Group Capital Management in an Increasingly Global Insurance Market

By Paul Song, Seong-Weon Park and Dean Kerr

The Financial Reporter, November 2023

An “insurance group” refers to a collection of insurance entities that operate under common ownership. The distinction between an insurance group and the operating entities that form the group is important as regulators begin to take a holistic view of supervising insurance companies (i.e., group supervision).

The concept of group supervision has been around for several decades but has seen a significant increase in focus since the global financial crisis. Insurance regulators have been trying to establish and evaluate group-wide risks, including those from insurance entities and non-insurance financial entities domiciled outside their specific jurisdiction. This has become increasingly relevant, as we continue to see large, global insurance organizations write and reinsure business across a number of regulatory jurisdictions.

What are the Objectives of Group Supervision and Group Capital?

The goal of group supervision is for one regulatory authority (group supervisor) to have a comprehensive view of an insurance group and its associated risks and, by extension, to promote increased financial stability and adequate solvency at a group level. To do this, group supervisors require insurance groups to calculate available capital and solvency requirements on a consolidated basis (group capital), considering the risks and financial positions of all entities within the group.

Who are Group Supervisors?

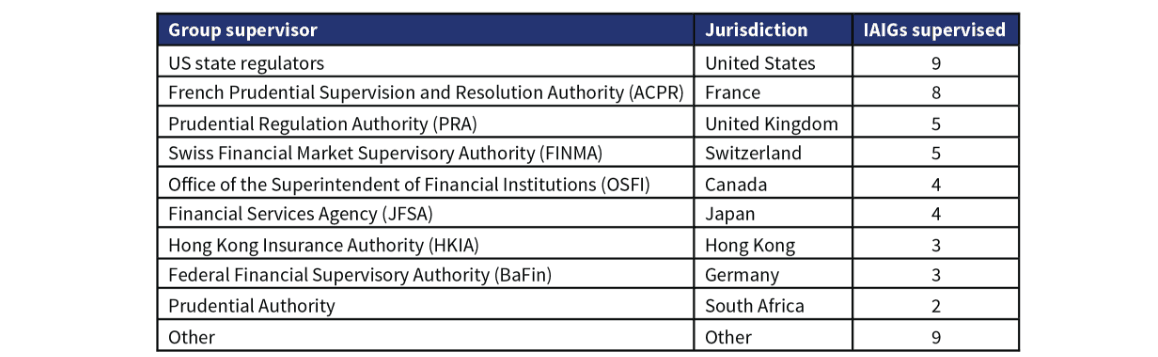

Group supervisors are generally the same regulatory bodies that oversee insurers on a local basis, for example, US state regulators, BaFin in Germany, the Office of the Superintendent of Financial Institutions (OSFI) in Canada, the Bermuda Monetary Authority (BMA), and the Hong Kong Insurance Authority (HKIA). The table below summarizes the number of internationally active insurance groups (IAIGs) supervised by each regulator (keeping in mind that group supervision is not only limited to IAIGs):

Table 1

Count of IAIGs by Group Supervisor and Jurisdiction[1]

Historically, group supervision for many insurance groups has been tied geographically to the group’s head office or where most business is written; however, recently, some companies have strategically evaluated various group capital structures and proactively pursued group supervision in specific jurisdictions.

Why is Group Capital Important?

The key objective of group supervision and capital is to promote global financial stability. That said, an implication of different group supervisors is that differences in capital frameworks can lead to varying risk assessment outcomes for similar risks. For example, Companies A and B may have very similar asset and liability portfolios. However, if Company A is subject to group supervision in one jurisdiction, and Company B is subject to group supervision in another (or none at all), then differences in group capital requirements can affect the companies’ capital planning and business strategies.

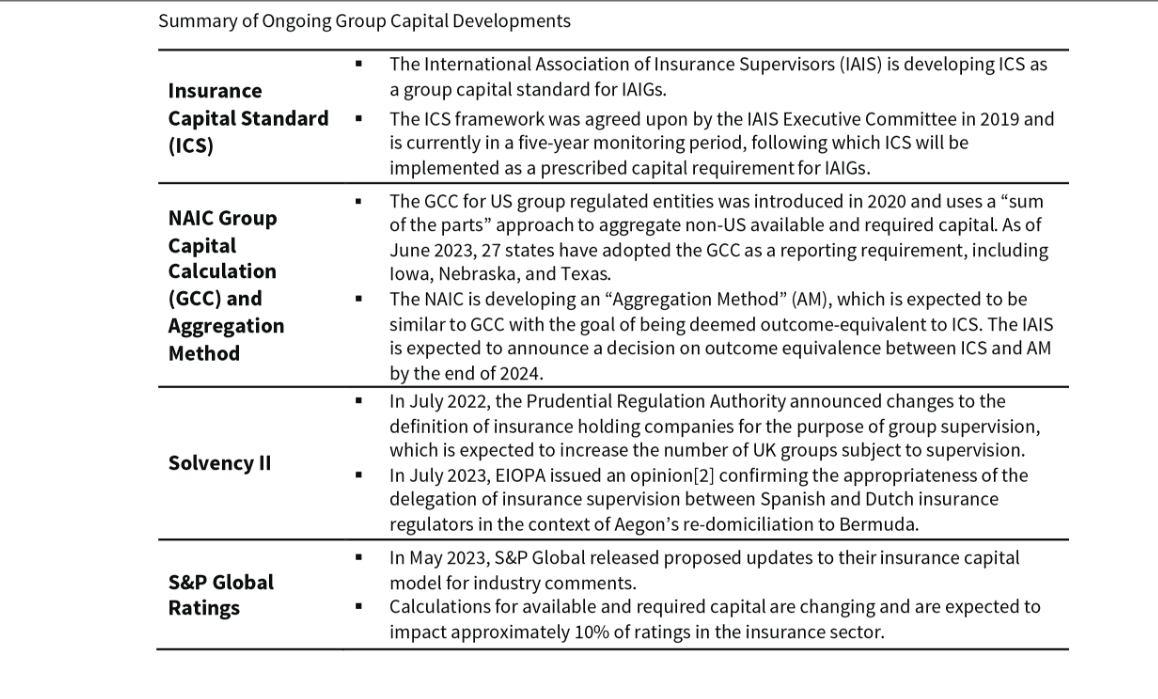

Global frameworks for group capital are still evolving. Additionally, non-regulatory bodies, such as rating agencies, also have a view of what constitutes an appropriate level of overall capital. Outlined below are some of the recent developments.

Table 2

Summary of Ongoing Group Capital Developments

How are Companies and Regulators Thinking about Group Capital?

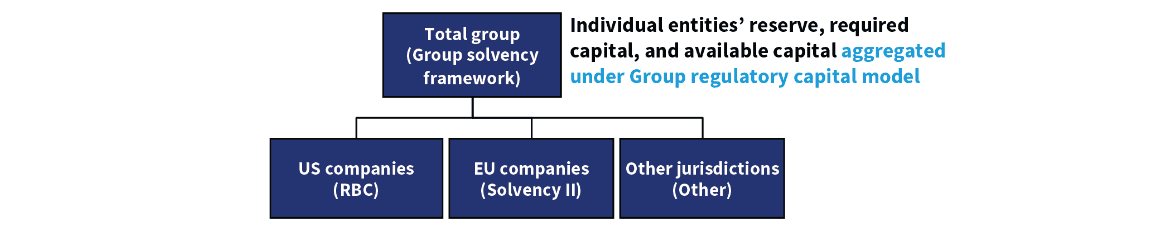

In practice, there are three methods used to calculate group capital under the structures defined by Solvency II. The diagrams below illustrate how each of the methods would apply for a sample group.

Method 1: Accounting consolidation-based method

Group capital is calculated on a consolidated basis under the solvency framework in which the group is supervised:

Examples of companies employing Method 1 include Bermuda-domiciled companies Resolution Life[3] and Athora,[4] who calculate group capital requirements aggregated under the Bermuda Solvency Capital Requirement (BSCR) model.

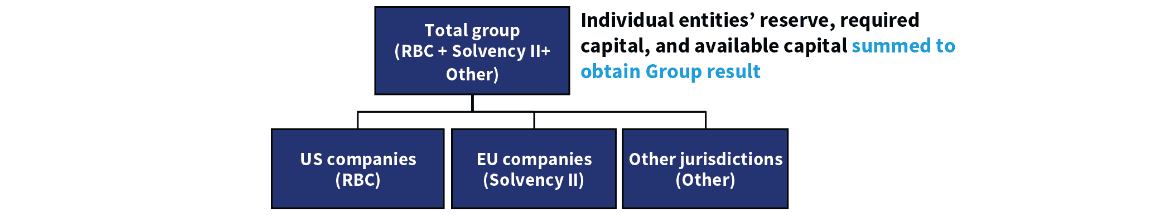

Method 2: Deduction and aggregation (D&A) method

Group capital is calculated by summing together the individual entity capital from different jurisdictions:

Companies using Method 2 include those group supervised in the US or Hong Kong, such as Berkshire Hathaway[5] or FWD.[6]

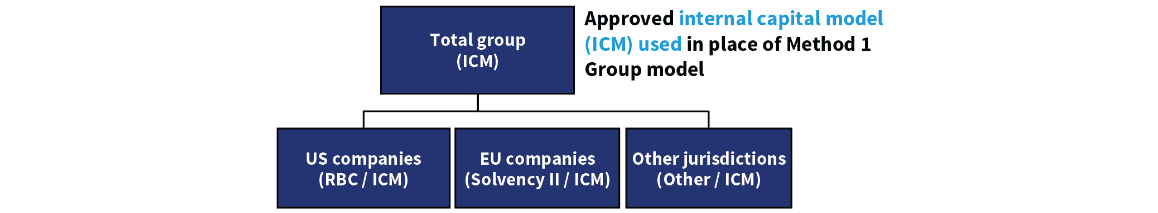

Method 3: Group internal capital model

Group capital is calculated using an internal model approved by the group supervisor:

Allianz[7] is an example of a company utilizing an ICM. Companies in certain jurisdictions may be able to employ a combination of methods, as is the case for Allianz, which calculates Solvency II capital for its European businesses using an ICM and combines that with capital for its US business using the D&A method (a combination of Methods 2 & 3).

A key consideration in selecting the optimal group jurisdiction is regulatory feasibility, as different group supervisors allow for different capital calculation methods. For example, Solvency II guidelines permit each of the three methods above,[8] whereas the NAIC GCC and HKIA’s local capital summation method (LCSM) prescribe calculations falling under the deduction and aggregation method.[9].

Conclusion

Undoubtedly, the insurance industry is becoming more of a global marketplace than a local operation. Global insurers recognize that different jurisdictions are optimal for different types of assets and liabilities. It is critical for insurers to perform quantitative analysis to inform a thorough understanding of each jurisdiction’s reserving and capital standards and establish a plan for group capital structure. As global regulators begin to refine their group supervision frameworks, now could be the right time for insurers to reconsider their group capital management strategy.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the respective authors’ employers.

Paul Song, FSA, FCIA, CFA, is a manager at Oliver Wyman. He can be reached at Paul.Song@oliverwyman.com.

Seong-Weon Park, FSA, MAAA, is a senior principal at Oliver Wyman. He can be reached at SeongWeon.Park@oliverwyman.com.

Dean Kerr, FSA, MAAA, ACIA, is a partner at Oliver Wyman. He can be reached at Dean.Kerr@oliverwyman.com.