Insights Into Life Reinsurance and In-force Management Current Trends

By Katie van Ryn, Nina Han and Christopher Halloran

Reinsurance News, December 2021

Identifying the key drivers of change within the life insurance industry is becoming increasingly difficult. Economic pressures and other external factors, like the current low interest rate environment and the global COVID-19 pandemic, have affected pricing departments and the overall strategic focus for new business. Compounding that, companies fresh off their PBR implementations may now be working through preparations for LDTI or IFRS 17 with a non-trivial amount of modeling and data work. Life writers have been facing multiple competing priorities to stay competitive with their newly written business while getting ready to report under changing valuation bases. The changing economic and regulatory landscape impacts more than just companies’ pricing and valuation and raises the question; how are companies evaluating their current reinsurance goals and managing their existing blocks of in-force business?

To answer this question, this article will leverage results from Oliver Wyman’s recently completed “2021 Life Insurance Survey of Current Trends & Hot Topics.” The 2021 survey included more than 40 companies, representing nearly 90 percent of the individual life market by individual life sales and included a section focusing on reinsurance and in-force management trends. This article summarizes the key insights with respect to the reinsurance objectives and in-force management strategies of the participants.

Drivers of Life Reinsurance Engagement

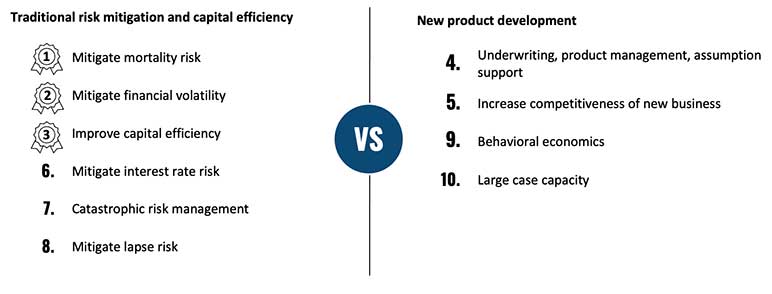

Despite everything going on in the life insurance industry, the primary objectives for engaging in a life reinsurance transaction remain as expected. Participants were asked to rank their reinsurance objectives and according to survey results, mitigating mortality risk, alleviating financial volatility, and improving capital efficiency were the top three objectives in order. (See Figure 1)

Figure 1

Primary Objectives for Engaging in Life Reinsurance

The mitigation of mortality risk and alleviation of financial volatility remain at the forefront of life reinsurance transactions. Participants were also asked about utilizing reinsurance to mitigate other risks such as interest, catastrophic, or lapse risks but ranked these decidedly below mortality risk and volatility. At sixth, seventh, and eighth respectively in terms of primary reinsurance objectives these other risks were also ranked below other “value added” services reinsurers provide.

Rounding out the top objectives was a continued focus on capital efficiency. Reserve financing for existing XXX/AXXX business remains a commonly used reinsurance structure. It remains to be seen whether PBR specific reserve financing will emerge as that block of business increases over time.

Beyond traditional XXX/AXXX reinsurance structures, onshore and offshore affiliates are alternative reinsurance solutions gaining popularity. Almost half of the participants have either considered or already implemented some form of onshore or offshore affiliate solution. For the participants that are considering or had already implemented an offshore affiliate solution, Bermuda is the clear first choice of jurisdiction. Bermuda, along with the EU, UK, Japan, and Switzerland, had been granted Reciprocal Jurisdiction status effective from 1/1/2020. Once their states’ domicile adopts the new NAIC regulation, insurance companies will be able to cede business to their Bermuda affiliate solution without any extra collateral requirement. This, along with the ability to release redundant reserves and capital has made Bermuda the most popular jurisdiction for recent affiliate and sidecar reinsurance solutions.

Beyond the top primary objectives, life insurance companies often leverage relationships with reinsurers to launch new products or product features utilizing the “value added” services they provide. Respondents ranked underwriting, product management and assumption support as the fourth primary objective for engaging in reinsurance. Two other objectives raised by participants on top of the eight options included leveraging behavioral economics and large case capacity of the reinsurer.

Accelerated underwriting continues to be an area of focus for life insurers. Reinsurers had observed higher activity in accelerated underwriting programs in 2020. More than half of the participants had partnered with reinsurers to launch or expand their accelerated underwriting program. During the pandemic, traditional underwriting practices became more cumbersome driving a need for non-traditional options. Insurance companies are looking into increasing the limits that they allowed under their accelerated underwriting program. This trend is likely to continue and receive additional scrutiny from regulatory bodies as the size of business increases. These are potential risks and opportunities for reinsurers as life insurance writers rely heavily on the underwriting expertise and risk mitigating capacity of reinsurers.

Twenty-four percent of the participants had launched a new product recently in collaboration with a reinsurer. Among them, approximately half of the participants launched a Critical Illness product and slightly less than half of them launched a new Life/LTC combo product.

Impact of Regulation on Reinsurance and Treaty Provisions

Although there are multiple recent changes in regulation and accounting standards, the survey shows life insurers report little to no impact on their views of reinsurance. Part of the reason for the indifference, as discussed before, is top priorities with regard to reinsurance (mortality/capital management) have remained mostly unchanged under recent regulatory and accounting standard changes. While insurers continue to value and engage in reinsurance, the increased economic and regulatory pressures have caused insurers to scrutinize existing and new treaty provisions.

Non-guaranteed YRT has been a topic of discussion under the PBR framework, putting a microscope over downstream events of future rate increases. The interim solution that was adopted in 2020 for non-guaranteed YRT has become a permanent solution in 2021, where full cash flow modeling is replaced with a formulaic reserve credit. With the recent uncertainty on regulatory change around non-guaranteed YRT, more than 40 percent of the participants made updates to their reinsurance strategy. Adding additional disclosures regarding the circumstances in which non-guaranteed rates could be changed were the most implemented options. Twenty-five percent of participants either implemented or considered guaranteed rates in their existing treaties.

Future rate changes remain a primary concern on all reinsurance treaties as over 75 percent of participants expressed apprehension. Many participants cited worse than expected mortality experience, worse than expected reinsurer performance, and emerging regulatory trends as their reasons for concern regarding rate changes on non-guaranteed YRT treaties. The uncertainty surrounding rate changes is likely driving the prevalence of full-guaranteed YRT reinsurance agreements reflected in their new business strategy. Additionally, concerns regarding recapture provisions and other ambiguous treaty provisions (e.g., truncated rate tables) were reported by 57 percent and 19 percent of participants, respectively.

In-force Management Trends and Techniques

While the profitability of new products typically gets the spotlight, companies are continuing to look for ways to optimize their ever-increasing book of in-force business. Adjusting crediting rates and expense management are the most considered and implemented in-force management techniques across the entire suite of life insurance products. Eighty percent of participants with term business have implemented expense management techniques on those blocks of business, with an additional 7 percent having considered them. For IUL writers, approximately 90 percent have adjusted caps and crediting rates for their in-force business. Although many participants consider COI and block transfer actions, few had implemented them. For companies offering UL protection type products, survey participants have implemented the widest array of management techniques, which appears to align with the increased transaction activity seen recently for these blocks of business.

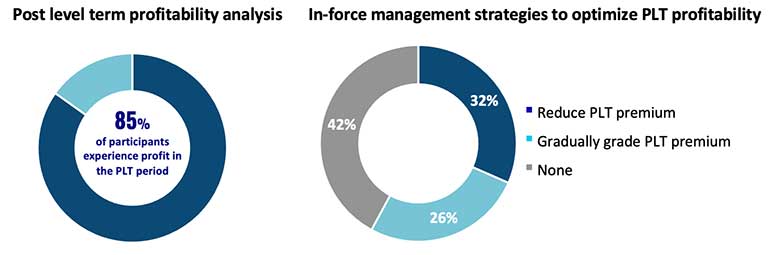

Life companies also are continuing to monitor the experience in the post-level term period of their in-force term blocks. Of the survey participants, interestingly, more than 80 percent had experienced profit in the post-level term (PLT) period and almost 60 percent report leveraging in-force management strategies to optimize PLT profitability through reducing or gradually grading PLT premiums to optimum rate to improve persistency and mortality experience in the PLT period. That is an example of an area where reinsurers and cedants have partnered recently to achieve “win-win” solutions. (See Figure 2)

Figure 2

Profitability and In-force Management in the PLT Period

Looking Forward

While reinsurance objectives and methods have remained steadfast in a sea of economic and regulatory impacts, life companies still are looking at different solutions to make improvements in profitability, stability, and scale. Solutions could take the form of an expanded accelerated underwriting program, continued management of in-force business, or shoring up guarantees when renewing treaties. The everchanging regulatory and accounting changes, and pressure from the pandemic, post both risk and opportunities for reinsurers and direct writers alike. Innovative reinsurance structures to solve the current common and unique challenges faced by each life insurance company are a constant hot topic and great opportunities for the reinsurers to demonstrate their strength and expertise.

Katie van Ryn, FSA, MAAA, is a senior manager at Oliver Wyman, located in Toronto. She can be reached at Katie.vanRyn@OliverWyman.com.

Nina Han, FSA, MAAA, is a senior manager at Oliver Wyman, located in New York. She can be reached at Nina.Han@OliverWyman.com.

Christopher Halloran, FSA, is a principal at Oliver Wyman, located in Charlotte. He can be reached at Christopher.Halloran@oliverwyman.com.