Leveraging the Power of Reinsurance to Manage Growth, Address Solvency and Boost Risk-Based Capital Ratios Amongst U.S. Health Care Companies

By Ankit Nanda and Rob Kreager

Reinsurance News, April 2024

My Quota—Your Quota

Reinsurance comes in many forms. A primer would suggest two popular variants—excess of loss and quota share. An excess of loss treaty allows for claims above a chosen attachment point to cede to a reinsurer in return for a subject premium. Writers of medical stop loss coverage as well as large reinsurers are known to issue treaties of this kind. Risk is not shared on a proportional basis, and there can be winners and losers between the insurer and reinsurer as per the performance of the treaty in various excess layers. Alternatively, a quota share treaty allows for splitting of premiums and losses from the ground up based on a predetermined formula. As an example, a policy with $1M in premium split halfway would allow each party to partake in premium in the amount of $500K. If the treaty then ran at a loss ratio of 70%, the underwriting profit of $300K would be split 50-50, or $150K a piece. Risk in this case is shared on a proportional basis. Simple enough. But what of all the noise about quota share reinsurance and risk-based capital (RBC)?

In this article, we take a closer look at a rather ingenious way in which proportional reinsurance is being used by insurers and health plans to manage their regulatory capital and RBC ratios. As you may recall, the RBC ratio is a critical metric monitored by regulators to ensure the long-term solvency of an insurance entity and has been coming into increasing focus as a result of recent high-profile near or real term failures of start-up health InsurTech companies trying to make inroads into the world of health insurance through novel (and some may argue) untested offerings.

Growth, but not Simply for the Sake of Growth

Growth is known to bring its own set of trials and tribulations. Apart from seemingly rudimentary concerns around managing increasing headcount and added administrative burdens, regulators are known to take a keen interest in insurers and health plans seen to be growing at a rapid clip. If you’ve been in the world of (re)insurance long enough, you may have taken for granted how the space we inhabit is unique in ways more than one, for insurance is but a promise to pay (uncertain) benefits in the future in exchange for (certain) premiums in the present. The associated concerns around adequate reserve setting—leading ultimately to a (reasonably) accurate sketch of company health for year-end financials, solvency, and foremost the ability to make policyholders whole in the event of an insured event are paramount in the eyes of a regulator. With growth comes strain on capital, often on a 1-1 basis—a 25% increase in premium base can translate to a 25% increase in required regulatory capital. But what is capital, but the difference between assets and liabilities, or what is left when what we owe is subtracted from what is owed to us. National Association of Insurance Commissioners (NAIC) determines the risk-based capital requirement for a company based on its size and the inherent riskiness of its financial assets and operations. At its heart, it is a means to ensure that capital is held proportionate to risk undertaken.

The Results are Mine, but Seem Hardly of my Making

Insurers and health plans can hit a rough path due to poor underwriting performance, a result of pricing missteps, unanticipated increase in health care service utilization, or simply due to the impact of external variables outside company control. Available capital can erode as a result, and RBC ratios suffer in the process. Regulators can step in at various junctures depending on the acuity of the problem. There are plentiful recent examples of heroic efforts by new age InsurTech startups trying to change the world of health insurance and health care in general, only to find themselves in the crosshairs of regulators due to severe impairment of company capital as a result of unanticipated losses. When underwhelming results impair the ability of a company to meet present and future policy obligations, regulators step in with proposed corrective actions, of which the most severe include mandatory control and possible liquidation of the company.

Equity, Debt

Companies can raise capital through equity offering, or issuance of debt. Each come with their fair share of advantages and disadvantages. Debt has in recent past become prohibitively expensive due to rate actions on the part of Federal Reserve Bank (Fed) in an attempt to tame decades-high rates of inflation. While inflation seems to finally be coming down to more agreeable levels, it will be some time before the Fed takes commensurate action and interest rates revert to historically low levels. Alongside, the appetite to raise capital through equity offerings—IPO or secondary remains subdued due to continued pressures around industry profitability. In times such as these, the road to raising capital through equity or debt remains a challenging proposition.

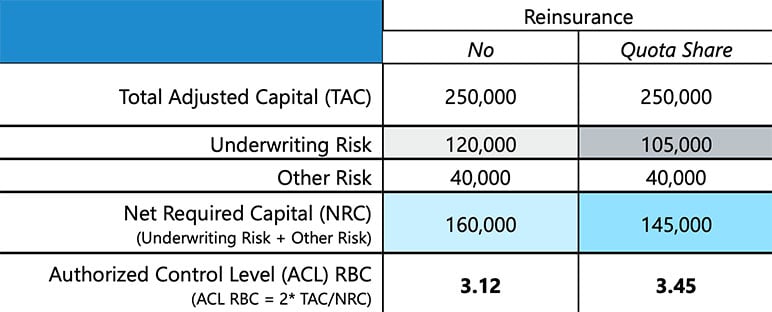

The following table illustrates the ability of a quota share reinsurance transaction to boost the RBC ratio for a company by roughly 33 points. The numerator in the ratio stays unchanged while the size of the denominator is reduced due to proportional sharing of risk.

Table 1

A Simple Example, a Timeless Lesson

An Accounting Gimmick, or a True Sharing of Fortunes?

What makes a quota share reinsurance transaction particularly appealing is that it allows for the party ceding risk to enjoy favorable policy experience through what is essentially an arrangement resembling an experience refund. Profits are handed back to the cedent, while losses are repaid to the reinsurer over time in a manner predetermined and codified as part of the reinsurance contract. In exchange for its troubles, the reinsurer is paid a risk charge. The level of risk charge typically varies based on several attributes, such as line of business reinsured (and resulting volatility in results), volume of premium, historical profitability (or lack of), etc., and is typically measured in terms of basis points. This peculiar arrangement where profits are cedent’s to keep, and the losses too are theirs to have, raises perhaps the most critical of questions—should such an arrangement even count as risk transfer? If so, how does it pass muster under the eyes of a regulator?

To prove that there is a real possibility of loss (and a transfer of risk is in fact taking place), a document entailing a risk transfer calculation is usually submitted to the Department of Insurance for the state in which approval is being sought. More crucially, examples abound in the recent past of health plan bankruptcies where the reinsurer has been left with losses to recoup and no further recourse. In light of recent experience, regulators have had little trouble in approving such transactions, especially for lack of evidence around risk transfer.

The Capital Motivated Quota Share Reinsurance Market

A key theme driving a health insurer’s evaluation of a capital motivated quota share reinsurance transaction is the prevailing market appetite for similar deals. The market is slightly more global than the traditional excess markets and dominated by reinsurers with a strong non-US presence that nonetheless eye a real market opportunity in the US health space. In general, there are several US-based as well as global reinsurance companies known to entertain capital motivated transactions, although their appetite seems to ebb and flow as per considerations peculiar to their individual performance in this segment or otherwise.

We Received Attractive Terms from a Reinsurer. Now What?

Throughout the submission and negotiation process and before the signing of a reinsurance contract, a health insurer will vet potential reinsurers using its accounting and audit firm, especially on their ability to pay its portion of claims without much ado or delay. Reinsurance brokers play a vital part role during the process in advising clients on the mechanics of risk transfer as well as precise contract wording to ensure the transaction is tailored to meet specified client goals. More crucially, they strive toward favorable economics by driving down the overall reinsurer risk charge through proactive negotiations in a competitive environment. Depending on the nature of the transaction as well as its underlying complexity, the concerned government agency will ultimately provide its blessing or create a new set of requirements as it relates to the deal structure.

Additional Considerations

Pursuing a capital motivated reinsurance transaction with a health plan invariably requires c-suite and board-level approvals. The actual process from data gathering to ultimate signing on the dotted line can take as little as three months, but sometimes longer than a year to finalize. Amongst best practices for taking this kind of transaction to the market is to have a clear end goal in mind. For example, ABC Health Plan wants to boost overall RBC in the range of X-a < X < X+b. Once this goal has been established, several paths can be crafted toward making it a reality. Different lines of business can be considered based on their attractiveness as it relates to premium volume and benefit to RBC calculation. Stop loss insurance provides a bigger boost to RBC compared to comprehensive medical and hospital for the same amount of premium, due to a higher underwriting risk factor in the RBC formula. Ultimately however, the cedent is driving toward the lowest possible overall reinsurer risk charge, while maximizing the boost to its RBC ratio.

As part of the process, it is important to have strategic direction from several streams, including finance, reinsurance, underwriting and actuarial as well as strong engagement from broader leadership driving to an ultimately fruitful transaction.

Just as crucial and perhaps not discussed as freely, is the ease with which parties enjoy transacting with each other, for this is usually a multi-year arrangement binding the insurer and reinsurer together in a fold, through times bad and good.

A quota share reinsurance transaction can serve as an attractive avenue for a health insurer looking to utilize the reinsurance market in lieu of traditional financial instruments to meet capital related goals. In doing so, the advice of an experienced reinsurance intermediary broker can serve an invaluable need in constructing appropriate guard rails and managing the associated complexity for a seamless engagement.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the respective authors’ employers.

Ankit Nanda, FSA, MAAA, is senior health reinsurance actuary at Lockton Re and can be reached at ananda@lockton.com.

Rob Kreager is accident health & life leader at Lockton Re and can be reached at rkreager@lockton.com.