Recent Motivations in Life Insurance Mergers and Acquisitions

By Zeeshan Rehmani, David Alison and Baudouin Richier

The Financial Reporter, November 2021

The insurance industry is facing significant changes. The COVID-19 pandemic has had a severe impact to the economy and the insurance industry has not been immune. The market turmoil as a consequence of COVID-19 has had far-reaching implications for the insurance industry; the volatility of equity markets, interest rates at historical lows, and heightened credit risk all have a significant impact on the balance sheets and capital ratios of insurers.

The pandemic also added to the continued capital strain on the industry, stemming from increased solvency requirements, credit risks and a low interest rate environment that has persisted for almost a decade.

Insurers are reflecting upon their current capital management strategies to ensure that they have sufficient capital to meet obligations under current conditions. As they continue to build their understanding of the short and long-term impacts on their organization, the economic volatility has generated both opportunities and threats with regards to strategic capital deployment. Major life insurance companies in the current environment are primarily evaluating their portfolio of business to be more focused strategically as they redefine their “core” business and operating model for the future.

In addition, the pandemic has accelerated the digital journey for insurers and refocused them on customer experience, digital distribution, and operational excellence. Insurers have been leveraging their internal capabilities while accessing external capabilities through acquisitions and partnerships with technology vendors where there have been gaps. This article reviews some of the resulting recent developments in the industry.

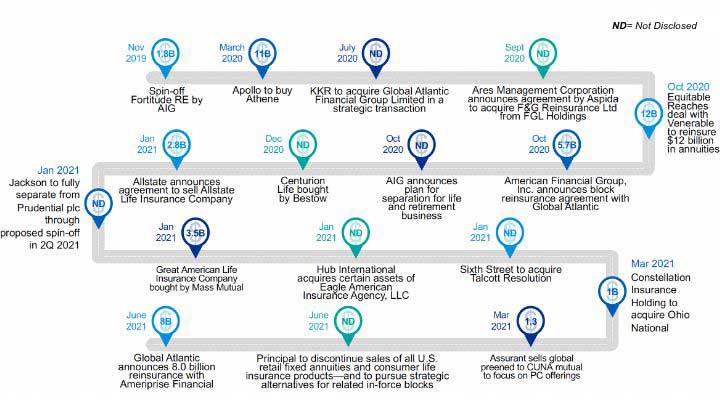

Recent Transactions

One area in particular has been the notable increase in mergers and acquisitions (M&A) activity within the insurance industry over the course of 2020–21, and the market has experienced multiple high-profile examples of such activity in recent months as shown in Figure 1.

Figure 1

Timeline of Recent Transactions

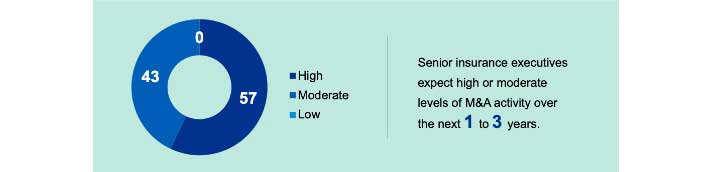

Not only is recent activity strong, but the expectation is that the level of M&A activity in the insurance industry will continue to be high over the next one to three years as shown in Figure 2.

Figure 2

Near-term M&A Outlook

Source: Based on a KPMG Poll of over two dozen senior executives at major insurance companies engaged in M&A, Strategy, and/or Innovation initiatives at their respective companies (mid to late 2020).

Key Themes

Although each transaction is unique and developed in reaction to a variety of conditions, there have been a number of common themes in the recent motivations from buyers and sellers, which include:

- Exiting lines of business that have become sub-optimal due to the low interest rate environment

- De-risking balance sheets against anticipated accounting change impacts

- Releasing capital for market and product expansion

- Increasing focus by private equity firms in the insurance market for capital-intensive products

- Acquisitions for building business scale, synergies, and enhanced capabilities

Strategic Drivers of Divestiture from Capital-intensive and Non-core Business

Exiting Lines of Business That Have Become Sub-optimal Due to the Low Interest Rate Environment

Interest rate have been at historical lows since the 2007–2008 financial crisis; real Treasury rates have turned negative and the expectation is that rates will take a number of years to increase, which has had a considerable and lasting impact on the insurance industry. Given their high investment in fixed income securities, insurance companies during this tenure have found it difficult to generate their required returns.

Furthermore, life insurers are also susceptible to interest rate risk on the liability side of the balance sheet due to the nature of their rate sensitive products. The liability portfolio for many life insurers includes minimum guaranteed income benefits built around historic rates much higher than the ones available in today’s fixed income market.

With the expectation that rates will persist at these low levels for a significant period of time, there will be continued pressure on short term returns and restrictions to the flexibility in pricing of new and existing products. Therefore, the focus has shifted to exiting sub-optimal lines of businesses and to other methods to counteract the low interest rate markets and accompanying capital strain.

As potential evidence of such behavior, one recent transaction example could be Equitable Holdings Inc. reinsuring their $12 billion block of annuities to Venerable Holdings Inc. The block includes over 140,000 variable annuities that contain guaranteed minimum income benefit guarantees and/or guaranteed minimum death benefit guarantees with the guaranteed rates ranging from 6 percent to 6.5 percent. These contracts were sold between 2006 and 2008 when interest rates were significantly higher than today’s rates and could back these guaranteed rates.

Another example where exiting from lower growth and return business has been referenced includes the sale of Allstate Life Insurance Co. by Allstate Corp. to entities managed by investment firm Blackstone. Allstate CEO Tom Wilson explained that the company “is deploying capital out of lower growth and return businesses while continuing to execute our strategy to grow market share in personal property-liability and expand protection solutions for customers.”

On the other hand, one personal lines and life mutual company’s stated reason for not selling its life business was that it believed that the personal lines business would stick longer if the customer had a life policy as well.

De-risking Balance Sheet Against Anticipated Accounting Change Impacts

Recent and forthcoming regulation changes in the industry have also encouraged entities to reassess the capital intensity and profitability for all lines of business within their portfolio. Public companies are facing pressure from their boards and analysts to de-risk their balance sheet. On the other hand, mutual companies have not followed suit even though they are getting questions from their boards and stakeholders whether they should de-risk.

In addition, accounting changes in the industry such as International Financial Reporting Standards 17 (IFRS 17) and long-duration targeted improvements (LDTI) have changed the way insurers recognize profit, and certain cohorts that were profitable in the past may lead to disclosure of losses in the future. Although the companies are still assessing the potential impact from LDTI implementation, it is expected that those portfolios with the following characteristics will be more adversely affected:

- Older product vintages, as these most likely have higher locked-in discount rates under current GAAP.

- Long-tail liabilities where no unlocking has occurred to date due to adverse deviations from their pricing assumptions such as LTC utilization and payout annuity longevity.

- Materiality of variable annuities, especially if not hedged, and GMxB riders, as market risk benefits are now fair valued and will be more volatile.

IFRS 17 will also impact the financial reporting of insurance companies. Examples of these impacts include the requirement to isolate onerous contracts from profitable ones and to disclose a loss component. In addition, insurance companies subject to IFRS 17 reporting will need to rethink their communication to investors with new revenue and profit recognition patterns that are expected to be significantly different than under current reporting basis.

Finally, implementing these new regulations is more complex and expensive for entities that are exposed to a wide range of insurance products. On top of other factors, skipping this process can provide an incentive to refocus around the core business and the increased regulatory costs have been cited as a motivation for divestiture.

In March 2020, Constellation Insurance Holdings, Inc. acquired life and disability insurer Ohio National Mutual Holdings, Inc. for a total of $1 billion. Barbara A. Turner, president and chief executive officer of Ohio National, stated that “in the midst of a challenging economic environment, historically low interest rates, increased regulatory costs and pressure for the entire industry, Ohio National is taking this next logical step to fortify the business with additional capital and a more flexible capital structure.”

Releasing Capital for Market and Product Expansion

Many insurers in the current environment have offloaded capital-intensive, non-core entities or blocks of business to deploy capital for growth and focus on capital light businesses. The majority of these insurers have offloaded legacy and non-profitable business to either stabilize their capital ratio, pay out dividends or to invest in profitable lines of businesses or geographies. Static new business levels in traditional markets and the opportunity for greater margins in other lines and geographies together drive capital redeployment.

Several companies have entered the group life, disability and voluntary benefits businesses through acquisitions in order to get to the customers at the top of the value chain. Some recent transactions include:

- MetLife’s US$1.7 billion acquisition of Versant Health in 2020.

- New York Life’s US$6.3 billion acquisition of Cigna’s group life & disability insurance business in 2019.

Following these transactions, New York Life and Metlife became the second largest market participants in Group Life and Voluntary Benefits, respectively.

One notable example where geographic and product expansion was used as justification for divestiture is the spinoff of Jackson Financials from Prudential plc, where the company will use excess capital to fund their growth in the Asian market. Mike Wells, group chief executive of Prudential commented: “The demerger we are announcing today will significantly accelerate Prudential’s transformation into a business purely focused on profitable growth in Asia.”

Another example is American Financial Group Inc.’s decision to sell its annuity business to Massachusetts Mutual Life Insurance Company for US$3.5 billion. AFG’s co-chief executive officer, S. Craig Lindner commented “AFG’s capital and liquidity will be significantly enhanced as a result of the transaction. With a strong balance sheet and substantial excess capital, we will continue to evaluate opportunities for deploying AFG’s excess capital, including the potential for healthy, profitable organic growth, expansion of our Specialty Property & Casualty niche businesses through acquisitions and start-ups that meet our target return thresholds, as well as share repurchases and special dividends.”

Strategic Drivers Behind Acquisition of Complementary Portfolios

Increasing Focus by Private Equity Firms in the Insurance Market for Capital-intensive Products

On the acquisition side of a number of these transactions are private equity firms rather than other insurance companies. Private equity companies have been enthusiastically acquiring legacy insurance companies and the pace of such acquisition dynamics has only accelerated in recent months.

By acquiring insurance companies, private equity firms can increase their assets under management considerably with low risk of losing these funds. This allows them to maintain strong credit quality due to most insurance companies having heavy fixed income portfolios and a strong capital base. Private equity firms can leverage the steady stream of reliable assets offered by insurance books and having such capital at their disposal means they won’t have to raise money in the market as readily.

Private equity firms provide expertise and greater tolerance for offshore and unique capital structures than some insurance companies including partnering with pension funds requiring low rate of returns. The investment management focus on finding the optimal capital efficiency and desire to up-risk the portfolio will help these insurance products stay profitable in low interest rate environments. As such, private equity firms serve as enablers for insurance companies seeking to increase yields on capital.

Recent transactions in the industry include: Blackstone’s purchase of Allstate Life Insurance Company, Sixth Street’s purchase of Talcott Resolution Life Insurance Company, and KKR’s strategic transaction with Global Atlantic where KKR will acquire all of Global Atlantic’s outstanding shares. After KKR’s announcement of the deal, Joseph Bae and Scott Nuttall, co-presidents and co-chief operating officers of KKR, commented: “This transaction is highly strategic for KKR—it meaningfully expands our base of permanent capital, further diversifies and scales our business, and significantly grows our position within the insurance industry, which has been increasing its exposure to alternative investment strategies. Insurance providers play a critical role in supporting the financial security for millions of individuals.”

Acquisition for Building Business Scale, Synergies, and Enhanced Capabilities

A number of recent acquisitions have been motivated by insurance companies aiming to grow their core book of business inorganically. Increasing business size will allow firms to benefit from economies of scale, greater assets under management, and a larger participant base. In addition, such acquisitions bring with them the opportunity to access enhanced technology expertise or new distribution channels.

In the example of MassMutual, the annuities acquired complement its existing annuity business and adds new distribution capabilities that will help position the company for long-term growth. Roger Crandall, chairman, president and CEO, MassMutual explained that “this acquisition is an excellent strategic fit for MassMutual that will broaden our product offerings, expand our distribution, and generate additional earnings, allowing us to build a true lifetime income franchise and deliver ongoing value to our policyowners and customers.”

On the other side of this transaction, S. Craig Lindner, AFG’s co-chief executive officer stated that “this transaction presents an excellent opportunity for Great American Life and MassMutual to be one of the leading providers of traditional fixed and indexed annuities in major distribution channels and markets.”

Conclusion

While the US economy continues to recover from the effects of the COVID-19 pandemic, the primary drivers of M&A activities in the insurance industry are expected to keep insurance companies under pressure; effective dates of regulatory and accounting changes have only been delayed and interest rates are likely to remain at low levels for several more years.

We have seen an uptick in M&A activity in the market over the last several months and expect to see more churning in the market going forward. COVID-19 has created an unprecedented economic environment for insurers to navigate and life insurance companies must continue to evaluate their portfolio of business in order to optimize capital deployment in line with their overall strategic objectives.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the respective authors’ employers.

Zeeshan Rehmani, is a managing director at KPMG. He can be reached at zrehmani@kpmg.com.

David Alison, is a director at KPMG. He can be reached at davidalison@kpmg.com.

Baudouin Richier, is a manager at KPMG. He can be reached at baudouinrichier@kpmg.com.