Next-generation AI-powered Digital Risk Assessment

Transforming Customer Experience and Operational Efficiency

By Lee Sarkin

Reinsurance News, September 2021

Digital transformation in the life and health insurance industry is reaching an inflection point. Today, the shift to digital sales platforms and processes is rapidly accelerating. More than ever, insurers are striving to provide an increasingly seamless, personalized, and digitally enabled customer experience. Medical and financial underwriting is an integral part of this customer experience. It is deeply ingrained in insurers’ operations and legacy systems. It’s at the very core of their risk management functions, ensuring long-term profitability and solvency. It’s common for insurers to already have rules-based automated underwriting engines. Now, many are looking to transition to the next generation of underwriting—“Augmenting underwriting with artificial intelligence (AI)” using AI/predictive/machine learning models and data to augment existing underwriting processes. This is nothing short of a revolution in customer experience.

The shift is accelerated exponentially with the onset of COVID-19 that forced the industry to redesign customer engagement for risk assessment. Today, consumers value convenience and speed, placing traditional life insurance practices under scrutiny compared to other sectors, e.g., banking, that already provides digital customer engagement. Attracting, engaging and retaining customers through the existing, and sometimes archaic on-boarding process is becoming ever more challenging, putting margins at risk.

Insight from our global customer base tells us that insurers alike face a broadly consistent set of challenges from a new generation of consumers that are well-versed in researching, buying and reviewing products online but are not necessarily buying. The inconvenience, time and even nature of questions being asked are often intrusive and represent significant barriers to entry. Even those who have no intention of falling out of the process may drop off the process due to doctors’ appointments, medical tests, blood-tests, and requests for further details that frustrate the process.

As risk-bearers, the insurer and reinsurer have a somewhat different perspective. Life insurance, unlike general or health insurance, is a long-term guaranteed contract that spans over decades and underwriting is crucial to ensure adequate risk selection and pricing to ensure long-term sustainability.

Whilst insurers sympathize with the desire of a “one-click” buying experience for insurance, they face common challenges in non-disclosure of heath conditions by applicants. This is in addition to anti-selective behavior that underwriting aims to mitigate.

Ultimately, it is important to bear in mind that when it comes to transforming the underwriting experience, there is often a trade-off between a frictionless and fast onboarding process and customer acquisition costs and future claims experience.

Digital and AI-driven solutions are increasingly deployed in the underwriting process for life insurance to address these challenges. Broadly, there are two areas where significant progress has been made. Existing underwriting processes have been streamlined and the use of data combined with AI, domain expertise and modern IT technology is reinventing these processes.

Traditional Underwriting Pain Points as Opportunities

Addressing underwriting pain points requires an understanding of the complexities in the traditional underwriting process:

- Applicants complete an application form and disclose their medical and financial conditions. The former is needed for medical underwriting that assesses mortality/morbidity risk and the latter for financial underwriting that assesses the financial background to prevent over-insurance and anti-selection.

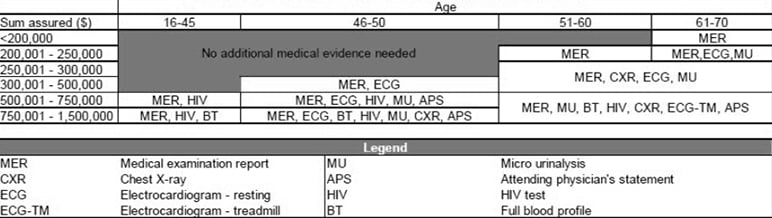

- Depending on the medical disclosures in the application and the applicant’s age and sum assured applied for, additional medical tests and reports (see Table 1) might be requested. The simplest form is a medical examination report by a physician comprising vital signs and general health conditions. At higher sum assureds and ages, further medical evidence is required—from urine tests, chest x-rays, to blood profile tests, stress ECGs and Attending Physician’s Statement (APS). An APS is a report by a physician, hospital or medical facility who has treated or is currently treating the applicant. The APS, in addition to the other medical evidence, thus provides a detailed medical history in addition to the self-disclosure made in the application form, enabling identification of potential non-disclosure or misrepresentation.

Table 1

Sample Medical Requirement Schedule (Non-medical Limits)

The medical underwriting process is cumbersome and inconvenient for applicants. Firstly, where paper application forms are used, these are often submitted incomplete or illegible and require a revised re-submission or additional queries from the insurer. Secondly, the inconvenience of a medical examination and related tests that sometimes trigger requests for further investigations/tests. Thirdly, it may take several weeks for an APS to be completed and a decision made on the application. Applicants therefore often drop off and don’t proceed with the application. For the insurer, this means a missed new sale, irrecoverable incurred acquisition costs and a frustrated customer that may not re-engage.

Insurers’ traditional solutions to manage inefficiencies in the new business process include:

- Reducing the number of application form questions, i.e., instead of a “long” application form with dozens of medical and financial questions (“full underwriting”), insurers reduced these to three to five questions (“simplified issue”) or even no questions (“guaranteed issue”). The latter two are commonly seen in bancassurance.

- Relaxing underwriting requirements, e.g., by increasing the non-medical limits. This does not address the actual process inefficiency but rather reduces the number of applicants that undergo full underwriting that therefore treats the symptoms, not the cause. From a risk management perspective, this generally results in further claims experience. A higher risk of anti-selection is also commonly observed, i.e., applicants not providing full disclosure of their medical or financial situation that results in early claims or under-pricing. Unless these risks are adequately priced in and actively managed by the insurer, the technical result of the insurer will deteriorate over time. However, in the face of market competition, insurers often struggle to implement premium increases or tightening of underwriting requirements.

Digital risk assessment solutions that augment the traditional underwriting process with data, AI and modern IT technology now provide a solution to improve the customer experience and lower customer acquisition costs whilst minimizing implications for the insurer’s future claims experience.

Evolution of Automated Underwriting to Date

The biggest impact on the underwriting process came with the introduction of automated underwriting systems, i.e., the transition from a manual process to a digital one. Digitizing underwriting information has become a strategic necessity in an AI- and data-driven world and further by the COVID-19 pandemic. Insurers that have implemented underwriting engines do have a significant strategic advantage over their peers. The availability of comprehensive underwriting data in a structured digital format significantly increased the opportunity to develop AI (hereafter used interchangeably with predictive analytics, machine learning and advanced analytics) models and to implement them into production. This evolution of underwriting automation can be broken down into five distinctive phases—the first two are currently familiar to most in life insurance:

First generation—jet engines: Insurers digitized their systems in the transition from paper to electronic applications and implemented jet casing or clear-casing systems. Typically, these ‘engines’ would allow application forms that had no disclosures to be expedited and checked with basic business validation rules. They sped up the onboarding process and provided a degree of efficiency but lacked transparency on their workings to enable insights for improving the underlying underwriting philosophy. Further, being mainly hard-coded rules, they offered limited ability for adjustment.

Second generation—Automated underwriting engines (AUE): These systems introduced the concept of “reflexive questioning” that aims to mimic how an underwriter would investigate medical disclosures. For example, if the applicant discloses high blood pressure, additional reflexive questions would be asked to assess the medical severity and reach an underwriting decision at the point of sale. This iteration gave insurers the opportunity to develop, review and amend their own underwriting philosophy. Reinsurers provided comprehensive expert underwriting rulesets based on their underwriting manuals. AUEs could therefore increase underwriting automation and significantly increase the straight-through-processing (STP) rate up to 50 percent to 80 percent depending on the underlying products, mix of business and underwriting philosophy. Changes in underwriting rules could also be done directly by the underwriters without the involvement of IT.

Third generation—descriptive analytics: This stage of system evolution added descriptive analytics capabilities via reporting dashboards and reports. These improvements allowed underwriters to closely monitor and analyze the performance of the underwriting ruleset and make adjustments to further increase the overall STP rate. However, given the large number of risk factors that impact an underwriting decision, AI is clearly better placed to increase automation given it’s ability to learn complex (multivariate) relationships between risk factors and underwriting decisions.

The Next (Fourth) Generation: AI-powered Digital Risk Assessment

The next generation, “Augmenting underwriting with AI,” combines various data sources, AUEs, AI models, insurance domain knowledge (actuarial, underwriting, etc.) and modern IT technology for deploying AI models into insurers’ business processes and systems. This generation:

- Offers an industry-transforming point-of-sale digital risk assessment and instant decisioning system that will revolutionize the customer buying experience.

- Improves both the automation and accuracy of underwriting: Balances the trade-off between customer experience, customer acquisition costs and risk tolerance. By leveraging data sources like the claims experience and external data, more accurate risk assessment is possible, i.e., moving beyond replicating traditional underwriting decisions that may lack a feedback loop to claims experience (ground truth).

- Future-proofs insurers by leapfrogging barriers to deploying AI cost-effectively and at speed: Uses modern IT technology for supporting machine learning operations (MLOps) to achieve scale and cost-effectiveness when deploying and maintaining AI models.

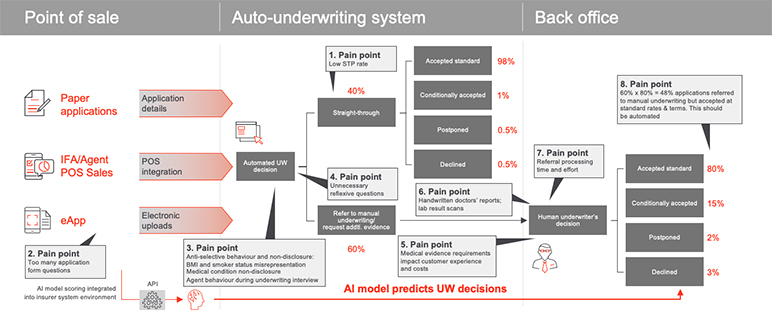

While second- and third-generation solutions improved automation and the customer experience to a degree, many pain points remain (see Figure 1) as opportunities to appropriately apply AI. For example, many insurers’ AUEs present room for improvement in STP rates since they may still refer a material number of applications for manual underwriting, often resulting in further medical or non-medical evidence requirements. Experience in delivering AI initiatives to several insurers shows that many of these applicants are observed to finally (back office) be rated as standard risks, i.e., the additional evidence requested—with hindsight—created unnecessary inconvenience for the applicant and customer acquisition costs for the insurer. Further, such applicants may withdraw (“not-taken-up”) due to the inconvenience and the insurer may miss sales opportunities. To address this pain point, AI models are developed and deployed within the AUE to predict the final underwriting outcome (see Figure 1) and applicants with the highest probabilities of being a standard decision are approved in real time without further underwriting, thereby avoiding unnecessary referrals and increasing STP, resulting in a smoother customer experience.

Figure 1

Examples of Underwriting Pain Points to Address With AI

Key features of Next-generation AI-powered digital risk assessment include:

- Multiple AI models are applied in real time at point of sale to address multiple pain points.

- Orchestrates AUEs and AI models in a new underwriting process to leverage strengths of both. Increased STP allows for automation from both the AUE and AI model.

- Flags applicants at the point of sale who are most likely to non-disclose, make early claims and anti-select—especially important in digital sales without face-to-face.

- Detects possible non-disclosure with deep learning models that predict underwriting risk factors (e.g., BMI) from unstructured data such as customer images and videos.

- Use AI models to understand the value of external data such as physical activity, lifestyle, bank, or retail data to enable simplification of underwriting.

- Incorporates historic claims experience in AI models for underwriting.

- Telemetry (behavioral analytics) gathers data on and identifies anti-selective agent behavior from the web-based digital underwriting application.

- Enables effective cross- and up-sell/buy or next-best-offer initiatives with simplified underwriting.

- Agnostic to different automated underwriting rule engines.

- Follows modern MLOps practices to monitor model performance and maintain (retrain) AI models to ensure they perform as expected and manage risk implications for future claims experience.

- Responsible AI frameworks to comply with insurance regulation that covers fairness, ethics, accountability and transparency (FEAT).

Benefits of “Augmented underwriting with AI” include:

- Increases STP, thereby enhancing the customer experience by shortening onboarding times, reducing questions and medical evidence requirements.

- Increases the accuracy of risk selection.

- Increases underwriting capacity without increasing staff count.

- Reduces referral processing effort.

- Reduces customer acquisition costs.

- Improves profitability by reducing the impact of anti-selection.

- Audits at scale.

Professionalizing AI: Comprehensive Risk Implications, Responsible AI and Regulatory Compliance Analysis

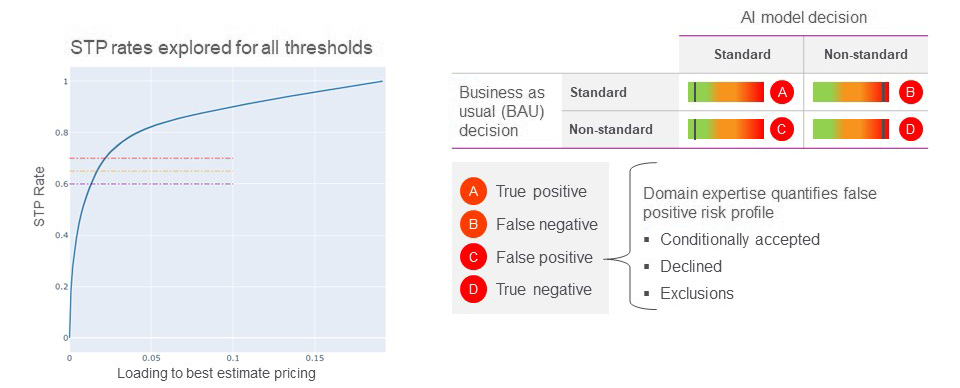

Balancing a smoother customer experience against operational, technology, regulatory, and risk implications of AI for future profitability requires an in-depth understanding of the entire underwriting process and its technology (see Figure 2).

Figure 2

Capabilities Needed to Successfully Deploy AI

For example, prior to deploying AI models to increase STP, insurers and actuaries need to quantify and manage the risk implications of AI model errors (e.g., false positives) for future claims experience. When increasing STP, Figure 3 illustrates that when an AI model incorrectly predicts that an applicant should be underwritten as a standard risk, a false positive error occurs and the applicant should actually be conditionally accepted, postponed or declined. The higher the extent of such false positives, the greater the expected impact on future claims (profitability) and hence the higher the adjustment required to best estimate pricing to absorb the impact. Figure 4 provides an example of an AI risk implication calculator that assesses, for each level of STP, both model performance metrics and best-estimate pricing adjustments. Further, the impact of risk management controls like knock-out criteria and random holdouts is incorporated. Such capabilities require deep actuarial, underwriting, operations and data science expertise. Such tools also ensure models are compliant with FEAT regulation.

Figure 3

Example of AI Model Risk Implications Associated With Different STP Rates

Figure 4

AI Risk Implication Calculator

Conclusion

Digital transformation has resulted in a continuous improvement of a traditionally paper based and tedious underwriting process. Underwriting automation through rules-based expert systems is, and has been, the starting point for life insurers to improve the customer experience and operational efficiency. The digital underwriting data collected puts insurers at a significant strategic advantage over their peers in the current transition towards utilizing AI to transform their underwriting and claims processes.

New data sources are expected to be introduced as proxies for traditional underwriting requirements, to avoid medical tests and move toward fluidless underwriting where justified from an AI and risk management perspective. Reinsurers play a leading role in vetting these solutions, i.e., quantifying the risk impact on the mortality and morbidity experience.

The stage and maturity of the underwriting transformation varies widely by region and insurer. North America has industrialized use of third-party data in AI models already, whereas in APAC, many large insurers have deployed third generation underwriting engines and early adopters in Southeast Asia are moving to the fourth generation, i.e., augmented underwriting with AI.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the respective authors’ employers.

Lee Sarkin is chief analytics officer, APAC, Middle East, Africa (Life & Health) Munich Re. He can be contacted at lsarkin@munichre.com.