Coinsurance for Long-term Care: Another Viable Benefit Reduction Option for Rate Increases?

By Joe Neary and Courtney Williamson

Long-Term Care News, June 2022

For many years now, premium rate increases have been commonplace for long-term care (LTC) policies. However, options to reduce the premium rates for policyholders have not changed significantly. Most insurers provide the following benefit reduction options:

- reduce the daily benefit amount,

- increase the elimination period, and/or

- reduce the benefit period.

In an effort to provide policyholders with more choices, many insurers also allow all policyholders to elect a contingent benefit upon lapse (CBUL) benefit, even if they are not required to do so. Some insurers have started to offer alternative rate mitigation options such as “landing spots” or, more recently, cash buyouts to provide additional options to policyholders to combat rising premium levels.[1]

Coinsurance has long been a mainstay of major medical health insurance products and has even been incorporated into newer LTC policy forms. However, a coinsurance option has not been widely offered as a benefit reduction option to offset LTC rate increases. Coinsurance, as a benefit reduction option, could allow policyholders to maintain maximum benefit coverage in certain situations while potentially reducing the impact of a rate increase; it could simultaneously reduce the liability for the insurer. This article does the following:

- Estimates the reduction in future claim liabilities if coinsurance were added to the portfolio of benefit reduction options through an illustrative study

- Calculates the potential offset electing a coinsurance option could have on the premium rates for policyholders

- Explores various considerations that stakeholders should think about when evaluating whether coinsurance is the right option

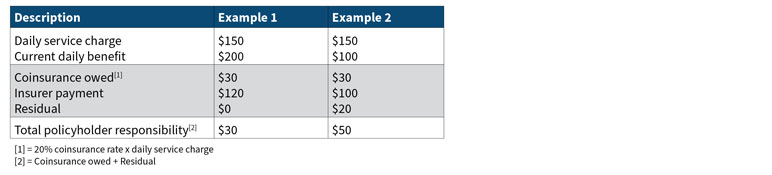

Before we dig into our analysis, it is important to clarify how a coinsurance option would be applied for an LTC policy. Under a reimbursement plan design without coinsurance, the insurer pays for LTC services up to the current daily benefit amount, and the policyholder pays any remaining charges. Under a similar plan design with coinsurance, the policyholder is initially responsible for the coinsurance portion (e.g., 20%) of total service charges, and the insurer is responsible for the remaining costs up to the current daily benefit amount. The policyholder is then responsible for any remaining charges. For example:

A policy has a current daily benefit of $200 and 20% coinsurance. If the total daily service charge is $150, then the policyholder is initially responsible for $30 (= $150 × 20%), and the remaining $120 (= $150 – $30) is paid by the insurer.

If, however, the policy has a current daily benefit of $100, the policyholder is responsible for the additional $20 (= $120 – $100) because the remaining charge ($120) is greater than the current daily benefit ($100). The total responsibility for the policyholder is $50 (= $30 + $20).

Figure 1 compares these two examples.

Figure 1

Coinsurance Examples

Future Claim Analysis

Our analysis focused on the potential impact that various coinsurance levels might have on an insurer’s future claim liabilities, as well as the approximate reduction to the rate increase a policyholder would face.

We first created sample LTC policies reflecting common demographics (e.g., issue age, gender, marital status) and benefits (e.g., inflation option, benefit period). Premiums for these policies were developed based on representative industry premiums from the early 2000s (when many LTC policies receiving rate increases were priced) for comprehensive reimbursement LTC policies with a $150 original daily benefit. The sample policies were then projected over 70 years based on all-lives assumptions. The morbidity assumption used in the projections was developed using the Milliman Long-Term Care Guidelines. Total life mortality reflected the 2012 Individual Annuitant Mortality (IAM) Basic table. The voluntary lapse assumptions varied by duration and had a 0.75% ultimate lapse rate. Although projection assumptions vary company to company, these assumptions are reasonable to calculate illustrative impact values.

We projected experience under the following two scenarios reflecting endpoints, understanding actuality would fall in between:

- no coinsurance option is available, and

- all policyholders that continue their policy (i.e., do not shock lapse) elect a given coinsurance option.

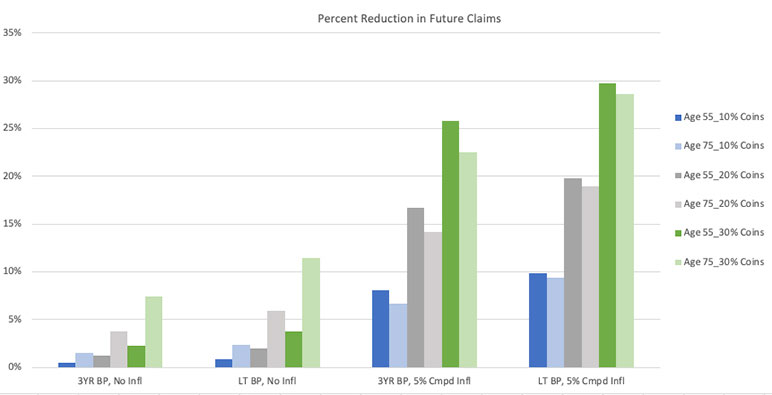

We looked at varying levels of coinsurance (10%, 20% or 30%), benefit periods (three-year and lifetime), inflation options (no inflation and 5% compound), and attained ages (55 and 75). Other benefit and policyholder characteristic combinations from our sample policies were analyzed. For our sample policies, we found benefit period, inflation and attained age were the most impactful on the reduction in projected liabilities.

Figure 2 shows the reduction in future claims for each of the coinsurance and benefit combinations analyzed; the reduction is higher for richer benefit combinations. On average, policies with richer benefits use a lower portion of their total available benefits. Without coinsurance, the full cost of services is paid for by the insurer when the charges are below the maximum daily benefit. With coinsurance, the policyholder is now responsible for a portion of the cost, reducing the insurer’s responsibility. This is demonstrated in the example from the introduction.

For policies with limited benefit periods, lower utilization extends the period during which benefits may be payable. This extension may result in more claim terminations prior to the full pool of benefits being paid.

Figure 2

Impact of Coinsurance on Future Claims

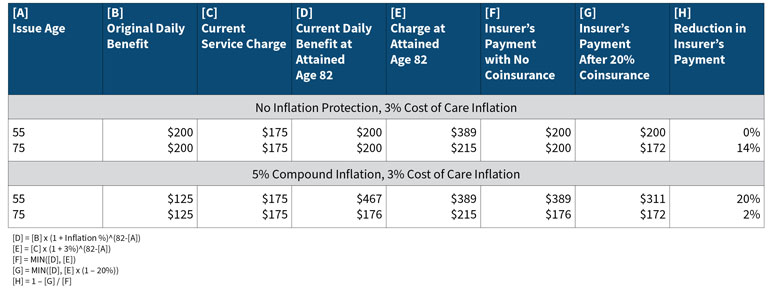

For reimbursement policies, an insurer will see greater savings on older policyholders without inflation protection compared to younger policyholders. The larger savings are driven by cost of care increases and the amount of time to claim onset. The average age of a policyholder going on claim is 82, meaning on average, policyholders with younger issue ages are expected to be active for many years prior to becoming claim-eligible. While policyholders are in force and their duration increases, the cost of care is expected to increase, resulting in higher service charges at the time of claim onset. Therefore, the total charge after coinsurance is more likely to exceed the current daily benefit. If charges exceed the current daily benefit after coinsurance is applied, then the insurer does not realize any savings. The reverse can also be true for policies with 5 percent compound inflation if the annual increase in the cost of care is less than 5 percent. Figure 3 provides illustrative numerical examples of these concepts.

Figure 3

Impact of Coinsurance on Insurer’s Payment

Due primarily to the impact on benefit utilization, insurers that have LTC blocks of business with significant portions of the population with reimbursement products, long benefit periods and high inflation protection could see notable reductions to future claims by offering coinsurance. Please note that these are only illustrative examples. Results will vary for a given insurer’s situation as well as for different underlying assumptions.

Premium Rate Reduction

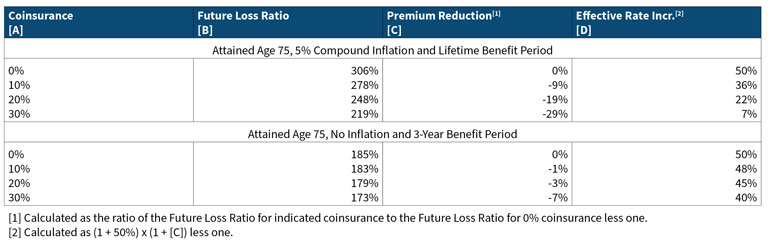

After modeling the reduction to claims for various benefit characteristics and coinsurance options, we explored the approximate effective rate increase for two sample policyholders. Specifically, we determined the premium reduction with coinsurance that resulted in the same future loss ratio as the base scenario (i.e., 0% coinsurance with rate increase). While our analysis targeted the same future loss ratio, other approaches in determining the premium reduction (e.g., equivalent future profit margins) could be utilized and would lead to different results.[2]

Figure 4 demonstrates the premium reduction and effective rate increase from our analysis assuming a 50 percent rate increase request. The figure provides the future loss ratio, premium reduction and effective rate increase for each coinsurance option for a 75-year-old female policyholder with the richest (5% compound inflation and lifetime benefit period) and leanest (no inflation, three-year benefit period) benefit combinations modeled.

Figure 4

Impact of Coinsurance on Rate Increase

Consistent with the observations from the future claim liabilities, the premium offset is greater for richer benefits and higher coinsurance percentages. This is intuitive as the richer benefits had greater reductions to future claim liabilities. As such, these richer policies could receive a lower rate increase in exchange for accepting coinsurance.

Considerations

Our analysis demonstrates the potential to offset premium rate increases for policyholders and reduce future claim liabilities for insurers. However, other considerations should be contemplated among the various stakeholders.

Policyholders

Flexibility for policyholders. Coinsurance adds an additional option for policyholders to consider when trying to make the best decision for themselves when faced with a premium rate increase. This further allows policyholders to tailor their LTC policy benefits to their expected future health and financial conditions.

Consider short-term and long-term impacts. Policyholders should carefully consider their long-term outlook on health and finances. A coinsurance option may reduce the magnitude of a rate increase, thereby lowering the premium paid over the life of the policy. However, this does not guarantee a policyholder will have lower total expenses. Policyholders may be tempted by the short-term savings on premiums; however, they could face higher out-of-pocket costs if they go on claim later in life. It may be difficult for policyholders to fully understand the implications of electing coinsurance, and they should seek input from their health care and financial advisors.

Insurers

Drivers of financial impact. Coinsurance will likely reduce future claim liabilities for policyholders who elect the option. The total reduction of future claim liabilities for a block of business will depend on the number of policyholders who elect the coinsurance option as well as the level of coinsurance. The greater the portion that elects coinsurance and the higher the coinsurance percentage, the greater the reduction to future claim liabilities.

However, the reduction to future claims is also dependent on the cost-of-care inflation rate and adverse selection.

- In low cost-of-care inflation environments, the insurer may see greater savings on policies, especially those with richer inflation protection (e.g., with compound inflation). The lower cost of care decreases the chance that the reimbursable amount after coinsurance exceeds the daily benefit.

- The potential claim reduction may be offset by adverse selection. It is expected that healthier policyholders will elect coinsurance at a higher rate as well as, potentially, a higher coinsurance level relative to other, less healthy policyholders. Adverse selection may also be reflected through policyholders with low daily benefit amounts. These policyholders are likely to elect coinsurance regardless, because they may max out their daily benefit with or without coinsurance.

Future rate increases. The expected reduction in future claim liabilities may reduce the need for future rate increases.

Reputational risk. Changing the policy contract to incorporate coinsurance may be a reputational risk to the insurer. Policyholders may be unhappy years after electing the coinsurance option, contending they were misled by the insurer and did not fully understand the implications of this new benefit design. This risk is an existing concern in the face of rate increases for other innovative benefit reduction options, such as cash buyouts. However, as some policyholders may be familiar with coinsurance from major medical health insurance policies, coinsurance may be easier to understand relative to other benefit reduction options.

Modeling and implementation capabilities. Insurers will need to evaluate their ability to implement and model coinsurance. This will require insurers to work with their claims administration department or third-party administrator to ensure the system is updated and tested, as needed, to ensure this policy design change is performed correctly.

Modeling updates should also be considered. Claim cost models would require new claim costs reflecting revised utilization and benefit extension assumptions and insurer liabilities associated with any elected coinsurance. Alternatively, first principles modeling would require adding a coinsurance variable and updated calculations in addition to revised utilization assumptions. Any modeling updates should be tested and validated. Updates to the administration system and modeling are likely to result in additional upfront costs.

Regulators

Policyholder options and minimization of risk. Some regulators have expressed a desire for insurers to offer innovative rate increase mitigation options and may, therefore, appreciate this additional benefit reduction option. Adding such an option would give policyholders a chance to minimize the impact from a rate increase. For some insurers that are struggling financially, this option may reduce solvency risk, which would also be welcome news to regulators.

Protecting older insureds. As seen in Figure 4, the premium offset for a coinsurance option may be minimal for older policyholders with leaner benefits. Regulators may be cautious about exposing older policyholders to additional financial risk when the immediate impact is limited.

Review time. Regulators may also require additional time and support in the rate filing to be certain that the underlying assumptions are reasonable and that the coinsurance option is fair and equitable for policyholders.

Additionally, as the coinsurance option would change the contract language, regulators would also need to review new policy forms and/or amendments, which is not typically required for LTC rate increase filings. Regulators may also need to review the policyholder notification letter to ensure there is clear communication regarding policyholder options.

Conclusion

Our analysis shows that coinsurance might be a viable rate increase benefit reduction option. Insurers may see a reduction in future claim liabilities with greater reductions on older blocks of business with richer benefit mixes. This reduction may also lead to a lower effective rate increase and allow policyholders to better tailor LTC benefits to their needs.

While our analysis supports benefits to insurers and policyholders, there are still questions to be answered. Would regulators approve smaller or larger rate increases if policyholders had this additional coinsurance option to offset the increase? Would the inclusion of coinsurance result in a higher benefit reduction election rate?

Although answers to these questions are still unknown and insurer experience will vary, our analysis indicates that coinsurance has the potential to minimize risk for insurers and reduce the premium rates paid by policyholders.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

Joe Neary, ASA, MAAA, is an associate actuary at Milliman. Joe can be reached at joe.neary@milliman.com.

Courtney Williamson, ASA, MAAA, is an associate actuary at Milliman. Courtney can be reached at courtney.williamson@milliman.com.