Economic Growth Prospects—Are We Being Honest With Ourselves?

By Max J. Rudolph

Risks & Rewards, February 2021

Actuarial models in all practice areas typically use interest rates or equity returns as exogenous drivers. This assumes sustained positive growth in gross domestic product (GDP), while recent history has shown examples of negative nominal interest rates and low economic growth.

The Society of Actuaries sponsored a paper, written by Mark Alberts and Max Rudolph, to introduce concepts about low economic growth to actuaries.[1] As the pandemic hit in 2020 and unprecedented government intervention quickly followed, actuaries received an opportunity to consider how policies could impact the unique set of assets, liabilities and company risk culture they are modeling.

This article will review four topics that were discussed in the research paper, adding some recent developments. First is an overview of literature related to economic theories of growth and the potential drivers of a low-growth future. Several “headwinds to growth” have been proposed to explain recent declines in GDP growth rates, including demographic, environmental, technological, sociopolitical and geopolitical factors. These factors could exhibit an ongoing drag on future growth. The standard economic growth models do not consider these headwinds in any direct way. Forecasters who want to include such factors in their economic models must build them in separately, which some have begun to do.

It’s always better to build off the work of others, and 20 long-term (e.g., 50-year) economic forecasts produced by a number of different authors are available. They represent a range of potential growth conditions. These 35- to 50-year forecasts with a start date of 2010 for the U.S., China and the world found annual growth rates roughly half of those experienced over the prior 50 years.

But how does this impact practicing actuaries? A low-growth scenario could be expected to impact asset, liability and strategic risks, and should be considered by an organization’s ERM program. Effects would depend heavily on government and central bank responses to systemic low growth, with traditional fiscal and monetary policy responses likely to have unintended and potentially adverse consequences. Certain consistent themes emerge and serve as a basis to discuss likely industry responses.

ERM stress scenarios should consider interrelationships among variables. Quantitative scenario analysis tools exist and may be useful, but beware of black boxes with a false aura of precision. The most effective near-term ERM responses to the risk of a long-term low-growth scenario are probably driven by qualitative analysis, monitoring processes and developing contingency planning to build resiliency. Being open to new ideas and critically deciding how to utilize that information helps a risk manager build scenarios to test the limits of potential outcomes.

Viewed as the means for achieving many social goods, GDP growth is considered necessary to improving the well-being of society. Growth also creates its own imperative in another way. Governments, businesses and households borrow against the expectation of future growth.

Compound economic growth is actually a relatively new phenomenon. Since the start of the industrial revolution, one person sees a remarkably consistent long-term trend while another sees this period as an aberration. Growth has historically resulted from infrequent technological developments that did not lead to recurring improvements in living standards. Going forward, growth could be reduced and even lead to smaller levels of GDP. Some even see a “Mad Max” scenario as a possibility.

These risks are significant enough to be considered by risk managers and strategists. Questions to consider include:

- What drivers might cause future growth to fall short of past growth levels?

- What are the drivers of growth in the standard economic growth models?

- What range of economic growth is anticipated?

The long run objective, under the context of sustainability, is for industries and firms to be resilient enough to survive the foreseeable future. A time horizon of 200 years is too long to be meaningful and a typical strategic planning horizon—say three to 10 years—is too short to truly consider sustainability. A reasonable analysis focuses on a horizon of 35–50 years, projecting out to the next century at times.

Future emerging risks, with results both positive and negative, are difficult to predict but will be important and should be considered qualitatively.

One of the most interesting side benefits to the research paper is identification of an analytic process—a disciplined approach to evaluating “macro” risks and assumptions more generally. It is human nature to focus attention on risks we understand and have methods to quantify. For actuaries, this includes mortality, property losses, interest rates, etc. Even our understanding of these risks is based on historical data that may not extrapolate to an evolving macro environment. Quantification of low-growth risks may not be possible, but that does not mean we are helpless. By studying the literature of growth and evaluating potential impacts of low growth, a process has been developed that considers the risk of low growth and other macro risks.

Existing Literature

The era of economic growth began with the advent of the industrial revolution in the 1700s. While growth rates have varied over time and by country, compound growth has been the norm over this period. The first 70 years of the 20th century, and 1940–1970 in particular, were an era of strong growth, reflecting the full integration of transformative inventions such as the lightbulb, telephone, automobile and refrigerator; development of modern manufacturing methodology; and the unique set of conditions following the Great Depression and World War II that favored rapid growth in investment and productivity. Since approximately 1970, economic growth rates have fallen significantly in the developed world, with growth in aggregate GDP falling from more than 4 percent in the decade ending 1970 to approximately 2 percent since 2000. Rapid growth in the developing economies, led by China and India, has resulted in more modest declines in global GDP growth rates—from 5 percent to 4 percent for the same periods.

There is a rich literature covering the impact of factors contributing to the decline in growth—headwinds to growth, as described by Robert Gordon.[2] These headwinds include: demographics, with slowing fertility rates and aging populations, a limited ability to bring new segments of the population into the workforce, a leveling out of educational attainment and a recent distaste of immigration; technological, with future breakthroughs proving less consequential than the breakthroughs of yesterday; environmental, with climate change leading to productivity loss and diversion of investment, and resource constraints leading to increased production costs; sociopolitical, with increasing inequality and class conflict; and geopolitical, with decreased global cooperation and increased conflict.

By and large, economic models are inadequate to evaluate the impact of these headwinds. These simple models employ just a few factors, assume a growing or stable population with productivity growth through technological development generating ongoing growth. These models rely either on an exogenous productivity growth factor taken as a matter of faith (neoclassical models) or on virtuous cycles leading to self-sustaining productivity improvement (endogenous models). They do not explicitly capture any of the potential headwinds to growth and fail to consider any impact of physical limits or resource depletion.

Economic models are developed to fit historical data and assume linear changes in conditions, so are inconsistent with complex adaptive systems. Economists, working with multidisciplinary models, are developing growth models with more complete representations of reality and more robust feedback loops, but results of these models are subject to highly uncertain assumptions.

Review of Scenarios

There are a few sources of long-term growth scenarios or forecasts. Some are predictions, but most are considered scenario analyses—projections intended to be consistent with stated conditions, intended to illustrate the consequences of those conditions but without ascribing probabilities to the outcomes. Some researchers create a set of multiple scenarios to capture alternate potential futures.

The most useful and robust scenarios start qualitatively as a narrative or story that captures likely consequences, feedback loops and responses to a set of specific conditions. Quantitative modeling of a scenario can be useful to explore feedback loops and interactions among variables. Complex models can capture interactions more robustly, but at the risk of overreliance on black-box calculations/assumptions and a false sense of precision. The Pardee Center for International Studies at Denver University provides a wonderful and transparent resource. Its International Futures model[3] considers the physical, human and economic worlds in highly complex and interrelated ways. Such a model may be of considerable use in scenario building and testing but must be used with great care.

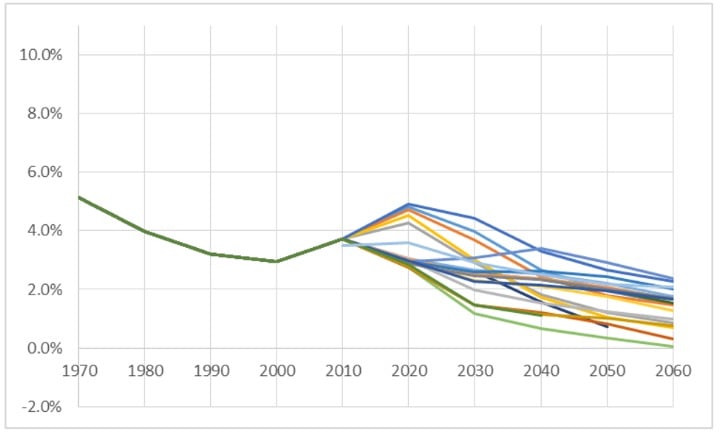

The research surveyed the results of 20 global long-term economic growth projections, generated by five authors, comparing projected growth rates for the United States, China and the world for the period 2010–2060 against historical growth rates for the period 1960–2010. This is shown graphically for global aggregate GDP growth rates in Figure 1.

Figure 1

Summary of Growth Scenarios, 2010–2060; Global Annualized Growth Rates by Decade Versus Actual, 1960–2010

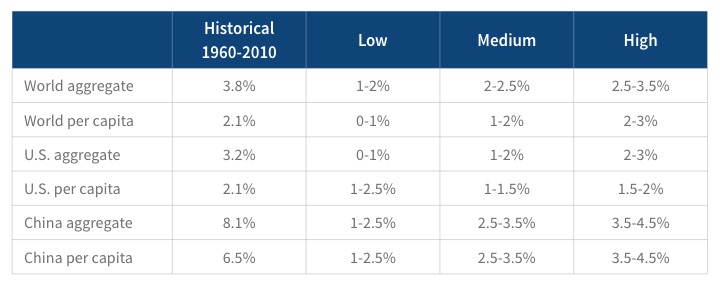

These scenarios include a full range of expectations—high growth, medium growth and low growth. As seen in Table 1, even high-growth scenarios exhibit growth rates generally lower than historical results. The medium range results show both aggregate and per capita growth rates for the U.S. and China roughly half historical rates. The lowest of these scenarios shows global growth rates of 1 percent on an aggregate basis and 0.3 percent on a per capita basis—effectively a return near preindustrial-era growth levels.

Table 1

Growth Ranges in IFS Scenarios Compared With 1960–2010

These projections are based on long-term equilibrium models and, unrealistic for the real world, do not project shocks. The impact of both positive and negative shocks from economic shocks (economic cycles, debt crises), geopolitical shocks (military and economic conflict), sociopolitical shocks (political revolutions, class conflict) and environmental shocks (natural disasters, climate dislocation) should also be considered.

Impact of Low Growth on the Insurance and Pension Sectors

Growth in per capita GDP better represents changes in the standard of living for an individual. Aggregate growth determines financial sustainability (i.e., whether future on- and off-balance sheet promises can be kept). Historically, population growth has been steady around the world, resulting in higher growth rates for aggregate GDP than for per capita GDP. As populations age and population growth begins to slow and even decline, this relationship will shift. Japan has used debt to show that in at least some circumstances, gains in standard of living can be maintained (at least temporarily) in the face of low aggregate growth.

The standard fiscal and monetary responses to low growth rates assume that growth is cyclical. Policies to stimulate growth involve accumulating government debt and stimulating private market borrowing. Systemic low-growth drivers would likely not respond to these stimuli. If long-term growth capacity were reduced to near or below zero, a soft landing would require great foresight by policymakers. The likelihood of deflationary spirals or debt crises would be greatly increased.

Low growth would likely accompany low real interest rates. As a result, asset-side impacts are the most obvious consequences for the insurance and pension industries. Low growth would lead to lower real returns. Default and inflation risks would be exacerbated in some low-growth scenarios, leading to higher—possibly very high—nominal interest rates and higher nonperformance risk. Those reaching for yield would accept uncompensated risk. The universe of available assets could change substantially. In the extreme case, debt markets could collapse permanently. The exception, creating a stagflation scenario of low growth and high inflation, would require a psychological shift from saving to spending that is reflected in the velocity of money.

Reduced growth would likely have mortality and health impacts. Adverse health effects and psychological factors would lead to additional deaths due to a slower improvement in living standards. The drivers of some low-growth scenarios, especially those due to climate change, would also act as a threat multiplier for these risks. Mortality deterioration could occur in some scenarios. This is especially likely in the U.S., where suicides and opioid use disorder have recently been trending up among groups who feel they have been left behind.

Environmental factors contributing to low growth would likely lead to higher property damage and increased uncertainty in modeling and pricing property risks. These factors might also lead to increasing portions of GDP committed to remediation of property damage or mitigation of property risks, leaving a smaller share for productive investment and individual consumption.

Unanticipated consequences of low growth are likely. Systemic low growth is outside our range of experience, and extrapolation and intuition may not apply. These unanticipated consequences may include nonlinear shocks from tipping points and feedback loops as well as long-term trends that vary from historical experience.

In the life insurance industry, a shift from investment-focused products to protection-focused products is likely, but with higher prices and potentially shorter-term guarantees. Risk sharing might increase further, with a shift to more separate account products and a return to participating insurance. The IRS recently moved in this direction by lowering the rates used in Section 7702 to determine life insurance contract taxation.

The pension sector would see offsetting effects from higher mortality and lower investment returns, with the net effect being uncertain. A stable environment allows profitable pricing, so uncertainty is itself a risk. Low growth might cause firms to fail more frequently, exacerbating the disconnect between the firm life cycle and the life cycle of its pension benefits, intensifying funding crises and hastening de-risking of the defined benefit system unless valuation methods are modernized. Alternatively, it seems possible that slowdown in mortality improvement could favor the trade-off in pension benefits for wages, increasing the interest in defined benefit plans and options in defined contribution plans that act like payout annuities.

The property and casualty and health insurance industry might experience increased pricing pressure due to lower investment returns, but these pressures would be mild compared with life insurance and pensions. The industry will be well served by short-term policies with the ability to reprice frequently. In an environmentally driven scenario, this may not be sufficient to compensate for the increased and uncertain cost of property coverages as shown by the California wildfire experience.

Overall, for industries where actuaries are typically employed, the goal in a low-growth scenario will be to move away from products with systemic risk and toward those that use risk pooling and frequent repricing.

Enterprise Risk Management Implications

Risk managers should include low-growth scenarios in their ERM work, including regulatory Own Risk and Solvency Assessment (ORSA) reports. It’s a plausible scenario and the magnitude of impact could be significant. Low-growth scenarios can be qualitative analyzed across multiple drivers. One should analyze likely consequences, including feedback loops and interaction of different variables, using both internal and external expertise.

Quantitative scenario modeling tools may be helpful but should be used with care. It is important to understand the model dynamics, review the results carefully and interpret results with skepticism. Simple interest rate scenarios, frequently used by regulators, without also considering the concomitant economic effects may be of limited use. Quantitative results may be most useful to evaluate relative effects, not to set absolute expectations.

Ultimately, the likelihood and consequences of a low-growth future are highly uncertain, so near-term risk mitigation opportunities may be limited except for divesting the block of business. The result of one’s ERM efforts may initially be risk-monitoring processes and contingency plans rather than trades or hedging programs. These efforts may be enough to build resiliency into products that last into the next century.

Conclusion

While not part of the traditional actuarial toolbox, techniques are available for us to objectively evaluate the effect of economic growth and other macro-level assumptions. As actuaries and risk managers, we must use such tools in a forward-looking way in order to effectively perform the risk management on which our stakeholders depend.

The research presented the case for why risk managers should be concerned about low economic growth, shared some tools and modeled an approach for using them.

Following are some of the key takeaways from a low economic growth scenario:

- A number of factors could plausibly limit future growth, and the dominant economic growth models are inadequate. These factors might also interact in unexpected ways.

- Existing long-term projections suggest the expected annual global GDP growth rate over the period 2010–2060 might be half that over the period 1960–2010, and a “low-growth” scenario might have average growth rates of 1 percent or less.

- Standard stimulative monetary and fiscal policy responses to cyclical low growth would be ineffective and could have adverse consequences. Spending more on one thing (e.g., health care, education, defense, social safety net) will crowd out spending on something else. Choices must be made, and some will be painful.

- Lower real returns would be expected on all asset types, with increased risk and potential change in the universe of available assets. This increases the cost of benefits to policy holders, encourages product feature changes and regulators may change interest-rate guarantees (move from nominal to real rates) on liabilities.

- Low growth would be expected to adversely affect mortality and morbidity rates, with adverse effects for life/health insurance liabilities and potential benefits to pension and annuity liabilities.

- Impact of low growth on property risks and other general insurance risks would vary by the drivers of the low-growth scenario.

- Risk managers should consider low-growth scenarios in their ERM programs and ORSA filings. Complexity and uncertainty make quantification difficult, but following a disciplined process for evaluating these risks can lead to improved decision making. It can be summarized as:

- Understand conventional wisdom.

- Evaluate gaps in conventional wisdom.

- Actively seek wisdom, knowledge and opinions of others (especially those who think differently than you do).

- Critically evaluate that wisdom, keeping best practices.

- Apply your learnings to the unique risk profile of your business.

Those interested in more information about these topics can read the paper, found on www.soa.org (or by clicking endnote[1]), or watch one of several presentations the authors have given.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

Max J. Rudolph, FSA, CFA, CERA, MAAA, is the founder of Rudolph Financial Consulting, LLC. He can be contacted at max.rudolph@rudolph-financial.com.