Tenth Annual Survey of Emerging Risks: Summary of Findings

Cybersecurity ranks as the greatest looming threat, according to the tenth annual Emerging Risks survey of risk managers. The survey also revealed that the majority (73 percent) of risk managers project a moderate risk outlook for 2017, which is consistent with 2016 projections. The following summary highlights key findings from research conducted by Max Rudolph, FSA, CERA, MAAA, a member of the Society of Actuaries (SOA) and owner of Rudolph Financial Consulting, LLC.

Tenth Annual Survey of Emerging Risks: Summary of Findings

Top Emerging Risks

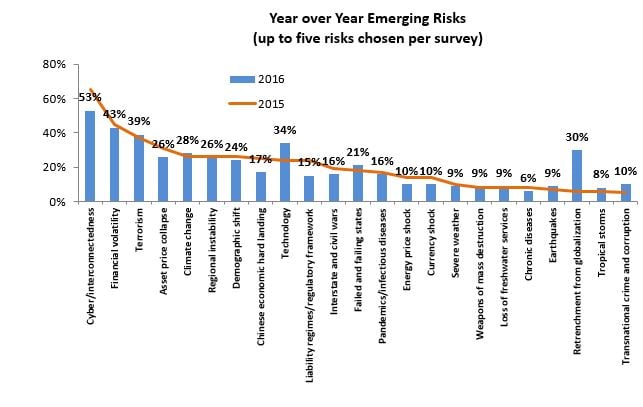

Risk managers perceive cybersecurity (53 percent), financial volatility (43 percent) and terrorism (39 percent) to be the three greatest emerging risks for the third year in a row. Notably, retrenchment from globalization ranked among the top five greatest emerging risks this year, as survey respondents reacted to the rise of populism around the world. This particular risk was ranked as the twenty-first risk last year, demonstrating evidence of anchoring through recency cognitive bias, where responses gravitate toward recent events such as the U.S. election.

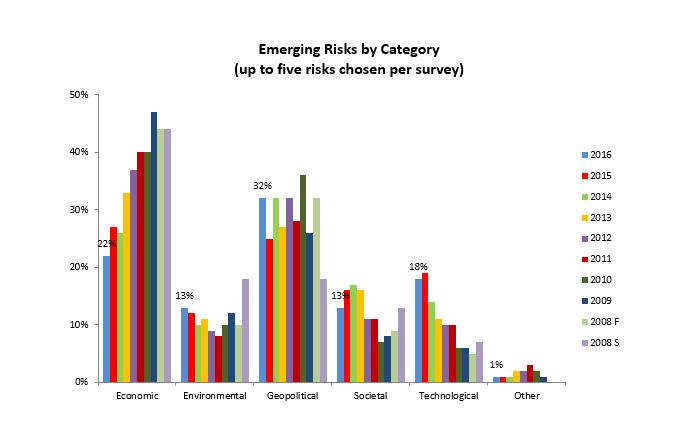

When analyzing top emerging risks by category, it’s noteworthy that the geopolitical category – including retrenchment from globalization – surpassed economics for the top spot. Geopolitical risks increased seven percent, while economic risk decreased five percent during this timeframe. The last time geopolitical risks overtook economic risks was in 2014.

Year-over-Year Comparisons

- Cyber risks are stabilizing, but remained strong. This risk continued its position as the number one emerging risk, but for the first time since its entry as a risk in 2009, the threat level didn’t increase. Instead, it declined to 53 percent, from 65 percent the previous year.

- Geopolitical category risks are higher than 2015 highlighting a pattern of even numbered year increases, possibly tied to the U.S. election cycle. For example, the increased prevalence of retrenchment from globalization as a top risk is likely tied to the rise of populism in the U.S. and overseas.

- Several risks in the economic category were materially lower than 2015, including a Chinese economic hard landing (declined from 25 percent in 2015 to 17 percent last year) and asset price collapse (31 percent to 26 percent).

- Technology risk continues to move up the rankings and into the top five emerging risks category. This risk highlights the insurance industry’s unique role in risk management, not only managing its own risks but seeking out and accepting the risks of others to help business increase resilience.

About the Survey

A total of 223 risk managers from across the globe participated in this online survey in November 2016. The research was funded by the Joint Risk Management Section (JRMS) of the Canadian Institute of Actuaries, Casualty Actuarial Society and Society of Actuaries.