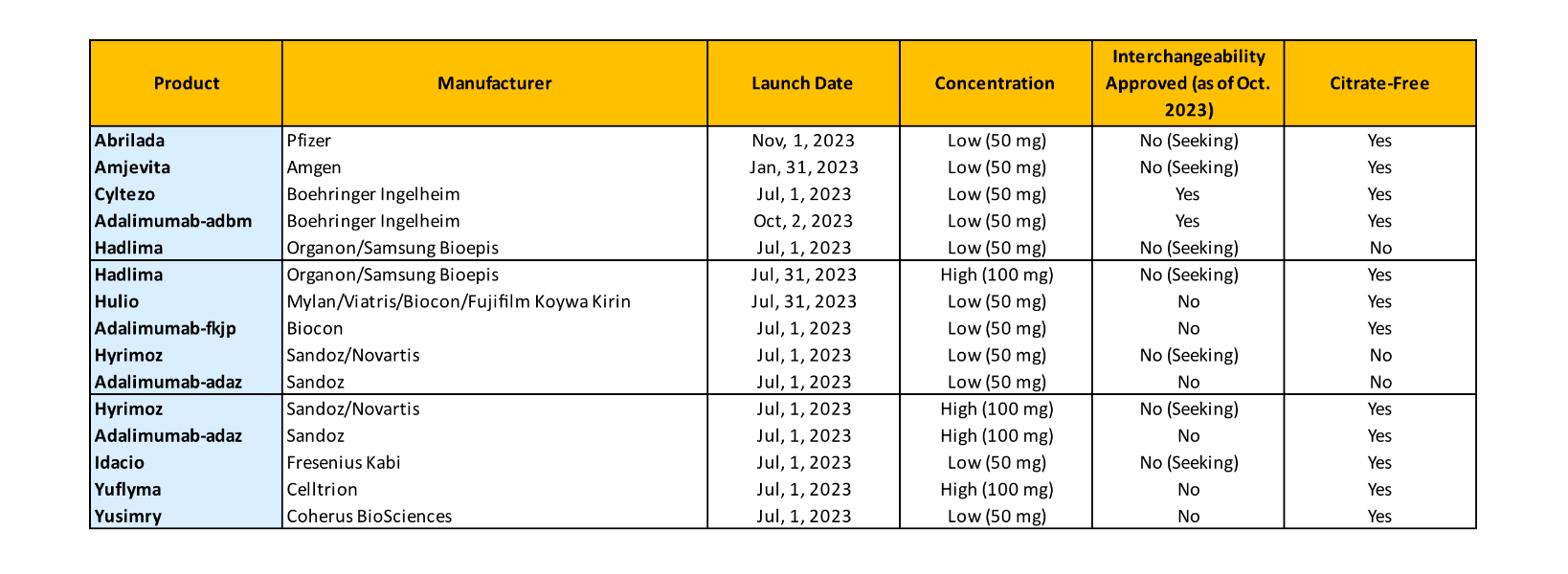

Figure 4 summarizes the current biosimilar launches as of October 2023. With 10 manufacturers marketing 15 products (and some products even being marketed under multiple NDCs with separate price/rebate structures), the landscape has quickly become crowded.

Figure 4

Humira Approval Outlook

The various launch dates were determined through negotiations with Humira’s manufacturer AbbVie. All of AbbVie’s many patents have not expired, but these biosimilars have obtained the right to launch through settlement negotiations with the company.

Some of the manufacturers are familiar names in the US market, while others are less so. This raises a two-part question for some payers and PBMs: What is the reliability of the supply chain, and how certain can we be of the manufacturer’s ability to deliver whatever quantities might be demanded in a timely manner?

Amjevita from Amgen was the first Humira biosimilar to launch (in January 2023), and several more followed later in the year. Cyltezo from Boehringer Ingelheim launched in July and is interchangeable with Humira’s low-concentration form. Others are still seeking approval to be interchangeable with Humira’s high-concentration form.

Summary

This is the big event of 2023. It is going to be a fascinating and exciting journey. Numerous on-formulary, off-formulary and preferred or nonpreferred tiering options exist for payers and PBMs to employ to try to achieve the greatest savings benefits for themselves and the patients they cover. Only time will tell how the manufacturers’ various pricing strategies and the payers’ and PBMs’ various clinical and savings strategies will play out. Will competition really drive the financial impact so many are hoping for? We will examine this further in Part 4.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

Gregory Warren, FSA, MAAA, FCA, is a partner and consulting actuary at Axene Health Partners. Greg can be reached at greg.warren@axenehp.com.

Tony Pistilli, FSA, MAAA, FCA, CERA, CPC, is a consulting actuary at Axene Health Partners. Tony can be reached at tony.pistilli@axenehp.com.