The Impact of a Rising Interest Rate Environment on Life Insurance

By Alexander Tall, Jeff Raven and Jack Pizzo

Reinsurance News, October 2021

For over a decade, life insurers have been challenged by a low interest rate environment, making it difficult to find investments with adequate yield, manage corporate spreads, and offer competitive products to consumers.

While interest rates are still low compared to the early 2000s, volatility in rates over the past year, during which the 10-year U.S. Treasury rate has increased by nearly 100 basis points, could indicate a longer-term trend of rising rates. What would a rising rate environment imply for life insurance writers?

Insurers able to react to interest rate changes with agility can remain relevant in an evolving economy, protecting themselves and their policyholders. This article addresses risks and considerations faced by insurers with respect to:

- In-force retention,

- pricing and product mix, and

- reinsurance and mergers & acquisitions.

In-force Retention

A rising interest environment would bring changes to the competitive ecosystem for life insurance products. In-force blocks with low policyholder yields or slower asset rotation would face competition from new products built on higher yielding assets. For some products, this could drive adverse policyholder behavior, most notably lapses and surrenders, and negatively impact profitability.

Traditional Products

Traditional products with prescribed premiums and guaranteed benefits offer few levers to influence policyholder behavior. Term life insurance is unlikely to face significant retention issues in a rising rate environment. Though rising yields could lead to a decline in term premiums, it seems unlikely that any change would be drastic enough to persuade policyholders to be re-underwritten.

Traditional accumulation products, like whole life, present significantly greater challenges. While re-underwriting may provide a deterrent for some, the richer benefits and reduced cost of new-money products will inevitably drive policyholders to consider surrendering their policies to reinvest the proceeds elsewhere. Lost profits from the surrendered policies are not the only concern; re-underwriting will only be an option for better risks, which will drive adverse mortality in the remaining business.

Ultimately the best solution is an active retention program, identifying the policyholders most at risk of surrender and intervening before the time of surrender. Furthermore, while in-force retention is often desirable, insurers must identify which products are lapse-supported to ensure they are excluded from in-force retention actions.

Interest-Sensitive Products—Fixed Universal Life

As with whole life, fixed universal life (UL) has the potential for adverse policyholder behavior in a rising rate environment; however, unlike traditional products, there are more levers to manage policyholder behavior. Credited interest rates are the obvious competitive difference between the in-force block and new money alternatives, and by managing crediting rate strategies insurers can encourage policyholder persistency.

Portfolio yields change slowly as assets turn over and new money is reinvested, causing returns to lag current rates. As a result, increasing credited rates in order to remain competitive with new money products will require compromising on credited rate spreads.

In principle, if the policyholder response to different crediting strategies were known, one might strike a balance between the cost of crediting at higher rates and the future profits of retained business. However, identifying an optimal crediting strategy faces significant obstacles in quantifying policyholder behavior.

Perhaps the greatest impediment is simply a lack of data—though the past decades have provided ample evidence of behavior in a declining rate environment, there is little relevant historical data from rising rate environments. Additionally, past research has shown that excess lapses are driven by both interest rates and macroeconomic factors (e.g., unemployment). As such it is necessary to understand how policyholder behavior is influenced by both interest rate and macroeconomic sources and consider how each might evolve in a rising rate environment.

It’s also important to consider how differing product designs and policyholder objectives can drive differences in behavior. Policyholders relying on secondary guarantees will be far less concerned with credited rates, and since many secondary guarantee blocks react favorably to increased lapses, care should be taken to not apply accumulation-related dynamic lapse behavior to protection-style products.

New Business Profitability and Product Design

While company actions around in-force management may be limited by locked-in premiums or guarantees, insurers will have more flexibility with respect to the issuance of new business. What impact would rising rates have on the profitability of products issued today, and what actions might insurers take to fully realize the advantage of increased asset yields?

New Business Profitability

In general, higher interest rates should allow insurers to experience greater profits in the short term due to the increased yield from debt instruments. The challenge insurers will face is finding the balance between retaining additional earnings and increasing competitiveness of products. Insurers who can find this balance quickly will experience less sensitivity to competitor factors in the short term than those that delay action until the market is saturated with products already reflecting the increased interest rate environment.

The source and scale of additional profits will vary based on the decisions made by each insurer, and will depend on such factors as product design, business mix, pricing strategy, and capital requirements. Insurers who make little or no adjustments to benefits will experience higher spread on investment yields, while insurers who pass that yield on to policyholders may enjoy higher sales volume.

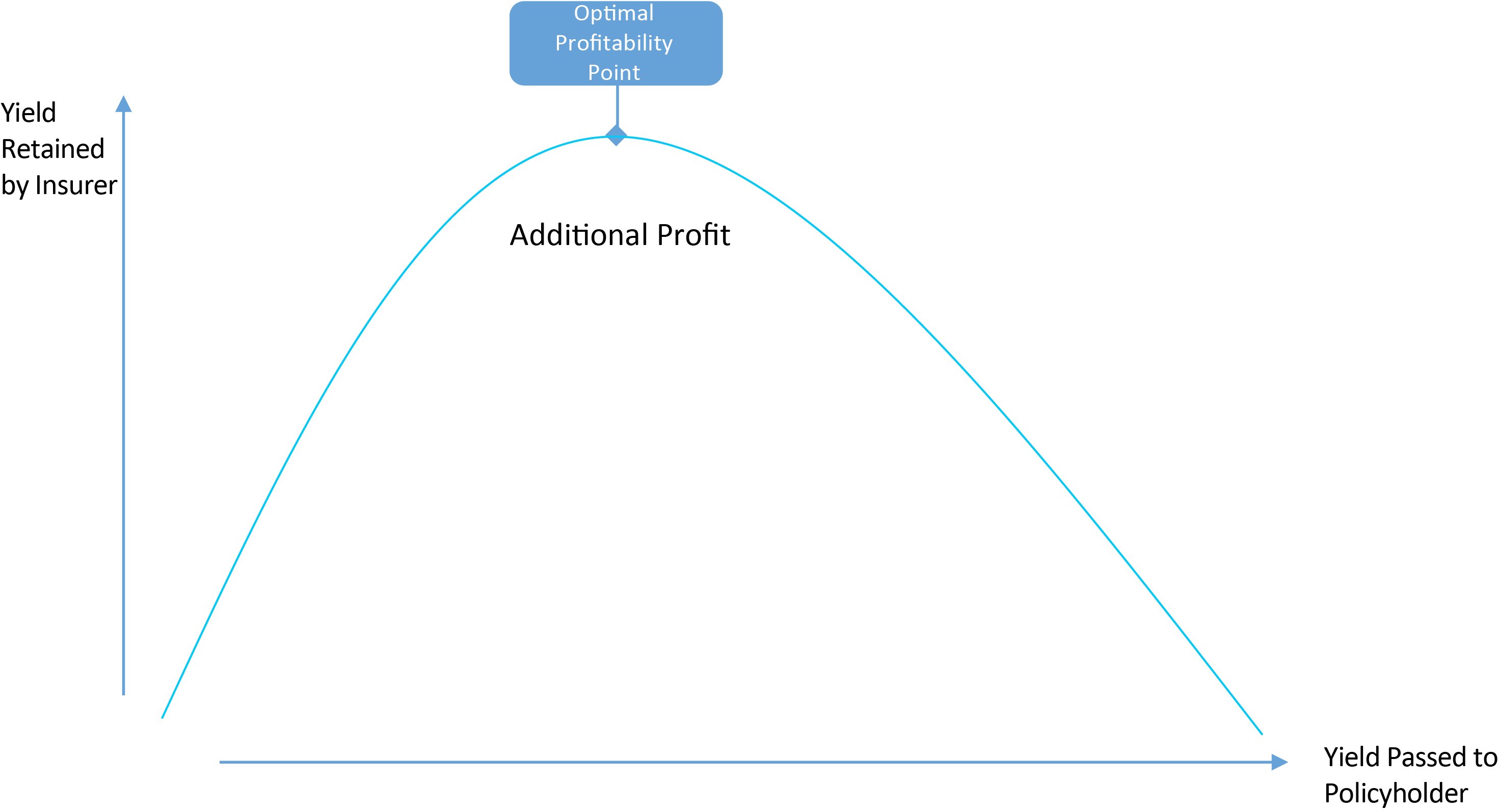

Figure 1 illustrates a hypothetical optimal balance between retaining additional asset yield and passing yield to policyholders in the form of reduced premiums or richer benefits. The optimal point produces the highest additional profits.

Figure 1

Yield Retention Balance Example

Pricing areas will face additional challenges if insurers choose to re-price products. Insurers using portfolio rate methodologies may need to switch to new money rate methodologies in order to take advantage of rapidly changing interest rates. Principle-based reserving will also pose challenges to pricing areas due to the increased time required to perform stochastic reserve analysis. Companies may consider fire sales if they anticipate repricing being too slow.

The availability of higher-yielding, high quality assets also may provide insurers flexibility over whether to realize the gains through asset yield or reduced capital requirements. Insurers may be able to replicate current investment returns using higher-rated debt instruments, reducing cost of capital. Whether or not this approach is preferable will vary across insurers.

In the long term, additional profits on new business stemming from the interest rate environment will decline due to competition offering increasingly rich benefits to attract consumers. Those insurers who act quickly may realize the largest additional profits in the short term. They will also bear the risk that increasing interest rate trends reverse, reducing or eliminating additional profits.

New Business Product Design and Business Mix

Companies seeking to issue new business in a rising interest rate environment may need to adjust their product design and business mix, as products that may have been profitable and competitive in a low rate environment may lose traction as rates increase.

Traditional Products

Traditional products, particularly whole life which relies on long term asset yields to cover expenses and profit requirements, have struggled under low interest rates for some time. Rising rates may enable insurers to redesign products with lower premiums or accelerated cash values, both of which would entice consumers reviewing life illustrations. Participating products may also become more viable, with higher anticipated asset yields allowing for a more favorable illustrated dividend scale.

From a product mix perspective, insurers may wish to emphasize traditional permanent products over investment-oriented indexed or variable products, which may lose appeal to consumers if equity experiences an inverse, downward trend compared to interest rates.

While term life is typically insensitive to interest rates, insurers may still benefit from shifts in product design. The design of base term life products is not likely to change due to rising rates; however, investment-oriented riders that were unappealing under a low interest rate environment may become increasingly relevant. In particular, a shift toward return-of-premium products/riders, may allow insurers to benefit from spread income without requiring sky-high premiums.

Interest-Sensitive Products

Interest-sensitive life products will be materially affected by a rising interest rate environment. In the current environment, many insurers have shifted focus away from spread-based products in favor of indexed or variable products. These products rely on the strong performance of equity markets to provide value to policyholders.

In an increasing rate environment, insurers may be able to return to offering high-yielding, investment-oriented fixed UL products by passing some of the increased yield back to the policyholder through credited rates. Increased return on assets may also allow insurers to offer richer secondary guarantee benefits, such as increased shadow account crediting rates or lower specified premium requirements, increasing the appeal of ULSG products.

Equity-driven UL products, such as indexed and variable UL may become less appealing, particularly if an inverse trend between interest rates and equity market performance arises. As crediting rate guarantees become increasingly generous, consumers seeking less volatile gains may instead select fixed UL or traditional life products.

Insurers wishing to continue focus on indexed or variable products could alter product designs to reflect the rising interest rate environment. Indexed products may increase guaranteed minimum account values or use the additional option budget from increased asset yield to raise index caps or participation rates. Variable products could take advantage of rising interest rates by offering more interest-sensitive fund options, or by increasing guarantees associated with available stable value funds.

Reinsurance and Mergers & Acquisitions

Low Interest Rate Impacts on Recent Market Activity

Low interest rates have been a key driver of the reinsurance and mergers & acquisitions (M&A) market over the past decade, as insurers have turned to external solutions for business that was not designed to perform under low yielding fixed income securities. While all interest sensitive life insurance products have been affected, those with high guaranteed crediting rates and/or long duration have been most impacted.

As interest rates and bond yields continue to fall, some US writers have favored reinsurance to offshore jurisdictions as their capital and reserving frameworks are kinder to high-yielding securities, relative to the US. As an example, a Bermuda-based reinsurer may be able to invest in high-yielding fixed income assets at lower capital charges, presenting a viable option for boosting investment income and relieving spread compression.

Complete divestiture from interest-sensitive blocks has been another response to low yields, particularly for businesses deemed “non-core” or not strategic going forward. The continued level of low interest rates has helped maintain a steady supply of transactable blocks throughout the past decade. New and incumbent counterparties have responded by honing their ability to raise and deploy capital quickly and cost-effectively. Strong market activity even persisted through a challenging 2020, in which total transaction value in the US life insurance M&A market, excluding annuities, exceeded $9 billion.

Rising Interest Rate Considerations for the Reinsurance Market

Timing is paramount for any reinsurance arrangement involving the sale of existing assets. Ideally, sale and subsequent reinvestment would occur as rates rise, generating realized gains upon sale and higher yields upon reinvestment. Conversely, higher interest rates by the time of execution could trigger significant realized losses due to depressed asset market values.

An increase in interest rates may give pause to writers looking to leverage a reinsurer’s ability to invest in alternative investments or equity-like securities. For example, higher bond yields could help alleviate spread compression on older universal life business without the need for alternative or equity-like investments. With that said, the timing and magnitude of relief will depend heavily on the length of the existing asset portfolio. Given a slow stream of maturity cashflows, higher interest rates may take years to provide a material uplift to overall portfolio yields. If selling existing assets is the only path to a material increase in investment income, enabling cost-effective alternative investments via offshore reinsurance may still be a viable option.

For actively marketed, asset intensive business, like indexed UL, insurers may still find value in offshore arrangements aimed at making their products more competitive. Even if bond yields were to increase to pre-2008 levels, a shift toward alternative investments or equity-like securities may still provide enough of a boost to increase option budget and index credits.

For blocks with material reserve and/or capital redundancy, like pre-PBR term life and ULSG, a looming inflationary environment suggests the time to seek financing relief is now. Current economic conditions allow an insurer to (1) realize capital gains tied up in high asset market values, and (2) lock in a low financing cost.

Rising Interest Rate Considerations for the M&A Market

Acquiring blocks of life insurance policies is just one of several investment options available to institutional investors. If other options become more attractive, potential buyers of life insurance businesses would demand a higher return. For example, assume BBB rated bond yields increase to 8 percent, and a term life block is appraised or valued using an 8 percent discount rate. The former is likely a more stable and attractive option for a comparable return profile. As such, investor expectations would drive up the discount rate used to price the latter, reducing the value of the life insurance block.

From an equity cost of capital (as opposed to weighted average cost of capital) perspective, an increase in interest rates should have a smaller value impact on riskier businesses. This is because, proportionately, the risk-free component of the discount rate is much smaller for riskier business (as the risk premium for the business is much larger). For example, assume a term life block is priced to an 8 percent discount rate, while an LTC block is priced to 25 percent. If risk-free rates were to increase by 2 percent, the term block’s discount rate would increase more, proportionately, (8 percent to 10 percent) than the LTC block’s (25 percent to 27 percent). Therefore, the value for products with less market and policyholder behavior risk (e.g., term life) may be more sensitive to interest rates.

Rising interest rates also create a new set of considerations for how a target’s assets are handled upon deal execution. Buyers typically aim to replace assets backing the business they acquire, often turning over a sizeable proportion of assets within 12 to 36 months. In the midst of a rising rate environment, this practice could be punitive due to depressed market values. While this risk can be hedged using futures or other derivatives, rising rates and rate volatility still have the potential to drive down value and/or threaten viability for some transactions.

Conclusion

The persistent low interest rate environment has challenged life insurers, but a rising rate environment could pose equally difficult challenges. Below are some action items for insurers wishing to prepare for the possibility of rising rates:

- Develop internal outlook for the interest rate environment,

- inventory product offerings and prepare assessment on the potential impact of rising rates,

- prioritize actions based on inventory and assessment,

- design business strategy to adapt to rising interest rates without cannibalizing business if rates stay low, and

- commit to ongoing monitoring and flexible/dynamic responses.

Insurers who are prepared for the impact of rising interest rates, having devoted resources to the considerations discussed in this paper, as well as those specific to each insurer, will find themselves at a competitive advantage in their ability to take timely and tactical actions.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the respective authors’ employer.

Alexander Tall, ASA, MAAA, is a consultant for Oliver Wyman. He can be contacted at alexander.tall@oliverwyman.com. LinkedIn: https://www.linkedin.com/in/alexander-tall-asa-maaa-1aa33455/

Jeff Raven, FSA, MAAA, Ph.D., is a consultant for Oliver Wyman. He can be contacted at jeff.raven@oliverwyman.com. LinkedIn: https://www.linkedin.com/in/jeff-raven-00497350/

Jack Pizzo, ASA, is a consultant for Oliver Wyman. He can be contacted at jack.pizzo@oliverwyman.com. LinkedIn: https://www.linkedin.com/in/jack-pizzo/