Meeting New Demands: Adapting Actuarial Practices to Support FP&A Modernization

By Alpesh Sanghani and Elaine Zhou

The Financial Reporter, July 2024

An increasing number of insurance companies have started to put more emphasis on their Financial Planning & Analysis (FP&A) function, especially after the implementation of new financial regimes of Long-Duration Targeted Improvement (LDTI)[1] and International Financial Reporting Standard 17 (IFRS 17).[2] The objectives of FP&A for these insurance companies have changed from simply reporting financial metrics to understanding drivers of these financial metrics and deriving business insights. Consequently, many firms have started to make FP&A improvements for efficiency and better business capabilities.

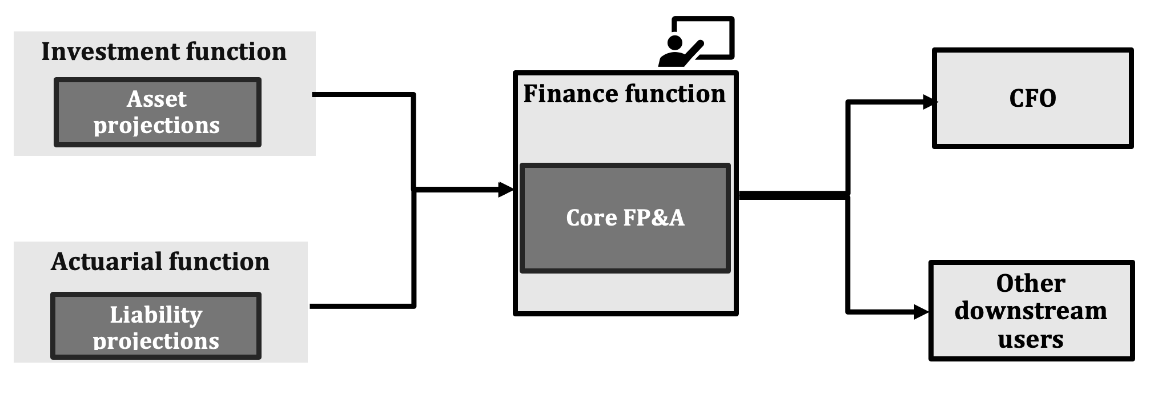

Figure 1 below underscores the collaborative nature of FP&A processes, which engage diverse stakeholders within an organization. The core FP&A function is usually handled by the finance function, which is responsible for generating projected financial statements, performing analytics and presenting these FP&A results to senior management. The chief financial officer (CFO) of the organization is typically responsible for signing off on the FP&A results for budgeting and planning purposes, and the FP&A results may also feed a few other downstream users such as the capital team and the risk team. The finance function relies on the support of the investment function and the actuarial function to generate the FP&A results. The investment function provides the finance function with the asset projections, while actuaries own and share the liability projections with the finance function.

Figure 1

Illustration of an FP&A Process

FP&A modernization has set new demands on where and how actuaries can better support FP&A. This article starts with the areas in the FP&A processes that the actuarial function commonly serves. It then highlights new demands we are seeing on actuaries as well as some leading practices, based on our past engagements, that the actuarial team can use to support FP&A modernization.

Actuaries’ Roles in Insurance FP&A

The actuarial function typically serves as the provider of liability projections of cash flows, reserves, as well as other related line items in not only the annual planning processes but also other more frequent FP&A reporting cycles. To produce a holistic view of liabilities, actuaries account for in-force policies as well as potential new business—spanning direct insurance operations as well as reinsurance activities. For new business, pricing actuaries collaborate with the sales team to incorporate the latest information around sales volume. Actuaries normally review and update the actuarial assumptions embedded in the liability projections annually in the planning process.

Actuaries commonly develop and utilize actuarial software to produce liability projections, although it is possible that some businesses are either still modeled using spreadsheets or non-modeled. We are seeing that actuarial software is mostly used to produce liability projections, but we did occasionally observe that it is used to generate asset projections as well.

New Demands for Actuaries from FP&A

Challenges and pain points have historically been observed in FP&A processes, and after IFRS 17 and LDTI implementation, some of these challenges have intensified. Undertaking FP&A modernization is imperative to address these challenges, from which we are seeing the following new demands for actuaries:

- Accelerate FP&A processes through automation: For many companies, each FP&A reporting cycle takes a significant amount of time. These lengthy FP&A processes are often driven by the substantial manual effort involved. Gathering assumptions and inputs depends on reaching out to different stakeholders, and delays are commonly seen, especially when it involves multiple teams. Also, the tasks of compiling results and performing analysis are often manual and heavily reliant on spreadsheets. As senior management looks for results to be more frequently refreshed, automating and streamlining FP&A processes has become a key objective for many companies in their FP&A modernization. A centralized system that automatically collects inputs, compiles results, and produces analytics is being developed by many companies. Actuaries should try integrating the actuarial data warehouse into this system, freeing up time to delve deeper into results analyses.

- Enable multiple scenarios capabilities: Today’s insurance landscape is marked by greater product complexity and fiercer competition, making scenario analysis indispensable. Actuaries should advance their modeling capabilities using actuarial software to generate liability projections in a timely manner, reduce their reliance on spreadsheets, and leverage a centralized system to summarize the multi-scenario results more effectively.

- Enhance analytical insight: Besides producing liability projections, actuaries are required to provide better business insights into these projections. Senior management now places a higher value on additional analyses. For instance, a quarter-over-quarter analysis that assesses impact from changes between reporting cycles helps senior management identify key drivers of changes in liabilities. Also, an actual-versus-forecast analysis helps explain the deviations and facilitates the improvement of future forecasts to generate more accurate results.

- Strengthen governance around FP&A processes: As seen from a few of our engagements, the current FP&A processes often lack proper governance and need to be more controlled. For instance, documentation around any updates in the actuarial model from one reporting cycle to the next might be insufficient, and understanding these updates might rely on some key personnel. Proper controls should be set throughout the processes of producing liability projections, integrating these projections into the centralized system, and performing further analyses. Key person risk should be minimized.

- Improve collaboration and achieve consistent storytelling: Modern FP&A practices demand cohesive teamwork and better collaboration between stakeholders. Actuaries need to effectively discuss their insights from the liability projections with the finance function to avoid any misinterpretation of the results. Changes in liabilities are likely to impact assets as well, and actuaries should inform the investment function of these changes in a timely manner so that it can adjust asset projections accordingly. Actuaries may also need to provide additional support to respond to finance team inquiries or provide alternative scenario analyses.

Leading Practices for Actuaries to Support FP&A Modernization

Leading Practices for Actuaries to Support FP&A Modernization

Based on our experience, below are some leading practices that actuaries can adopt to support FP&A modernization:

- Efficient new business projection generation: New business can be processed in different ways. One approach we have seen is that actuaries use actuarial software to generate unitized projections and then apply sales volume from the sales team to scale these unitized projections accordingly. This enables actuaries to swiftly revise projections in response to any sales volume changes.

- Seamless actuarial data integration: Many companies are working on establishing a centralized system for FP&A. Instead of manually feeding liability projections into the FP&A processes, actuaries can help integrate the actuarial data warehouse into this centralized system so that the actuarial data can be automatically input into FP&A. This saves manual effort and enables the actuarial data to smoothly flow into the FP&A processes.

- Comprehensive scenario analysis: Actuaries should design representative scenarios based on the product dynamics and forecasted economic environment and enhance modeling capabilities to process these scenarios. Cloud computing and batch processing are often useful ways to save modeling time.

- In-depth analysis and business insight: With FP&A processes more streamlined and cohesive through modernization, actuaries are now not only a data provider but are also an insight provider. Actuaries can now focus more on reviewing that data input into FP&A is complete, further calculations and analyses are properly controlled, and variations in liabilities meet expectations. Changes in liabilities and business insights should be properly documented as well as communicated with other teams and senior management.

Concluding Thoughts

Many insurance companies have started their journeys of FP&A modernization. All these FP&A enhancements empower companies to generate financial forecasts and derive business insights more effectively, but at the same time they set higher demands on stakeholders, including actuaries. To face these new requests, actuaries should adapt by embracing the leading practices in the industry. Ultimately, the triumph of FP&A modernization relies on the seamless collaboration of stakeholders and synergy of different skill sets across the organization.

The statements of fact and opinions expressed herein are the views of the authors and do not necessarily reflect the views of Ernst & Young LLP or other members of the global EY organization, the Society of Actuaries, or the newsletter editors.

Alpesh Sanghani, FSA, is a consulting senior manager at Ernst & Young LLP. He can be reached at alpesh.sanghani@ey.com.

Elaine Zhou, FSA, is a consulting senior at Ernst & Young LLP. She can be reached at elaine.zhou@ey.com.

Endnotes

[1] LDTI is effective for fiscal years beginning after Dec. 15, 2022, for most SEC filers and for fiscal years beginning after Dec. 15, 2024, for other companies.

[2] IFRS 17 is effective for annual reporting periods on and after Jan. 1, 2023.