The Use of Alternative Data in Life and Health Risk Assessment—An International Experience

By Adam Musnitzky, John Schoonbee and Doug Rix

Reinsurance News, August 2023

New digital data otherwise known as alternative data is everywhere. Our industry has seen the financial, banking, and hi-tech industries leverage new digital data to expand their key offerings and core services. From the lens of the global life and health industry, new digital data is still searching to be further understood.

Risk assessment is a current focus area for using alternative data. A key question is even though risk assessment has always been data-driven, can it now move to the next level with the arrival of this alternative data. Can we use alternative data to make the risk assessment process quicker, cheaper, or faster thereby driving more sales and better conversion rates.

It is an exciting time! With the increased adoption of health and well-being apps, data such as physical activity, nutrition, sleep, and mental wellness is now readily available. Expanded data such as digital biomarkers, IoT data, electronic health records and many more can also be accessed.

However, how to effectively implement alternative data remains a challenge across the industry. We firmly believe it is, and will continue to be, imperative to take a structured approach to alternative data through a set of key considerations and a framework of principles.

Why the Desire to Use Alternative Data in Risk Assessment?

Decision makers at insurance companies are eager to explore this data as they recognize that it has the potential to benefit all parts of the value chain including:

- Consumers who have increased health and wellbeing awareness as well as desire personalized experiences and recognition from insurers;

- insurers who want to create attractive product propositions and improve risk assessment, are seeing the explosion of health apps, wearables, e.g., the Apple Health kit, as well as the proliferation of credible data, as an opportunity to do this;

- society who could reap the benefits of improved health awareness, better wellness, and reduced global burden of diseases; and

- brokers and advisers who may be able to offer quicker, technology savvy, and cheaper insurance offerings to consumers.

Understanding the Value of Alternative Data

To unleash the full potential of alternative data and use it meaningfully is not as simple as it may seem. It is important to understand the validity and protective value of this new data relative to established practices.

The key to assessing any new data in risk assessment is analyzing it's potential to provide enhanced commercial value. Some key considerations for insurer's are:

- Is alternative data faster, allowing for greater automation and faster processing?

- Is alternative data cheaper to implement and run?

- Can it provide greater accuracy or predictive value?

- Is alternative data easy to use and based on data or technology that is widely available?

These questions may appear straightforward but many “underwriting innovations” struggle to answer "yes" to these considerations. Some may offer incremental increases in speed or accuracy but come with increased costs due to increased risks. These questions should be considered together to assess the overall business case for using the alternative data.

Five Applications to Using Physical Activity Data from Wearables

There are five common applications that we, at Swiss Re, are seeing in the market. To make these applications more tangible, we will look at them through an example of physical activity, measured in Metabolic Equivalent of Task or METs.

Measuring physical activity – METs: When measuring physical activity, the best way to measure, objectively track and compare the health benefits of different activities, such as, walking, cycling, or swimming, is to use METs. METs is an all-encompassing value that combines the type of activity, duration, and level of effort.

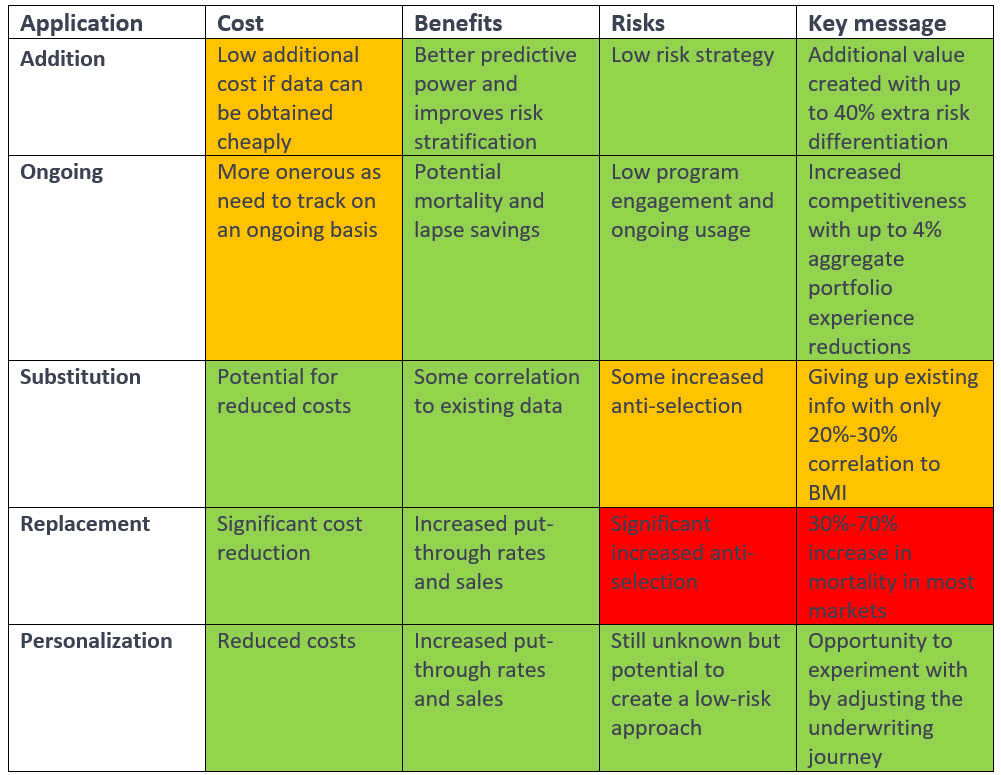

The five applications of physical activity are:

- Addition: Augmenting current risk assessment with METs to better stratify risk.

- Ongoing/Continuous: Using METs for dynamic underwriting.

- Substitution: 1-for-1 risk factor replacement, e.g., BMI with METs.

- Replacement: METs used in place of several health risk factors.

- Personalization: Using METs to pre-select customers for different underwriting journeys.

Table 1

Summary Table of the Five Applications of Wearables

Addition: Is it Worth Adding METs into the Risk Assessment Journey?

Swiss Re research shows METs provide additional predictive power and risk prediction due to their correlation with better mortality and morbidity outcomes. This in-turn helps to improve risk stratification and has the potential to select and attract more physically active applicants. The selection is beneficial as it results in an insurer having a portfolio of policyholders who on average have lower mortality rates, and this typically allows them to offer more competitive premiums in the market through this additional risk differentiation.

When expanding this approach to other risk factors, the level of risk differentiation can be enhanced even further. It is important to note that a wider risk differentiation range does not mean that a portfolio will automatically have better mortality rates. It is still a zero-sum game whereby the consumers who receive additional discounts for a healthy lifestyle should be balanced against less healthy lives who may receive additional loadings. Insurers will need to create additional value by attracting healthier lives through the additional risk stratification and thereby generate better mortality rates.

The benefits of additional risk differentiation also need to be considered against the costs and ease of obtaining this data on a one-off basis, as well as the credibility of the data, the robustness of the historical data, and other competitive pressures.

Ongoing: Is There a Future for Dynamic Underwriting?

Dynamic underwriting has gained attention in recent years, even before the explosion of wearables. The idea of policyholders engaging with and improving their clinically modifiable risk factors (e.g., BMI or blood pressure) to gain some financial or other reward benefit, has been around for over a decade. Wearables promise a more automated and consistent flow of information to update modifiable lifestyle risk.

METs has been shown to be an excellent fit for dynamic underwriting; the data is widely available and easy to access. Over the medium- to long-term, the predictive power of tracking METs makes it easier to identify, price for, and drive healthy behavior change that can help to reduce a customer’s risk or prevent their risk worsening.

Our global internal data research shows that health and wellness engagement platforms that track and reward particular levels of METs, as well as run annual health assessments that track other clinical and lifestyle risk factors may be able to see aggregate mortality and lapse experience reductions of up to 4% across the entire insurance policy book, with a substantial proportion of the benefit coming from getting customers to positively change their behaviors.

It is important to assess the full business case when looking to introduce dynamic underwriting, e.g., the costs of annually re-underwriting policyholders and having a reward program, as well as how to adjust premiums if a person’s health or level of physical activity worsens.

Substitution: Can METs be a 1-1 Risk Factor Replacement?

Although METs, as a risk factor, have some protective value, research shows it cannot replace existing underwriting risk factors. If we were to replace BMI with METs, data shows that this approach could lead to important and meaningful gaps in risk assessment. In fact, the US National Health and Nutrition Examination Survey (NHANES) database and UK Biobank both show low overall correlation:

- < 30% on NHANES between BMI and METs even after allowing for diseases, and

- 20% on the UK Biobank between BMI and step count when using accelerometer data.

As a result, replacing BMI with METs could result in poorer lives with higher BMI levels selecting into the product. However, this level of anti-selection will depend on factors such as competitive considerations, relevant market disclosure rates and the range of BMI values.

Replacement: Can METs Replace Traditional Clinical Risk Factors and Medical History—are We Ready?

Some InsureTech companies promote a view that METs alone are as predictive as current underwriting. The view is that by collecting METs, age, gender and only a couple of other risk

factors, they can create a portfolio that in some circumstances is at least 95% as predictive as current underwriting and hence a shorter underwriting approach could be adopted.

Although the frequency of inaccuracy can be low, the severity of the incorrectly priced risks can be very high. As an example, the NHANES data shows that there is a low correlation between people having a disease and METs (< 20%). This means that underwriting that relies mainly on METs, will result in people with medical diseases being added into the standard underwriting pool without being priced correctly. The potential for anti-selection can also increase significantly if diseases are not being considered. In fact, our internal data research shows that this anti-selection typically increases claims by 100% or more in the U.S.

Personalization: Can METs be Used to Personalize the Customer Journey?

Insurers and third-party providers are exploring the idea of using METs to create a tailored underwriting journey for customers. This works by first receiving digital customer information and then adjusting the number of underwriting questions or underwriting tests depending on the strength of their digital data metrics. Any use of third-party data would require full disclosure and compliance with any data privacy laws.

The digital data may be used to streamline customers through an accelerated form of the underwriting process as well as used to increase straight-through-processing rates. However, the potential for customer anti-selection must be assessed. Key to this assessment is to understand the customer journey process, as well as the marketing and distribution channel.

A Framework for Assessing Alternative Data in Risk Assessment: The 3C's and 2A's

- Context: What is the market context, which of the above five applications is the business working with, and relevant market disclosure rates.

- Correlations: How correlated is the alternative data relative to the existing current data, how to account for missing information and what will the impacts be on underwriting and pricing.

- Credibility: How credible is the alternative data across its length, duration, reliability, and likelihood of fraud relative to the existing data.

- Anti-selection: Assess the impact that the alternative data could have on consumer behavior. Focus on monitoring the performance of the data through keeping an eye on cost and portfolio impacts.

- Attraction: Can the new data attract new applicants either through its simplicity, ease of use or ability to offer cheaper prices. Focus on monitoring performance over time.

Exploring Next Steps

Key next steps for insurers to consider when approaching alternative data are:

- Identify the appropriate application that matches your business strategy.

- Create a test-and-learn environment to pilot or experiment with different opportunities and different types of new data.

- Consider other important consumer factors such as legal, regulation, fairness, ethics, and transparency.

- Create a business case that helps to show the return on investment.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the respective authors’ employers.

Adam Musnitzky is a global products actuary for Swiss Re. Adam can be contacted at Adam_Musnitzky@swissre.com.

John Schoonbee is a global chief medical officer for Swiss Re. John can be contacted at John_Schoonbee@swissre.com.

Doug Rix is head UW R&D core & innovation. Doug can be contacted at Doug_Rix@swissre.com.