Navigating IFRS 17's Currents: Steering Reinsurers Towards Transparent Horizons

By Bob Owel

Reinsurance News, December 2023

As IFRS 17 Insurance Contractscasts its net wide, reinsurers find themselves sailing toward new horizons of financial reporting. The transition to IFRS 17 is not just a regulatory compliance exercise but a transformational journey that reshapes the financial reporting landscape for reinsurers. The enhanced disclosure requirements, the granular contract-level accounting, and the measurement consistency across different reinsurance contracts promise to unveil a clearer financial picture. Yet, these new reporting waters could be choppy, demanding a sturdy understanding and application of IFRS 17's principles.

Taking a Deeper Dive—IFRS 17 Disclosures in Half-year 2023 Reporting

As reinsurers peered through the mist of half-year (HY) 2023 reporting under IFRS 17, a fresh array of disclosures emerged, albeit less extensive compared to some of the primary insurers. I have taken a deep dive into four reinsurers that have reported their HY 2023 interim financial statements and I have assessed qualitative and quantitative impacts, where these were provided. These reinsurers all have both property and casualty (P&C) and life and health (L&H) business and reported an aggregate of EUR 359bn of total assets as of June 30, 2023. Three are domiciled in Europe and one in Asia. Reinsurers are not specifically required to include the disclosures listed in IFRS 17 in their interim reports under IAS 34 Interim Reporting; they need to apply judgement. Some of the key disclosures that were provided are discussed below.

Some reinsurers have provided disclosures on the discount rate methodology. All reinsurers in our sample have disclosed they are applying a bottom-up approach that consists of the risk-free rate and an adjustment for illiquidity. The risk-free rates have been based on swap rates. The reinsurers disclosed different approaches for the illiquidity premium including an approach based on the spread of a reference portfolio (such as risk-adjusted spreads of corporate and government bonds) adjusted for credit risk and other non-liquidity related items. However, only one reinsurer in our sample has disclosed the yield curves applied to discount the reinsurance liabilities.

The reinsurers have provided disclosures about confidence levels for the risk adjustment for non-financial risk. These disclosures varied on the time-horizon where some disclose on a one-year value-at-risk basis and others on an ultimate basis, which reflects the full run-off of the reinsurance liabilities. The confidence levels range from 70% to 90%, but because of the difference in time-horizon, the percentages are not fully comparable yet.

Unfortunately, insights into the contractual service margin (CSM)—reflecting deferred profit—for insurance contracts under the general measurement model is limited thus far for the reinsurers as limited or no disclosures were provided in the following areas:

- Coverage units reflecting the pattern of services that drive profit emergence; and

- expected recognition of the CSM remaining at the end of the reporting period in profit or loss quantitatively, in appropriate time bands.

Quantitative Impact and Transitional Adjustments

IFRS 17 unveils quantitative insights through the restated opening balance sheets and the 2022 numbers. As reinsurers anchor their financial statements to the new standard, transitional adjustments reveal a new understanding in a number of areas, such as shareholders’ equity, insurance revenue and net profit.

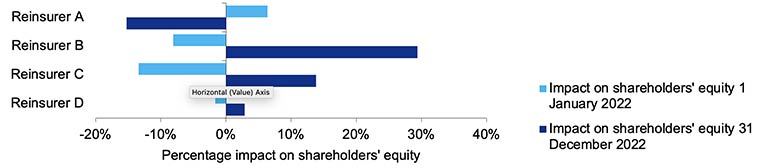

Shareholders’ Equity

Restated shareholders’ equity was generally lower or only slightly higher when compared to shareholders’ equity under IFRS 4 Insurance Contractsand IAS 39 Financial Instruments: Recognition and Measurementas of Jan. 1, 2022. Figure 1 below also shows the impact on shareholders’ equity as of Dec. 31, 2022, which is more positive compared to the previously reported numbers under IFRS 4 and IAS 39 for three out of four reinsurers in our sample.

Figure 1

Impact on Shareholders’ Equity

Some insurers have explained that the change in interest rates during 2022 in combination with the more consistent accounting of financial assets and insurance liabilities under IFRS 17 and IFRS 9 Financial Instruments have caused a more positive impact at the end of 2022. One reinsurer noted a significant loss component for onerous contracts reflecting the conservative reserving approach in the P&C segment.

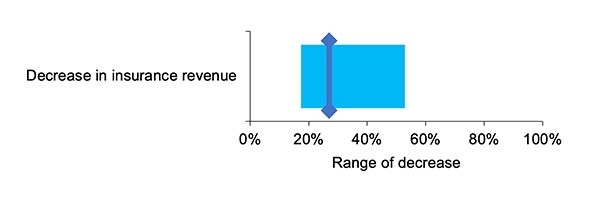

Insurance Revenue First Half-year 2022

Insurance revenue in HY 2022 is restated under IFRS 17. In comparison with previous line items such as gross written premiums, in the first half-year of 2022 the reinsurers in our sample have reported insurance revenue that is on average approximately 27% lower. This is mainly because under IFRS 17 investment components (e.g., non-contingent profit commissions) are excluded from insurance revenue (and insurance service expenses). Figure 2 below shows the range of outcomes for the four reinsurers as well as the average.

Figure 2

Range of Outcomes and Average

Three out of four reinsurers have continued reporting gross written premiums as a key performance indicator (KPI) in addition to IFRS 17 insurance revenue.

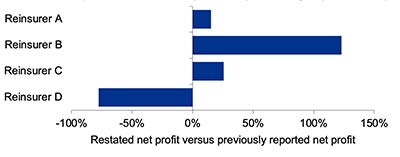

Net Profit First Half-year 2022

Reinsurers’ HY 2023 reports identify a number of key drivers of changes in net profit under IFRS 17 and IFRS 9 compared to IFRS 4 and IAS 39.

- Discounting of reinsurance liabilities:This has been amplified in the current increasing interest rate environment and affects both P&C and L&H reinsurers, especially if they have longer-term liabilities. In the P&C segment, reinsurance liabilities were often not discounted under IFRS 4.

- Reclassification of financial assets:Reinsurers have changed the measurement of certain financial assets, either from fair value through profit or loss to fair value through other comprehensive income (OCI) or vice versa. Three out of the four reinsurers have indicated electing to apply the IFRS 17 option to disaggregate insurance finance income and expenses between profit or loss and OCI. One reinsurer has not disclosed the election yet. In addition, two of the reinsurers have elected to recognize changes in the fair value of equity instruments in profit or loss, which creates an accounting mismatch in profit or loss.

- Introduction of the CSM and risk adjustment: Reinsurers report that the reinsurance service result for the L&H segments will become more predictable and provides a more economic view due to the introduction of the CSM and risk adjustment.

Figure 3 below shows the impact for the four reinsurers in our sample:

Figure 3

Impact for Four Reinsurers

Diving into Key Performance Indicators

Reinsurers are in the process of revising their KPIs under the IFRS 17 regime. KPIs like “return on equity,” and some form of “operating profit” continue to be reported. Metrics like “new business value” are being updated for IFRS 17 impacts or new KPIs, such as “economic value” based on IFRS 17 have appeared.

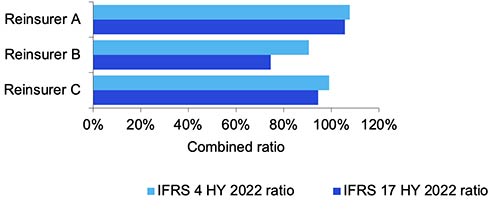

Combined Ratio for P&C Reinsurers

For the P&C reinsurance segments, the combined ratio continues to be reported in HY 2023 reporting. One reinsurer did not change the combined ratio calculation, but the P&C reinsurance segments of the three other reinsurers in our sample have used the base formula of insurance service expenses divided by insurance revenue and made an adjustment to reflect the effect of retrocessions. There are different ways of adjusting for retrocessions; either by adjusting both the numerator and denominator for reinsurance or including the net reinsurance result only in the numerator. The combined ratios for 2022 have been restated and key impacts are:

- Discounting of reinsurance liabilities,

- deduction of investment components from numerator and denominator, and

- only including directly attributable expenses under IFRS 17.

See Figure 4 for the combined ratios for P&C segments of three of the reinsurers.

Figure 4

Combined Ratio P&C Segment HY 2022

New Business Value and the Total Business Value

Three out of four reinsurers have used the new CSM recognized in the reporting period as a basis for reporting on the new business value for their L&H segments. Some have adjusted for contracts recognized under IFRS 9 (i.e., contracts that do not transfer significant insurance risk) or onerous contracts. One reinsurer has also indicated commentary that compares the new CSM in the reporting period to the release of the CSM in that period, which may indicate whether the company is growing or not.

Three out of four reinsurers have reported on a total business value. There is significant variation in the metric that is used to express the business value in our sample; “embedded value” (not based on IFRS 17), “economic value” (based on shareholders’ equity and CSM after tax) and “book value per share” (based on shareholder’s equity).

Financial Leverage Ratios

Two out of four reinsurers in our sample have reported a financial leverage ratio, which was generally calculated as debt divided by debt plus shareholders’ equity under IFRS 4. Both reinsurers are reporting a significant decrease (approximately 10 percentage points) in the ratio. This is due to their inclusion of the CSM in the denominator in the ratio under IFRS 17.

Conclusion

The journey toward IFRS 17 compliance may be challenging, but it brings about greater levels of transparency and comparability for reinsurers. As they navigate through the currents of the new IFRS 17 requirements, being adaptable to developing market practice will be crucial. While the initial shift to IFRS 17 might seem overwhelming, it harbors the opportunity to gain new knowledge and insights for both management and external stakeholders. By steering the transition effectively, reinsurers can anchor a better understanding of their financial statements and a fresh narrative for explaining their results, paving the way toward calm and clear reporting waters ahead.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the respective authors’ employers.

Bob Owel, MS, RA, technical IFRS technical associate partner and deputy leader insurance contracts topic team at KPMG. Author can be contacted at bob.owel@kpmgifrg.com.