Successful Project Management: An Actuarial Perspective

By Jacqueline Desmond and Rahat Jain

The Stepping Stone, September 2023

Introduction

An actuarial career often begins with a focus on technical skills, but as careers progress, many actuaries learn that project management is an essential skill that will drive their professional success. Effective project management is further emphasized by hybrid work, where collaboration and alignment could be needed across multiple locations, time zones and working styles.

This article provides key themes of effective project management and case studies to illustrate their successful application. Key learning outcomes are:

- To understand project management goals and key themes for success.

- For students, be empowered to manage. For managers, empower students to develop project management skills in tandem with their technical skillset.

Project Management Goals

Effective project management ensures both one-time and recurring projects are completed on time, within budget, and meet stakeholders’ expectations. As actuaries, we have unique insights related to our business, timelines, and stakeholder requirements critical to this discipline.

Themes of Successful Project Management

Stakeholder Alignment

The project manager should ensure all stakeholders are identified and are aligned with each other on the desired outcome or goal of the project before it begins.

- Stakeholders are those who have a vested interest or stake in the project. They include those who use or depend on the end work product and those who are responsible for the project’s execution. When there are multiple stakeholders, there will be several key decision-makers.

- It may be difficult to fulfill the requirements of all stakeholders within the allocated time and budget. The project manager should identify conflicting priorities and work with them to reach a resolution that meets most stakeholder objectives.

- Some projects may fall entirely within the actuarial department, but others may involve stakeholders from other departments such as information technology, finance and accounting, human resources, or distribution (e.g., agents, brokers). Working with other functions can give actuaries a greater understanding of how their work impacts others

Budget Development and Monitoring

A project manager’s role is to work with stakeholders to set and monitor the budget.

- A project budget is an allocation of time, resources, money, or computing costs. An effective project should have a defined budget before it begins. This can be an explicit statement of work or an implicit recognition of the opportunity cost associated with the project.

- Budgets should consider the total resources needed to satisfy stakeholders’ requirements, including the number of people, the requisite skillsets, and the cost based on expected time commitment. The budget-setting process may involve non-actuarial stakeholders.

- Active budget monitoring is required to ensure efficient resource utilization. Project managers track the budgets and the resourcing plan and communicate with stakeholders when there are any unexpected events.

- As actuaries, it may be tempting to create complex models to set and monitor budgets. However, simple is better and will be easier for stakeholders to understand.

Timeline Development and Monitoring

The project manager works with stakeholders to set the initial timelines and ensures a project remains on schedule.

- Before a project begins, a formal project plan should lay out interim steps and associated due dates needed to meet agreed-upon stakeholder requirements.

- The timeline should be achievable and consider competing priorities—both professional and personal—of the expected resources. For example, if a valuation actuary is working on the project, the project deadlines should not interfere with quarter-close deadlines. If a student is studying for an actuarial exam, the project manager should consider their study schedule when setting deadlines for tasks requiring their involvement.

- Active monitoring of the project progress against the plan is key to ensuring on-time completion. The project manager should monitor timeline and budget in lockstep. They are responsible for communicating any adjustments to the plan with stakeholders to stay on time and in-budget.

Risk Mitigation

A project manager should ensure risks or dependencies are properly identified and communicated to stakeholders early and frequently.

- There is always a risk that the project does not go as planned. But as actuaries, we have unique insights to propose solutions in real-time and anticipate or accommodate dependencies on data needs, methodology, and modeling decisions.

Active Communication

A project manager ensures knowledge flow across all stakeholders during a project.

- Effective communication is characterized by alignment, i.e., those working on the project are aware of interim and final deliverables, relative priority, and how their individual piece of work will impact those around them. They should also be kept informed of any changes in scope or stakeholder feedback throughout the project.

- Effective project managers should also ensure all communication and deliverables sufficiently address stakeholders’ needs. This applies to both interim and final deliverables and requires knowing stakeholders’ preferences and adapting to their working styles (e.g., frequency of meetings; verbal or written status updates).

Case study

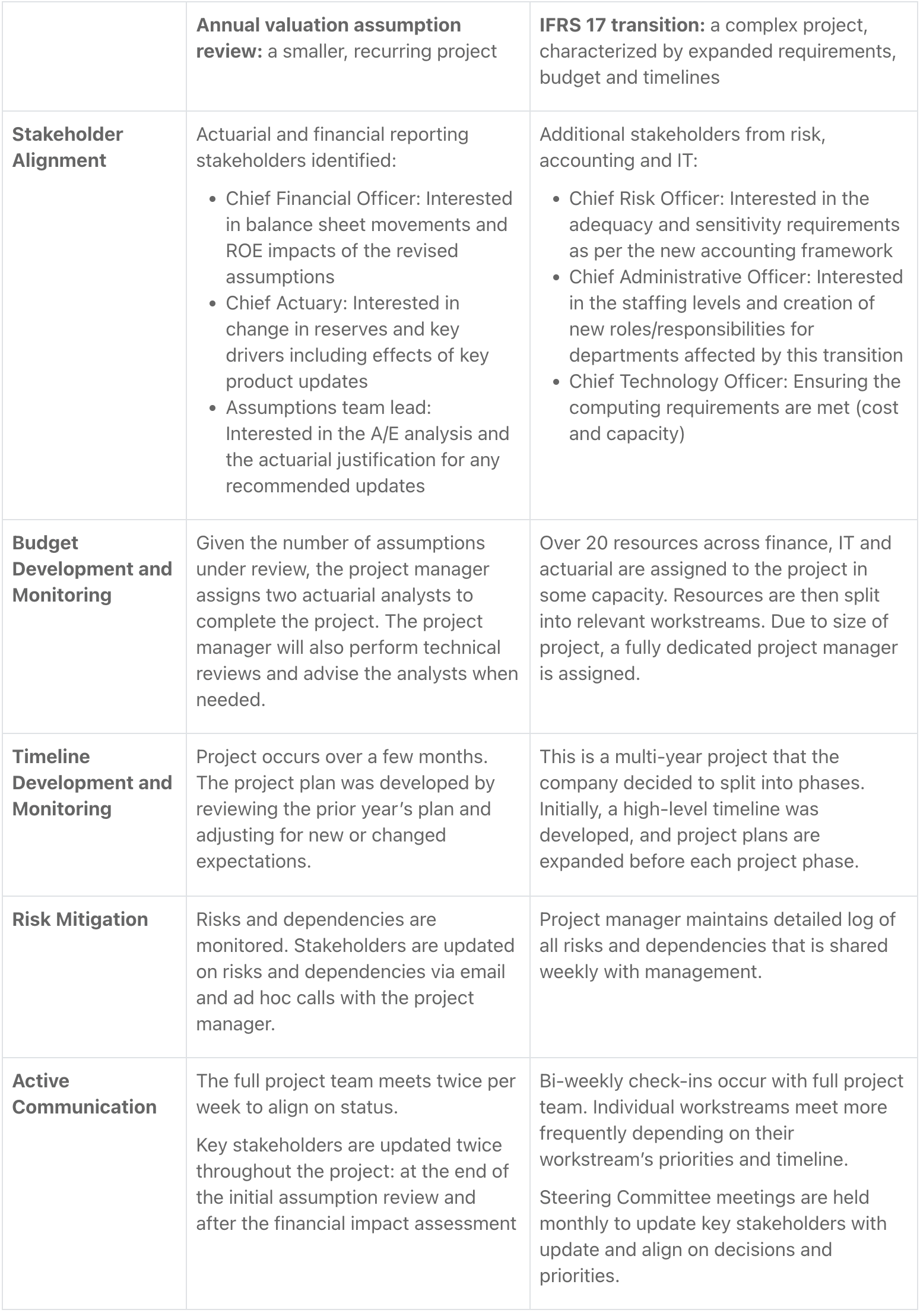

The following are two common actuarial project examples to illustrate successful application of the above themes.

Conclusion

Successfully managing projects is an essential skill for actuaries to deliver accurate and timely results of their work. Actuaries should be empowered to apply project management skills in their daily work and contribute to the overall success of their organizations. Actuaries bring many unique talents that make them excellent project managers who are well-equipped to deal with uncertainties, work with stakeholders and apply strong organizational skills.

From managing an individual work product or exam study schedule, to managing large-scale cross-functional projects, project management is embedded in actuarial work and can be developed starting day one on the job.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

Jacqueline Desmond, FSA, is a Senior Manager at Oliver Wyman. She can be reached at jackie.desmond@oliverwyman.com or via LinkedIn.

Rahat Jain, FSA, CERA, MAAA, is a Manager with Oliver Wyman. He can be reached at rahat.jain@oliverwyman.com or via LinkedIn.