How to Retain High Quality Actuarial Talent

By Rahat Jain and Matt McPhail

The Stepping Stone, January 2024

Introduction

This is the second installment of a two-part series. Part I was published in the July 2023 issue of The Stepping Stone and provided guidance on how a new (re)insurance company can build an attractive work environment for actuarial talent. In part II we will focus on how to encourage those actuaries to remain with the company in the long run.

How to Retain Actuarial Talent

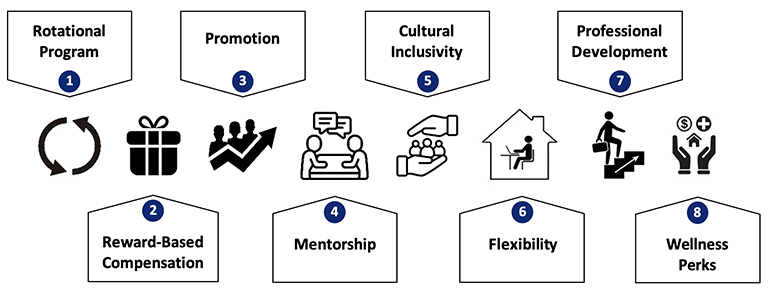

Figure 1

Factors to Optimize Employee Retention

1. Rotational Program

A company can retain its high-quality actuaries by introducing a rotational program at both junior and senior levels. According to a study by the National Association of Colleges and Employers (NACE), companies that offered a rotational program had higher one-year retention rates than companies without rotational programs, by roughly 20%.[1]

Senior actuaries can take on new challenges and responsibilities with rotational assignments in different divisions of the company, leading to a holistic understanding of the organization and its operations. This also helps maintain interest and avoid job burnout. Ideal rotational time lengths for senior employees are 3–4 years. This allows them to gain an in-depth understanding of each function and the processes behind the operations, which will help put them on track for opportunities in upper management (e.g., CFO, CRO, Chief Actuary).

2. Reward-Based Compensation

Rewarding high performers based on their work product, skills and contributions will ensure higher employee retention. Recognizing and compensating employees who produce high-quality work acknowledges their efforts and provides them with a sense of accomplishment.

Companies should offer bonuses to increase actuarial retention. Bonuses are tied to performance metrics such as meeting project deadlines, delivering high-quality work, or proactively initiating work that adds value to the company. This helps to recognize and reward employees who are valuable to the company but may not yet have the experience or qualifications necessary for a promotion. By offering bonuses, companies can motivate these employees to continue performing well and stay with the company in the long term.

Additionally, companies should set salaries based on level (e.g., a VP’s salary should be more than a manager’s) to incentivize employees to progress in their careers at the company.

3. Promotion

To help retain high-performing actuaries, companies should provide them with a clear path for career advancement through promotions or other leadership opportunities. Promotions allow employees to take on greater responsibilities and engage in strategic initiatives, both of which are integral to career growth. Ultimately, everyone wants to know that their employer values their contributions and is invested in their future progression at the company.

4. Mentorship

Learning from a mentor and knowing their success story will increase actuaries’ motivation to stay and progress towards a similar success level. To do so, companies can offer a formal mentorship program that pairs employees with a mentor who has experience and expertise in their area of interest. Mentors can help their mentees navigate their way in the company and provide guidance on career development.

Companies can also encourage an informal mentorship environment in the workplace, where employees have opportunities to talk to their colleagues for advice and help. Opportunities such as networking events, office events, and training sessions can facilitate the creation of this environment.

5. Cultural Inclusivity

By promoting open and transparent communication, and a culture that values feedback and encourages constructive criticism, organizations can foster a more inclusive and supportive work environment. This allows for an office culture that has a more engaged and satisfied workforce, resulting in increased employee retention.

Social events held in the office (e.g., happy hours, mixers) should be mindful of all cultural and religious beliefs. For example, due to drinking limitations/restrictions in certain cultures, companies are encouraged to diversify the types of events hosted, rather than having bars as a status quo for social events. Instead, events that accommodate different demographics and cultures, such as paint nights and bowling, create a more inclusive environment for all.

6. Flexibility

During the COVID-19 pandemic, many companies embraced remote work and offered more flexible working hours to employees. Over the years, employees have seen the value in the flexibility and balance remote work has provided. As more companies have transitioned to a hybrid work environment, allowing employees flexibility in their work hours and location has become an important factor in retaining talent.

If a hybrid situation isn’t possible, and the actuary must work in the office, incorporating 2–3 weeks of remote work annually can give employees the opportunity to visit home or other locations of interest while remaining productive, which will increase employee satisfaction and retention.

7. Professional Development

In addition to providing regular feedback and promotion opportunities, companies can provide professional development programs (e.g., learning materials on actuarial modeling systems, pricing case studies, the role of predictive analytics in actuarial science, etc.) to aid employees’ knowledge and skill growth. By investing in professional development, companies can create a more skilled and engaged workforce, which can ultimately lead to increased productivity and profitability.

Similarly, companies can provide opportunities for actuaries to attend and even speak at industry conferences and meetings (e.g., ImpACT, ReFocus). In doing so, actuaries can expand their network and connect with the broader actuarial community, while gaining leadership and speaking experience through hosting educational sessions (e.g., industry presentations, lunch and learns) or chairing a meeting.

Further, companies should recognize the importance of actuarial exam progression and should ensure that study time is sufficient and respected. Managers should work with their actuaries to develop a study schedule and keep an open line of communication, encouraging them to voice any concerns with regards to their study schedule and work capacity.

8. Wellness Perks

Wellness perks are an effective way to increase actuarial retention as they create a sense of value and appreciation among employees, which increases job satisfaction and loyalty towards the company. This also boosts productivity and morale, benefiting the company in the long run. Wellness perks such as paternal leave, daycare facilities, and wellness programs (e.g., fitness activities, mental health support) can demonstrate that a company values its employees’ contributions and is invested in their well-being and success.

Case Study

We looked at a company formed out of the divestiture of another insurer’s legacy business. Since then, the company has experienced substantial growth and is now seeking to hire and retain more actuaries to sustain this momentum. In part I of this series, we shared what two actuaries said when asked why they chose to join the company. Figure 2 shows their responses when asked what factors encouraged them to remain with the company.

Figure 2: Results from Interview

The case study in Figure 2 demonstrates key drivers that encourage actuaries to stay at a company. Senior-level actuaries value job satisfaction and a sense of ownership, including meaningful work that motivates them and future tasks that will benefit their careers. Junior-level actuaries, on the other hand, value support in the form of mentorship and assistance with exams. On all levels, being given opportunities to grow and develop in their career is heavily valued.

Conclusion

Retaining actuaries requires a comprehensive approach that considers factors beyond just compensation. To retain actuaries, organizations can provide opportunities for career development, create a supportive work environment that values diversity and open communication, and regularly assess and address factors that may lead to high turnover rates. Part I and II of this series together provide valuable insights on how insurance entities can build and maintain an actuarial taskforce for the day-to-day workings and growth of the new department/company.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

Rahat Jain, FSA, CERA, MAAA, is a manager with Oliver Wyman. He can be reached at rahat.jain@oliverwyman.com or via LinkedIn.

Matt McPhail, FSA, is a vice president with Fortitude Re. He can be reached at matt.mcphail@fortitude-re.com or via LinkedIn.

Endnotes

[1] https://ebiztest.naceweb.org/talent-acquisition/onboarding/rotational-programs-yield-higher-retention-rates/