Building Societal Resilience during a Pandemic: Lessons Learned from Covid-19

By Frank Schiller

International News, March 2022

Just in the recent two years, COVID-19 has demonstrated very impressively that a pandemic is not something for which one can fully prepare. However, what makes a pandemic so special and difficult to manage compared to other low frequency and high severity events such as volcanic eruptions or tsunami damage?

The information uncertainty during a pandemic and its long duration pose particular challenges to management and risk management of a (re)insurance company, but also to the management of the crisis under social and macroeconomic aspects. Especially at the beginning of the COVID-19 crisis, but to some extent even now, we had and still have to cope with time lags in reporting and limited statistical comparability between countries. As a consequence, it was and effectively still is extremely difficult to assess and compare the success of different measures taken by governments to contain the pandemic.

This information uncertainty and extreme developments in the crisis—e.g., the first months of 2020 in Northern Italy, March and April 2020 in New York and during spring 2021 in India—led to drastic responses from some economies and governments. For example, we observed a dramatic drop of stock prices around the world in the first months of 2020. As a countermeasure, a comprehensive lockdown was imposed by many countries and is still the remedy of last resort—with a further negative feedback loop on the economy.

Exponential growth dynamics of a pandemic’s development, paired with unavoidable information time lags of important key indicators like infection, hospitalization and mortality rates further increase the complexity to manage a pandemic well. Add to this the urge of many governments not to react too hastily, as countermeasures like a lockdown or mandatory vaccination provoke strong backlash among the population and it becomes a typical lose-lose situation for all—society, economy and government.

In such an environment, it is not wise to rely solely on contingency plans as these may not be effective or would come too late, but to prepare for similar future extreme events and generally become more resilient against pandemics.

Concerns about Future Pandemics

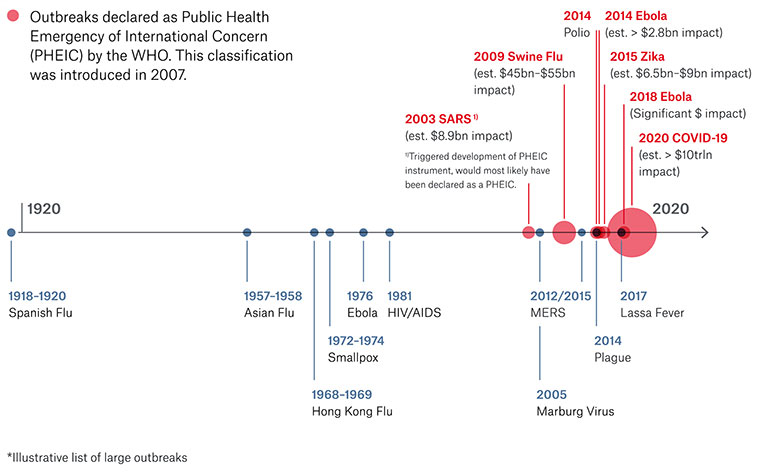

The World Health Organization (WHO) is monitoring with great concern the recent developments of increasing disease outbreaks worldwide. With SARS in 2002/03, MERS in 2012/15 and now COVID-19, we have experienced three significant coronavirus outbreaks in the past 17 years, without taking into account other pathogens.

Population growth, rapid urbanization, environmental degradation, and the misuse of antimicrobials are disrupting the equilibrium of the microbial world. New diseases […] are emerging at unprecedented rates disrupting people’s health and causing social and economic impacts. Billions of passengers travel on airplanes each year, increasing the opportunities for the rapid international spread of infectious agents and their vectors.[1]

Modelling firms expect that pandemics similar to or more severe than COVID-19 might have a probability of about 3 percent for any year, about 25 percent to happen again within the next 10 years and about 50 percent to happen again within the next 25 years.[2] See Figure 1.

Figure 1

The Increasing Frequency and Severity of Worldwide Diseases[3]

Hence, not only is it necessary to find a way to more effectively manage the current COVID-19 pandemic, but it is also important to find ways to prepare for future pandemics that are still to come.

Can (Re)insurers Cover Pandemic Risks?

The Geneva Association has devoted itself to this question and in 2020[4] published an article on the insurability of pandemic risk. Considering only business interruption insurance, due to projected losses inflicted by COVID-19 and its handling in 2020, the insurance industry would have had to pay for USD 4.5 trillion globally. However, the total property & casualty insurance industry generates annual premiums of only USD 1.6 trillion globally, the business interruption segment only about USD 30 billion.

The insurability issue is not just about the problem of huge, virtually unlimited losses that need to be covered. It also involves the problem that a lockdown, and thus the business interruption losses inflicted by a pandemic strongly depend on the decisions of governments and, hence, are not sufficiently well assessable for P&C (re)insurers. Systemic risks of such a magnitude are impossible to be borne by the (re)insurance sector alone, and for this reason one can already observe that P&C (re)insurers are excluding these risks where possible.

For life and health (re)insurers, the situation is different. Here, the objectives of governments, society and the (re)insurer are strongly aligned, making risk assessment by insurers more feasible. Even though the industry, especially in life (re)insurance, has experienced considerable losses in several countries, this has not yet resulted in questioning pandemic covers for life and health (re)insurers.

Finding Solutions for Mitigating Effects of a Lockdown

Private-Public-Partnerships have already been discussed intensively in Europe as a possible solution, but have not yet been implemented. Pools for terror or natural hazards have been considered as blueprints, but the approaches could not yet be applied to a solution for a pandemic.

However, instruments to mitigate pandemic risks already exist. To provide a certain level of economic protection to countries that have been hit particularly hard during the Ebola epidemic in 2014, the World Bank launched in 2016 the Pandemic Emergency Financing Facility (PEF) covering a maximum exposure of USD 195.84 million for 64 of the poorest countries. Although this facility was originally designed for covering and providing quick support for expenditures during epidemics like Ebola, the full amount was paid out during the COVID-19 pandemic.[5]

Similar structures involving public and private investors and with parametric triggers that provide for quick payouts during a pandemic event could be an effective solution for preparing for and mitigating the effects of a lockdown:

- A fair prize for the risk transfer can be calculated and companies can be incentivized to adequately prepare for future events.

- Both private and public investors can be included and, hence, the systemic risk of a potential misalignment of interest between governments and private investors or (re)insurers can be reduced.

- As tranches and the denomination of the structure can be very flexible, the hurdles for establishing such an instrument might be lower than similar pools.

- Contingent private or public lenders could be included in addition to investors, reducing the immediate need for liquidity and also providing a plannable budget for the public sector for future expenditures related to such events.

These instruments have already been discussed in more detail by the Geneva Association[6] and the Munich Risk and Insurance Center[7] and have been deemed suitable based on experience and expectations. With the implementation of such instruments, the economic impact of future pandemics could be mitigated more effectively and we could introduce at least some resilience to the interaction between society, economy and government during a future pandemic.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

Frank Schiller is a Member of the Board of Directors of the German Association of Actuaries. He can be reached at frank.g.schiller@gmail.com.