Highlights from a Rate Increase Survey

By John Hebig

Long-Term Care News, February 2022

Rate increases have been a fixture in the long-term care (LTC) industry for well over a decade. However, filing requirements and actuarial reviews have evolved over this time. Although a more uniform approach to actuarial reviews is being pursued as part of the Multi-State Actuarial (MSA) review process, rate increase filings continue to be a state-by-state process. In addition, regulations and practices differ widely among states, resulting in a complex terrain for companies to navigate.

To help companies obtain a better sense of the rate increase landscape, Milliman surveyed carriers about their recent LTC rate increase experiences. This survey represents an update to one conducted in 2016. A total of 20 companies participated in the survey, representing 65 percent of LTC premium in the United States. Of the responding companies, 18 provided detailed information on 35 nationwide rate increase filings, comprising more than 1,000 submissions to individual states.

Full survey findings will be available publicly on Milliman’s website in March 2022. Until then, this article provides some highlights to those in the LTC industry.

Actuarial Assumptions and Modeling Approaches

A majority of companies report using the same assumptions for rate increase requests as for cash flow testing (CFT). In cases where the rate increase assumptions differed from CFT assumptions, the impact to projected premiums and claims generally resulted in a lower lifetime loss ratio and a more consumer-friendly rate increase request.

Slightly more than half of respondents report using claim cost models. The remainder use first-principles modeling. We expect the proportion of companies using first-principles to grow in the future, as it has since the 2016 survey, due to industry trends toward these models and the increasing availability of cloud computing.

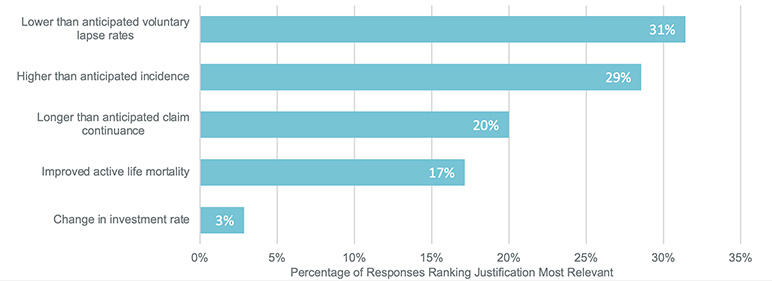

The primary driver for filing a rate increase varies by block; however, as has been the case for years, lower-than-anticipated lapse rates are the most-cited justification for a rate increase, followed by higher-than-anticipated claim incidence, as shown in Figure 1.

Figure 1

Factors Comprising the Actuarial Justification

Requested Rate Increases

The average nationwide rate increase request in the survey amounted to 47 percent. The cumulative requested rate increase varies greatly by jurisdiction and block, and in several cases is over 400 percent.

More than half of the filings represented in the survey requested rate increases that varied by at least one parameter, often to target underperforming cohorts. In our experience, some states prefer a uniform rate increase request, while others expect the increase to vary by cohort. Varying the requested rate increase by inflation protection option and benefit period were the most common.

Filing Outcomes

The average time frame from submission to disposition for filings in this survey is seven months. Some states tend to approve rate increases quickly, relying mostly on the information in the carrier’s filing materials, while others require a more involved process and take years to provide approval. The latter may result in multiple actuarial and nonactuarial objections. In particular, California, New York and Florida were identified by respondents as the most cumbersome states in which to file a rate increase.

Some states, such as South Dakota, Wisconsin and Wyoming, have shown a willingness to approve most, if not all, of the requested rate increases that are submitted. States such as Texas and Virginia have also been willing to approve large increases, sometimes in excess of 100 percent. However, these increases are generally phased in at the request of the state. Not reflected in these survey responses are recent California and New Hampshire approvals that have exceeded 100 percent, which is a departure from their approvals in the past.

Limiting a rate increase on the basis that it is recouping past losses has become more common in many states over the past few years. While there is no consensus in the industry about how to determine if a rate increase is recouping a past loss, the prospective present value (PPV) analysis is now requested by several states. In addition, the Minnesota analysis has been increasingly requested by regulators over the past year. Both the PPV and Minnesota analyses have been incorporated into the actuarial framework of the MSA review process, which may further promote their use by states (even outside of an MSA filing).

Many states will only approve rate increases up to a given amount. In some states, such as Mississippi and Maryland, these limits are based on regulation. In other states, such as Georgia and Massachusetts, these approval limits are not codified in regulation but have been observed over several years.

While many states review rate increase filings with significant actuarial rigor, the most common reason cited by (a large margin of) survey respondents for a reduced approval or disapproval is a nonactuarial cap. More frequently than any other state, Indiana disapproved more than half of the dispositioned rate increases reflected in the survey.

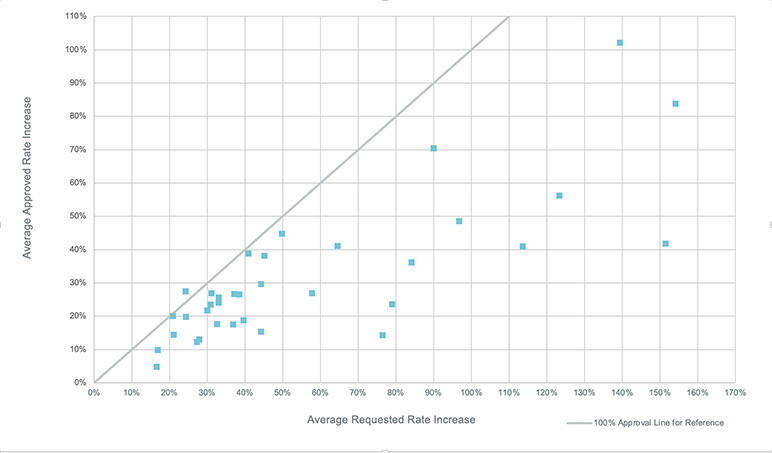

Figure 2 illustrates the average rate increase requested along with the average rate increase approved by nationwide filing. The diagonal line reflects full approvals of the requested rate increase by filing for reference. In some rare instances, an approved rate increase may be greater than that requested. This is generally due to a state seeking an end-game rate increase from a company, or a phased-in rate increase is permitted to be slightly larger than the request to account for the delayed implementation.

Figure 2

Average Rate Increase Approved by Average Requested Increase

Policyholder Notification Letters

Like rate increases, requirements and review processes regarding policyholder notification letters also vary by state. Departments required a policyholder notification letter (PHNL) to be submitted for approval along with rate increases in a quarter of the submissions reported. In other submissions, the letters may have been submitted as part of a rate increase filing for reference or not at all.

The NAIC LTCI Reduced Benefit Options (EX) Subgroup[1] is currently developing a checklist for premium increase communications. This checklist may bring more uniformity to PHNL requirements and review processes.

Reduced Benefits Options and Contingent Benefit upon Lapse

Reduced benefit options (RBOs)—such as changes to daily benefit, benefit period, elimination period and inflation protection—are offered in almost all filings. More innovative RBOs, such as cash buyouts, landing spots and coinsurance, were not widely offered. According to respondents, an average of 10.6 percent of policyholders facing a rate increase elected to reduce their benefits, which is slightly higher than the average 8.9 percent election rate in the 2016 survey.

Additionally, a contingent benefit upon lapse (CBUL) was voluntarily offered to all policyholders in most filings. According to respondents, the average CBUL election rate for policyholders facing a rate increase was 3.8 percent, which is lower than the average 5.7 percent election rate in the 2016 survey.

Considerations for the Future

The 2021 Milliman LTC Rate Increase Survey provides a retrospective look at rate increases for different companies. Insurers should also be aware of the following developments that may affect the landscape of LTC rate increases in the future.

COVID-19 Pandemic

Survey respondents reported that the COVID-19 pandemic delayed the rate increase review process and the implementation of new rates. However, the rate increases represented in this survey likely do not capture any changes to experience or assumptions caused by the pandemic. It remains unclear how the pandemic will impact behavioral and health trends of LTC policyholders or how it will influence regulators’ attitudes when it comes to approving premium increases.

MSA Review Process

The MSA review process was adopted by the NAIC LTCI Multistate Rate Review (EX) Subgroup[2] on December 12, 2021. This process hopes to simplify and bring uniformity to the LTC rate increase review process in participating states. Carriers should consider it for future filings, as pursuing an MSA review has the potential to streamline the filing process in participating states.

Regulatory Changes

Regulations and regulatory practices continue to evolve, sometimes in unpredictable ways. For example, in New Hampshire, regulations that limited rate increases by attained age were struck down in a February 2021 opinion by the state’s supreme court. Since that time, rate increases in excess of 100 percent have been approved by the state. In Connecticut, insurers were previously allowed to “stack” phased-in rate increases on top of one another, such that the first and second phase of a recently approved rate increase could be layered on top of the second and third phases of a previously approved increase. This may no longer be permitted beginning in 2022 under new regulation.

Inforce Management

Rate increases are one available tool to improve the performance of a block of LTC insurance. However, wellness programs designed to improve quality of life for policyholders and delay or prevent claims are increasingly part of the tools available to companies. These types of interventions require LTC insurers to understand and engage with their customers in a deeper and more sustained way than has been the norm. The benefits for both insurers and customers could be significant in managing LTC costs and improving quality of life. How these programs interact or accompany rate increases is yet to be seen.

Continuing Evolution of the LTC Rate Increase Environment

It is fair to say that most professionals in the LTC industry and its policyholders would like to move beyond continual rate increases. Our survey shows the reality that the industry is not there yet. We hope the insights provided by this summary and the full report (available in March 2022) will help the industry identify ways to manage the filing process more efficiently and effectively.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

John Hebig, FSA, MAAA, is a consulting actuary at Milliman. John can be reached at John.Hebig@milliman.com.