RILA Nonforfeiture Requirements

By John Balbach and Ricardo Trachtman

Product Matters!, November 2023

Registered Indexed Linked Annuity (RILA) product sales have enjoyed meteoric growth over the past decade, driven by offering a compelling package of upside market exposure with some downside market protection. Prior issues of Product Matters! have discussed the common product features and market landscape, but earlier this year the NAIC revised the regulatory framework around these products when they adopted Actuarial Guideline 54, “Nonforfeiture Requirements for Index-Linked Variable Annuity Products.”

Interim Values

The Variable Annuity Model Law defines a variable annuity as providing “annuity benefits that vary according to the investment experience of a separate account,” and so for RILAs to qualify as variable annuities there must be some means of calculating daily market-based policy values. In the past decade, insurers have designed a variety of ways to determine the intra-term or “interim value” of these products in a way that is reflective of separate account performance, though often falling short of providing a truly “unitized” account value.

Among the styles of interim value calculations, there have been:

- Explicit Black-Scholes calculations using market-consistent inputs for valuation, or

- A simple intrinsic value approach, or

- Use of a unitized structured-outcome fund, potentially along with

- Application of a proportional adjustment based on the portion of the term completed, and/or

- Inclusion of a deduction for the “unearned” portion of the initial derivative purchase or option budget.

In many cases, carriers have explicitly sought to make the calculation more comprehensible to policyholders by simplifying elements of the interim value calculation—for example, through omitting any interest-rate driven adjustments, applying a linear interpolation over the course of the term to reflect the implied “vesting” pattern of the option budget, or applying explicit schedules to the caps or participation rates in order to limit a policy’s upside participation in the interim index returns.

It was this variation in interim value determination among RILAs that attracted regulatory attention; specifically, it was noted that some RILA designs that had been approved and were available for sale looked less “market consistent” than others. Based on that observation, the growth of RILA sales and an industry desire for clear and consistent regulatory treatment, the NAIC established the Index-Linked Variable Annuity (A) Subgroup in late 2021. Over the course of 2022, the subgroup worked through several exposure drafts of a proposed actuarial guideline addressing the requirements for RILAs to qualify as a variable annuity and thus be exempted from Standard NonForfeiture Law for Individual Deferred Annuities.

AG54 Requirements

Actuarial Guideline 54 (AG54) was adopted by the NAIC executive plenary on March 25th at the 2023 Spring Meeting and will be effective for all new policies issued on and after July 1, 2024. There is no relief or “grandfathering” for previously filed and approved products, necessitating that all insurers either re-design and re-file their products or, at a minimum, complete the analyses and file the certifications that are required by the guideline.

AG54 uses the term “Index-Linked Variable Annuity,” or “ILVA,” to make clear that product designs that comply with the new guideline would be viewed first and foremost as variable annuities, and in drawing this line they indicated how these products fit into the existing regulatory framework.

While the final index value in a term provides clear policy values, the daily Index Strategy Values (or “Interim Values,” in the language of the guideline) were the aspect that regulators felt needed clear and uniform guidelines. As such, the requirements of AG54 apply to policy values related to an index option, used in determining a policy’s death benefit, withdrawal amount, surrender value or annuitization amount. Meeting these requirements is deemed complying with the required “Nonforfeiture” valuation of the products and therefore meeting the definition of a “Variable Annuity.” To do this, AG54 defines a “Hypothetical Portfolio” as combination of a Derivative Asset Proxy and Fixed Income Asset Proxy.

The Derivative Asset Proxy is constructed such that it perfectly replicates the index option value at the end of the term (inclusive of caps, floors, buffers, and participation rates), and is valued consistently each day with market-observable inputs. This derivative portfolio may also include “trading costs” to reflect the bid-ask spread present on unwinding the derivatives prior to the end of the index term, though the filing actuary must certify that any trading costs included represent “reasonably expected or actual costs.”

Recognizing that RILAs are spread-based products, the hypothetical portfolio in the guideline also includes a “Fixed Income Asset Proxy,” which is a zero-coupon bond that at the start of the index term is determined as the initial account value less the Derivative Asset Proxy. Within the index term the initial discount is amortized, such that the end of term Fixed Income Asset Proxy value equals the initial notional amount allocated to the strategy. In this way, the Fixed Income Asset Proxy provides for a recovery of the “unearned” option budget spent at the start of the index term. The guideline allows some flexibility on the valuation of this component; a formulaic market value adjustment could be applied to the calculated “book value,” or a first-principles fair value calculation could be used instead.

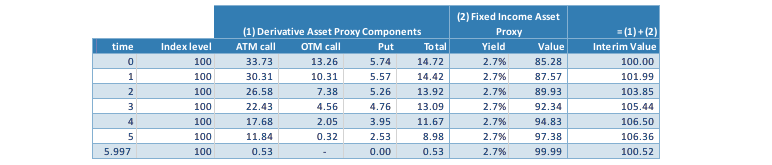

Table 1 shows a simple example of the calculation and indicative pattern of resulting interim values with static economic inputs, and a 6 year index term with a 10% buffer and 50% cap, assuming no index change, 4% risk free rate, 25% ATM volatility and 20% volatility at both the buffer and cap levels.

Table 1

Example Hypothetical Portfolio Calculation

* Total assumes a 10bps trading cost on the derivative portfolio value

** one day before the end of the index term

The principle at the heart of the guideline is establishing a clear means of defining equity between the insurer and policyholder in these contracts, so there is no identifiable gain for either party on a transaction mid-term. This is how traditional variable annuities work. The market value of the units for the account value is a pass-through for the insurer in operating the separate account. Clearly drawing that line for the ILVA is core to demonstrating that any individual RILA product meets the regulatory definition of a VA. With that context, it should come as no surprise that the guideline also requires that the filing actuary certify that the interim value calculations preserve equity between the insurance company and the policyholder.

As part of the policy filing, a qualified actuary will also need to describe the market-consistent valuation of the derivative asset proxy, including inputs into the calculation “consistent with the observable market prices of derivative assets over the index strategy term” as well as the formulas or techniques used (such as Black-Scholes, Monte Carlo techniques, other closed-form formulas, or alternate approaches as appropriate).

The guideline doesn’t entirely close the door on product design in terms of policy interim values, as it does allow a policy form to qualify without explicitly opting into the Hypothetical Portfolio construct. While all RILA filings require an explanation of the interim value calculation, if not using the Hypothetical Portfolio approach, the company would need to include several actuarial certifications that include quantitative testing showing how the Interim Value calculation is “materially consistent” with the Hypothetical Portfolio outlined in the guideline, including any assumptions or parameters that were used in the testing. However, there could then be differing acceptance or rejection of a variation between states, so companies may be reluctant to pursue interim value differentiation at the cost of product variations, marketing complexity, and a slower speed to market.

Looking Ahead

The review process can be lengthy for variable product filings, since they are reviewed by both the Securities and Exchange Commission and individual states. As a result, it is expected that many carriers are reviewing their existing offerings to determine what changes, if any, may be needed to comply with the requirements in AG54. The Secure Act 2.0, passed in December 2022, had language directing regulatory agencies, including the SEC, to expedite the RILA review process through the development of product-dedicated forms and streamlined filing similar to variable annuities. Variable annuities have their prospectuses filed on dedicated forms, as opposed to RILA’s S-1 filing, which is a general-purpose initial issuance form used for, among other things, initial public offerings. However, their rule-making and exposure process is expected to last until late in 2023, and companies who wait for that to be finalized prior to re-filing their product may risk not having an approved product ready for the July 1, 2024 effective date.

The Interstate Insurance Product Regulatory Commission (IIPRC or Compact) standards have been drafted and a second draft was exposed for comments through Aug. 31. The adoption of an ILVA standard would allow carriers to file RILA products more expeditiously. These products, lacking an IIPRC standard, have not been eligible for filing through the Compact. Notably, the July exposure draft of the proposed standards required that Interim Values must be determined using a Hypothetical Portfolio methodology.

Further, some states that were previously not approving these products are now considering legislative changes to accommodate ILVAs.

A potential state variation issue remains in that the drafting of AG54 left the specifics of how to do the valuation of the Fixed Income Asset Proxy up to states to apply their own view; currently on Fixed and FIA products there isn’t a uniform consensus on what is acceptable. MVA formulas and factors have one description in the Compact standards, but there have typically been some nonCompact states that required variations for product approval. As such, opting for a MVA formula over a first-principles fixed-income valuation could result in state variations. One suggestion from a regulator was that any ILVA filing going forward should include a discussion from the certifying actuary as to why a MVA was either included or excluded in the interim value determination.

Even though AG54 continues to allow for regulatory discretion in its implementation across states, many companies not currently using a Hypothetical Portfolio approach for calculating interim values are likely to redesign their products to use the hypothetical portfolio safe harbor. This, along with the availability of an additional product approval process through the IIPRC and a dedicated RILA form from the SEC, means that the RILA market will see continued evolution and growth over the coming years.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

John Balbach, FSA, MAAA, is a consulting actuary with the life practice of Milliman. He can be reached at john.balbach@milliman.com.

Ricardo Trachtman, FSA, MAAA, is a principal & consulting actuary with the life practice of Milliman. He can be reached at ricardo.trachtman@milliman.com.