Infusing Systems Science in Risk Management: Part 1—Debunking Risk, Equilibrium, and Exogenous Shocks

By Bryon Robidoux

Risk Management, February 2024

This article is the first in a series of articles on improving risk management within the insurance organization based on complexity, computation, and information theory. These theories will force us to rethink the static concepts of risk, equilibrium, and shocks and replace them with dynamic principles of uncertainty, emergence, and feedback. To do this requires understanding their downfalls and the extreme limitations of risk, equilibrium, and shocks because they are the foundation of our risk management processes.

Why is Risk an Opportunity?

Have you ever asked yourself what is the root of the saying, "Risk is opportunity?" Why do people not say that "Uncertainty is opportunity?" The reason is crucial for understanding the limitations of risk metrics.

As defined by financial market theory, “risk is when an agent cannot observe the immediate state of the world but has complete knowledge of the probability space. Uncertainty is when an agent does not perfectly know the probability of events.”[1] As was argued in “Real Options in Radical Uncertainty: Part 1—The Nature of Risk and Uncertainty” (ROP1), knowing the outcomes with certainty can only happen in a casino because casino managers define the rules of play. For example, everyone knows the number of card decks in the shoe when playing blackjack, so knowing the likelihood of a particular outcome is possible. Risk is an opportunity because the player can learn the odds of getting a specific result before playing her hand.

In the physical world outside casinos, no one can know all the outcomes with certainty. Risk is a gamification of events, whereas uncertainty is a computation of events based on universal innovation by the physical world. The possible results change at every instance of time as the universe computes its next state, so knowing all possible outcomes is impossible. Even though people use risk and uncertainty as synonyms, they are vastly different concepts with vastly different origins. As actuaries, we never issue policies in a casino, so we never manage risk. On the other hand, actuaries constantly confront uncertain events, such as catastrophes and market guarantees.

Limitations of Risk

The article “Real Options in Radical Uncertainty: Part 2—The Limits of Financial Option Theory” (ROP2) explains that risk preferences, such as risk neutrality, are undefined in the physical world through prospect theory. The definition of a risk-neutral investor is an agent indifferent between a guaranteed payoff and a risky bet with an expected payoff equal to the guaranteed payoff. An agent would make this tradeoff only when the underlying probability space is known with certainty. In an uncertain world, there is no guarantee that agents can reliably calculate the expected value, so there is a difference between the information content of a certain payoff and an expected payoff. This information difference explains the hypothesized indifference between certain and expected payoffs versus prospect theory's empirical results. The empirical evidence shows that risk and uncertainty will lead to different decisions, which makes it erroneous to use findings based on risk metrics to handle uncertainty.

Information

In ROP2, I made a mistake in the risk-neutral analysis, which a colleague of mine pointed out. The error does not change the conclusion about information preferences versus risk preferences, but the issue is a great learning opportunity. I stated that a certain outcome contains more information than an uncertain expectation, but this is backward. According to Wikipedia, "Shannon information is interpreted as quantifying the level of 'surprise' of a particular outcome." People favor certain payments over the uncertain expected value because a certain outcome can have no surprising content. Therefore, they contain no information. In contrast, an uncertain expectation can have an unpredictable result because it contains unaccounted information.

Fundamental Change to Risk Management Processes

Therefore, this correction leads to the conclusion that there is a missing step in all risk management processes. Risk assumes the impossible: Anyone can know all possible outcomes of the physical world with certainty. By its definition, risk is sweeping much of the uncertainty and possible outcomes under the rug. If risk were a rug, it would be the size of a doormat. But uncertainty under the rug is the size of a 20-story building! Risk makes us highly overconfident.

Steven Keen describes three types of assumptions: negligible, domain, and heuristic.

- Negligible assumptions have little to no impact on the studied phenomenon.

- Domain assumptions specify the main conditions in which a theory will apply.

- Heuristic assumptions are assumptions known to be false, which are the first steps to a general theory. These assumptions are stated and used to simplify at first, then relaxed later to finish the thesis correctly.[2]

Contemporary risk management literature is treats risk as a domain assumption, which assumes away uncertainty. But risk should be a heuristic assumption. The certainty of the underlying probability space needs to be relaxed. The difference in measurement results before and after relaxation of certainty is known as riskiness. In other words, riskiness is the degree of certainty in which the risk manager has the underlying probability space and the assumed distribution. Complete certainty is a risky measurement. No certainty is an entirely uncertain measurement, such as a projected yield curve 50 years from today. The degree of riskiness determines how narrow the confidence interval can be on the measure.

Assuming uncertainty away does not mean it does not exist, so measuring the confidence level is vitally important. What good does it do to perform risk management activities, such as portfolio optimization, immunization, or risk mitigation, but not measure or at least articulate the uncertainty involved in their results? How much sense does it make to optimize your portfolio only to realize it contains vast amounts of uncertainty and missing information, overthrowing the answer? How does this help improve the reliability of our insurance operations?

Limitations of Equilibrium

Just like risk, equilibrium is a gamified static view of the world. When the roulette wheel spins in a casino, it eventually stops when it comes to an equilibrium. Each game is independent of the ones before or after it. Upon equilibrium, the croupier determines the outcomes; the game starts anew.

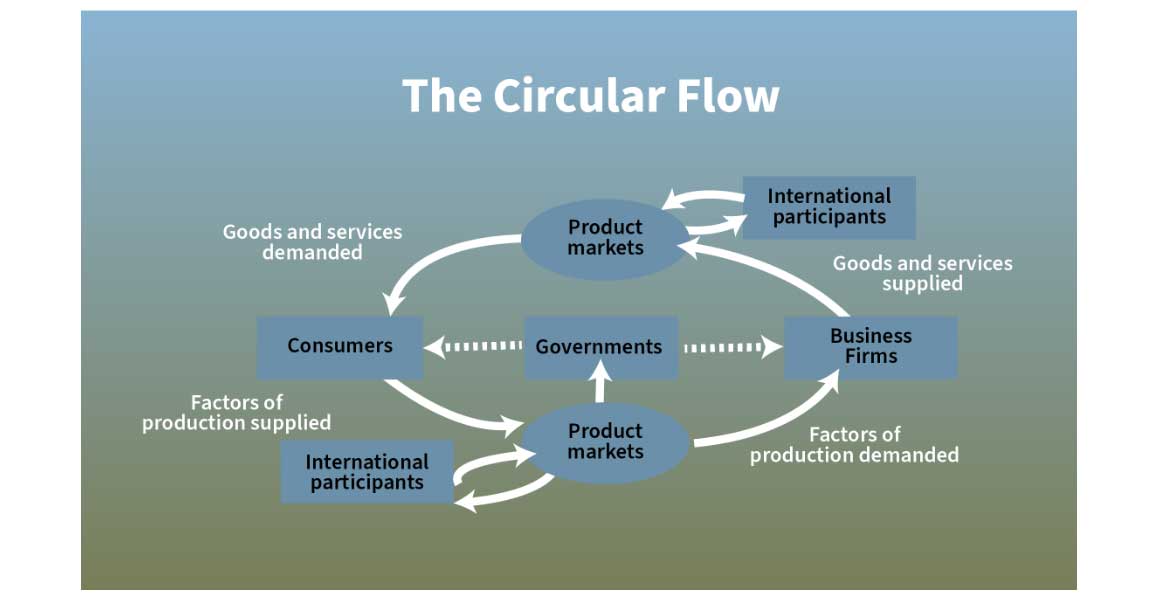

Figure 1

Introduction to Flows and Energy

This Photo by Unknown Author is licensed under CC BY-SA-NC

In Doughnut Economics: 7 Ways to Think Like a 21st Century Economist, Kate Raworth describes how, in 1948, Paul Samuelson created a machine called the Monetary National Income Analogue Computer (MONIAC) to show the circular flow of income through the United Kingdom's economy. It used tanks and pipes to demonstrate John Maynard Keynes's theory of how economies could spiral into recession. It was a brilliant visual representation of the macroeconomic ideas still in use today.

Raworth points out that Samuelson's machine had to be plugged into an electrical outlet to power all the pumps so the water could flow through the model. Yet nowhere in Samuelson's explanation of the macroeconomy did he explain how energy played into the flow of income.[3] The only way the MONIAC would have come to an equilibrium was by unplugging it from the wall, which would have killed the MONIAC and the economy! As is often the case, macroeconomic models see energy as a secondary economic input. Energy and computation should be seen as the primary input of the economy.[4]

The Death of Equilibrium

In the physical world, uncertainty is the antithesis of equilibrium. According to ROP1, uncertainty occurs through computation, creating an ordered output from disordered inputs using energy. For example, if a system contains two hydrogen atoms and enough energy is applied, they will fuse to form a helium atom. Therefore, the infusion of energy caused the process to transform from a less ordered state to a more ordered state where chemical reactions act like primitive transistors.[5] The new form of matter solidifies as information. Only systems far from equilibrium and full of energy undergo this computation process. Applying more energy produces more computation, creating more information and complex structures, which is the basis of universal innovation.

Only systems far from equilibrium and bursting with localized energy can create physical order within pockets of the universe, such as Earth. When energy is removed, entropy will turn order into disorder, the object will disintegrate, and the physical ordering will be lost. Systems in equilibrium and complete disorder are dead.[5] Universal innovation created all life that could not exist without information, computation, and energy. Without human life and the sun's energy, the economy could not exist. Keen calls this bad equilibrium[4] because the economy is dead!

Equilibrium outside of death can exist, which is what Keen calls good equilibrium for obvious reasons. Keen explains that the economy doesn’t settle in equilibrium, then get shocked out of equilibrium, and then always start moving toward equilibrium again. The economy has nonlinear dynamics, which means it behaves differently whether the economy is far from equilibrium versus when it is close. It is likely that far away from equilibrium the economy will move closer, but at some point, before hitting equilibrium, forces will change and move it away. This process will create a never-ending cycle within the economy, which is counter to what we were taught in economics. Equilibrium is not guaranteed to happen or should be expected to happen. The only guaranteed equilibrium is death!

Limitations of Exogenous Shocks

The universe is a system that contains our solar system. Our solar system includes Earth. Earth is an organization of geology and a living ecosystem. In the ecosystem, humans have a process of trade called the economy. As energy flows, universal innovation recursively creates new states. There is no such idea as being exogenous of any system or the economy. Therefore, there is no exogenous shock that moves the economy from state to state.

Further Issue with Shocks

In risk management exercises, we often shock variables in the model to determine the impact of a change to calculate exposures to a risk. There are three problems that I would like to address:

- Criticality and inflection points,

- light tailed distributions, and

- expectations.

Criticality and Inflection Points

Knowing and understanding the underlying dynamics is essential in the systems we model. Stable systems can have an inflection point where they change behavior. The inflection point may even be a critical point where the system fails. Examples of inflection points are the shock lapse at the end of the surrender charge period of a variable annuity or water changing to ice. An example of a critical point is a ski slope right before an avalanche. If the models do not incorporate these mechanics, they will behave incorrectly.

Light Tailed Distributions

ROP2 stated, "The Gaussian distribution is most famously associated with the central limit theorem. The central limit theorem should be renamed the center limit theorem because it deals with the center of the distribution. The central limit theorem states that for independent and identically distributed samples, the sample mean merges with the normal or Gaussian distribution even if the original samples are not normally distributed. The likelihood of deviation from the average or center of the distribution exponentially decreases with the amount of deviation." Our heavy reliance on the Gaussian distribution has our models reverting to the mean no matter how dramatic a change in the economy.

Expected Value

Think of this like Hooke's law in physics. According to Wikipedia, "It is the force (F) needed to extend or compress a spring by some distance (x) scales linearly for that distance—that is, F = kx, where k is a constant factor characteristic of the spring (i.e., its stiffness), and x is small compared to the total possible deformation of the spring." Springs are rated to know their strength and the maximum amount at which Hooke's law applies. But at some point, the spring will hit its yield point, the inflection point where Hooke's law is inapplicable or breaks down. Imagine the spring is rated to handle up to five kilograms, but you add seven kilograms. The spring will deform slightly. The spring will probably continue to work, but not concerning Hooke's law. Now add 500 kilograms, which will ruin the spring.

When performing a Monte Carlo simulation with scenarios of large market swings or doing large shocks to determine Greeks, we assume that there is no yield point. Hence, the market will return to its original state and magically behave as it always has. But we know this is not true; markets have inflection and critical points when they behave differently and deform. John Kay and Mervyn King state that there is little use in shocking or simulating large market displacements without modeling the underlying inflection and critical points. To add random jumps without understanding underlying dynamics is of little use.[6] Since our economic models focus on the expected value, they are likely incorrect in the tails. The shocked model focused on expectation will give vastly different results relative to the expected value of a model incorporating inflection and critical points.

The Bottom Line

Risk management is a critical activity in insurance. By drilling into the definition of risk, it becomes immediately apparent there are improvements to make. The book Modern Investment Management: An Equilibrium Approach states, "If the markets are assumed irrational, then there is little much to say. Perhaps we could find some patterns in irrationality, but why should they persist?"[7] The foundation of this opinion is rooted in risk, equilibrium, and exogenous shocks. I believe that this attitude is typical and holds us back.

We know humans are irrational, and life does not work like games. I have shown that decisions based on risk will lead to different conclusions than ones based on uncertainty, which means not much more is gained by clinging to risk. We cannot learn to deal with uncertainty if unwilling to face it. We need to develop novel solutions and tools to deal with uncertainty.

Before you can understand the importance of systems science and its power in risk management, it is essential to understand the weaknesses in the current approaches. This article showed that:

- Risk metrics assume certainty and information that no one can possess.

- Economics gives the impression that processes always move toward equilibrium but to the linearity assumed in the economic models.

- There is no ability to have exogenous shocks to the economy because the economy is a system that flows from state to state through computation and universal innovation.

The oversimplifying views of the world lead to radically oversimplified and incorrect solutions. By assuming complete knowledge of all outcomes, we are far more confident in the results of our models than warranted. To improve our management capabilities, we must manage the uncertainty we face.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the respective authors’ employers.

Bryon Robidoux, FSA, CERA, is assistant vice president of Product Development at Constellation Insurance. He can be reached at bryon_robidoux@ConstellationInsurance.com.