Understanding the Current Underwriting Cycle—Difficult Times Extend Hard Market

By Dr. Thomas Holzheu and James Finucane

Reinsurance News, August 2021

Re/insurance rates have been hardening since 2018, and the price momentum picked up at this year's January renewal period before decelerating slightly later in the year.[1] The January renewal sets price and coverage for the largest share of reinsurance business, especially in Europe. In the most recent renewal on July 1, premiums continued to increase across most property and liability lines and geographies, with divergence driven by loss experience and emerging risks.[2] Global commercial insurance prices increased 18 percent in 1Q 2021, according to Marsh's Global Insurance Market Index, after an increase of 22 percent in 4Q 2020.[3] The current market is characterized by tighter capacity, mostly due to reduced risk appetite on the part of re/insurers, rather than a shortage of capital per se. Indeed, last year's capital losses were temporary as asset valuations recovered quickly from the lows of March 2020. Global re/insurance incumbents and a few new players raised close to USD15 billion of equity capital in 2020 to take advantage of the hard market opportunities created by attractive rates, according to Aon.[4]

The property & casualty underwriting cycle is characterized by periods of soft market conditions, in which premium rates are stable or falling and insurance is readily available, and by periods of hard market conditions, where rates rise, coverage may be more difficult to find and insurers’ profits increase. The underwriting cycle is driven by competition between re/insurers, with risk appetite and alternative sources of capital affecting overall capacity and the speed with which prices adjust to updated assessments of risk. Premium rates drop as insurance companies compete to gain market share. As the market softens, profits decline and insurers are forced eventually to withdraw capacity and restore profitability. In the hardening phase of the cycle, competition is less intense, premium rates are rising and underwriting standards become more stringent, leading to improving profitability. The prospect of higher profits draws more capital into the marketplace, leading to intensifying competition and setting the scene for the next down-phase of the cycle.

What Drives the Current Cycle?

The reduction in re/insurers' risk appetite is driven by modeling uncertainty in an environment of ambiguity about macro developments and volatile capital markets. Elevated modeling uncertainty arises from multiple factors including social inflation, which has pushed up US liability claims; prior-year adverse reserves development, uncertainty around COVID-19 business interruption (BI) losses; successive years of above-average cat losses; continued uptick in secondary peril losses; and increased scrutiny of the modeling of climate change impacts (see Figure 1).[5] Actual industry losses are still highly uncertain. Recent top-down market estimates of global industry losses for COVID-19 claims range from USD30–60 billion.[6] The 2020 North Atlantic hurricane season brought a record 30 named storms, of which 12 made landfall in the US. These avoided densely populated areas but still caused insured losses of USD20 billion in the US. Global insured losses from wildfires in 2020 are estimated around USD11.6 billion, mostly due to the record-breaking wildfire season in the western US. The consensus view for 2021 is for “above average” storm activity in the North Atlantic.[7] Reported US Nat Cat losses through May 2021 are already above USD20 billion. Likewise, there are warnings about another potentially catastrophic wildfire season due to the extended drought condition in the North American West.[8]

US liability claims growth has been trending higher since around 2015.[9] The current episode of social inflation relates to single-claimant cases rather than mass tort and is not caused by legislative changes. Key drivers of recent social inflation include the trial bar increasingly using psychology-based strategies, data analytics, digital media advertising and litigation funding. Other factors relate to jurors' attitudes to issues like social injustice, rising inequality and negative sentiment toward corporations. The uncertainty about liability reserves and pricing new business is particularly affecting excess liability and liability reinsurance treaties.

There is also property-insurance-related social inflation, particularly in connection with the assignment of benefits (AOB) crisis in Florida, which is driving up homeowners' attritional claims costs.[10] Under AOB a policyholder grants a third party, such as a home contractor, permission to bill an insurer directly to settle a claim. It is a standard practice that enhances claims processing convenience but can be abused. Certain features of Florida's legal environment led to a rapid increase in legal costs for homeowners’ insurance claims. Florida accounted for 8 percent of homeowners' claims opened by insurance companies in the US yet accounted for over 76 percent of homeowners' suits opened against insurance companies.[11]

The impact of low investment returns on re/insurer earnings is a further factor pushing up re/insurance rates. Aon's January 2021 reinsurance market outlook reported that investment returns were lower at all reinsurers in its analysis. Even after rises in the first quarter this year, interest rates and consequently investment returns remain low by historic standards. This places more focus on underwriting profitability to make up for the lost investment income in order to compensate investors for their cost of capital. Meanwhile, macro risks are elevated, with an increasing focus on rising inflation and interest rate scenarios, which can trigger adverse reserves development and losses in asset valuations.

The reinsurance capacity provided by third-party capital is an important contributor to property cat lines of business. A reduction in capacity in collateralized reinsurance (CR), which has suffered poor returns in recent years, is contributing to selective tightening in the retrocession market and is also a factor in rate hardening in the reinsurance market.[12]

Overall capacity growth has been restrained due to uncertainty about natural catastrophes, COVID-19-related losses, and social inflation. These market conditions indicate price rises are likely to continue both this year and next, although at a decelerating rate as capital on the sidelines responds to the hardening market.[13] Rate increases in 2022 would increase the profitability of new business and are probably necessary to earn an acceptable return given uncertain loss developments in existing and new lines.

How Does This Cycle Compare With the Past?

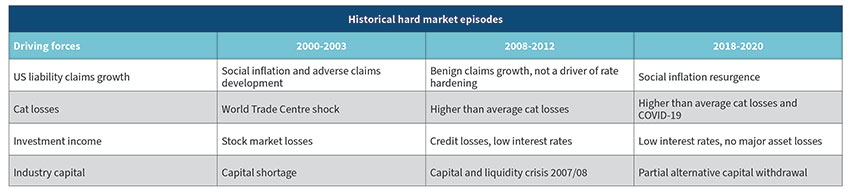

The last two hard market periods (2008–2012 and 2018–2021) were/have been based on a confluence of factors rather than pure capital shock (see Table 1). In contrast, the hard markets in non-life re/insurance in 1984, 1992 and 2001 were triggered by exogenous shocks (i.e., loss or asset shocks). In the early 2000s, large cat losses, including the un-modeled 9/11 terrorism risk, met with a multi-year stock market downturn and large adverse development in casualty, creating a perfect storm for a hardening market.[14] Since then, the nature of cycles has changed. Soft markets periods have become longer, and hard markets are delivering smaller profit opportunities than in the past. Markets have become more global and alternative capital (AC) has limited rate hardening. The current hard market is seeing earnings pressures from cat losses, social inflation and un-modeled COVID-19 losses. However, there is no capital shortage from major asset losses.

Table 1

Historical Hard Market Episodes

Source: Swiss Re Institute

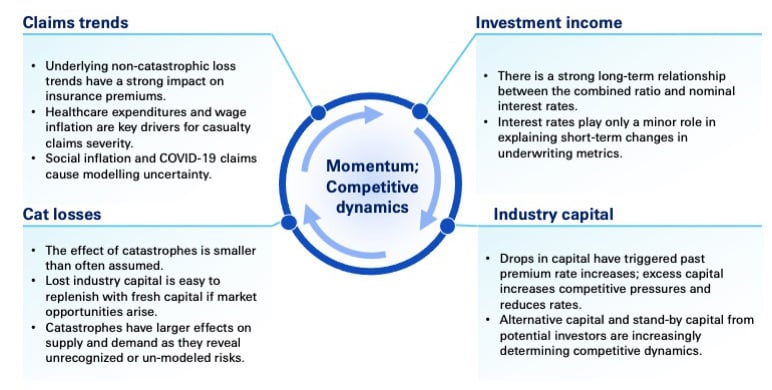

Industry capital remains one of the key factors shaping underwriting cycles. However, its importance is diminished compared to the past (see Figure 1). The supply of non-life reinsurance capacity is dependent on capital. In the long-run, most capital growth is organic and comes from within the industry through retained earnings and capital gains on invested assets. New capital enters the industry during times of market opportunities through AC and start-ups (often based offshore), which lowered the barrier to enter the industry, and led to an abundance of capital. AC was the main driving factor for the market softening after 2012.

The terms capital and capacity are often used interchangeably, and it is important to differentiate the two. Changes in claims trends or expected losses alter the relationship between industry capital and capacity offered to the market. A rise in unexpected losses and higher parameter uncertainty about loss expectations can lead to reduced capacity, even if the overall amount of capital remains the same. Reinsurers must hold additional capital for unexpected losses, thus removing capacity from the market. The most severe hard market was the US liability crisis in the mid-1980s, triggered by a strong rise in liability claims frequency and severity.

The effect of catastrophic losses on pricing and the underwriting cycle is smaller than often assumed, and less so than in the past. This is because losses from large cat events are quickly replenished by new capital raised by both traditional carriers and via AC. If the industry is already well capitalized and/or profitability is strong, the impact of large cat events is diminished. For example, the losses from the Northridge earthquake (1994) were offset by strong investment returns and reserves releases and in the case of Hurricane Sandy (2012), losses were offset by high capacity and reserves releases.

There is a strong long-term relationship between the combined ratio and nominal interest rates. However, the relevance of these interactions is small when looking at changes in interest rates and the short-term impact on combined ratios. This means that interest rates play only a minor role in explaining short-term changes in underwriting metrics.[15]

Finally, there are market dynamics that we call "momentum." Rate trends are benchmarked with prior-year changes, causing pricing trends and cycles where rates over- and under-shoot the actuarial costing base. Syndication of reinsurance programs and the bargaining power of brokers facilitate this. A bias in costing often follows the cycle. There is an optimistic bias after a hard market, when underwriters under-estimate expected losses. This allows for rate softening. Similarly, there is a pessimistic bias after a soft market when underwriters over-estimate losses, facilitating rate increases. The adjustments of loss expectations to reflect current reality comes with a lag and this perpetuates the cycles.

Figure 1

The Importance of Industry Capital

Source: Swiss Re Institute

The average length of underwriting cycles has increased: hardening of markets has shortened with increasing competition from new capital, and soft market periods have become longer. Further, the amplitude of rate changes is decreasing. Hard and soft cycles have become less regular and pay-back dynamics, where high profitability during hard markets can compensate for low profits during soft markets, can no longer be relied on.

Looking Beyond the Cycle

The re/insurance industry faces two challenges simultaneously: enhancing profitability while improving the value proposition for clients. With longer underwriting cycles and capital playing a smaller role in pricing, re/insurers must use scale and efficiency to assess and handle complex, global risks in a cost-effective manner.[16]

Regarding underwriting profitability, we expect continued claims pressures from growing natural catastrophe risks, a transitory jump in general inflation, and an elevated trend in social inflation. Nat Cat risk exposures are growing at a steady pace in excess of general economic activity (e.g., GDP growth). Climate change and secondary perils, as well as urban development and social inflation, are risk drivers with trends that are currently not well captured by modeling and pricing practices in the industry. Getting ahead of evolving risk trends is necessary to secure the industry's resilience for larger events to come.

Insurers' investment returns should be roughly flat in 2021 and only rise marginally in the years after, as the low-for-longer interest rate environment extends. Overall, insurer portfolio yields have steadily declined over the last decade despite taking on more equity, credit and illiquidity risk. Investments in higher-risk assets have increased, albeit with caution and within a strict solvency framework in most jurisdictions. The search for higher yields must be balanced with the need to manage investment risk. Enhancing profitability must come from the underwriting side.

Contract uncertainty, and its interaction with risks such as cyber and supply chains, is another challenge for the industry. It is also an opportunity to improve the value proposition for clients, since lack of clarity and consistency around contract terms leads to uncertain and undesirable outcomes. Re/insurers who understand their clients' needs and place a renewed underwriting emphasis on standardization of contractual terms can increase resilience while closing protection gaps and improving offerings on evolving risks.

Emphasis on the customer is especially important now that access to capital is less of a differentiating factor today. Re/insurers who have developed a relationship and understanding of their client's needs can go beyond standard service offerings and provide customised solutions to optimise risk transfer, enhance capital efficiency, and support strategy.[17] The structural shift of re/insurance value proposition toward risk knowledge and client relationships will favor re/insurers who adapt creatively to evolving conditions.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the respective authors’ employers.

Dr. Thomas Holzheu is chief economist americas at the Swiss Re Institute. He can be contacted at thomas_holzheu@swissre.com.

James Finucane is senior economist at the Swiss Re Institute. He can be contacted at james_finucane@swissre.com.

Endnotes

[1] See Market Conditions Harden Further at January 2021 Renewals, fitchratings.com, Jan. 13, 2021.

[2] See Emerging Equilibrium: Willis Re 1st View, Willis Towers Watson, 1 July 2021.

[3] See Global Insurance Markets: Pricing Increases Moderate in First Quarter, Marsh, May 2021.

[4] See Reinsurance Market Outlook, AON, January 2021.

[5] See US social inflation amid the COVID-19 recession – here to stay?, Swiss Re Institute, 3 December 2020. For Nat Cat losses and secondary perils, see : Natural catastrophes n 2020: secondary perils in the spotlight, but don’t forget primary-peril risks, Swiss Re Institute, sigma 1/2021.

[6] As of July 2021, the loss tally from company disclosures ranged from about USD30–37 billion. E.g. Dowling at USD30bn (IBNR weekly 18/2021), Peristrat at USD37bn incl. Lloyd's.

[7] See 2021 hurricane pre-season forecasts: another turbulent year, Swiss Re Institute, 30 March 2021.

[8] See 2021 North American Wildfire Season, Center for Disaster Philanthropy, 21 June 2021.

[9] See US social inflation amid the COVID-19 recession – here to stay?, Swiss Re Institute, 3 December 2020.

[10] See Litigation costs erode Fla. insurers' capital, threaten viability, S&P Global, 2 March 2021.

[11] See Letter from Commissioner Altmaier to Financial Services Commission Chair Ingoglia, Florida Office of Insurance Regulation, 2 April 2021.

[12] See Hard Times, Howden, January 2021.

[13] See Commercial property rates still firming, but evidence of deceleration grows, Artemis, 9 June 2021.

[14] Global non-life insurance in a time of capacity shortage, Swiss Re, sigma 4/2002.

[15] See for example Profitability in non-life insurance: mind the gap, Swiss Re, sigma 4/2018.

[16] The value of capital has changed & re/insurers have to adapt: Swiss Re's Mumenthaler, Reinsurance News, 24 June 2021.

[17] For a description of various motivations for non-traditional reinsurance and applicable strategies see: Strategic reinsurance and insurance: the increasing trend of customised solutions, Swiss Re, sigma 5/2016: