Insurtech’s Impact on the Industry: Post-Pandemic

By Andrew Rea and Farron Blanc

Reinsurance News, June 2022

p>In this article, Andrew Rea and Farron Blanc provide their personal views on the post-pandemic InsurTech opportunities for both startups and incumbents. We’ll provide a quick recap on notable trends in the US InsurTech ecosystem, with a list of notable companies—however, given the landscape changes so quickly, these are not endorsements but rather a starting point for readers to conduct further research.

Our professional experience informs our perspectives. Rea has predominantly worked in Property & Casualty insurance having worked at Liberty Mutual, Allstate and Kemper and now leads the Insurtech Partnerships segment at Legal & General America. Conversely Blanc’s expertise is exclusively in Life & Health. Having worked as a corporate venture capitalist, and innovation incubator, sold his VC Backed InsurTech, Blanc now leads brokerage distribution and is responsible for marketing at Legal & General America.

An Overview of InsurTech

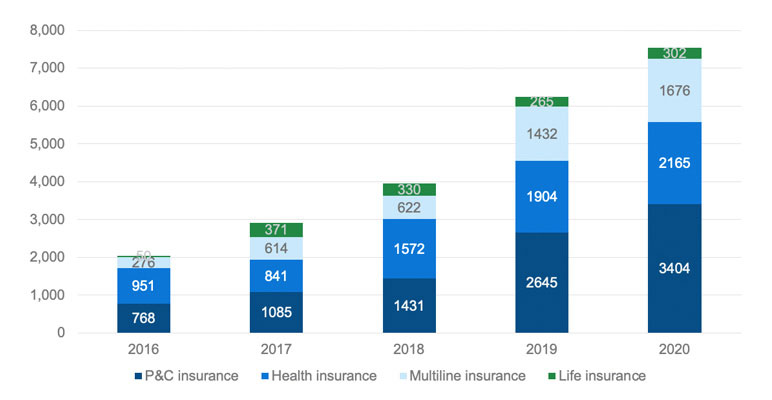

Figure 1 shows the Boston Consulting Group’s FinTech Control Tower. InsurTech funding immediately prior to the pandemic amounted to US$7.5B with P&C accounting for 45 percent of the total—more than US$3.4B.

Figure 1

Equity Funding Amounts by Cluster (US$millions)

Source: BCG FinTech Control Tower

Fast forward to the third quarter of 2021—and InsurTech funding amounted to US$10.4B projecting a US$13B run-rate nearly double that of 2020. Obviously, the quick bounce-back from the economic shocks of early 2020 and many well-established InsurTechs raised mega-rounds (above US$100M) contributed to bounce—but there is also evidence that InsurTech remains a viable asset class.

Deep-Dive: P&C InsurTech

In the P&C “InsurTech MGA/Carrier” ecosystem, reinsurance has played a pivotal role in bringing underwriting capacity to market, allowing innovation and new entrants to thrive.

This marriage between tech and reinsurance has had run-on benefits for the entire industry. InsurTech products often began as “me too” filings of existing products but coupled to a vastly simpler customer journey and use of enriched data from third parties, to minimize customer pain points at quote, and backed by strong reinsurance panels to lend credibility. In an industry that is confusing for customers to navigate, these new entrants have changed customer expectations and deserve huge credit for pushing the industry toward customer centricity.

As these companies mature to full-stack carriers who absorb more risk, reinsurance remains at the center of the wheel, providing the capacity to allow these disruptive entities to grow and normalize the best possible customer experience.

In P&C, it has proven difficult to make money underwriting as a new entrant for a variety of reasons; the “new business penalty” as a book earns in and renews, lack of significant experience data to get to indicative trends, and a volatile market where even the most seasoned incumbents are struggling to stay ahead of losses and claims inflation. Reinsurance brokers have played the vital role of putting together complex, creative coverage stacks that allow growth InsurTech entities to find capacity, without compromising any individual reinsurer.

One frequent pitch of InsurTech MGAs to investors and reinsurers is that they have more sophisticated ways of assessing risk and engaging with customers than the legacy insurers they seek to displace. While over time, this may prove to be true, it has been mitigated by the lack of large-scale experience data to best refine the underwriting loop. There has simultaneously been significant improvement from legacy carriers to use similar tools to improve customer experience, risk selection and claims. Examples include telematics, property imagery, and the utilization of big data.

Reinsurers have borne the primary brunt of these new-entrant mistakes, and for over half a decade, have remained keen to line up for more. It is now clear that it will get more and more difficult for reinsurance brokers to cobble together programs for the InsurTechs MGAs over time. The wariness of reinsurers to take losses in the hope of future profit will make reinsurance renewals more difficult year upon year. Because of this, the winners in the space will be those entities that are able to combine growth, even if slower, with loss ratios that make them appealing to reinsurers.

Evan Greenburg made waves last year at ITC when he took aim at InsurTech as being largely driven by hype over fundamentals. The profitability difficulties of P&C insurgent InsurTechs, and the resultant decline in market cap of the InsurTech MGAs that have gone public, has been compounded by their own mistakes. Examples of these mistakes include growing too quickly in difficult regulatory or cat-prone states, not recognizing rate need early enough; prioritizing the growth story necessary for Wall Street to invest over the underwriting necessity of returning profitable books that reinsurers can benefit from. To this end, Greenburg reminds us that a focus on the fundamentals is critical.

Deep-Dive: Life InsurTech

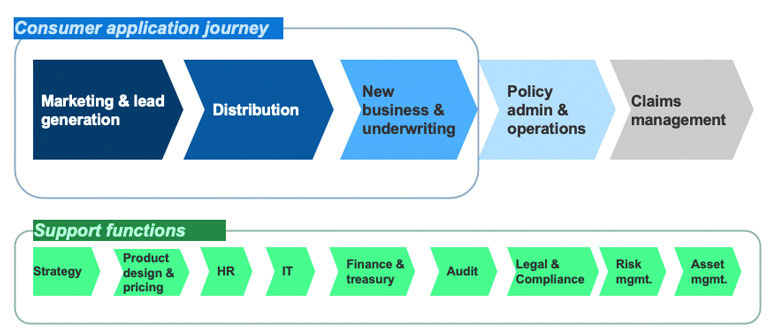

At Legal & General America we have made the strategic decision to focus solely on protection products. Specifically, term life insurance. Smartly deploying data and technology impacts all functions—from asset management to product pricing. However, as Figure 2 depicts, the consumer application journey—Marketing & Lead Generation through to new business and underwriting, are the primary areas of potential InsurTech improvement. Furthermore, with first year commissions in excess of 100 percent, a disproportionate percentage of premium is concentrated within this part of the value chain.

COVID-19 has raised both consumers’ and distributors’ expectations about getting affordable protection digitally. Using technology to remove friction and enabling distributors to effectively reach traditionally underserved portions of the population is one of the main drivers behind all the activity within InsurTech.

Figure 2

Legal & General America’s View of the Value Chain Within Insurance

Source: Authors

InsurTech Funding From 2017 to Date

As illustrated in Figure 1, life InsurTech funding lags Property & Casualty. However, the large amount of Venture Capital funding can be ascribed to mega rounds (larger than US$100M). Lately that has started to change with Ethos announcing a US$100M raise in June 2021.

Given nearly US$200M flowing into life InsurTechs for the past five years, clearly this is no fad: Tech-native privately financed companies are here to stay. For leaders at incumbent insurers, the initial strategic question becomes one of build versus buy versus partner.

In the first camp and full acquisition “buy” here are some notable transactions and rationales:

Kicking off the first wave of acquisition was Prudential Financial purchasing Assurance IQ for US$2.35B in September 2019. The rationale behind the deal was Assurance IQ would enable Prudential to reach the underserved mass market through a wholly owned direct-to-consumer channel in a fast-growing highly scalable business model.

Another direct-to-consumer acquisition by an incumbent includes Western & Southern buying Fabric in January 2022. Terms were not publicly disclosed—however Western & Southern noted that it was excited about reaching middle market consumers noting that Fabric already served 60,000 customers.

Although M&A often generates splashy headlines, another route is to build new InsurTech capabilities within a wholly owned but distinct unit of an established company. This is the route that MassMutual has undertaken since 2015 with the launch of digital direct-to-consumer agency Haven Life. Although after nearly seven years, Haven has recently announced that their competitors can leverage Haven as a SaaS (software as a service) offering. Essentially rival competitors could pay a monthly fee to Haven Technologies to leverage the digital direct to consumer platform with limited involvement from MassMutual.

Finally, partnering with InsurTechs is another route. One exemplified by Legal & General America’s partnership with Ethos. In which LGA and Ethos jointly collaborate to build new products and services reaching underserved populations. With all partnerships—contractual terms vary but for success there needs to be a foundation of trust built first and foremost on a shared vision of the future, and repeated demonstrations of working in the other partner’s interests.

Insurtech 2022 and Beyond

A lot of the pre-pandemic InsurTechs were focused mostly on marketing, and distribution for new tech savvy prospective insured. Two areas that we feel will be very interesting and impactful are RegTech and Finance & Treasury.

Given insurance is a heavily regulated industry, one could argue that all InsurTechs are RegTech companies. However, when we say RegTech, we are specifically talking about targeting the opportunity to reduce the friction and costs associated with the legal & compliance, or risk management operations of an insurance company. One such company, AgentSync, has found early traction, and a US$1.2B valuation from deploying technology to smooth out the appointment and validation of agent credentials for both P&C and L&H carriers.

Within Finance & Treasury, we believe there is a very large opportunity applying some of the pureplay Fintech innovations of the past five to 10 years and focusing them narrowly on InsurTech. Such innovations include Ascend, which borrows some concepts from BNPL “Buy-Now-Pay Later,” or the rewards platform built by Marble Pay.

In conclusion, despite some of the newspaper headline crunches of public InsurTechs the amount of capital following into Insurtech means that tech enabled transformation is here to stay. Talent and capital will continue to flow into the market at an increasingly accelerated pace.

For carriers to succeed they should carefully prioritize Test & Learn approaches across the Build, Buy, Partner paradigm to continue to create value for their policyholders, employees, and shareholders.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the respective authors’ employers.

Farron Blanc is VP, Brokerage Distribution & Strategy at Legal & General America. He can be contacted at fblanc@lgamerica.com.

Andrew Rea is VP, Partnerships at Legal & General America. He can be contacted at area@lgamerica.com.