IFRS 17: Reinsurance Contracts Held and Loss-recovery Component

By Tze Ping Chng, Steve Cheung, Cecilia Hui and Fung Chan

Reinsurance News, February 2021

Editor’s note: The references marked by { } represent the text or extraction from the IFRS 17 Standard and Basis for Conclusions (June 2020 IFRS 17 Standard).

After a very long journey, the International Accounting Standards Board (IASB) issued IFRS 17 “Insurance Contracts” (IFRS 17) in May 2017. IFRS 17 replaces IFRS 4 that was issued in 2004. The overall objective is to provide a more useful and consistent accounting model for insurance contracts among entities issuing insurance contracts globally. Three years after the release of the IFRS 17 Standard, the IASB published the amended version of IFRS 17 on June 25, 2020. The revised effective date of IFRS 17 has been deferred to annual reporting periods beginning on or after Jan. 1, 2023.[1]

This article is intended to provide an update to the articles we published previously on reinsurance contracts held and onerous contracts. You may want to refer to the previous articles for the background information.[2]

Underlying Insurance Contracts and Reinsurance Contracts Held

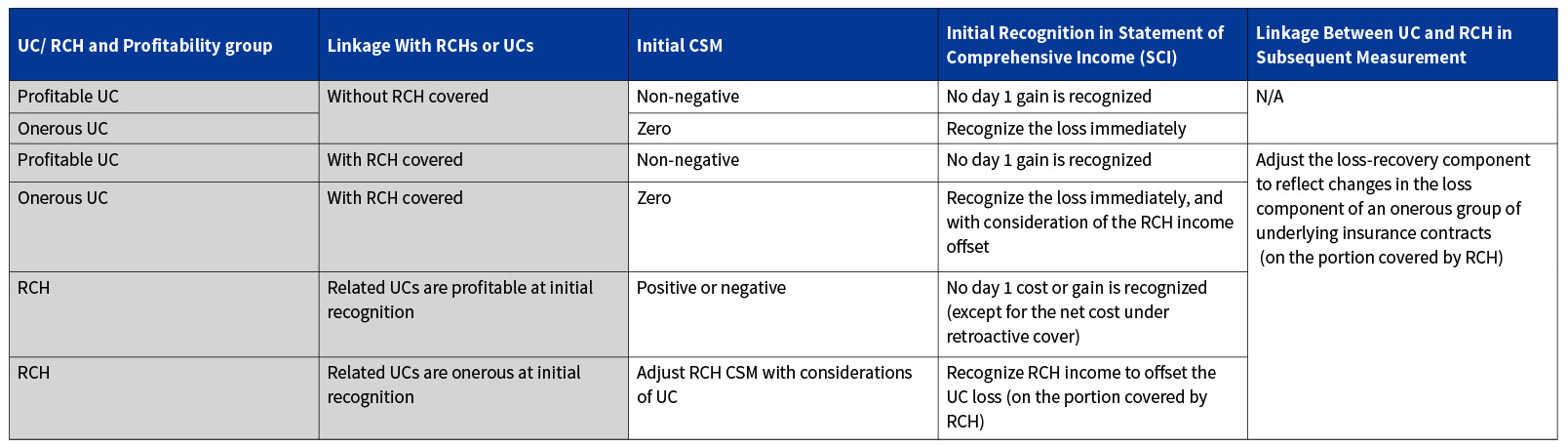

An entity shall also apply IFRS 17 to reinsurance contracts it holds (i.e., as cedant). All references in IFRS 17 to “insurance contracts” also apply to “reinsurance contracts held,” except for references to “insurance contracts issued” and some specific modifications related to recognition and measurement (as noted in IFRS 17 paragraph 60 to 70A). Table 1 summarizes the June 2020 IFRS 17 Standard on the treatment of the profitable and onerous contracts for underlying contracts (UC) and reinsurance contracts held (RCH) under the general measurement model (GMM).

Table 1

Summary of Profitable and Onerous Contracts Treatment for UCs and RCHs (June 2020 IFRS 17 Standard)—under GMM

Key Changes of IFRS 17 for Reinsurance Contracts Held

(1) What are the changes in the IFRS 17 Standard that affect the initial recognition for the RCHs?

An entity shall adjust the contractual service margin of a group of reinsurance contracts held, and as a result recognize income, when the entity recognizes a loss on initial recognition of an onerous group of underlying insurance contracts or on addition of onerous underlying insurance contracts to a group {IFRS 17.66A}. This is the amendment decided by the IASB to align the treatment of the impact of RCH CSM for onerous underlying contract at initial recognition and subsequent measurement. IFRS 17.66A applies if, and only if, the reinsurance contract held is entered into before or at the same time as the onerous underlying insurance contracts are recognized.

(2) Per Q1 above, how should the “income” be calculated?

According to IFRS 17.B119D, an entity shall determine the resulting income by multiplying:

(a) the loss recognized on the underlying insurance contracts; and

(b) the percentage of claims on the underlying insurance contracts the entity expects to recover from the group of reinsurance contracts held.

(3) When shall a group of reinsurance contracts held be recognized?

An entity shall recognize a group of RCHs from the earlier of the following:

- The beginning of the coverage period of the group of RCHs; and

- the date the entity recognizes an onerous group of UCs, if the entity entered into the related RCH in the group of RCHs at or before that date.

Notwithstanding the (a) above, as noted in IFRS17.62A, an entity shall delay the recognition of a group of RCHs that provide proportionate coverage until the date that any UC is initially recognized, if that date is later than the beginning of the coverage period of the group of RCHs.

(4) What is loss-recovery component?

An entity shall establish (or adjust) a loss-recovery component of the asset for remaining coverage for a group of reinsurance contracts held depicting the recovery of losses recognized. The loss-recovery component determines the amounts that are presented in profit or loss as reversals of recoveries of losses from reinsurance contracts held and are consequently excluded from the allocation of premiums paid to the reinsurer {IFRS17.66B}.

(5) How does the change of loss component of UCs affect the loss-recovery component of RCHs?

After an entity has established a loss-recovery component by applying IFRS 17.66B, the entity shall adjust the loss-recovery component to reflect changes in the loss component of an onerous group of underlying insurance contracts. The carrying amount of the loss-recovery component shall not exceed the portion of the carrying amount of the loss component of the onerous group of underlying insurance contracts that the entity expects to recover from the group of reinsurance contracts held {IFRS17.B119F}.

Illustrative Example for Reinsurance Contracts Held and Loss-recovery Component

In order to illustrate the loss-recovery component logic, a simple reinsurance contract is entered into to cover the underlying three-year endowment product that is onerous. It is assumed that (i) IFRS 17.B119C is met, i.e. the RCH was in place on or before the initial recognition of the UC; (ii) all UC claims and expenses are ceded proportionally to the reinsurer.

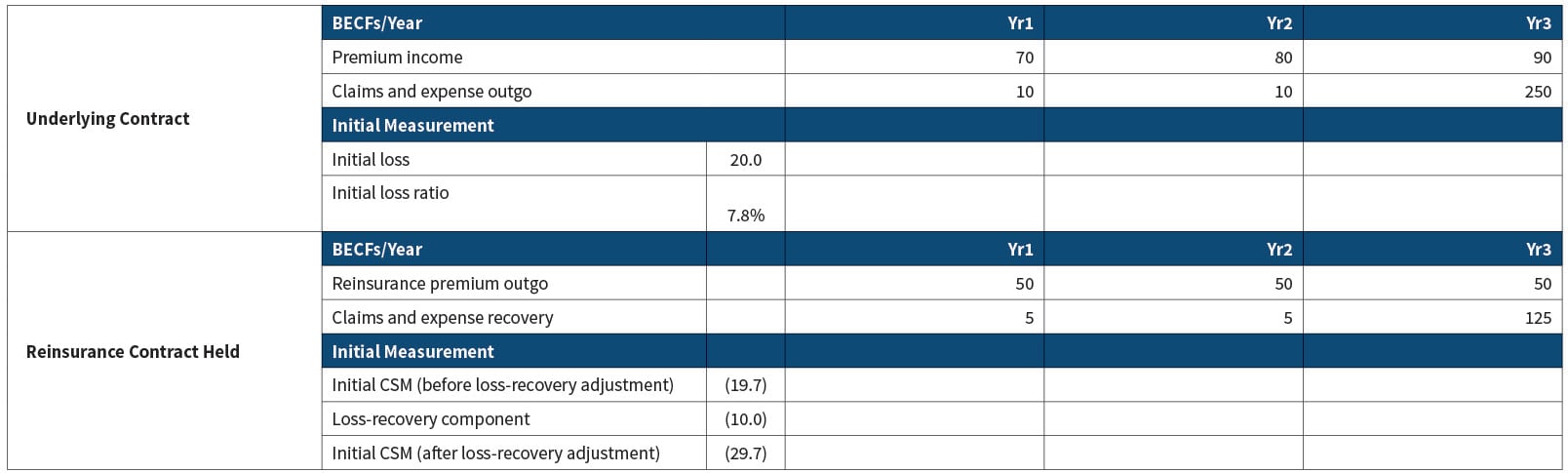

Table 2

Projected Best Estimate Cash Flows (BECFs) and Initial Measurement for UC

* In this illustration, all calculations are presented in liability position (i.e., a negative RCH CSM represents a reinsurance asset)

Table 2 summarizes the key fact pattern of the UC and RCH best estimated cash flows and the initial recognition results. For simplicity, let’s assume there is no risk adjustment (RA), time value of options and guarantees, or investment income.

At issue:

- With the discounting applied, UC FCF equals 20, which means the expected outflow is larger than the expected inflow; it is an onerous contract with an initial loss of 20.

- For RCH, FCF equals 19.7 so the initial CSM equals (19.7) before considering loss-recovery adjustment.

- The RCH CSM is adjusted by (10.0) and 10.0 is recognized as income to “offset” the loss on initial recognition of the onerous UC. This adjustment is calculated as the initial loss of 20.0 from the UC multiped by the percentage of claims expected to be recovered, which is 50 percent in this example.

- RCH CSM equals (29.7) after the adjustment of the loss-recovery component, which is a net cost on purchasing the RCH.

At the end of year two, due to deterioration in experience, the expected claims and expense outgo for the UC in year three is increased from 250 to 300. Simultaneously, the expected recovery for RCH in year three is updated from 125 to 150 accordingly.

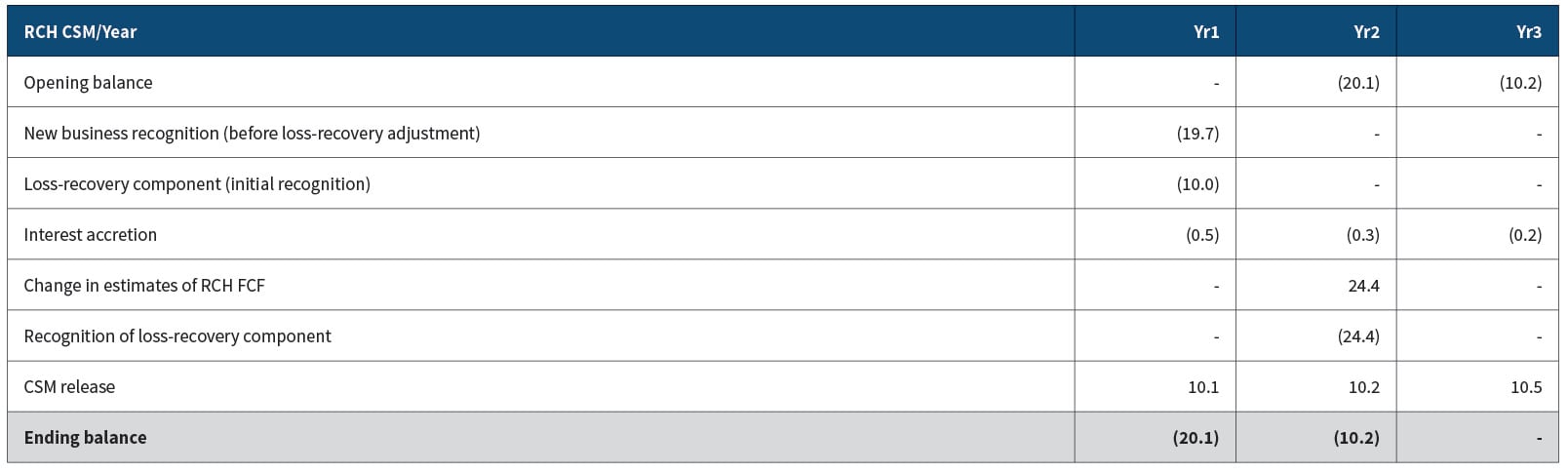

Table 3

RCH CSM Rollforward

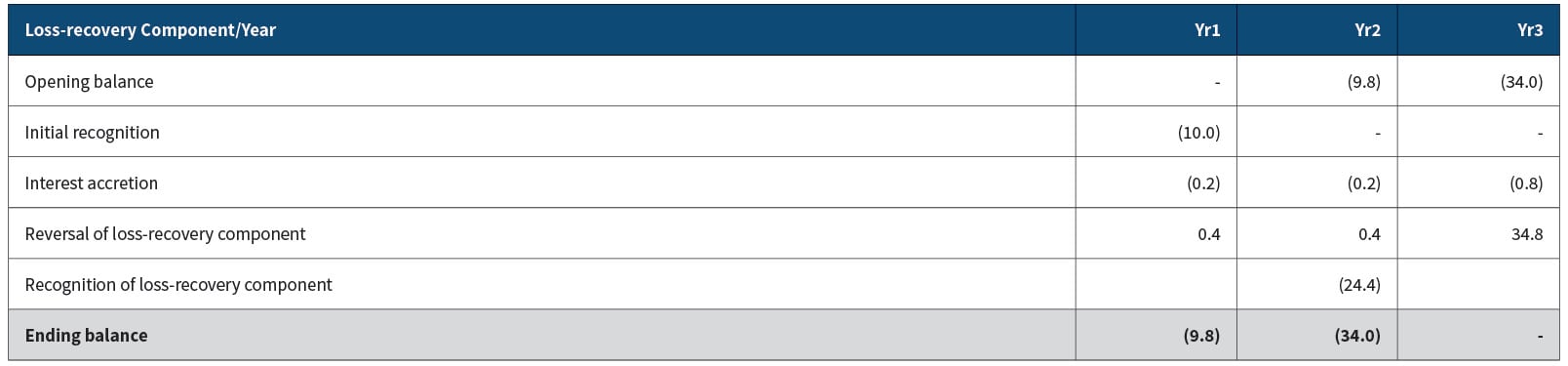

Table 4

Loss-recovery Component Rollforward

Tables 3 and 4 illustrate the rollforwards for RCH CSM and the loss-recovery component respectively. At the end of year two, there is an unfavorable change of UC (increase of FCF) and a favorable change to the corresponding RCH (decrease of FCF). Since the change in the estimates of UC will make the UC more onerous (i.e., the impact is not absorbed by the UC CSM), the change in estimates for RCH of 24.4 at the end of year two will not adjust RCH CSM but instead be recognized as an income in SCI. This 24.4 will also be recognized as the loss-recovery component at the end of year two.

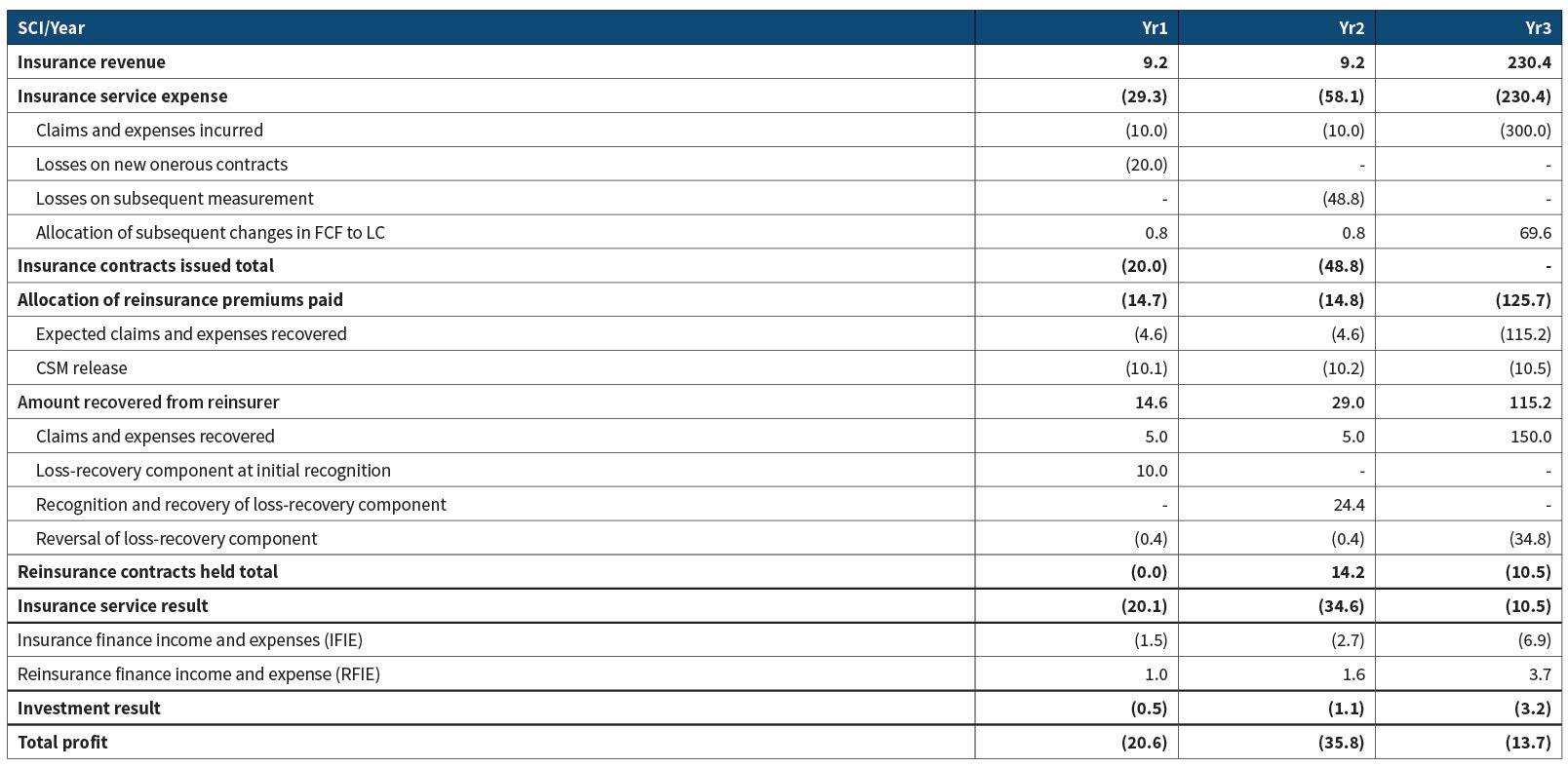

Table 5

SCI

Table 5 summarizes the items to be shown in the SCI in this illustrative example:

- The Insurance revenue equals Insurance component of the outgo * (1- loss ratio).

- For the UC insurance service expense, (i) the total insurance component is presented assuming everything goes as expected (no investment components is assumed in this example), (ii) the initial loss and subsequent loss are recognized immediately in the SCI, and (iii) the allocation of subsequent changes in FCF to loss component (LC) equals Insurance component of the outgo * loss ratio.

- For the RCH allocation of reinsurance premiums paid, it includes (i) the expected claims and expenses recovered excluding the reversal of loss-recovery component, and (ii) the RCH CSM release.

- For the RCH amount recovered from the reinsurer, (i) the total recovery is presented assuming everything goes as expected, (ii) the initial and subsequent recognition of loss-recovery component are recognized as income in the SCI, and (iii) reversal of loss-recovery component are recognized in the SCI (from Table 4).

- For the insurance finance income and expenses, it includes (i) IFIE allocated to LC which equals PV of total outgot * discount ratet * loss ratiot, and (ii) IFIE allocated to LRC excluding LC which equals FCF unwinding minus Reversals of losses (IFE).

- For the reinsurance finance income and expenses, it includes (i) RFIE allocated to asset for remaining coverage (ARC) excluding loss-recovery component, which equals the interest accretion of FCF and CSM, excluding the interest accretion of loss-recovery component, and (ii) RFIE allocated to loss-recovery component.

- Certain checks and balances need to be performed for the SCI: (i) The total insurance revenue is the amount of premiums paid to the entity, adjusted for a financing effect and excluding any investment components; and (ii) the total profit should tie with the net CFs (given no investment income is considered in this example).

The simplified example above illustrates the key changes introduced in the June 2020 IFRS 17 Standard for the measurement of RCHs. More specifically, the example shows the linkage between the RCHs and the UCs during the initial recognition and subsequent measurement. These changes also impact the corresponding SCI presentation.

Remarks: The SCI above is for illustrative purpose only, as we have provided further breakdowns of the items. In a formal SCI, some of the items can be combined and details may be shown in the notes to financial statements.

Conclusion

While onerous underlying contracts and RCH loss-recovery component may not be a significant part of an entity’s portfolio generally, the entity should consider its logic during system development to ensure the SCI and corresponding disclosures can be handled properly by the IFRS 17 reporting systems.

The illustrative example included in this article provides only one of the approaches that fulfil the standard requirements, and we expect there are other ways of performing the calculation. Similar to prior financial reporting regime changes, it is generally expected that certain market consensus will converge on the approaches. The related methodology and considerations should be properly documented and approved within the entity’s governance structure, and agreed with the entity’s auditor. It is also important for individual entities to understand both the financial and operational impacts of the RCH loss-recovery component during the implementation journey.

The views reflected in this article are the views of the authors and do not necessarily reflect the views of the global EY organization or its member firms, or the Society of Actuaries.

Tze Ping Chng, FSA, FASHK, MAAA, is a partner at Ernst & Young Advisory Services Limited in Hong Kong (EY HK). He can be contacted at tze-ping.chng@hk.ey.com.

Steve Cheung, FSA, FASHK, is an associate partner at EY HK. He can be contacted at steve.cheung@hk.ey.com.

Cecilia Hui, is a consulting actuary at EY HK. She can be contacted at cecilia.hui@hk.ey.com.

Fung Chan, FSA, is a consulting actuary at EY HK. He can be contacted at fung.chan@hk.ey.com.

Endnotes

-

Please refer to EY’s “Insurance Accounting Alert - IASB meeting (June 2020); https://assets.ey.com/content/dam/ey-sites/ey-com/en_gl/topics/ifrs/ey-iaa-june-2020-ifrs.pdf?download.

-

Please refer to “IFRS 17: Implications for Reinsurance Contracts Held”; https://www.soa.org/globalassets/assets/library/newsletters/reinsurance-section-news/2018/july/2018-reinsurance-news-issue-91-ching-cheung-aeberli.pdf. And “IFRS 17: Implications for Onerous Contracts”; https://www.soa.org/globalassets/assets/library/newsletters/financial-reporter/2019/december/fr-2019-iss119-chng-cheung-lee-chan.pdf.