Insurers’ Hidden Risk From Reinsurance Recaptures: The Perspective of UK Annuity Writers

By Mudi Ugono (chair) and Brad Ashton on behalf of the Institute and Faculty of Actuaries’ Insurers’ hidden risk from reinsurance recapture working party

Reinsurance News, August 2022

Editor’s note: This article has been revised from a version that was published in The Actuary magazine. It has been updated and tailored for a non-UK readership.

A jurisdiction’s regulatory regime can make some insurance products capital intensive to write. This can increase incentives for insurers to enter into risk transfer arrangements, such as reinsurance, to support their business plan and growth objectives.

This can introduce new risks to insurers’ balance sheets that are neither obvious (a “hidden risk”) nor straight forward to measure and manage. One such risk is the adverse effect that a reinsurance counterparty default (or other recapture event) could have on ceding entities’ balance sheets and the implications for broader financial stability. This is referred to as “reinsurance recapture risk” throughout the article. Reinsurance recapture risk describes the point in time when previously reinsured risk is returned to the ceding entity’s regulatory balance sheet for recognition purposes. This could occur if:

- A recapture provision agreed between the ceding entity and the reinsurer is triggered.

- The ceding entity’s reinsurance arrangement was deemed, e.g., by the regulator, to no longer meet qualifying criteria to be recognized for regulatory capital relief. This could take the form of a synthetic reinsurance recapture event irrespective of whether an actual reinsurance recapture clause had been triggered or not.

In the UK, annuity writers’ reinsurance activities to support their pension risk transfer propositions has increased the materiality of, and interest in, this risk from a range of stakeholders including regulators.

The UK Institute and Faculty of Actuaries’ (IFoA): Insurers' hidden risk from reinsurance recapture working party was established to explore and understand the risk management approaches used by insurers to manage the adverse effect that a reinsurance counterparty default (or other recapture event) could have on their regulatory balance sheet.

The observations and analysis discussed in this article has been informed by an IFoA survey of UK annuity writers as well as insights from the members of the working party. It has been written by market practitioners for professionals interested in understanding the risk management approaches used by insurers to deal with a risk typically characterized as low probability but whose financial impact, were it to materialize, is high. The full report will be published later this year.

About the Survey Participants

The survey participants, in summarised form, is set out below:[1]

- Total number of survey respondents: Six (five of the eight currently active UK pension risk transfer writers (buy-outs and buy-ins) were represented).

- Total value of transactions (buy-outs & buy-ins) conducted by survey respondents between 2009 and H1 2020: £110bn or c.75 percent of the UK market.

- Total number of transactions (buy-outs & buy-ins) completed by survey respondents between 2009 and H1 2020: 1,670 or c.95 percent of the UK market.

- Market share of active annuity writers (buy-outs & buy-ins) between H2 2019 and H1 2020: £22bn or c.55 percent of the UK market.

- Likelihood of providing a quote for buy-in or buy-outs: Full range represented, from transactions of less than £50m to more than £2bn, including deferred lives.

The Materiality of Reinsurance Recapture Risk on UK Annuity Writers’ Balance Sheets

The reinsurance counterparty risk regulatory capital requirement (known in the UK as the Solvency II Solvency Capital Requirement (SII SCR)) is calculated by multiplying the probability of a reinsurance counterparty default (PD) by the loss given if a default occurs. Reinsurance counterparties are typically well established, financially strong and operate in a highly regulated sector. The associated PD parameter is usually small as a result. This materially reduces the resulting reinsurance counterparty risk SII SCR. The reinsurance counterparty risk SII SCR of survey participants was calculated by the working party to be circa. 1 percent of reported YE2020 SII SCRs on average.

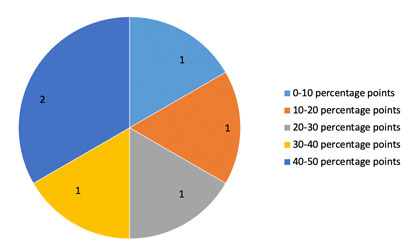

Figure 1 shows that the adverse impact on solvency coverage following the recapture of all business ceded to a single reinsurance counterparty before management actions could be up to 50 times the amount of counterparty risk capital held to cover all reinsurance counterparty exposures.

Figure 1

Loss of Solvency Coverage That Would be Incurred if all Business to Survey Participants' Most Material Reinsurance Counterparty was Recaptured Before Management Actions

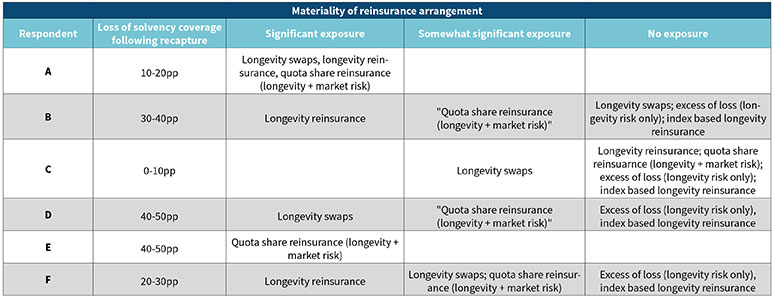

Table 1 provides a more detailed breakdown showing the relationship between the loss of solvency coverage and the relative materiality of different reinsurance arrangements respondents have entered into. Three exposure buckets are used for this purpose: significant exposure, somewhat significant exposure and no exposure.

Table 1

Materiality of Reinsurance Arrangement

Longevity swaps, longevity reinsurance and quota share reinsurance are the reinsurance covers of choice amongst respondents.[2]

A number of annuity writers have increased their credit capabilities and exposure to illiquid assets in recent years, and is considered a source of competitive advantage. Longevity swaps and longevity reinsurance do not transfer away rewarded credit risk and can be seen as a complimentary de-risking proposition for annuity writers.

The significant or somewhat significant use of quota share reinsurance for five of the six respondents could signal a lower risk appetite towards retaining market and longevity risk (often UK annuity writers’ biggest risks on a contribution to SII SCR basis) for particular types of schemes. It could also reflect use of quota share reinsurance as a strategic asset used to better match annuity writers’ long duration books where credit assets of sufficient duration and volume can be more difficult to source.

There are signs that appetite for quota share reinsurance is increasing: possibly to meet annuity writers’ changing demands, or from overseas reinsurers willing to write quota share reinsurance and accept asset risk.

Understanding Reinsurance Recapture Risk

An insurer’s Board has overall responsibility for the management and oversight of the insurer and its activities. Boards may establish committees to assist in fulfilling their oversight responsibilities.

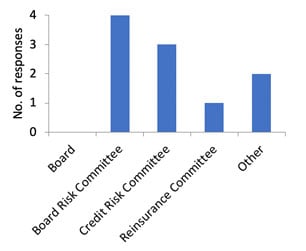

Figure 2 shows that all respondents Boards delegate responsibility for reinsurance counterparty exposures to one or more committees. Delegating technical topics leaves more time for the Board to focus on, and provide leadership over, the insurer’s strategic direction, culture, and setting the general tone from the top.

Figure 2

Key Committees Responsible for Reinsurance Counterparty Exposure

The Board Risk Committee was the most frequently cited oversight forum (four of the six respondents) followed by a Credit Risk Committee (three of the six respondents). The “Other” category included an Insurance Risk Committee and Capital Management Committee.

What information is communicated to the Board and Executive Committees?

Respondents were also asked to indicate the information communicated to their Board and Executive Committees.

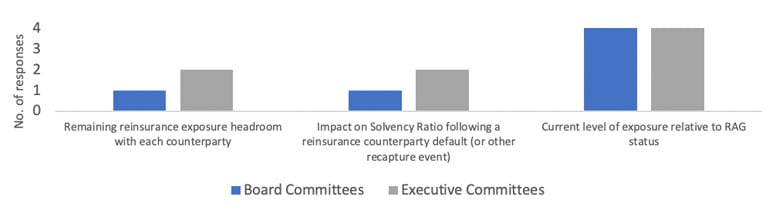

Figure 3

Information Provided to Board & Executive Committees

Figure 3 shows that four of the six respondents provide the current level of exposure relative to a Red, Amber and Green (RAG) status to their Board and Executive Committees. This metric is likely to be chosen for its visual nature, simplicity, ability to be used as a signal to focus management’s attention or as an indicator to take actions.

The “remaining headroom” and “impact on solvency ratio” metrics are quantitative in nature and require a deeper understanding of the technical detail including assumptions and management actions that sit behind the metrics. This is more challenging to acquire for individuals who are one or more steps removed from the process; and could explain why the majority of respondents do not provide this information to their Board (five of the six respondents) or Executive (four of the six respondents) Committees. Twice as many respondents provide information to Executive Committees relative to Board Committees. The Executive is closer to their firms’ reinsurance counterparty exposure and is thus more likely to be able to contribute meaningfully and engage on the topic than their Board Committee counterparts.

What approach do insurers take to modelling reinsurance counterparty default (or other recapture event) when analysing “what if” impacts across a range of stresses and scenarios?

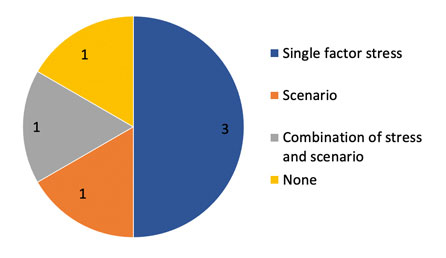

Figure 4 shows that respondents take a wide variety of approaches to model the impact of reinsurance counterparty default (or other recapture event) on their business. This is likely driven by the reinsurance exposures and reinsurance strategies adopted by the different insurers.

Figure 4

Stress and Scenario Approach for Modelling Reinsurance Counterparty Risk (or Other Recapture Event)

There are likely to be several possible explanations for why the relatively simple single factor stress approach is the most common response (three of the six respondents).

- It can be hard to model how a reinsurance counterparty default (or other recapture event) would interact with other stresses. There could also be the assumption that a reinsurance counterparty default (or other recapture event) alongside other events, e.g., a longevity stress, is too remote a possibility to be considered a severe but plausible scenario.

- Insurers may make the assumption that the most likely driver of reinsurance counterparty default (or other recapture event) would be idiosyncratic in nature, e.g., a major operational risk event or fraud that only impacts a single reinsurer, and not the result of a market wide or more systemic stress.

- Incorporating other stress factors may make the story less clear and divert attention away from the impacts of a reinsurance counterparty default (or other recapture event).

On the other hand, a single factor stress approach could oversimplify the real world dynamics and dependencies with other risk factors, which could lead to the modelled financial impacts understating the true risk exposure. This could frustrate the attempts of decision makers to ask the right questions and leave the insurer less well positioned to deal with a reinsurance counterparty default (or other recapture event) were it to occur.

Non-capital Protections to Manage Reinsurance Recapture Risks

Three non-capital protections used by insurers to manage their exposure to a reinsurance counterparty default (or other recapture event) were it to occur are discussed below.

- (1) Risk appetite and risk limit setting

Each insurer has its own set of key performance indicators that are used by management to assess the financial performance of the business. These heavily influence the metrics used by insurers to measure and calibrate their reinsurance counterparty risk appetite and limits.

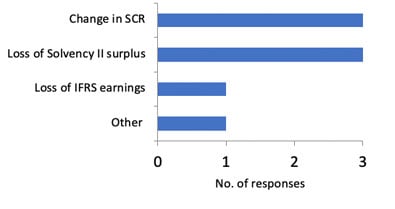

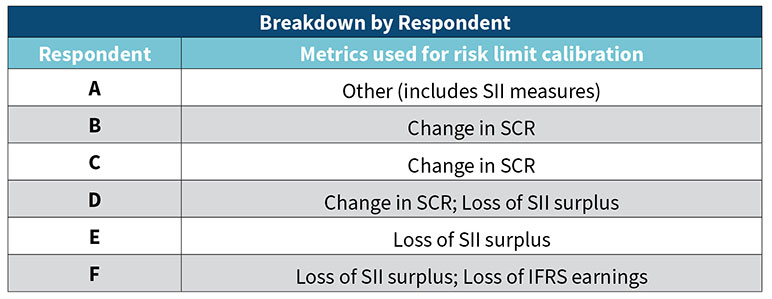

What financial metrics are important to insurers when setting their reinsurance counterparty risk appetite and risk limits?

Figure 5 summarizes the metrics used by respondents to calibrate their reinsurance recapture risk limits. Table 2 shows that five of the six respondents calibrate their risk limits with respect to a change in SII SCR or loss of SII surplus metric. The remaining respondent uses other SII metrics, e.g., based on a 1-in-X year longevity stress or proportion of regulatory reserves. Only one respondent considers the loss of earnings when calibrating their risk limit.

Figure 5

Metrics Used for Risk Limit Calibration

Table 2

Figure 5 Breakdown by Respondent

How do insurers reflect their preferences between reinsurance counterparties when setting risk appetite and risk limits?

When assessing how much risk to take on, insurers not only need to worry about the quantum of the risk, but also who the counterparty is. Insurers consider a financially weaker counterparty to be more likely to default and therefore set risk limits that depend, in part, on the counterparty’s financial soundness. All respondents use the reinsurer’s credit rating as an approximation of its financial strength with a few also considering wider financial performance, risk profile, type of counterparty, and geography.

How quickly do insurers assume a reinsurance counterparty defaults and are any post stress management actions taken into account when setting risk limits?

All respondents assumed that their reinsurance counterparties default instantaneously when setting risk limits, which does not leave any time to take pre-emptive rectification actions. This measure is possibly chosen for its simplicity as a modelling approach. However, three of the six respondents took post stress management actions into account when setting their risk limits. All three respondents assumed for example that they would be able to obtain replacement reinsurance six to 12 months following a reinsurance counterparty default (or other recapture event). The confidence in, and ability to take, management actions to protect the balance sheet may explain why insurers are prepared to accept a significant drop in solvency ratio when setting their risk limits.

- (2) Use of collateral

The future payments made by a reinsurer under an annuity related reinsurance treaty change over time as longevity experience emerges and updates are made to future longevity assumptions, covering both base mortality and longevity improvement rates. Collateral posted reduces exposure to counterparty risk for either the reinsurer or insurer. The collateral received by the insurer provides partial protection from the balance sheet effects of a reinsurance counterparty default (or other recapture event).

All respondents have at least one collateralized annuity related reinsurance treaty and allow for collateral in their exposure calculations. How this is incorporated into the exposure calculation including the approach to haircutting assets and the frequency that collateral balances are settled may differ across the market. The importance of each of these is increased when considering quota share reinsurance where the pre-collateral counterparty exposure generally covers the full regulatory reserves and not only the net exposure (the difference, in present value terms, between the “floating” and “fixed” legs). Any growth in the market for quota share reinsurance to meet annuity writers’ demand is likely to see an increased focus on collateral.

What protections do insurers employ to manage their exposure to a deterioration in a reinsurer’s financial standing?

Five of the six respondents include protections within their reinsurance treaties that trigger upon a breach of early warning signals or indicators that the reinsurance counterparty may be in difficulty. Four of the six respondents introduce or increase collateral requirements; and two of the six respondents include stricter asset eligibility requirements to restrict the type of assets that can be posted as collateral by the reinsurer. One respondent includes a protection to restrict the level of new business that can be written within existing reinsurance flow treaties.

What risks do insurers take on upon recapturing the collateral following a reinsurance counterparty default (or other recapture event)?

The collateral received upon recapture is unlikely to fully match the insurance contract’s underlying features. Rebalancing costs, e.g., converting the collateral into suitable assets to support the recaptured liabilities, could therefore be significant. All respondents identify currency related basis risk between the assets in the collateral pool that would be received following recapture and the underlying insurance liabilities. Other sources of basis risk identified by respondents arose from:

- The indexation of the collateral assets (five of the six respondents),

- the duration of collateral assets (five of the six respondents), and

- the collateral assets’ expected cashflows (five of the six respondents).

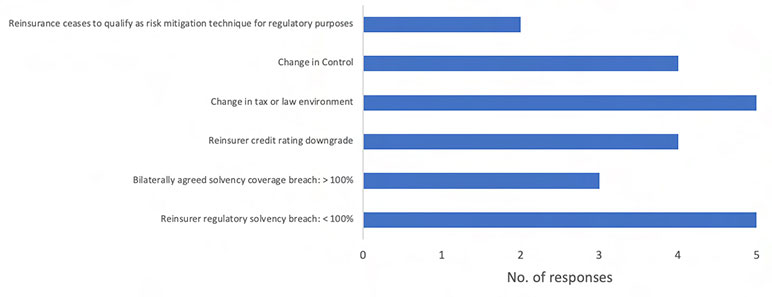

- (3) Treaty provision protections

Reinsurance contracts are complex legal documents that are binding for both counterparties. Figure 6 summarizes the main recapture provisions included by respondents within their reinsurance treaties.

Figure 6

Main Recapture Provisions Contained Within Two or More Longevity and Quota Share Reinsurance Treaties

The recapture provision following a breach of a reinsurer’s regulatory solvency position is noteworthy given its potential to cause a disorderly market disruption. The inability for insurers to recognize the full benefit of reinsurance within their SII SCR and balance sheet following a breach of a reinsurer’s regulatory solvency position could lead to a “run on the reinsurer.” This could have macroeconomic consequences if a single reinsurer was a counterparty to a number of insurers. It is unclear whether, and if so when, the reinsurance market would have the appetite and capacity to absorb all previously reinsured risk across the affected insurers in this scenario.

Summary of Key Conclusions

The effect of a reinsurance counterparty default (or other recapture event) on a UK annuity writer’s balance sheet can be material. The nature of the risk and the levers available to manage and control it will therefore be important for all levels of an organization including the Board to understand.

The Boards of all insurers surveyed delegated this responsibility to one or more committees with many insurers communicating key management information to support decision making on a frequent basis.

Other areas of convergence between the insurers surveyed included the approach to setting risk limits. All assume that their reinsurance counterparties default instantaneously when setting risk limits, with almost all choosing to calibrate their risk limits using a change in SII SCR or loss of SII surplus metric.

Collateral is a key tool used by all insurers surveyed to manage their reinsurance counterparty exposures. This is not without risk; and the basis and other risk that the insurer’s surveyed would take on following a reinsurance counterparty default (or other recapture event) may be an area to further consider, for example during collateral negotiations.

The working party identified the approach to considering reinsurance counterparty default (or other recapture event) when analyzing “what if” impacts across a range of stresses and scenarios as an area that could benefit from refinement. A single factor stress approach is used by half of the insurers surveyed to model the impact of a reinsurance counterparty default (or other recapture event). However, this could oversimplify the real world dynamics and dependencies with other risk factors, and could frustrate the attempts of decision makers to ask the right questions. This could leave an insurer less well prepared to deal with the financial and solvency implications of a reinsurance counterparty default (or other recapture event) were it to occur.

The treaty recapture provisions was also identified as an area that could benefit from further refinement. The majority of insurers surveyed did not include recapture provisions that would give them the right to recapture a reinsurance arrangement that no longer qualified as risk mitigation for regulatory purposes. This could leave a ceding entity liable to pay for a cover that they were not able to recognize as capital relief for the purpose of calculating the SII SCR.

The broader implication to the macro-economy, were a material reinsurer to default, is difficult to know or quantify. It is, however, likely to be amplified by the use of retrocessions and other risk transfer activity that reinsurers can enter into to manage its risk. A disorderly reinsurance recapture event could pose a threat to macroeconomic stability and will undoubtedly be an area of interest for policymakers and regulators around the world.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the respective authors’ employers.

Mudi Ugono has 15 years’ experience in the life insurance industry. He has gained extensive experience as a policymaker, insurance supervisor and in more traditional actuarial roles at the Bank of England (BoE), industry and consultancy. He currently leads the BoE Insurance division’s counterparty risk specialism. Mudi is an active UK Institute & Faculty of Actuaries (IFoA) volunteer and is a member of the Life Board.

Brad Ashton has 7 years’ experience in the life insurance industry. At Aon, he works across the full spectrum of capital and balance sheet solutions and reinsurance structuring, with a particular focus on asset-intensive and longevity reinsurance. He joined Aon from Barnett Waddingham, where he was involved in providing outsourced actuarial function services to medium-sized UK life insurers.