A Fresh Look at Accounting for Reinsurance of Universal Life

By Steve Malerich

The Financial Reporter, September 2022

Accounting Standards Update No. 2018-12, Targeted Improvements to the Accounting for Long-Duration Contracts (LDTI), left provisions for universal life (UL) liabilities and for reinsurance largely unchanged. Other than changes to the amortization of deferred acquisition costs (DAC), market risk benefits, and premium deficiency, LDTI’s effects on accounting for universal life and reinsurance are mostly indirect and often insignificant.

If LDTI has so little effect on accounting for UL liabilities and for reinsurance, why should we take a fresh look at UL reinsurance accounting?

Why a Fresh Look

Under LDTI, DAC amortization will no longer obscure the relationship between direct and ceded accounting. It is now possible to align ceded accounting with direct, without any noise from DAC amortization. With poor alignment, distortions within the results reported to management and financial statement users will be different, sometimes greater than before. Whether the goal is to improve reporting or to avoid making it worse, a fresh look can help.

Most of the approaches that have been used to account for UL reinsurance can still be used. One exception is the implicit approach where, in lieu of explicit accounting for reinsurance, the gross profits used to amortize DAC were adjusted to be net of reinsurance. With the elimination of gross profits as an amortization base, this approach no longer has meaning.

For surviving approaches, it is now easier to evaluate their effectiveness in presenting the economic protection provided by reinsurance.

In this article, I begin an evaluation by examining the fundamentals of accounting for the insurance element of universal life. After that, I consider the economic protection provided by reinsurance and look for an ideal—a way to effectively account for that protection.

In a second article to be published later this year, I’ll evaluate several reinsurance approaches in terms of noise from missing the ideal, then end with some thoughts on what might be done to eliminate noise.

The focus of both articles is on the insurance element. Accounting for the deposit element, embedded derivatives, and market risk benefits is beyond the scope of these articles. Also outside of scope is the requirement, in Accounting Standards Codification (ASC) Topic 326, to recognize a current estimate of credit losses from the failure of a reinsurer to reimburse reinsured benefits.

Universal Life Liability Basics

For universal life insurance, ASC Topic 944 separates accounting into two elements—deposit and insurance. The policyholder account balance is the liability for the deposit element (ASC 944-40-25-13). Accounting for the insurance element is sometimes on a pay-as-you-go basis, with assessments and benefits recognized in net income as earned and incurred. In contrast, some contracts require an additional liability for insurance benefits (ALIB) (ASC 944-40-25-27A)—an accrual for excess benefit payments (eB) accrued on direct assessments (dA) (ASC 944-40-30-20). In formula, ALIB is either:[1]

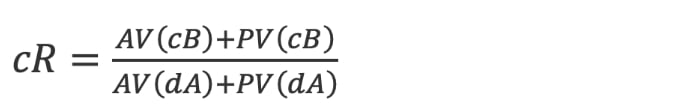

where AV represents an accumulated value of actual assessments earned and benefits incurred before the valuation date. bR is the benefit ratio:

with PV representing the present value of expected assessments and benefits projected beyond the valuation date.

| Excess Benefit Payments |

|

These articles follow the definition in ASC 944-20-15-24 of “excess payments” as “insurance benefit amounts and related incremental claim adjustment expenses in excess of the account balances.” |

As an alternative to formula <2>, it can be useful to express ALIB as an equivalent present value of future benefits and assessments.[2]

Reinsurance Accounting Basics

ASC 944-30-35-64 specifies that “reinsurance transactions that represent recovery of acquisition costs shall reduce applicable unamortized acquisitions costs in such a manner that net acquisition costs are capitalized ….” These articles assume compliance with this requirement.

ASC 944-40-25-34 requires recognition of reinsurance recoverable (RR) in a manner using assumptions that are consistent with those of the underlying reinsured contracts. To be consistent, the manner of recognizing reinsurance recoverable for universal life insurance depends on the requirement for an additional liability or the lack thereof.

Subtopic 944-605-35-15 requires amortization of reinsurance cost (RC) using assumptions that are consistent with those used in accounting for the underlying reinsured contracts. Subtopic 944-605 does not fully define reinsurance cost or specify an approach to amortizing it.

According to ASC 210-20-45-2, an entity may report assets and liabilities with a single counterparty as a single, net asset or liability if it has a right of setoff. Since reinsurance contracts often contain such a right, a company may combine reinsurance recoverable and reinsurance cost into a single asset or liability for financial statement presentation. In some circumstances, recoveries and costs might even be combined into a net cash flow stream for determination of the net asset or liability. This right, however, does not supersede the requirements of either subtopic 944-40 or 944-605.

Topic 944 does not include any explicit reference to reinsurance allowances other than the reference in 944-30 to “reinsurance transactions that represent recovery of acquisition costs. …” The manner of accounting for other allowances is therefore subject to interpretation. Possible interpretations include treating them as:

- Reductions to reinsurance premiums,

- additions to recoverable benefits, or

- analogous to direct expenses.

To best reflect the economic protection provided by reinsurance, level allowances should be treated as analogous to direct expenses and excluded from reinsurance asset or liability measurement. Non-level allowances (other than recovery of acquisition costs) might be added to recoverable benefits (analogous to claim adjustment expenses) or subtracted from reinsurance premiums.

Without an Additional Liability

For universal life contracts that do not require an additional liability, accounting for reinsurance recoverable in a consistent manner requires recognition of the recoverable amounts at the same time the benefits are recognized—when a claim is incurred. For these contracts, the additional liability is zero so the corresponding reinsurance recoverable should also be zero. (Incurred claim liabilities and their corresponding reinsurance recoverable assets are not addressed in these articles.)

Reinsurance premiums can be included in the reinsurance cost to be amortized. Whether that is necessary or desirable may depend on the pattern of reinsurance premiums. For example, it may be best to use a net premium approach to calculate a cost of reinsurance liability if first year reinsurance premium rates are zero.

Unless it is determined that reinsurance premiums can be recognized as a cost only when they become payable, the manner of accounting for recoveries and costs will be different. For these contracts, reinsurance recoverable and reinsurance cost can be combined for presentation, but their respective cash flows can’t be combined into a net calculation.

With an Additional Liability

Economically, reinsurance replaces volatile reinsured benefits with fixed reinsurance premiums. For contracts with an additional liability, the economic protection can be recognized by accounting for both reinsurance recoveries and reinsurance costs in a manner that produces a net liability after reinsurance (direct liability plus or minus a net reinsurance liability or asset).

Returning to formula <4> but with a substitution of formula <3> for the benefit ratio, ALIB can be expressed as:

Ideally, a net liability (after reinsurance) will substitute ceding premiums for ceded benefits (the portion of direct benefits that are reinsured) in formula <5>. To identify an approach that satisfies this ideal, it is helpful to separate excess benefits into retained benefits (rB) and ceded benefits (cB). Then, the benefit ratio can be split into a retained ratio (rR) and a ceded ratio (cR) such that:

Substituting ceding premiums (cP) for ceded benefits produces a ceding premium ratio (pR) and a net liability (NL):

Solving for the Ideal

Without an Additional Liability

Without an additional liability, the ideal reinsurance recoverable remains zero. This is represented in the unearned premium approach to accounting for reinsurance. When reinsurance premiums are paid annually, this approach will spread recognition of the annual cost over the year that it covers. It might be measured precisely as the unearned portion of each reinsurance premium or approximately as ½×cP or ½×cx. Except for this one-year spreading, the unearned premium approach does not accrue a reinsurance recoverable asset.

We said earlier that amortization of reinsurance premiums might still be appropriate but that there was no clear ideal for this situation. Looking at income, however, we might narrow the number of choices for the manner of amortization.

Specifically, LDTI removes retrospective remeasurement of DAC. Consequently, retrospective remeasurement of RC would produce an irregular gain or loss in a situation where there is no corresponding amount in direct measurements. It would seem, therefore, that in this situation an ideal approach to amortizing the cost of reinsurance would not include retrospective remeasurement.

These articles do not address any other considerations in the amortization of reinsurance premiums for contracts that do not require an additional liability.

With an Additional Liability

Having separated the additional liability into retained and ceded portions (formula <8>) and defined an ideal net liability (formula <10>), we can derive an ideal measurement for a net reinsurance recoverable asset as the excess of ALIB over NL:

Alternatively, we can derive an ideal measurement for a net cost of reinsurance liability as the excess of NL over ALIB:

Either way, this is the universal life version of the net cost approach to accounting for ceded reinsurance.[3] Under this approach, recognition of the net cost of reinsurance is aligned with recognition of the reinsured portion of excess benefits—net cost reduces income as a percent of revenue and remeasurement for experience variances and assumption changes aligns with the effect of reinsured cash flows on direct liability remeasurement.

Noise

This article identified the unearned premium and net cost approaches to accounting for UL reinsurance as ideal depending on whether or not an additional liability is required. Though ideal in appropriate circumstances, both approaches would fail to align reinsurance with direct accounting if used in other circumstances.

In the next article, I will compare established approaches to accounting for UL reinsurance to the ideals derived in this article. Where the approaches don’t match the ideal, I’ll describe the noise that results from differences between direct and ceded accounting and what might be done about it.

Statements of fact and opinions expressed herein are those of the author and are not necessarily those of the Society of Actuaries, the newsletter editors, or the author’s employer.

Steve Malerich, FSA, MAAA, is a director at PwC. He can be reached at steven.malerich@pwc.com.