Risk Management in a Rising Interest Rate Environment

By Chun Zheng and Yiru (Eve) Sun

Risk Management, June 2023

The Federal funds rate increased by 4.25% in 2022 with further increases in 2023,[i] which have already resulted in a liquidity crisis for a few banks. Insurance companies also face a considerable amount of unrealized capital losses and the possibility of excess surrenders as policyholders look for new-money-rate products that offer more attractive returns. As the rapid increase of the interest rates pushed the new money rates above the yields of many life insurers’ investment portfolios, insurance companies are facing a dilemma between compressed margins from peer pressure and the concern with liquidity shortfalls and realized capital losses should mass surrenders happen.

Emerging Risks

Unrealized and Realized Capital Losses

One of the major risks is the shift from unrealized to realized capital losses under such a rapid interest rates hike. In the past 20 years, with extremely low interest rates, life and annuity insurance companies had invested in long-duration assets to match their liability duration and to earn a relatively higher return. Now insurers are facing significant unrealized capital losses from these long-duration fixed income assets. If policyholders chose to purchase new products with higher return and mass surrenders occurred, insurance companies would soon run out of the short-duration assets and have to sell the long-duration assets at a loss. The most risky products are the ones with high surrender values, like Bank Owned Life Insurance (BOLI) and Fixed Deferred Annuities (FDA). Many BOLI cases have more than $100 million cash value per case.

Liquidity Issue and Capital Strain

Similar to the banks liquidity crisis, if there were signs of mass surrenders hitting insurers, the uncertainty around insurers’ solvency could cause more policyholders to surrender their policies and lead to a vicious cycle in which additional surrenders in each successive block of business put additional downward pressure on liquidity and capital levels. Therefore, the risk of a potentially overwhelming “run on the bank” is the key risk to be addressed immediately. The resources for increasing liquidity and reducing capital strain are both limited. On the other hand, much faster new sales under higher interest rates also stressed insurers with capital strain from another direction. Industrywide, FDA, Indexed Annuities and Payout Annuities have achieved +113%, +25%, +37% sales increase from 2021 to 2022, respectively.[ii] Many insurers have already seen their capital level decreased much faster than prior years.

Competitive Pressure from Peer Insurers and Other Financial Institutions

In addition to the realized capital losses, higher credit defaults due to the uncertainty of the economy might further reduce the insurers’ portfolio yields. While in 2022 many insurers saw significant sales increase in Fixed Annuities, Indexed Universal Life, Pension Risk Transfer, etc., if the existing portfolio rate wouldn’t soon catch up with the new money rate, insurance companies would likely experience lower than expected sales and lower retention rates. The competitive pressure on the in-force persistency and the new sales comes not only from the peer insurers but also from other financial institutions that offer products with higher returns.

Interest Rate Uncertainty

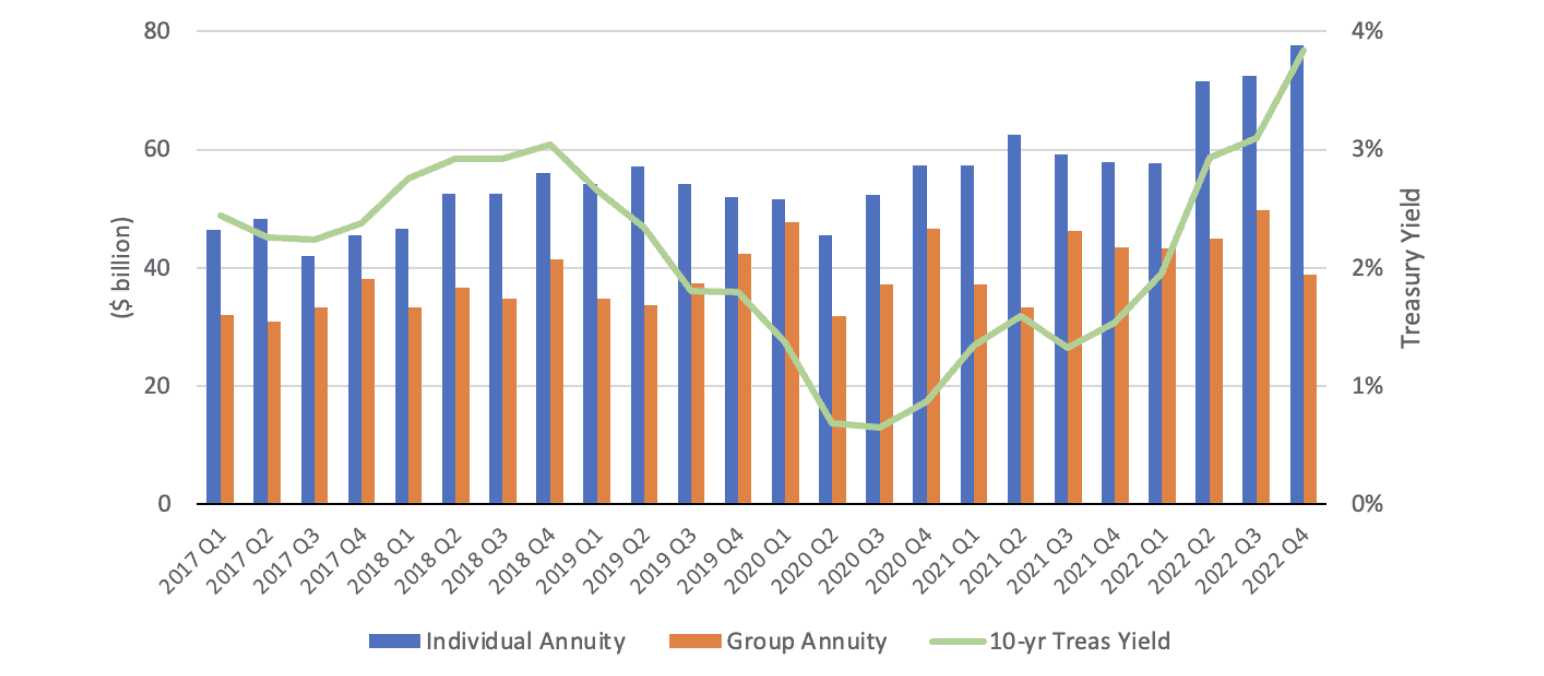

As inflation starts to cool down, interest rates might change from trending upward to downward as early as 2024. Historically, the Fed funds rate has had three periods of hikes in the past 20 years, i.e., increased 4.25% during 2004–2007, increased 2.3% during 2016–2019, and increased more than 4.6% from March 2022 to the time point as this paper was written in early 2023. The prior two periods of hikes were both followed by the Fed funds rate plummeting to 0.15% within a year. A sharp decline in interest rates is also possible following this period of increasing rates. Difficulties in forecasting the interest rates in both the short and long terms make it even more challenging for product design and hedging strategies. Should the interest rate turn downward soon, features like guaranteed minimum interest rates of FDA would add burden to insurers as they have embedded option values to the policy holders. Moreover, some products like individual annuities showed positive correlation between their sales and the interest rate (Figure 1),[iii] especially, FDA sales have more than doubled from 2021 to 2022 with the rising interest rate. A potential interest rate downturn would likely hurt new sales.

Figure 1

U.S. Annuity Sales (Quarterly)

Risk Mitigation

Investment Strategy

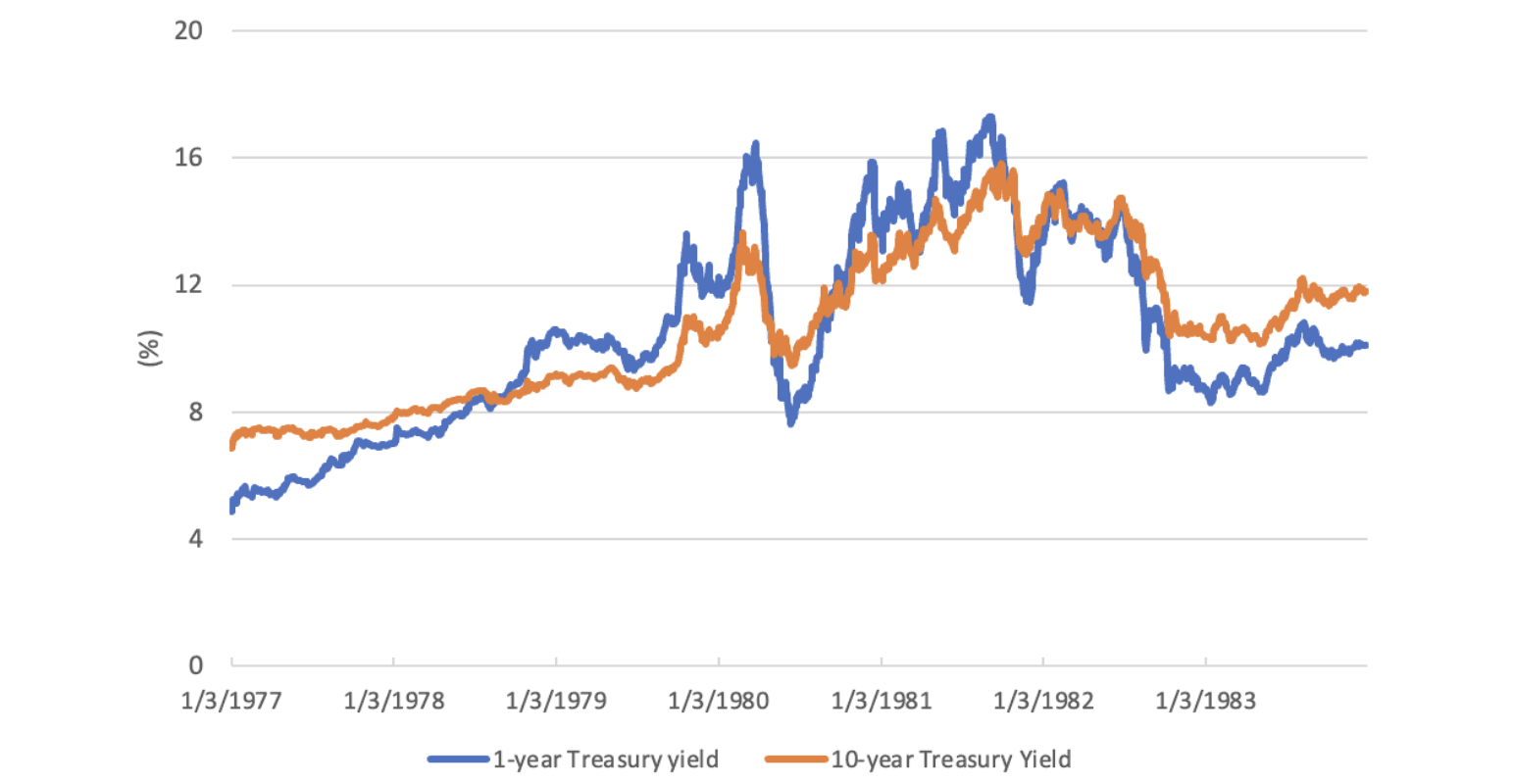

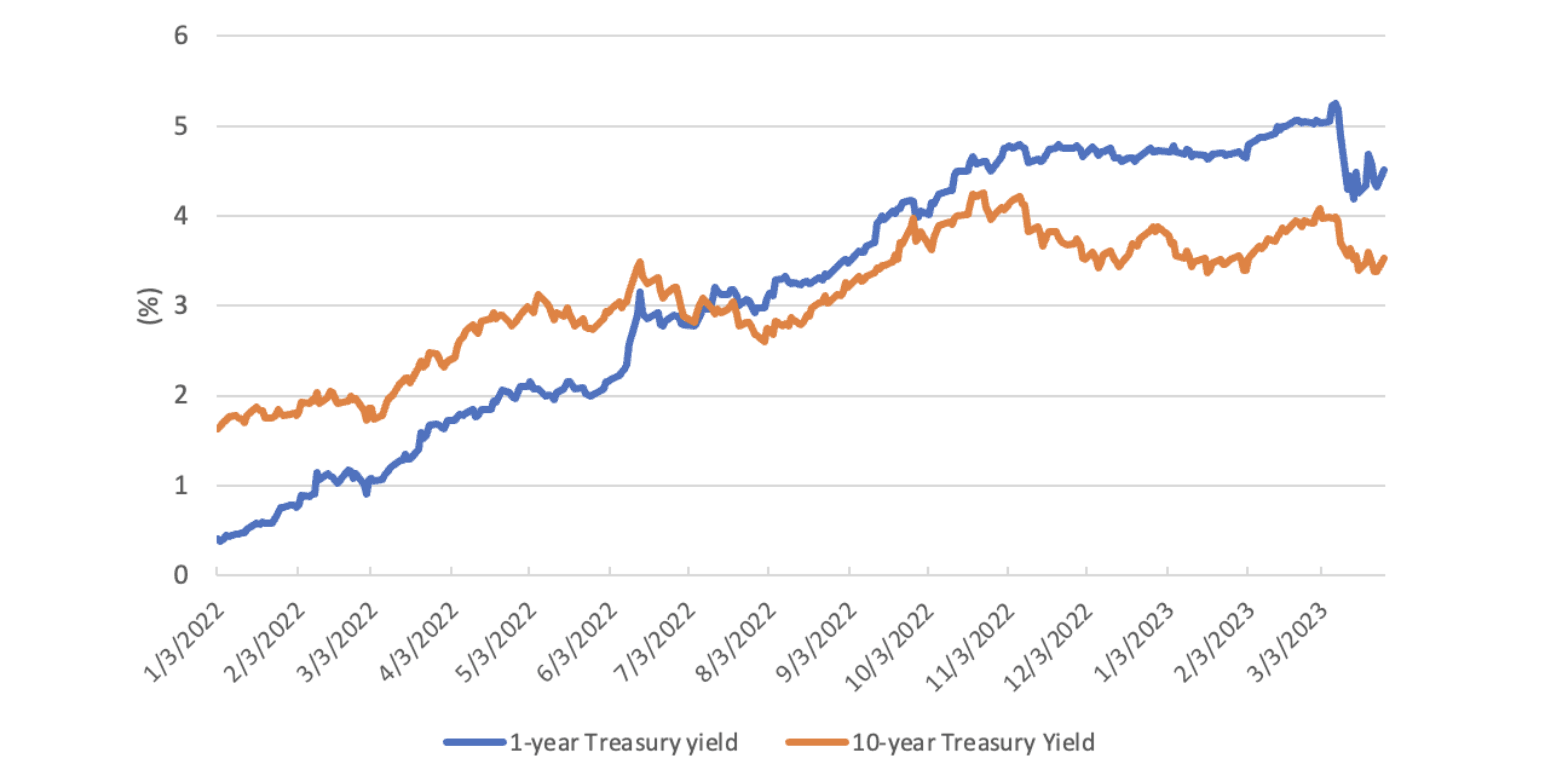

To deal with liquidity risk under rising interest rates, it is natural to consider changing the investment strategy to shorten the asset portfolio duration and increase the allocation to more liquid assets. With the current inverted yield curve, buying shorter maturity assets actually increases the portfolio yields as well as improves liquidity. In the last 50 years, the yield curve has only inverted twice: During 1979–1981 (Figure 2) and during 2022–present (Figure 3).[iv] However, since life insurers usually have long liability duration, allocation to short-duration assets will increase the asset-liability mismatch (ALM) risk.

Figure 2

Inverted Treasury Yield Curves (1979-1982)

Figure 3

Inverted Treasury Yield Curves (2022-2023)

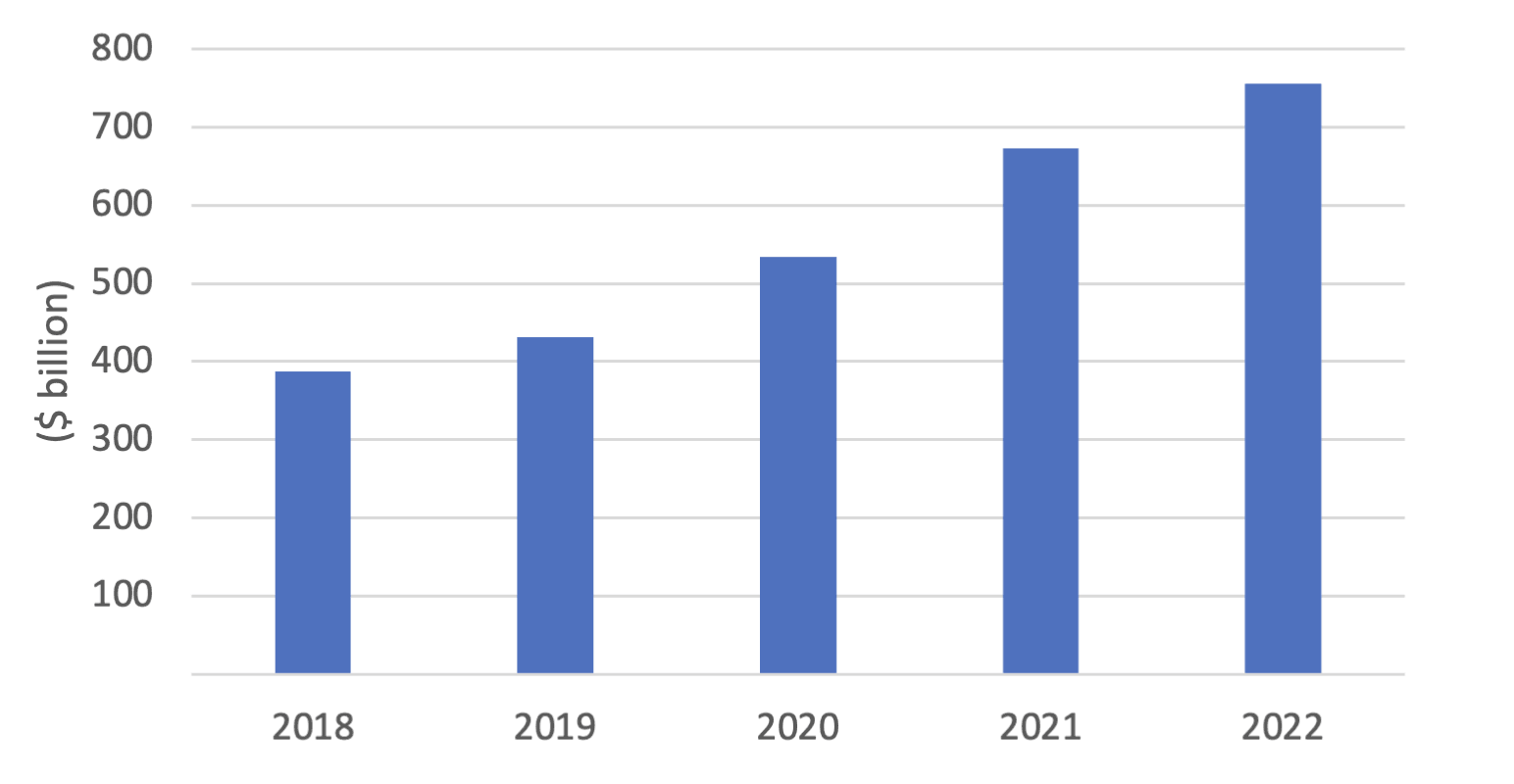

Asset-Intensive Reinsurance

Asset-intensive reinsurance (AIR) enables insurers to transfer all risks associated with reinsured in-force or new businesses in a cost-effective way. AIR provides solutions to the above liquidity issue, capital strain, competitive pressure, ALM risk, etc., for the duration of the underlying contracts. AIR has therefore become a popular tool among life insurers, evidenced by double-digit year-to-year increase in the assets transferred from life insurers to the asset-intensive reinsurers (Figure 4).[v] Due to a combination of tax benefits, flexible investment policies and capital requirements, etc., AIR reinsurers usually can provide considerably higher return than insurers. Quite a few insurers have seen significant sales increases after entering into new-business reinsurance, as AIR helped make their products more competitive and improved their own returns. Furthermore, since many annuity writers incurred capital strain after a record-high FDA sales year in 2022, some writers reinsured in-force FDA or other blocks to AIR, to immediately strengthen their capital and surplus positions and be able to write more new business. Otherwise, they would have difficulty in securing their market share when the whole industry’s sales ballooned.

Figure 4

Asset-intensive Reinsurers Total Assets

A disclosed case happened in 2023: SILAC’s capital had weakened over 2020–2021 as measured by AM Best’s BCAR due to a significant increase in annuity sales. However, in January 2023 AM Best removed SILAC from under review due to “improved capital position over 2022” as SILAC entered into a $2.5 billion reinsurance agreement with a Cayman-based AIR reinsurer Ludlow Re.[vi] With recently rising interest rates, the AIR pricing has become very favorable to the insurers compared to two years ago. If interest rates start decreasing soon following the flattening of inflation, insurers with high guaranteed interest rate businesses should consider AIR before that turning point.

Interest Rate Derivatives

If the investment strategy changes and asset-intensive reinsurance can’t be carried out in a timely manner, interest rate derivatives can be used. The derivatives can effectively and immediately boost portfolio yields and offset capital losses. However, they may expire worthlessly if interest rates don’t spike high enough. If interest rates increase gradually, portfolio rates will slowly catch up with the new money rates, in that case the interest rate derivatives may not provide much benefit. The analysis of cost versus benefit is important before entering into derivative contracts.

Subsidizing Crediting Rates

To ease the liquidity risk, on some occasions it may make sense to subsidize crediting rates to be closer to the new money rates to retain policyholders. Although subsidizing the crediting rates would hurt short-term earnings and surplus, it would help avoid the capital losses and retain future profits. It also sends a strong signal of the company’s financial strength to the policy holders, which in turn prevents mass surrenders and depletion of liquidity resources.

Conclusion

The hedging of interest rate changes is usually either under- or over-hedged, due to the inaccuracy in the dynamic surrender assumption, interest rate forecast, etc. It is very challenging to predict when massive surrenders will come and how large the surrender benefits will be. Insurance companies should monitor the surrenders outgo and adjust the hedging strategies dynamically, especially when new money rates are above current portfolios.

Insurance companies should use multiple strategies to mitigate the risk of interest rate movements and monitor the cost effectiveness of each. It is also important to increase the resilience of the company’s capital position to changing interest rates, in order to maintain the financial strength, which helps the retention of in-force businesses. Risks can never be fully eliminated but insurance companies can be well prepared.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

Chun Zheng, FSA, MAAA, PRM, is a senior director at New York Life. He can be reached at Chun_Zheng@newyorklife.com.

Yiru (Eve) Sun, FSA, MAAA, Ph.D., is a managing director at Aon. She can be reached at Eve.Sun@aon.com.