Actuarial Open Educational Resources

By Edward (Jed) Frees, Paul Johnson and Marjorie Rosenberg

Expanding Horizons, November 2021

Continuing education is the lifeblood of any profession for its members. This is certainly true for the actuarial profession that aspires to be among the “leading quantitative professional advisers in financial services, risk management and social protection” (from the vision statement of the Actuarial Association of Europe).

Increasing technology is available to create and disseminate educational resources worldwide. In response, we advocate a more inclusionary perspective: open educational resources (OERs) will benefit the actuarial profession with both recruitment and retention of members.

What Is an Open Educational Resource?

In our connected world, the public is becoming familiar with educational resources that are open—and free—to all. One example with which many readers are familiar is Wikipedia, a type of online encyclopedia. In addition, many available online courses teach computing and natural languages. One can learn about new ways of coding through Codecademy and DataCamp and develop foreign language skills through Duolingo, all for free.

A theory underpinning an OER is that education is a public good, and thus openness can have a strong, positive effect on education. In addition to open encyclopedias and courses, there are many other learning support resources including textbooks, interactive games and simulations, feedback on questions through intelligent tutoring systems and so on. An OER may range from a simple PDF document (such as a homework assignment) to a full-scale online interactive course.

Benefits of OERs

Traditionally, the publication of educational resources, such as books, has fallen under the domain of university presses or commercial publishing houses. In contrast, making an open resource publicly available offers important advantages to society:

- It equalizes access to knowledge, thus permitting a broader, more diverse community to learn about the actuarial profession.

- It has the capacity to engage viewers through active learning that deepens the learning process, producing analysts who are more capable of solid actuarial work.

- It can be continuously improved through viewer feedback, resulting in a resource with contents that are more accurate and relevant.

Naturally, OERs are receiving substantial attention from the education community. In some sense, the movement is a natural extension of the movement toward free and open computing resources. For example, in 1997, the statistical community published the open-source statistical package R that has now become a cornerstone of a statistics education and is widely used in actuarial applications. More recently, the COVID-19 pandemic has required academic institutions to use open technology–enhanced educational tools. A silver lining of this intense learning is the future use of open technology tools to enhance the learning process in the long run.

Who Builds the Library?

One can think of developing educational content as building a repository, or “library,” of knowledge. Where does this content come from? Actuaries advise and educate others about complex risks. Viewed from this perspective, we are all educators with the ability to contribute educational content at some level. Particularly for those involved in academia, there is tremendous capacity for developing content about the foundations, as well as cutting-edge developments, of the actuarial profession.

In this article, we describe three connected projects in which we, as faculty at the University of Wisconsin–Madison, have been involved. Each of these projects are ongoing and continue to serve the actuarial profession. First, we summarize a recent open short course developed under the auspices of the ASTIN Academy. Second, we describe an open textbook titled Loss Data Analytics. Third, we provide an overview of our Technology Enhanced Learning (TEL) project that began in 2010 with the sponsorship of the Society of Actuaries (SOA).

ASTIN Academy and a Short Course

In support of actuarial aspects of the OER movement, the ASTIN Section (the non-life section of the International Actuarial Association) recently created a working group called the ASTIN Academy. Its purpose is best described by its mission statement:

The mission of the ASTIN Academy is to provide high quality free educational materials in non-life insurance to actuarial students across the world. The Academy is committed to open course development under the Creative Commons licence and seeks innovation in teaching methodologies and application of technology. Let’s build the future of actuarial education together.

An international team of 15 contributors from four countries recently developed a short course based on the first five chapters of the open actuarial textbook Loss Data Analytics. This book is useful for those who are interested in both property/casualty and health applications and is summarized in greater detail in a later section of this article.

Although the book itself does not depend on any statistical language, the focus of the short course is to demonstrate loss data analytic techniques using R statistical software:

- There are several sections in each chapter. In each section, we have one or two short videos (5–10 minutes). Following each video is one or two interactive R-based tutorial problems. In total, there are 34 videos and 52 exercise tutorials.

- The short course is not tied to any course at an educational institution, nor is there a requirement for completing one section before moving on to another. At many institutions, instructors of statistics courses catering to an actuarial audience often seek insurance/actuarial applications. If you are teaching a course on how to fit a negative binomial or a gamma distribution, we have insurance examples to help support students learning the course material.

- All materials are free and available on the Web. The website is based in HTML and requires little bandwidth for users. We wanted to make this course accessible to students who are in the very beginnings of their actuarial journey.

- Students can participate in the course without downloading any software (including R), data or overheads.

An Open Actuarial Textbook

The open actuarial textbook Loss Data Analytics was designed to integrate classical actuarial loss data models from applied probability with modern analytic tools, including those used in data science. In particular, we recognized the availability of big data (including social media and usage-based insurance) and high-speed computation.

Two versions of the book exist. One is an online version that contains the content of the book, plus many interactive objects, such as quizzes, computer demonstrations and interactive graphs, to promote deeper learning. In addition to the online version, PDF and EPUB versions of the book can be downloaded for reading offline.

We hope to expand the online text to other languages to promote access to a worldwide audience. ¿Habla Español? For Spanish-speaking students, most of the book has been translated, primarily by the actuarial group at the Universitat de Barcelona.

This book is reflective of the actuarial academic community, as it features 19 authors from eight countries: Australia, Belgium, Canada, Egypt, Malaysia, South Korea, Turkey and the United States. Moreover, an additional 40 reviewers from around the world donated their time to reviewing portions of the book.

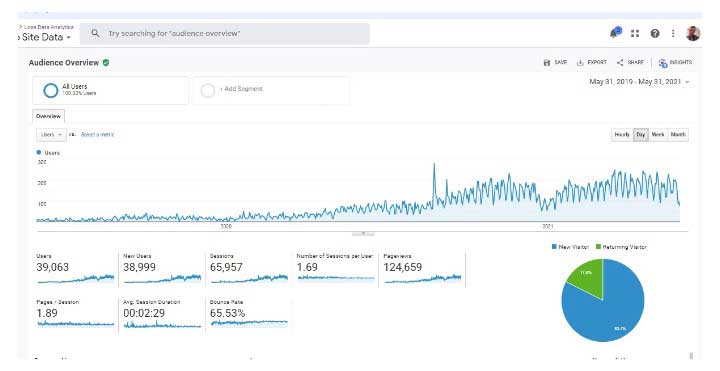

The initial version was released in September 2019 and has already enjoyed success within the actuarial community. Figure 1 summarizes usage of the book over the two-year period from June 1, 2019, to May 31, 2021, captured by Google Analytics. In particular, note that the book has seen almost 40,000 users and that usage trends have increased over time.

Figure 1

Loss Data Analytics Usage (June 1, 2019–May 31, 2021)

The Technology Enhanced Learning Project

Our journey to develop OERs began in 2010 when the SOA accepted our proposal to develop technology enhanced learning (TEL) tools. Our undergraduate students learned to produce video tutorials to help other students learn how to solve problems that are included on the preliminary actuarial exams. As a typical end result, each student produced a short video describing a solution to an exam question that contained a way to think through the problem initially, as well as the details for actually solving it. We sought to produce a tutorial video for each question on all of the then preliminary (pre-ASA) exams.

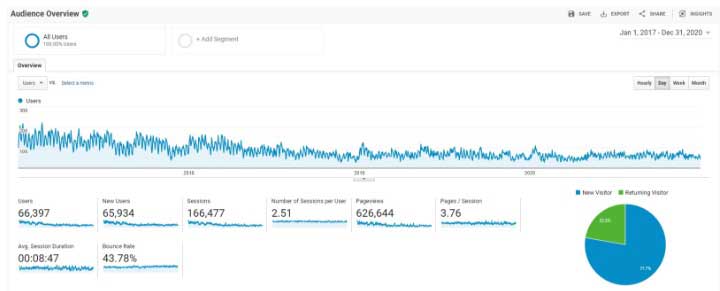

Funding for the TEL project ceased in 2013, and we discontinued updating its website in 2015. This effort has been a major success in terms of generating an OER that is consistently used by budding actuaries. Figure 2 shows TEL usage over the most recent five-year period (2017–2021 inclusive) with approximately 11,000 users visiting the site each year for an average session of nearly nine minutes.

Table 1 shows the 50 countries with the largest number of users of the TEL site during the same time period as Figure 2. As the SOA is based in the United States and Canada, it makes sense that those are the two countries with the largest number of users.

Figure 2

TEL Usage (2017–2020)

Table 1

TEL Usage by Country (2017–2020)

Authoring Your Own Short Course

We are hopeful that educators will experiment with their teaching approaches so they can contribute to OERs. For example, you might adapt the interactive short course described earlier into your own teaching portfolio. This does require an investment of time. However, our approach was to use publicly available resources such as R, R Markdown and Datacamp. You could base your design on the same resources. Our course is on Github and can be copied to your computer.

One of our aspirational goals is that educators interested in innovative teaching can develop their expertise with this teaching approach in their classes. With this, they can then become contributors to a course that can be enjoyed by the entire actuarial profession.

How Can You Help?

Many actuaries remember the days before open statistical software such as R was available, when software was expensive. In academia, the availability of free open software has transformed the way we teach and do research. Will the same be said of textbooks in the future? Even more intriguing is the opportunity to utilize technology-enhanced learning tools for both in-person and virtual classes. Perhaps the most compelling aspect is to provide these resources globally where alternatives are not available.

Although the base R software was developed by a small group of dedicated individuals, it is now maintained and developed by a wide community. It is not the same as crowdsourcing, where the wisdom of the collective rules. Nonetheless, it is far from having a single author, or small group, write the code. In the same way, we hope to have many people from a wide spectrum contribute OERs.

The following are a few other efforts currently underway or being contemplated:

- Translations. As described earlier, nearly all of Loss Data Analytics has been translated into Spanish. Clearly, as with many other OERs, much of the (freely available) base work could be translated into multiple languages.

- Other textbooks. A small team (Vali Asimit, City University of London; Dani Bauer, University of Wisconsin-Madison; Adam Butt, Australian National University; Emiliano Valdez, University of Connecticut) is developing a framework for a life contingencies textbook. As an aspirational goal, we would like to have resources available for all of the foundational actuarial courses. With the changing exam systems, updates for open textbooks can be more flexible and certainly more cost-effective for students.

- Alternative software. Much of the content developed to date has been based on R as the choice of computational software. Going forward, there are many advantages to supplementing this with other languages, such as Python.

- Case studies. The work so far has been on relatively low-level technical aspects that form the foundation of our profession. Another next step will be to include case studies or a broad computing platform (such as Anaconda) to demonstrate the impact of the mathematical approaches being presented.

This is an exciting time in actuarial education. For decades, teaching meant getting your fingers dirty with chalk from writing on blackboards while reading from faded, yellowish lecture notes. Now education initiatives invite creative approaches and have a similar thrill as when one does research. As we wrote in a 2019 article for The Actuary, we believe in pushing boundaries and creating new ways of teaching effectively for the future. The innovative use of technology and open-source materials is the way to create diversity, equity, and inclusion in the actuarial profession. For those interested in contributing, contact Jed Frees (jfrees@bus.wisc.edu) or Miyuki Ebisaki (mebisaki.astin@gmail.com) in their roles as caretakers of the ASTIN Academy.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

Edward (Jed) Frees, FSA, PhD, is an emeritus professor in the Risk and Insurance Department of the Wisconsin School of Business and professor at the Australian National University. He can be reached at jfrees@bus.wisc.edu.

Paul Johnson, PhD, is a lecturer in the Risk and Insurance Department of the Wisconsin School of Business. He can be reached at paul.johnson@wisc.edu.

Marjorie Rosenberg, FSA, PhD, is the Assurant Health professor of actuarial science in the Risk and Insurance Department of the Wisconsin School of Business. She can be reached at mrosenberg@bus.wisc.edu.