Attending In-person Conference Events After COVID-19

By Bryan Liu and Arthur da Silva

Actuary of the Future, January 2023

As COVID-19 measures and travel restrictions have loosened, more people have been travelling to in-person events recently compared to the last couple of years. Bryan Liu and Arthur da Silva discuss their perspectives on attending in-person conferences and meetings in this recent environment, where they networked, presented, and attended sessions. They have specifically participated in numerous in-person events, namely: 2022 SOA Life Meeting, SOA ImpACT, and the SOA Leadership Conference.

A few summary observations:

- In-person conferences are a great way to learn about interesting new developments in the industry and make connections with actuaries from all over the world.

- Being an in-person attendee and presenter is a refreshing change from two years of Zoom calls, but also comes with unique perspectives and challenges.

- Health and safety are definitely top of mind for the SOA—different measures were put in place to ensure all attendees are comfortable and safe.

- SOA meetings are also a great way to visit a new city!

Which SOA Meeting did you attend? What was the experience like?

Arthur: The 2022 SOA ImpACT was my first SOA conference, but I have attended several conferences in Canada over the years. ImpACT was an activity-filled conference in addition to the main line of speakers and sessions, with section events, company-hosted events, various impromptu meetings. I also recently attended the SOA Leadership Conference, which was another refreshing way to listen to speakers teach us how to improve leadership abilities as well as meet driven leaders volunteering in other areas of the SOA.

Bryan: Like millions of others across the world, I have spent the majority of the past two years looking at profile pictures on Zoom or Teams. I have previously attended the virtual 2021 Life Meeting, as well as other Canadian Institute of Actuaries conferences, but the 2022 SOA Life Meeting in Chicago was my first in-person SOA meeting.

In August, I attended the Life Meeting along with over 1,000 virtual and in-person attendees, attending sessions covering topics ranging from stochastic modeling to LDTI to offshore reinsurance.

As the chair of SOA’s Actuary of the Future section, I was also an attendee at the Leadership Conference. The SOA invited different speakers to present on critical aspects of leadership, such as inclusion and communication. It was also great to catch up with my friend and former colleague Arthur at the meeting.

How was the networking experience at the meetings? Were there any precautions in place to address COVID considerations?

Arthur: In-person events, particularly ones as large as ImpACT, provide countless opportunities to meet new people and catch up with old friends. ImpACT particularly brings actuaries from across the US, Canada, Caribbean, and other regions across several lines of business, making it the premier event to connect with a diverse set of actuaries. For those that required extra caution for COVID reasons, precautions were made through the placement of stickers on name tags. Each sticker was colored on a traffic light system that indicated a person’s degree of comfort with physical contact. The best part about ImpACT that was missing from a purely virtual experience was certainly bumping into old friends that I haven’t seen for many years and meeting friends of friends at the same time.

Formal networking events such as those hosted by various companies such as the event hosted at the Falls Pool Bar & Grill by my employer, Deloitte, or at a nearby offsite location allowed for connections and introductions in more intimate settings. At such events, I was able to meet with actuarial colleagues and people in my personal network to mutually get to know one another and create new connections. In addition to company-hosted events, ImpACT hosted a Canadian breakfast that invited all Canadian actuaries together to connect and hear about the priorities of the CIA and the SOA from the respective presidents of each organization. Several SOA sections also host breakfasts, each run a little bit differently depending on the section, to connect with its section members.

The in-person aspect of the convention also added several elements to the experience that wouldn’t have been possible virtually. For example, the exhibitors’ hall is a purely in-person experience, unless I missed an exhibitor that brought a “virtual booth” with them as well. For my personal role at work, it was great to meet and speak with different technology vendors to understand their offerings to explore any opportunities to work together. Many actuaries I spoke with said that it was the first time seeing their team in person all in one place. For me, it was energizing to meet my colleagues from different countries who I’ve only exchanged emails with or seen on Zoom calls from the shoulders up. With remote work looking like a long-term trend, I can foresee large conferences like ImpACT being an option for team gatherings, which will likely only occur a few times per year for many companies.

Bryan: Just like the impACT conference, the Life Meeting also had ample opportunities to meet new connections. This includes different networking events for various SOA groups and sections, as well as “networking” corners that were set up to allow attendees to have quick coffee chats.

One of the highlights of my Life Meeting experience was also a networking Chicago architecture boat tour sponsored by three SOA sections (Actuary of the Future, Entrepreneurial and Innovation, Leadership and Development). The boat tour was a fun way to meet other life actuaries, as well as an opportunity to learn more about the interesting history of Chicago.

Did you present at the meetings? Was the experience very different from presenting virtually?

Arthur: As the incoming chair of the Entrepreneurial & Innovation section council, I presented at our section breakfast, which was my first presentation in front of a live audience excluding internal Deloitte presentations. Unfortunately, we ran into some technical difficulties, which is not uncommon for in-person events, not just Zoom! Thankfully, when planning the session, Blake Hill (the past chair) and I decided to keep the slides light given that it was the first meeting of the morning. We were able to improvise by referencing back-up slides on Blake’s iPad and notes on my phone. Regardless of the presentation medium, the session reinforced the importance of having a contingency plan should something go unplanned. During the informal chats, we focused on connecting with our section members to understand their perspectives in order to determine what type of section content and events would best meet their needs. My one takeaway from the session was that there are a surprising number of actuaries working as entrepreneurs or in innovation roles!

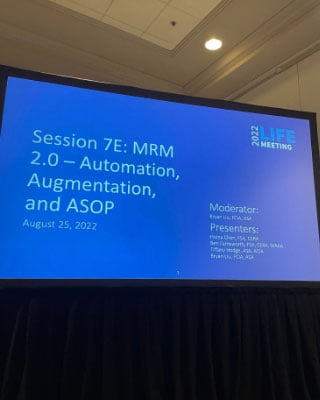

Bryan: I was presenting/moderating at three different sessions at the Life Meeting. Between preparing for sessions and work responsibilities, it was a pretty busy week!

It was a very different experience presenting virtually versus in-person. For one of my sessions, I was presenting on a stage that was about 10 meters or so away from the rest of the audience, bringing me back to memories of large lecture halls in university. On the other hand, presenting in-person allowed me to see the audience’s reactions to the content I presented, and also their reactions to the football jokes I keep trying to shoehorn in. In the last session, I was also quite encouraged to see a full room, with lots of attendee Q&A and discussion that went on until the scheduled break.

How about as an attendee? Was there any experience with interesting keynote speakers or specific sessions that you wanted to share?

Arthur: Attending sessions was a great way to gain perspectives from different topics and points of view that you wouldn’t normally see in your day-to-day work. Keynote speaker, Mico Yuk, was a pleasure to listen to, as she covered storytelling through data analytics, but really focused on how to build a narrative to drive decision-making despite our tendencies to want to show all the data and analysis behind the narrative. One of my takeaways from the presentation that was easy to put into use immediately was to use action verbs that paint a clear picture in your mind and minimize overused jargon whose meaning has become diluted. For example, when defining a Key Performance Indicator, you could use the word grow instead of increase, cut instead of decrease, etc. Studies have shown that the visual in your mind created from the action word elicits an emotion that not only more effectively grabs your attention, but also more often drives a response to the target you have set as a result of using those words. Rule of thumb is: if your 5-year-old can’t understand the word, then it’s probably an indication that you need to use a different one! Mico provides many more insights beyond wording changes around the art of data storytelling. She provides a short overview of these concepts in an article for The Actuary magazine, titled “Storytelling Through Data Analytics”.

I personally attended sessions covering emerging issues around the personalization of insurance, innovation, accelerated underwriting, and climate change. Not surprisingly, I found that keeping my attention on the presentation and learning new concepts to be much easier in an unfamiliar in-person environment as opposed to watching a virtual presentation from my home or the office for several hours. Unfortunately, my takeaways from the various sessions I attended will have to wait for another article. I plan to write a more detailed article on these learnings for The Actuary magazine’s Canadian edition. The article will likely be published in the coming months, so stay tuned!

Bryan: Aside from the excitement of attending the first in-person meeting in almost three years, the Life Meeting was also a great opportunity to hear about the different developments happening across the industry. Some of the highlights included:

- Fairness and Bias in Underwriting—This session details some of the recent and expected regulatory developments in assessing bias and disparate outcomes in underwriting. The speakers also gave specific examples where statistical techniques could be used to show if certain underwriting factors are a proxy factor for protected classes, or actual predictive factors.

- Bermuda—The Opportunities—With the increasing number of Bermuda-registered insurers and reinsurers over the past several years, and the number of M&A and reinsurance transactions that included a Bermuda component, this session went into detail on the benefits and opportunities behind the Bermudian regulatory framework and requirements. A panel of Bermuda insurance and reinsurance professionals went over different case studies of how value can be derived with special considerations to assets, capital release, and guideline interpretation.

Any final thoughts on the in-person meetings? Would you attend again next year?

Arthur: Attending the SOA meetings in person added a jolt of energy to the volunteering experience with the SOA, both as a session speaker and section council chair. I am certainly looking forward to attending future meetings in person and would encourage people to consider joining as well. Chances are you will find someone you already know or will make a new friend.

Bryan: I look forward to attending an SOA meeting again! All of my experience, from recruiting speakers and preparing for each session, to attending unique sessions, and meeting new people, was very rewarding and enjoyable.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the respective authors’ employers.

Arthur da Silva, FSA, FCIA, is a senior manager and actuarial innovation lead of Deloitte Canada’s Actuarial & Insurance Solutions practice in Toronto. He is also the chair of the SOA’s Entrepreneurial & Innovation section and sits on the editorial board for The Actuary Canada, SOA’s digital magazine publication.

Bryan Liu, FSA, FCIA is an actuary at Milliman’s Life Practice, providing risk management and M&A consulting services to clients across Bermuda, US and Canada. Bryan also chairs the SOA’s Actuary of the Future section and sits on the editorial board for The Actuary Canada, SOA’s digital magazine publication.

View during the architecture boat tour – the world’s largest “You are here” map on the 300 S. Wacker Drive building

Chicago view after leaving the architecture boat tour sponsored by AoF, E&I, L&D sections

Presenting during the Life Meeting on Model Risk Management

Networking during a break at ImpACT