The Changing Landscape of the U.S. Corporate Bond Market

By Glenn S. Davis and Dennis Woessner

Risks & Rewards, June 2021

U.S. bond markets have undergone dramatic changes due to the 2008 Global Financial Crisis (GFC) and the COVID-19 pandemic. In taking a retrospective view, we can see that bond markets, viewed through the lens of major bond indices, have been evolving for quite some time. Within this paper, TD Asset Management Inc. (TDAM) will explore underlying changes that have occurred within the U.S. Corporate Bond Index, a sub-component of the larger U.S. investment grade bond market, over the past decade. We will highlight key structural changes that have occurred within bond markets and why they are noteworthy.

A View From Above

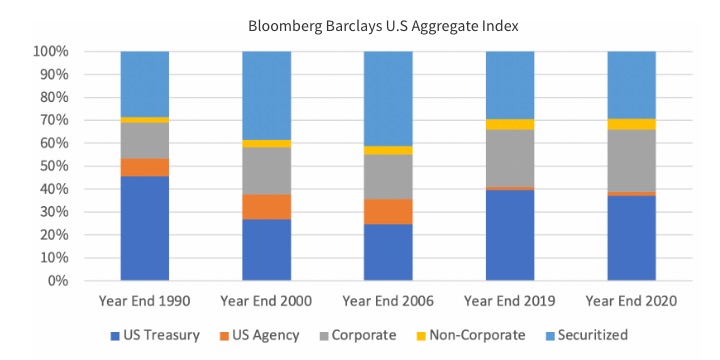

The Bloomberg Barclays U.S. Aggregate Bond Index, a proxy for the U.S Bond Market, has been a fixture within bond markets for decades; serving as a performance benchmark for investors and as a blueprint for passive bond fund index strategies. However, beyond its conventional uses, the index has compositional value and can highlight the structural changes that have occurred within the U.S. bond market, over time. The analytics expertise within our Fixed Income team has enabled us to actively identify when these structural shifts occur and the reason for their occurrence. As illustrated in Figure 1, not only has the underlying composition of the U.S. bond market changed over time—but the size of market has increased substantially. There has been significant growth in the Corporate and U.S. Treasury segments of the bond market.

Figure 1

The Growing and Changing Composition of the U.S. Bond Market

Source: Bloomberg Finance L.P., as of Dec. 31, 2020

The increase in the size of the bond market during the last decade can be primarily attributed to increasing U.S. Treasuries and Corporate issuance; due to Quantitative Easing and a prevailing low interest rate environment, respectively.

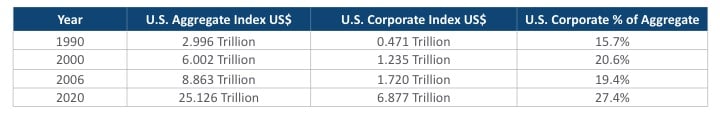

A Shift in Quality

The growth and structural change observed in the U.S. bond market has also been accompanied by a shift in investment grade quality, or risk exposure, within the investment grade bond market. As detailed in our paper “Looking Beyond the Ratings,”[1] the BBB bond segment now represents over 50 percent of the market value of the corporate bond index; mostly at the expense of AA and A bonds within the index (Figure 2). The size of the BBB rated segment has been gradually increasing over time, with a sizable shift occurring throughout the last decade.

Figure 2

The Shifting Quality of the Investment-grade Bond Market

Source: Bloomberg Finance L.P. As of Dec. 31, 2020

Why has the BBB Segment Been Increasing?

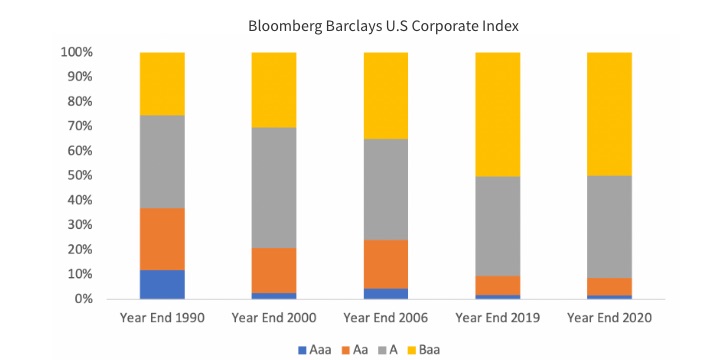

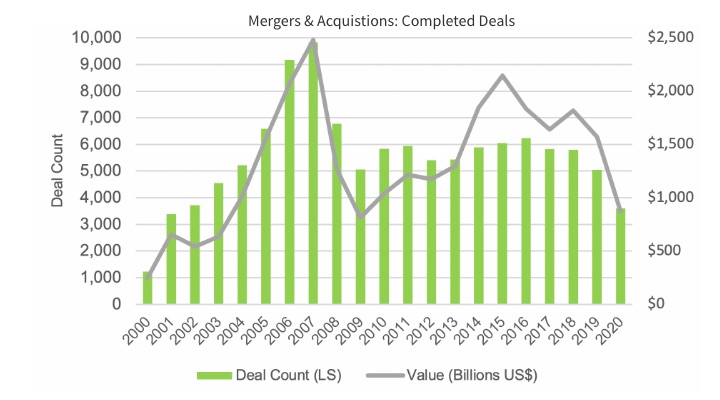

An increasing number of corporate borrowers have been willing to accept a lower credit rating if it meant funding corporate development activities at attractive levels. The increased level of merger and acquisition (M&A) and share repurchase activity, is shown in Figures 3A and 3B below. This resulted in an increased BBB-rated bonds representation within the U.S. corporate bonds universe. Note, a lower quality rating means these corporations are becoming more susceptible to interest rate risk. Though the current interest rate environment may be favorable, changes in borrowing conditions could lead to large increases in interest expense for corporations as existing debt rolls over. At the same time, bond holders could suffer a negative price impact in the event of widening corporate spreads should the degradation in credit quality of the issuer become central to market participants.

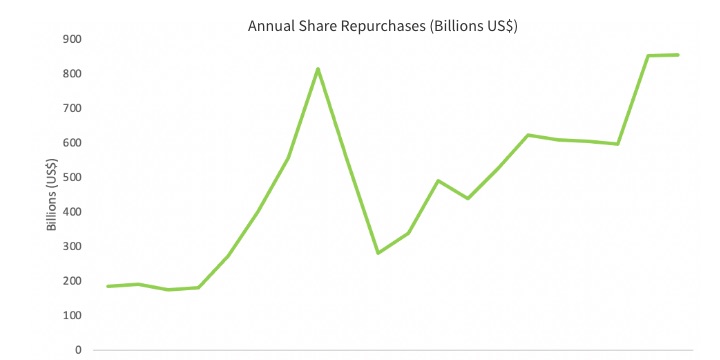

Figures 3A and 3B

Increased Level of Merger & Acquisition and Share Repurchase Activity

Source: Bloomberg Financial L.P. Data as of December 2019.

Source: Bloomberg Financial L.P. Data as of December 2020.

The Impact of an Increasing BBB Segment

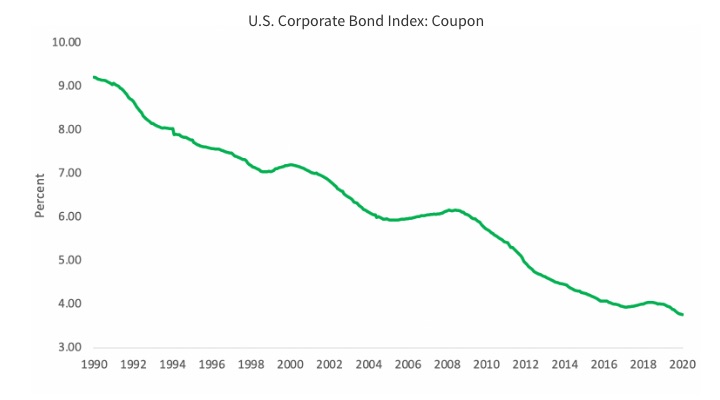

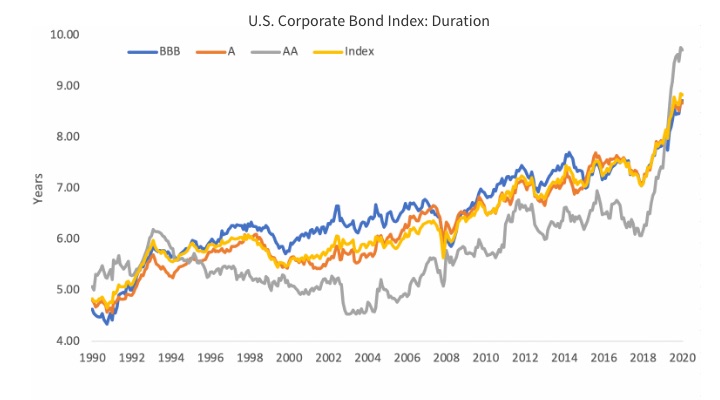

The “lower for longer” interest rate environment that has existed since the GFC has had far-reaching implications for the U.S Bond market. The yield or coupon rate on the U.S. Corporate Bond Index is currently below the 2006 levels, indicating declining expected returns investors may receive from investing in the corporate bond market (Figure 4A). Additionally, the duration or price sensitivity of the index has been increasing over time, a product of falling interest rates and longer maturities especially during the past couple of years, for new issuance; allowing corporations to prolong the benefits of cheap financing (i.e., lower interest payments for longer, extending principal payments into the future). The resulting impact on the index is higher interest rate risk. As the size of the BBB segment continues to grow, the corporate bond segment will increase in sensitivity (Chart 4B).

It should be noted, though our immediate analysis has focused on the U.S. investment grade market, the expansion of the BBB segment and its implications has been observed across developed bond markets globally.

Figure 4A

Corporate Bond Index Levels

Source: Bloomberg Financial L.P. Data as of December 2020.

Figure 4B

Corporate Bond Segment Sensitivity Increase

Source: Bloomberg Financial L.P. Data as of December 2020.

Maintaining Risk Awareness

Bond indices, like their index cousins, are typically market-weighted. In the case of capitalization-weighted equity indices, investors are investing in companies that are increasing in valuation. For the bond market, the more debt a company issues, the greater their weight within the index due to an increasing amount of debt outstanding. As a result, investors in passively managed index strategies end up lending more to the firms that borrow the most.

With interest rates expected to remain at historical lows for longer, alongside the continued expansion of the BBB segment, passively managed investment strategies tend to leave investors exposed to increasing credit risk and more sensitivity to interest rate risk.

Though passive bond investors may not be aware that they are lending to companies that borrow the most, active fixed income investors mitigate this exposure risk by ensuring that the market does not dictate the allocation of their fixed-income investments. Some investors may be willing to accept the resulting passive outcomes, others may want to avoid the changing composition (i.e., drift risk) of the index.

Capitalizing on Change

The changing risk profile of the corporate bond market provides investors with the opportunity to actively manage the risk profile of their portfolios. Through active management, rather than passively accepting the changing risk profile of the index or benchmark; investors may capitalize on the changing landscape of the corporate bond market.

The information contained herein is distributed for informational purposes only and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Investing involves risks, including the potential loss of principal. Financial markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. This information has been obtained from sources believed to be reliable, but TDAM does not make any representation as to their accuracy, correctness, usefulness, or completeness. The content provided is accurate as of the date published but is subject to change. Any performance information referenced represents past performance and is not indicative of future returns. Any projections, targets, or estimates in this presentation are forward looking statements and are based on TDAM's research, analysis, and assumptions made by TDAM. There can be no assurances that such projections, targets, or estimates will occur, and the actual results may be materially different. Other events which were not taken into account in formulating such projections, targets, or estimates may occur and may significantly affect the returns or performance of any accounts managed by TDAM. To the extent this insight contains information about specific companies or securities including whether they are profitable or not, they are being provided as a means of illustrating our investment thesis. Past references to specific companies or securities are not a complete list of securities selected for clients and not all securities selected for clients in the past year were profitable. Unless otherwise specified, all data is sourced from TDAM. Past performance does not guarantee future results

TD Asset Management (TDAM) operates through TD Asset Management Inc. in Canada and through TDAM USA Inc. in the United States.

TD Asset Management Inc., TDAM USA and Epoch Investment Partners are wholly-owned subsidiaries of The Toronto-Dominion Bank. The TD logo and other trademarks are the property of The Toronto-Dominion Bank.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

Glenn S. Davis, CFA, is a managing director for TD Asset Management. He can be contacted at GlennS.Davis@tdam.com.

Dennis Woessner, CFA, CAIA, is vice president & director for TD Asset Management. He can be contacted at Dennis.Woessner@tdam.com.