Actuaries Climate Index™ Summer 2017 Data Released

ACI Seasonal Value Dips But Remains at High Level

Contact: media@actuariesclimateindex.org

Washington, D.C., Arlington, VA, Schaumburg, IL, and Ottawa, ON (April 24, 2018)—New Actuaries Climate Index™ data reported today by organizations representing the actuarial profession in Canada and the United States show that the five-year moving average of climate extremes across the two countries remains at the high recorded in winter 2016-17 and spring 2017.

“Sea levels, high temperatures, and heavy precipitation continue to be pronounced relative to their historical norms, sustaining the long-term trend of high ACI values,” said Doug Collins, Chair of the Climate Index Working Group.

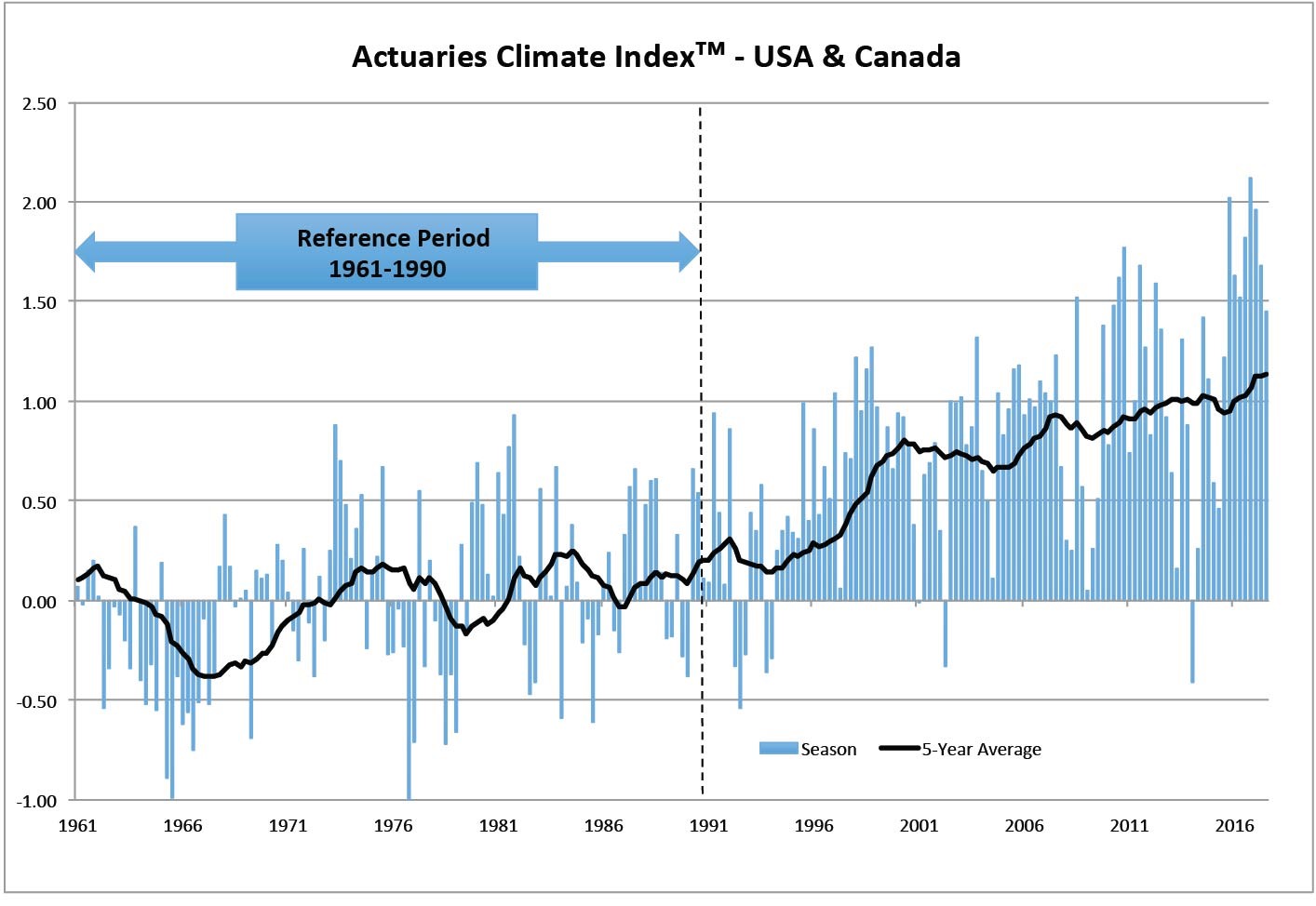

Measured with the new summer 2017 data included, the five-year moving average of the Actuaries Climate Index remains at 1.14, a record-high value first attained in, and sustained since, winter 2016-17. The elevated index value reflects continued deviation of climate and sea level extremes from historically expected patterns for the two countries.

A decline in the seasonal ACI value did not affect the five-year moving average. The seasonal ACI value for summer 2017 was 1.45, compared to 1.66 in spring 2017, making summer 2017 the first seasonal ACI value in eight seasons below 1.5. “While the seasonal value does not represent the extremes seen in the last two years, the value was still quite high from a historical perspective,” said Collins.

The Actuaries Climate Index is based on analysis of seasonal data from neutral, scientific sources for the six different index components collected since 1961. The index measures changes in extremes of high and low temperatures, high winds, heavy precipitation, and drought, as well as changes in sea level, expressed in units of standard deviations from the mean for the 30-year reference period of 1961 to 1990 for the United States and Canada combined.

The index, sponsored by the American Academy of Actuaries, the Canadian Institute of Actuaries, the Casualty Actuarial Society, and the Society of Actuaries, is designed to provide actuaries, public policymakers, and the general public with objective data about changes in the frequency of extreme climate events over recent decades.

Updated values are posted quarterly on ActuariesClimateIndex.org as data for each meteorological season becomes available. The organizations are also developing a second index, the Actuaries Climate Risk Index, to measure correlations between changes in the frequency of extreme events as measured by the index and economic losses, mortality, and injuries.

About the Sponsoring Organizations

The American Academy of Actuaries is a 19,000-member professional association whose mission is to serve the public and the U.S. actuarial profession. For more than 50 years, the Academy has assisted public policymakers on all levels by providing leadership, objective expertise, and actuarial advice on risk and financial security issues. The Academy also sets qualification, practice, and professionalism standards for actuaries in the United States.

The Canadian Institute of Actuaries (CIA) is the national, bilingual organization and voice of the actuarial profession in Canada. Its 5,000+ members are dedicated to providing actuarial services and advice of the highest quality. The Institute holds the duty of the profession to the public above the needs of the profession and its members.

The Casualty Actuarial Society (CAS) is a leading international organization for credentialing and professional education. Founded in 1914, the CAS is the world’s only actuarial organization focused exclusively on property and casualty risks and serves over 7,000 members worldwide. Professionals educated by the CAS empower business and government to make well-informed strategic, financial and operational decisions.

With roots dating back to 1889, the Society of Actuaries(SOA) is the world’s largest actuarial professional organization with more than 28,000 actuaries as members. Through research and education, the SOA’s mission is to advance actuarial knowledge and to enhance the ability of actuaries to provide expert advice and relevant solutions for financial, business and societal challenges. The SOA’s vision is for actuaries to be the leading professionals in the measurement and management of risk.