Top Five Differences Between IFRS 17 and Solvency II

By Carlos Arocha

International News, November 2021

As insurance companies in many jurisdictions around the world are in the midst a major overhaul of financial reporting processes for insurance contracts, the question about tapping on the experience of Solvency II may help these companies to implement IFRS 17.

True, there are a few similarities between IFRS 17 and Solvency II, most notably with respect to the economic balance sheet approach, or the probability-weighted cash flow discounting techniques that both methodologies require. In addition, both IFRS 17 and Solvency II imply as broad and profound impact on all aspects of how insurers conduct business, from valuation methodologies and governance, data, processes, and technology impacts. Changes in roles and responsibilities between actuarial and finance departments also represent a considerable business impact.

However, in this article we focus on the salient differences between IFRS 17 and Solvency II. These are:

Top Five Differences

-

Scope

- Solvency II is a European legal framework that goes far beyond the mere calculation of a solvency capital requirement. It is a full-blown enterprise risk management paradigm, comprised of three pillars that deal with quantitative requirements, corporate governance and internal control functions, and transparency and disclosure requirements. Insurers must disclose a Solvency and Financial Condition Report (SFCR) to the public and must submit to the insurance supervisor detailed information about specific attributes of their business, including the Own Risk and Solvency Assessment (ORSA), that is a fundamental component of Solvency II.

- IFRS 17 is a global reporting standard that has as its chief objective the measurement of performance of insurance contracts in a manner that is aligned with economic principles. It does not specifically address corporate governance or operations of insurance companies, and it does not impact only insurance and reinsurance companies, but also any entity that issues insurance contracts.

-

Purpose

- Solvency II attempts to guarantee the solvency of insurance and reinsurance companies. The idea is clearly to force companies to compute a risk-based solvency capital that is commensurate to the exposure to key risks. Solvency II was not designed to measure financial performance.

- IFRS 17, in contrast, is a tool for measuring risk-based financial performance of insurance contracts.

-

Contractual Service Margin (CSM)

- Given that Solvency II does not measure financial performance, the concept of a CSM is not defined.

- IFRS 17 introduces the CSM. The CSM refers to the carrying amount of the asset or liability for a group of insurance contracts representing the unearned profit the entity will recognize as it provides services under the insurance contracts.

-

Insurance Service Result

- Solvency II does not contemplate the calculation of an insurance service result.

- IFRS 17 establishes a requirement to segregate revenue between an insurance service result and a net financial result. The calculation of the insurance service result is based on current estimates of discounted, probability-weighted cash flows, with discount factors reflect the characteristics of the cash flows and adjustments for non-financial risk. In the development of the insurance service result, the release of a contractual service margin (i.e., expected unearned profit) and the period’s recognition of non-financial risk must be considered.

-

Changes in Estimates of Future Cash Flows and Their Impact on Results

- Given that Solvency II does not measure financial performance, there is no mechanism to reflect changes in estimates of future cash flows on the profit or loss account.

- For IFRS 17 purposes, changes in estimates of future cash flows are recognized in profit or loss of all future years through changes of the CSM in these periods. Consequently, there is a gradual change in equity. This is a major departure from other financial reporting systems, where the full effect of changes in estimates of future cash flows is immediately recognized in the profit or loss statement of the year in with estimates change, and therefore, there is an immediate change in equity. Furthermore, under IFRS 17, a breakdown of insurance contract liabilities is required to be presented in the accompanying notes to the financial statements.

Actuarial Involvement

IFRS 17 may have a broader impact for the actuarial profession, relative to Solvency II. Whereas in the past the finance department was able to create financial reports with somehow limited interaction with the actuary, under the IFRS 17 world it will be practically impossible to not involve actuaries in the financial reporting process. Indeed, under “traditional accounting,” many items of the profit and loss statement were taken directly from the company’s general ledger. Take gross written premiums (GWP). The amount included in the profit and loss statement comes mainly from premium receipts, an accounting transaction. But under an IFRS 17 income statement, GWP is nowhere to be seen. Instead of exhibiting GWP, a new item called “insurance revenue” must be developed. But insurance revenue involves discounted, probability-weighted cash flows, a calculation that belongs par excellence to the actuarial realm.

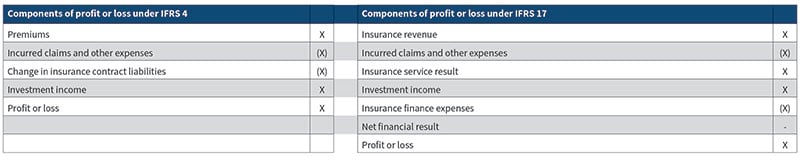

An insurance service result subtotal will be required under IFRS 17 for all insurance contracts and will exclude investment income and insurance finance expenses. The amount reported for the insurance service result may differ from underwriting profit under existing accounting due to differences in the measurement basis used.

Table 1 contrasts a profit or loss statement under IFRS 4 and IFRS 17.

Table 1

Components of Profit or Loss under IFRS 4 and IFRS 17

Thus, the involvement of actuaries will be critical to the process.

Conclusion

In this article, we have highlighted what we consider to be the top five differences between IFRS 17 and Solvency II. Notwithstanding, there is empirical evidence among European insurers (that have implemented processes for both Solvency II and IFRS 17), that the disciplined process employed in the implementation of Solvency II brings about important benefits for the implementation of IFRS 17.

The complexity of IFRS 17 has perhaps been underestimated by many insurance companies around the world. At its March 2020 meeting, the International Accounting Standards Board decided to defer the effective date of IFRS 17 for yet another year to Jan. 1, 2023. Will insurers be able to implement and test their processes on a timely manner?

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the respective authors’ employers.

Carlos Arocha, FSA, is managing partner of Arocha & Associates, an actuarial consulting firm based in Zurich, Switzerland. He can be reached at ca@ArochaAndAssociates.ch.