LTC Reserve Weakness and What an Industry Reserve Incentive Program Might Look Like

By Mark Gold

Long-Term Care News, February 2021

Recent regulatory actions have highlighted the crisis in Long-Term Care insurance. Left unaddressed, it threatens to erode confidence in the capability of companies to honor their policies, and spreads risk to the industry in general which must provide resources when companies fail.

People require long-term care due to a debilitating illness typically associated with old age. “In the U.S., the bulk of LTC costs (72 percent) are funded by Medicaid and other public programs. But people have to spend down or otherwise forfeit assets before they are covered by public programs. Protecting assets is thus a primary reason why people buy LTC insurance.”[1]

The fundamental problem has been related to the initial pricing of legacy long-term care (LTC) insurance offerings. Assumptions used for initial pricing had to be set with limited relevant actuarial data, and actual experience has largely emerged much differently than expected. As a result, pricing and reserving of such legacy policies has been lower than what is necessary to sustain those blocks. This, coupled with the long-dated event horizons, resulted in a suboptimal recognition of revenue and has exposed substantial numbers of policyholders to performance risk.

By increasing mortality, the novel coronavirus might have reduced liabilities, however it has also adversely impacted assets. The fundamental problems related to legacy contracts likely remain.

There are two potential paths to a solution: i) reprice the contracts, and ii) increase reserves. Delays, however, have made repricing problematic. Significant rate increases are not an ideal solution to policy performance and the offer of more affordable increases in exchange for lower benefits is also an imperfect solution.[2] Repricing can’t be a complete solution as the record of regulatory approvals shows.

In this note, the nature and extent of the reserve and performance problem is presented and dimensioned; the paper concludes with a consideration of existing support structures and possible alternatives to incentivize exposed companies to build stronger reserves and to reassure the public that policy commitments will be honored.

Regulatory Interventions Connected to Legacy LTC Contracts

LTC performance failure is already a reality. The Pennsylvania Insurance Department has intervened in two cases of LTC driven distress: i) Penn Treaty Network Insurance Company (PTNA) and its subsidiary, America Network Insurance Company (ANIC), and ii) Senior Health Insurance of Pennsylvania (SHIP). The problems with LTC insurance at PTNA and ANIC began in the 1990s, “when they widely sold policies carrying generous benefits, which proved to be underpriced and poorly underwritten.”[3] Reinsurance and price increase requests between 2001 and 2008 failed to cover the problems, successive price requests receiving approval at ever smaller proportions of requested amounts.[4] By 2009, the Department understood that liquidation was the most favorable option for policyholders, but this was resisted. As of Dec. 31, 2016, the commissioner found the companies had assets of $503 million and liabilities of $4.49 billion. The liquidation request was granted by the court on March 1, 2017.[5]

Researchers with the Chicago Fed, analyzing the failure, listed six faulty assumptions: i) policy lapse rates were overestimated, ii) mortality rates were overestimated, iii) investment earnings from accumulated premia payments were overestimated, iv) morbidity impacting the incidence of claim was underestimated, v) morbidity impacting the cost of claims was underestimated, and vi) the health recovery rate of claimants was overestimated.[6]

The case of SHIP presents a similar story with a new element, the ringfencing of liabilities in a closed block. Conseco Senior Health Insurance Company (CSHI), a subsidiary of CNO Financial Group, then known as Conseco Inc., originated long-term care policies, ceasing in 2003. In 2008, with an injection of $175 million from Conseco Inc., CSHI transferred its assets and liabilities into an independent trust; in conjunction with the transfer, CSHI was renamed Senior Health Insurance Company of Pennsylvania (SHIP), and charged with managing the closed book runoff.[7], [8] In its 2018 annual filing with the state insurance department, received on March 1, 2019, SHIP indicated a $466 million surplus deficit, triggering a mandatory control level event.[9] Conditions have since deteriorated. Unrealized forecasts for morbidity improvement, underestimated morbidity costs, and overestimated investment earnings were factors in the shortfall.[10] Insurance Commissioner Jessica Altman filed a request for rehabilitation with the Commonwealth Court with the consent of the company; in January 2020, the court approved the filing.[11]

The most recent regulatory action occurred on May 18, 2020, when the Wisconsin Office of the Commissioner of Insurance brought Time Insurance Company with its nearly 200,000 LTC policyholders into rehabilitation.[12], [13]

Corporate Exposure to Legacy Long-Term Care Policies

“In aggregate, U.S. insurers' reported LTC active life reserves grew to $131.8 billion at year-end 2018, compared to $123.6 billion in 2017.”[14] For some of these companies, such adjustments have been made serially over years. But are they enough? For large companies with traded common stock, it is instructive to compare reported GAAP book equity with market equity valuation.

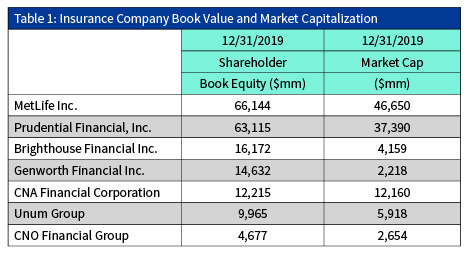

Book equity was taken from respective 10K reports filed in 2020. Market capitalization was determined by 12/31/2019 close of day prices and outstanding shares as calculated and reported by YCharts.

With the exception of CNA, market capitalization is well below book equity for the listed entities suggesting that the market discounts the revenue projections and/or reserve adequacy of the insurance companies listed, though not necessarily due to LTC problems alone. In absolute amounts, the aggregate deviation is considerable (nearly $76 billion).

CNA is a special case since, per its filing, at the end of 2019, nearly 90 percent of its shares were held by a single entity, Loews Corporation. Brighthouse is a spinoff from MetLife. Large non-US companies retain LTC exposure but do not make SEC 10K disclosures and are not included in the table above. John Hancock, a subsidiary of Manulife Financial Corporation, a Canadian company, has substantial LTC exposure but does not have a separate market value. In the consolidated presentations of its 2019 annual report, Manulife does make certain reports by geography and makes disclosures regarding its long-term care portfolio. Manulife’s LTC portfolio actual performance in 2019 was adverse relative to expectations; the $1.9 billion economic effects of the adverse experience were offset by projected income from premium increases yet to be approved. Manulife continued to project morbidity improvement over time but lowered its improvement assumptions. Losses associated with that change in assumptions were offset by reduced adverse deviation margins rationalized by portfolio aging. The company noted certain portfolio gains attributed to policyholders accepting lower coverage in lieu of premia increases.[15]

General Electric Corporation, a large industrial, retains significant LTC exposure contracted through a subsidiary, North American Life and Health (NALH).[16] NALH LTC reinsurance exposure is held primarily in two units, Employers Reassurance Corporation (ERAC) and Union Fidelity Life Insurance Company (UFLC). UFLIC was part of Genworth and was retained by GE when Genworth was spun off.[17] At the end of 2017, GE, took a $6.2 billion after-tax charge against income and announced a $15 billion increase in reserves to be added over a seven-year period against LTC exposure carried by a GE Capital subsidiary, North American Life and Health (NALH).[18] The charge was the result of a review in which assumptions regarding cost of claim, mortality, and investment returns were revised in light of adverse experience.[19] Roughly $10 billion of the commitment remains to be fulfilled. The GE 2019 10K disclosure shows both morbidity and discount assumptions remain aggressive. GE retains an exponential 1.25 percent annual morbidity improvement assumption. The overall discount assumption of 5.74 percent is aggressive relative to recent yield history and represents a mean reversion assumption over time that might not be realized.[20] GE discloses the reserving sensitivity to its morbidity improvement assumptions is $700 million per 25 bps reduction in morbidity improvement, implying a movement to a flat morbidity rate would require a $3.5 billion increase in reserves. The reserve sensitivity to a 25-basis-point reduction in the discount rate is $1 billion.[21] A realized rate of return of 4 percent would result in a roughly $7 billion under-reserving.

Problem exposure to legacy LTC policies are not confined to large companies. In 2018, S&P ranked LTC insurers by risk as measured by the ratio of policy holder surplus by reported LTC reserves; 13 vulnerable small companies were listed. The third most vulnerable company was SHIP.[22]

This research, in conjunction with losses experienced in the Pennsylvania regulatory cases, provides evidence, and, particularly, market-based evidence, of substantial under-reserving of LTC exposures.

The Support System

When a liquidation is ordered, policyholders are given recourse to state guarantee funds which are financed by insurance companies operating in the same state. The character of these guarantees varies from state to state; each state defines its own limit structure. The guarantee funds seldom have much in the way of reserves and often are funded on an on-going basis through industry assessments based on aggregate reserve size. That means a troubled insurance company must pay a material amount to cover the underfunded LTC commitments of failed companies in addition to meeting reserve requirements for its own distressed portfolio.

In the 1980s, the home loan system financed by savings and loan banks, also known as “thrifts,” came under crisis. The Resolution Trust Corporation, created by an act of Congress, was a key mechanism through which insolvent savings and loans were unwound and depositor insurance obligations fulfilled. Funding ultimately had five key sources: i) Treasury appropriations of taxpayer money; ii) bonds, the servicing of which was financed largely by thrift industry assessments; iii) Federal Home Loan Bank payments and assessments (another form of thrift industry support); iv) FDIC payments; and v) the sale of failed thrift assets which involved innovative private-public collaborations to maximize the value to the government of asset liquidations in the resolutions. In conjunction with this financing plan, regulation of thrifts was completely overhauled. While costly to taxpayers, the savings and loan resolution allowed the fulfillment of deposit insurance obligations, the failure of which would have not merely harmed depositors, including many small depositors, but would have weakened the faith in deposit insurance generally with implications for the stability of the whole banking industry in the United States.

The RTC experience presents an example of a government-industry partnership that resolved a performance integrity problem vital to the financial services industry.

Alternative Approaches to the Problem of LTC Reserving

There are a number of steps that would be useful to advance a solution to the problem of LTC reserving and the NAIC has made an important start. In 2019, it established a Long-Term Care Insurance Task Force to develop a unified approach to underwriting and pricing. It has also been asked to investigate guarantee funding and reserving practices including morbidity improvement assumptions. Clearly assumption standards and underwriting guidance would be helpful not only to insurance companies with LTC exposures, but for the commissioners as well as they are presented with closed block divestiture requests such as the one that created SHIP. A unified view on pricing would also help eliminate cross-state subsidization. The Task Force also has been asked to provide meaningful options for contract modification in situations where price increases make premiums unaffordable. Reducing benefits, however, is an unsatisfactory solution for policyholders who have paid premia for many years to obtain the financial security embedded in the policies they contracted and honored with their performance in good faith.

The Financial Accounting Standards Board (FASB) has introduced a new Long Dated Targeted Improvements (LDTI) standard for Generally Accepted Accounting Procedures (GAAP) which will have a widespread impact across the insurance industry. A critical component of LDTI is a new standard for discounting liabilities that will involve the reference to current market yields. This likely will impact income and balance sheet statements for firms that have historically used more aggressive discount assumptions. It will also require annual reviews of actuarial assumptions, but it does not establish them nor does it impact statutory reserve requirements; actuarial assumptions and statutory reserve requirements remain the province of the insurance industry and its regulators.

Decisions regarding actuarial assumptions and discount may be imposed through regulatory authority alone, but there could be alternatives. Consider the following description of a program to incentivize reserving and solidify confidence in the integrity of insurance contract performance: 1) Commissioners, in conjunction with industry executives, establish reserving principles that protect LTC performance to a tail loss experience; 2) exposed companies prepare a plan, subject to commissioner approval, to meet reserve targets consistent with the principles; and 3) provided companies in the program are not delinquent in their reserve plan commitments, the industry agrees to backstop company LTC performance.

Although the size of the problem is large, the industry has the advantage of a long time-horizon to ensure funds are available to meet the obligations to policyholders and maintain a healthy industry.

For some, projected periodic earnings may be insufficient to meet reserve obligations consistent with plan principles. In such a situation the industry could consider the establishment of a facility (perhaps with government assistance) to pre-fund claims over time should they materialize, with such monies reverting back to the funding participants should loss experience allow a release of funds.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries or the respective authors’ employers.

Mark Gold, Ph.D., is a consulting economist. He can be reached at mark.a.gold@gmail.com.