How We Became the Most Affordable UCAP-AC Program in Ohio

By Julan Al-Yassin

Expanding Horizons, August 2022

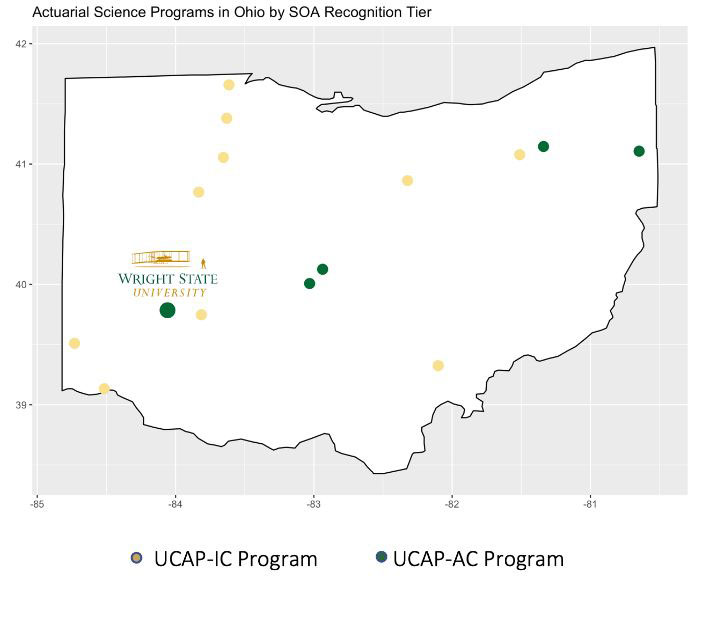

Wright State University is a public research university in Dayton, Ohio, with approximately 11,000 students. With the lowest tuition fees in Ohio, the university has an access mission and plays a critical role in the region by offering high-quality, affordable education. I joined Wright State University in fall 2019 as the director of the Actuarial Science program. In spring 2020 we attained the Universities and Colleges with Actuarial Programs (UCAP)-AC designation from the Society of Actuaries (SOA), becoming one of only three universities in southwest Ohio at this recognition tier, as shown in Figure 1.

Figure 1

In this article, I would like to tell you about the journey our program has taken—its successes and its challenges. The goal is to offer a resource to other universities seeking to upgrade their Actuarial Science programs.

Where We Started

The department of Mathematics & Statistics had designed an Actuarial Science program in 2014 and approved it as a concentration within the Statistics major. The program had coverage for two actuarial exams (P and FM) and two VEEs. The first set of students entered the program in 2016 when Bill Partridge, a retired professional actuary, came on board to teach the Theory of Interest (Exam FM) course and advise actuarial science students. Mr. Partridge also introduced a one-credit-hour seminar course focused on problem-solving for Exam P. With Mr. Partridge’s expert guidance, the program attained UCAP-IC status in 2017.

Attaining the UCAP-AC Designation

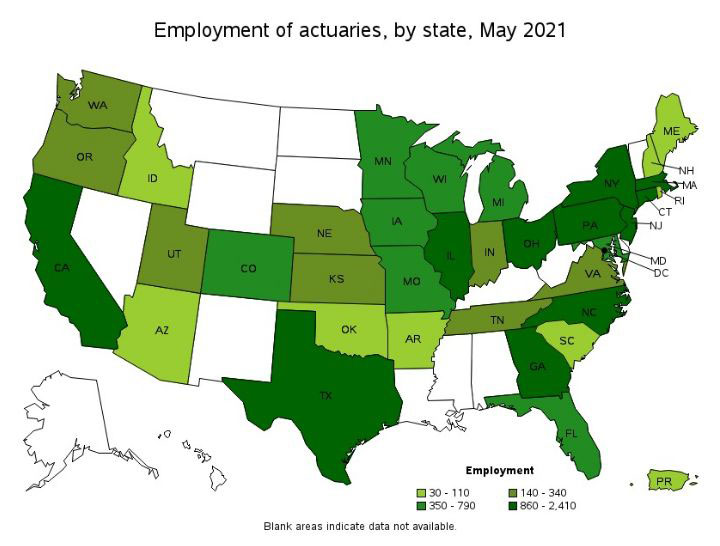

When I joined the program in fall 2019, I was tasked with upgrading the program’s SOA designation to UCAP-AC. Ohio has ample employment opportunities in the actuarial field, as illustrated in Figure 2, and Wright State offered an affordable option for students to enter this attractive career path. The university was willing to invest to expand the program capacity and ensure that it was competitive.

Figure 2

Source: U.S. Bureau of Labor Statistics, Occupational Employment and Wage Statistics: 15-2011 Actuaries, Mar. 31, 2022, https://www.bls.gov/oes/current/oes152011.htm#st.

To attain the UCAP-AC designation, a program must “maintain course coverage for at least four SOA preliminary exams with one of those being Exam LTAM or Exam STAM and approved courses for all Validation by Educational Experience (VEE) topic areas.”[1]

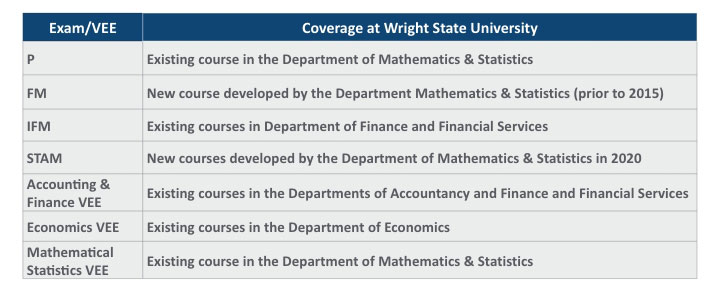

We already had coverage for exams P and FM and two of the three VEEs. Collaborating with colleagues in the Raj Soin College of Business, we were able to fulfill the requirements for the UCAP-AC designation without straining resources. We leveraged existing courses in the Department of Finance and Financial Services and created two new courses to cover STAM topics. Table 1 summarizes how we fulfilled the requirements for the UCAP-AC designation.

Table 1

Courses to Cover UCAP-AC Requirements

The SOA was exceptionally helpful throughout this process. Tiffany Tatsumi, the SOA manager of university programs, served as a valuable resource, explaining the SOA expectations in terms of a course’s coverage of exam material and other details. In addition, she provided guidance that helped us move through the process efficiently.

Curriculum Updates and Industry Partnerships

In designing our Actuarial Science program, we prioritized making it well-rounded. It includes requirements in several subject areas: mathematics, statistics, computer science, economics and finance in addition to the university’s general education requirements. In this sense, it was already set up very well before we made changes for the UCAP-AC designation. We regularly review the program to make sure we have the most relevant required and elective courses, making changes as necessary. For example, we recently swapped out one of the programming courses that was based on Java for one based on Python and added Machine Learning to the approved list of major electives.

One of the strengths of the Department of Mathematics & Statistics is the close relationship between faculty and students as well as among the students themselves. Having smaller class sizes, faculty at Wright State get to know their students well and can provide personalized advice and guidance when needed. Further, I mentor the students, advising them and advocating for them to ensure they have the smoothest possible journey toward their goals. I find this aspect of my job very enjoyable.

To ensure the program is effective in preparing our students for successful employment in the actuarial industry, we reached out to professional actuaries in our area. The profession has a wonderful culture of service and giving back. I have found professional actuaries to be generous in sharing their time and expertise and in providing advice and guidance to actuarial programs from an employer’s perspective. Based on our conversations, we learned of some key requirements that employers expect in their internship applicants. Here are some of the most important:

- Strong analytical and problem-solving skills

- Evidence of ability to pass actuarial exams

- Familiarity with a variety of software applications ranging from Excel and SQL to R, Python and other specialized software

- Strong communication skills

- Overall business and economics knowledge

- Other soft skills—leadership, independence, teamwork, time management

Our enhanced curriculum positions students well for items 1 and 3 through 5. To encourage students to take actuarial exams, we introduced an exam fee reimbursement scholarship to help reduce the financial burden. We also encouraged community building within the program to give the students peer mentoring opportunities and leadership experience. The students created the Future Actuaries student club, which is currently undergoing a formal registration process as a university club. Moreover, we regularly invite professional actuaries to speak to and meet our students. These opportunities are an important component of the program and allow students to network with potential future employers and connect with industry mentors and role models.

Building Pipelines

We work to build and sustain two pipelines in relation to the program:

- Pipeline out: In addition to advising our program and talking to and inspiring our students, our industry partners regularly share internship and employment opportunities with us. These companies believe in Wright State’s mission and like to see our program and students succeed. In addition, they have positive experiences with interns from the university. The skills and experiences our students develop in our program and their excellent work ethic make them productive actuarial interns; over 95 percent of them receive an offer of permanent employment by the end of their internship.

- Pipeline in: To build a pipeline into the program, we work closely with community colleges and high schools in the area. We promote the actuarial career path to students who enjoy problem-solving and work with the schools and colleges to streamline student entry into the program.

Goals and Challenges

As we go forward, we will continue to review and update our program as needed to ensure that it remains current and relevant to the employment climate. For example, working with our industry partners we have identified real-world problem solving as a high-priority programmatic goal. We are working systematically to build mini projects (or hackathons) into the program.

One challenge we have faced is low exam uptake among students despite the reimbursement scholarship and exam prep help that we have built into our courses. Most of our students are academically high-achieving, full-time students who are also working 30-hour workweeks to help fund their studies, leaving them with little time for exams. We are looking into ways we can help overcome these challenges and help them enter their junior year with one to two exams passed. Some of the ideas on the table are exam reimbursement for the first attempt, regardless of the result, and an exam study scholarship.

The COVID pandemic and other circumstances have meant that our enrollments remain quite volatile. This introduces challenges with course offerings and program planning. We continue to promote the profession in our community, and we are constantly thinking of recruitment strategies to grow the program in a stable manner and to make it more diverse and inclusive.

Conclusion

Our program has come a long way and is very competitive in this region. Just as the actuarial industry is continuously growing and evolving, so too will our program.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

Julan Al-Yassin, CFA, is an instructor and the director of the Actuarial Science Program at Wright State University. Julan can be reached at julan.al-yassin@wright.edu.