Negative IMR Considerations in a Higher Interest Rate Environment

By Charles Chacosky, Rey Malile and Yuan Tao

The Financial Reporter, June 2023

The concept of interest maintenance reserve (IMR) is more than 30 years old, but it has become a hot topic recently due to rising interest rates, causing decreases or even negative IMR balances for some insurers. As a result, actuaries, particularly those responsible for financial reporting, are facing some new tasks and questions:

- How should negative IMR be treated for statutory reporting?

- What are the other actuarial implications of negative IMR?

- What have regulators done and/or plan to do about negative IMR?

- What are potential mitigants?

This article aims to examine these questions.

IMR Background

All life, accident, and health insurers domiciled in the U.S. are required to include an IMR in their Statutory Annual Statement in accordance with SSAP 7. IMR defers recognition of the realized capital gains/(losses) (RCG/(L)) from the sale of fixed income investments resulting from changes in interest rates (but not credit related decreases). These RCG/(L) are amortized into investment income over the expected remaining life of the investments sold. IMR is calculated and amortized (via seriatim or grouped methods) in accordance with the NAIC Annual Statement Instructions.

The primary purpose of IMR is to spread the effect that after-tax RCG/(L) arising from interest rate movements would otherwise have on statutory earnings, surplus, and amounts available for shareholder dividends. When IMR was originally developed, fixed income assets were valued at book value (reflecting the yield available at the time of purchase), consistent with NAIC prescribed book value of liabilities. Later, if fixed income assets were traded with different asset yields, there would be a disconnect between the asset book yield and the liability’s fixed valuation interest rate. By amortizing RCG/(L), IMR addressed the potential valuation mismatch.

With the advent of principle-based reserving (PBR), IMR must be included for PBR reserves, asset adequacy testing (AAT), and certain products’ risk-based capital (RBC). In accordance with the Valuation Manual (VM) and RBC instructions, IMR (positive or negative) or pre-tax IMR (PIMR) is required to be included in the actuarially determined items listed in Table 1.

Table 1

Regulatory References to IMR for Actuarial Items

The explicit requirement to deduct negative IMR for PBR and AAT was unintentionally increasing reserves or reducing AAT sufficiency, which only became apparent in 2022.

Year-end 2022 Treatment of Negative IMR and its Impacts

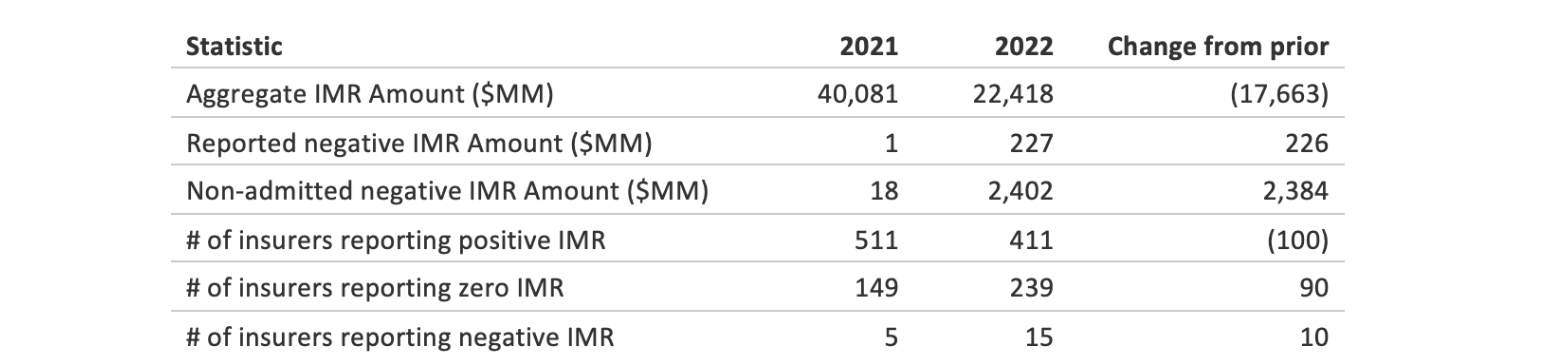

With rapidly rising interest rates in 2022, some companies that sold fixed income assets for a loss saw their IMR balances decrease or even become negative. Year-end 2022 NAIC statutory accounting rules treated negative IMR as a non-admitted asset. Table 2 summarizes IMR statistics from 2021 and 2022 statutory financial statements, highlighting the impact of realized losses on IMR in 2022.

Permitted practices allowing for the admissibility of negative IMR have been granted by some states to insurers meeting certain conditions. In Table 2, negative IMR is split between the amount reported as a statutory (negative) liability and all other negative IMR that was non-admitted.

Table 2

US Life Insurance Industry IMR Statistics (General and Separate Accounts Combined)

Source: S&P Global Market Intelligence Inc., 3/24/2023

For those insurers that did not admit negative IMR, the aggregate reduction to statutory capital and surplus during 2022 was $2.4 billion (approximately 0.5% of life insurance industry capital and surplus). As the $17.7 billion decrease in aggregate IMR shows, insurers are at risk of exhausting their remaining IMR ($22.4 billion at end of 2022), after which capital losses would directly impact capital and surplus. A capital loss of $20 billion per year represents approximately 4% of industry capital and surplus.

With the inclusion of negative IMR for the items in Table 1, the disallowance of negative IMR on the balance sheet can double count losses. To address this concern for year-end 2022, the NAIC Life Actuarial Task Force (LATF) adopted NAIC staff guidance for treatment of negative IMR in VM-20, VM-21, and VM-30. The guidance recommended that VM-20, VM-21 and VM-30 treat negative IMR consistently with statutory balance sheet reporting, thus avoiding the double counting of losses.

NAIC Developments Related to Negative IMR

At the NAIC Spring Meeting in March this year, the Statutory Accounting Principles (E) Working Group approved a seven-step way forward to a 2023 solution for admitting negative IMR. These “safeguard” steps included:

- Allow the admission of negative IMR up to 5% of surplus using the type of limitation calculation like that used for goodwill admittance. The new guidance will likely provide for a downward adjustment to the 5% when the RBC ratio is less than 300% Authorized Control Level.

- Recommend that the Life Actuarial (A) Task Force consider and address the asset adequacy implications of negative IMR.

- Recommend eliminating admitted negative IMR from RBC's total adjusted capital (TAC).

- Update the annual statement instructions for excess withdrawals, related bond gains/losses and non-effective hedge gains/losses to clarify that those related gains/losses are passed through asset valuation reserve (AVR), not IMR.

- Require the use of a special surplus (account or line) in the annual statement for negative IMR.

- Develop governance related documentation to ensure that sales of bonds are reinvested in other bonds.

- Develop footnote disclosures for quarterly and annual reporting.

- Clearly the removal of negative IMR from TAC would cause industry RBC ratios to deteriorate.

Therefore, these safeguards will undergo more considerations and scrutiny this year. One area for consideration would be to raise admissibility of IMR above 5% based on principle-based asset adequacy results. Another item that may require refining is the TAC downward adjustment because under RBC C3-Phase 1, negative IMR is already included in the RBC calculation (95th percentile risk).

As progress is made, we expect the industry will closely monitor and provide ongoing feedback.

Potential Mitigants and Conclusion

Insurers will continue to face interest rate-related risks even as the regulatory treatment of negative IMR changes, and have the following mitigants at their disposal.

- ALM: By effectively managing assets and liabilities, insurers can be better prepared to meet liability cashflow needs without selling assets at realized losses.

- Reinsurance: Closed block reinsurance can be used to manage IMR, subject to the ability of the reinsurer to provide reserve credit and desired collateral levels.

- Liquidity sources: Insurers may seek to generate liquidity to buy assets with attractive risk-adjusted spreads. In such cases, the preferred sources of liquidity may be maturing assets, new business in-flows, and potentially securities lending or other borrowing facilities.

Negative IMR is an important issue impacting insurers due to the rising interest rates. Recently, several banks experienced notable economic stress related to holding securities at book value at levels much higher than market value. The insurance industry, actuaries and risk professionals, and regulatory stakeholders must continue to work together to manage this risk and associated impacts.

The views expressed in this article are those of the authors and do not necessarily reflect the views of the authors’ firms.

Charles Chacosky, FSA, MAAA, is a managing director at Actuarial Risk Management. He can be reached at cchacosky@actrisk.com.

Rey Malile, FSA, MAAA, is a senior manager at Oliver Wyman. He can be reached at rey.malile@oliverwyman.com.

Yuan Tao, FSA, MAAA, is a principal at Oliver Wyman. She can be reached at yuan.tao@oliverwyman.com.