Management Navigation and Readiness for the Implementation of IFRS 17 and New Solvency Standards for Life Insurers

By Jon Wu

International News, May 2023

Editors’ Note: This summary is based on a presentation made by Dr. Bill Chang[1] on Nov. 30, 2022 at the annual meeting of the Actuarial Institute of Chinese Taipei (AICT).

Background

In the last 15 years (2007 to 2021), Taiwan’s life insurance premium grew from NTD 1.88 trillion to NTD 3.24 trillion (CAGR: 3.34%) with premium income reaching the peak at NTD 3.53 trillion in 2018 and assets under management went from 8.75 trillion to 33.34 trillion (CAGR:10.02%). Return of Equity (ROE) of the life insurance was between 8% and 10% from 2016 to 2020. ROE grew significantly in 2021 to 13.26% due to a large increase from realized capital income.

The life insurance industry adopted International Financial Reporting Standards (IFRS) in the late 2010s starting from IFRS 9 (2018 implementation). IFRS 17 is expected to be implemented by Jan. 1, 2026. At the same time the solvency standards are expected to transition from U.S. RBC style to ICS around 2026. Working along with the regulatory and international supervisory bodies, the industry is performing various quantitative impact studies at this point.

Beginning in March 2022, the U.S. increased the Fed fund rate to control the upward pressure of the inflation rate. By the end of 2022, the Fed fund rate had increased to a range of 5.00%-5.25% from the original range of 0.00%–0.25%. During this period, the life insurance industry was experiencing negative cash flow due to premium income reduction.

Moving Toward International Standards

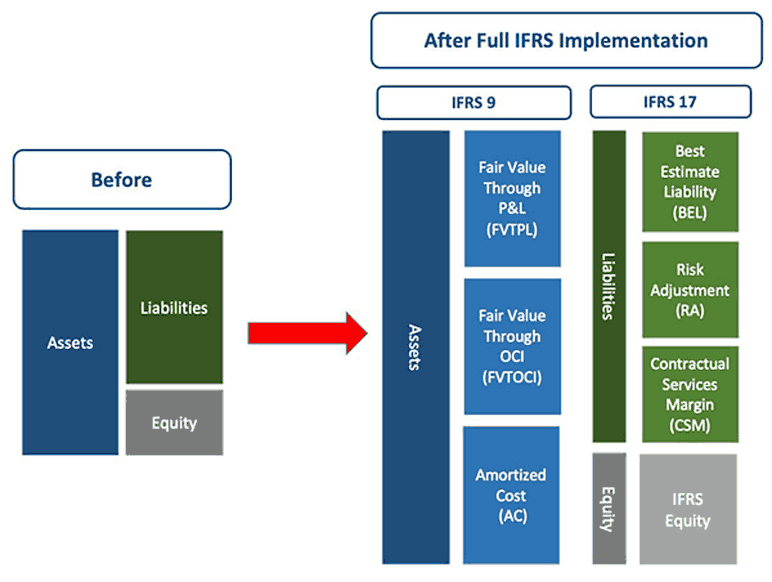

Per Hancock et al., 2001[2], the insurer’s economic balance sheet can be separated into three sub-categories. The author emphasized the importance of asset liability management. With the full implementation of IFRS and ICS in the future, the insurers have to further strengthen their asset liability management. The new balance sheet for the insurers under IFRS is shown in Figure 1.

Figure 1

After Full IFRS Implementation

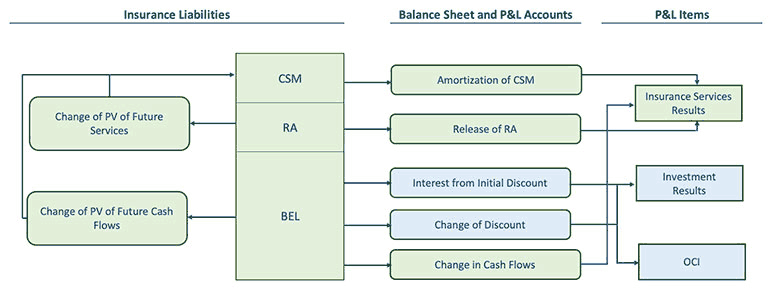

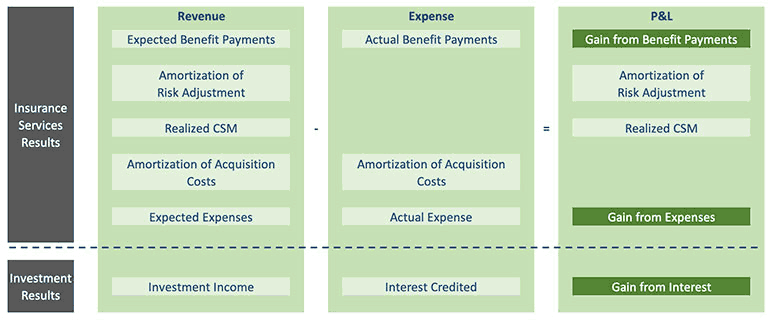

With the implementation of IFRS, fair value of assets and liabilities will be disclosed. In addition, there is a better disclosure of income by source of the P&L (as shown in figures 2 and 3):

- Insurance Services Results

- Gain from Benefit Payments

- Amortization of Risk Adjustment

- Realized CSM

- Gain from Expenses

- Gain from Interest

Figure 2

More Clear Disclosure between the Balance Sheet and P&L Items

Figure 3

More Clear Disclosure of P&L Statement

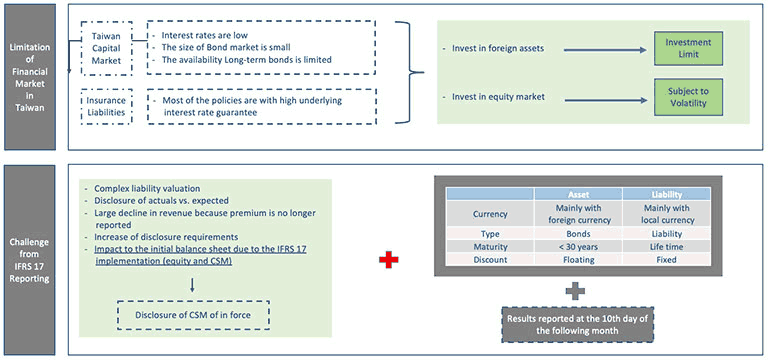

The new standards (IFRS 9 and IFRS 17) will improve the transparency, consistency, and comparativeness of financial statements. The stakeholders will be able to identify the source of gain. But, due to the limited availability of the investment instruments (see Figure 4) and the timing difference in implementing IFRS 9 (2018) and IFRS 17 (2026), the insurers are facing balance sheet mismatch during the transition period—the asset side is on fair value basis (IFRS 9), while the liability is on FAS 60/97 basis. The capital market does not have enough long duration assets and along with relatively lower interest rates in Taiwan, the insurers have to either invest overseas for long duration assets or enter into the equity market. The insurers are subject to interest rate risk, currency risk and equity risk.

Figure 4

Challenge in Implementing IFRS 17 in Taiwan (Chinese Taipei)

Most of the foreign investments are made in USD. During 2022, due to inflation pressure, the U.S. Fed increased its Fed fund rates from the original range of 0.00%–0.25% to 5.00%-5.25%. As a result, the invested assets dropped significantly so that shareholder equity reduced significantly. Shareholder equity is lower than 3% of total assets (not including assets in the separated accounts).[3] To relieve the pressure that arose during the transition period, the regulator provided two temporary measures:

- Allow reclassification of Fair Value through OCI (FVTOCI) assets to Amortized Cost (AC) assets. As a result, the reversal of OCI reduction (due to increase of interest rates) will increase shareholders’ equity. The reclassified assets will be monitored closely for selling purpose, and the increase of shareholders’ equity can’t be used for dividend purposes. With the reclassification, AC based invested assets are about 86%– 92% of the total invested assets from the big four companies.

- Allow insurers to measure their liability to reflect a higher interest rate environment so that policyholders’ liabilities will be reduced. The difference will be listed as “Special Surplus Reserve” in the shareholders’ equity. Special Surplus Reserve can’t be used for dividend purposes either.

Liquidity Issues

With the increase of U.S. interest rates, more money exited out from Taiwan to the U.S. for higher interest rates. The insurers encountered negative insurance cash flows since July 2022. The renew premiums are not enough to cover insurance cash outflows since March 2022. Liquid assets in the book are reducing from NTD 0.66 trillion at the beginning of 2022 to NTD 0.33 trillion at the end of Q3 2022. Meanwhile total premium income reduced about 20% vs. that in 2021. The interest rate difference of a U.S. 10-year government bond and Taiwan 10-year government bond was about 2.38% as of October 2022. The interest rate gap of the investment grade assets was even higher at about 2.80%. If the gap persists and NTD currency does not depreciate further, the negative cash flow is likely to continue.

Toward Sustainable Operations of the Insurance Industry

In the past few years, the insurers profited more from realized capital gains than that from insurance service margin and interest margin. Adopting IFRS and new solvency standards will help the insurers to focus on the sustainable income sources from the insurance service margin and interest margin. This will benefit the stakeholders and insurance industry.

Summary

In addition to the asset liability management, the insurers should continuously focus on the enhancement of

- The traditional insurance plans vs. spread only plans;

- The sale through traditional distribution channels (higher profit margin); and

- The usage of the hedging capability to reduce currency exposure and interest rate risk.

Meanwhile, the industry should work closely with regulators during the transition period either from a quantitative impact analysis prospective or from the issues not really covered by the international standards to avoid any misunderstanding from the market.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

Jon Wu, FSA, MAAA, CERA, is chair of the SOA International Section, a member of SOA CFE exam track committee, and a member of ORSA/ERM committee of American Academy of Actuaries (AAA). He can be reached at jzwu101@gmail.com.