The Future of Sustainability Reporting Standards

By Kyle Lawless

Risk Management, December 2021

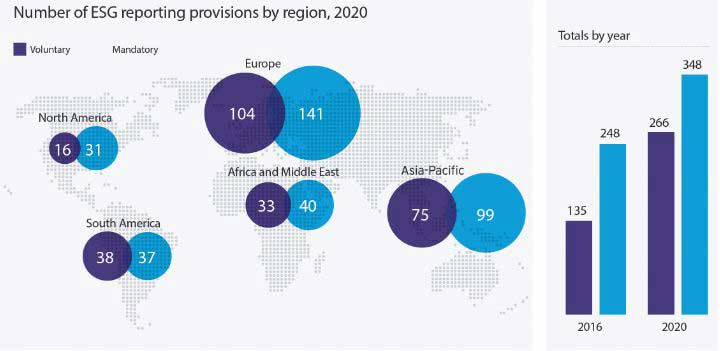

At a time of unprecedented progress toward achieving global sustainability reporting standards, EY, in collaboration with Oxford Analytica, has published a new report, “The future of sustainability reporting standards.” The report demonstrates the fast momentum with which sustainability reporting standards and mandated disclosures are changing. (See Figure 1)

Figure 1

Voluntary and Mandatory ESG Reporting Provisions

Source: Van der Lugt, C. T., P. P. van de Wijs, & D. Petrovics. (2020). Carrots & Sticks 2020 – Sustainability reporting policy: Global trends in disclosure as the ESG agenda goes mainstream. Global Reporting Initiative (GRI) and the University of Stellenbosch Business School (USB). https://www.carrotsandsticks.net/media/zirbzabv/carrots-and-sticks-2020-interactive.pdf

The report examines the growth over ESG reporting standards in recent years.

The report explores the expected role that the International Financial Reporting Standards (IFRS) Foundation’s International Sustainability Standards Board (ISSB) will play in achieving a global baseline standard. The IFRS Foundation, the body that sets accounting standards for most of the world, has received significant stakeholder support, including from G7 Finance Ministers and Central Bank Governors, since its initial announcement in September 2020.

The report also explores the European Commission’s recently announced Corporate Sustainability Reporting Directive (CSRD) which will require most large EU companies, including EU subsidiaries of foreign companies, to disclose and obtain external assurance over a series of environmental, social and corporate governance (ESG) matters—beginning from financial years starting on or after January 2023.

In addition, the report assesses the state of play in the US, UK, China and a number of other markets. The report identifies five actions companies should take to navigate and prepare for emerging disclosure requirements:

- Don’t wait for sustainability reporting to be mandated. The time to act and commit to transparency and accountability is now. The Stakeholder Capitalism Metrics developed by the World Economic Forum International Business Council is a place to start.

- Put ESG and sustainability reporting on the board’s agenda. Board members should oversee a materiality assessment and support the integration of ESG within broader strategy and enterprise risk management (ERM).

- Seek assurance to build trust in sustainability reporting. There are several ways that companies can increase the credibility of sustainability reporting, including by focusing on controls and procedures over sustainability reporting, similar to what is done to support financial reporting.

- Integrate the finance function. CFOs and financial controllers, whose teams have extensive experience in establishing processes, controls and assurance of financial information, can bring their financial leading practices and experience to support sustainability and ESG reporting.

- Contribute to the standard-setting process. There is ample opportunity for companies to be part of the process, learn from experience, and do not wait for regulators to mandate disclosures.

It is expected that there will be significant, global action in the next 12–18 months that will result in developments that represent one of the most significant innovations to corporate accounting and reporting in decades.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the respective authors’ employers.

Kyle Lawless, associate director, EY Global Public Policy. He can be contacted at kyle.lawless@jp.ey.com.