Growing Momentum of Environmental, Social and Governance (ESG) Investing in Financial Markets

By Patrick Ring

Retirement Section News, January 2021

Editor’s note: Karen Lockridge is the director, ESG Investing at the Canada Post Corporation Pension Plan, one of Canada’s largest single employer pension plans with assets of over $Cdn27 billion. Karen is also a fellow of the CIA and the SOA.

Francisca Quinn is the co-founder and managing partner at Quinn & Partners, and works with companies and investors to implement ESG leadership initiatives, manage ESG-related risks and opportunities, and excel in disclosures.

Interest in environmental, social and governance (ESG) investing continues to grow amongst investors and other financial market players. There are now over 3,000 signatories to the Principles for Responsible Investment (PRI) representing over $US100 trillion of assets under management. In the policy arena, the PRI reports that there are now over 730 hard and soft-law policy revisions, across some 500 policy instruments, which support, encourage or require investors to consider long-term value drivers, including ESG factors (97 percent of these have happened since 2000). Third, the soaring demand for consistent, comparable and high-quality ESG-related reporting from corporate issuers has led the IFRS Foundation to issue a consultation paper to solicit input on the need for global sustainability standards and the potential role that the IFRS Foundation could play in the development of such standards.

Despite this growing momentum on ESG, some pension plan sponsors remain concerned about the lack of clarity as to how they can incorporate ESG in a manner that is consistent with their fiduciary duty. For example, in June 2020, the U.S. Department of Labor released a proposed rule change on the stated basis that “ESG investing raises heightened concerns under ERISA.” The DOL received over 1,100 written comments, and more than 7,600 submissions made as part of six separate petitions (i.e., form letters) on the proposed rule change. An analysis of the feedback received found that 95 percent of the comments opposed the proposed rule change. Common objections cited were that it “is not based on evidence that a problem actually exists” and that “the proposed rule largely dismisses the financial materiality of ESG issues and ignores research regarding the materiality of ESG in financial decision-making.” On Oct. 30, 2020, the DOL issued the final rule and in its factsheet stated “the final rule’s operative text contains no specific references to ESG or ESG-themed funds. Many commenters expressed concern that the proposal could be read as improperly singling out, deterring, or prohibiting consideration of ESG factors even in cases where they were relevant to a risk/return evaluation of an investment or investment course of action.” While the DOL did not retain some aspects of its initial regulatory proposal, ERISA fiduciaries should be familiar with the final rule change.

I am pleased to interview Karen Lockridge, FSA, FCIA, and Francisca Quinn to give us some background on ESG investing, address fiduciary concerns and opine on the future of ESG investing.

Patrick Ring (PR): What is ESG investing?

Karen Lockridge (KL): “ESG Investing” is a commonly used phrase, but a better way to think about ESG is as an analytic disciple or as an investment strategy. As an analytic disciple, it is how the investor incorporates non-traditional, but financially material data, in the investment process. As a strategy, it is how the investor includes ESG factors and broader systemic issues (such as climate change, sustainable development) in investment decisions and active ownership (stewardship).

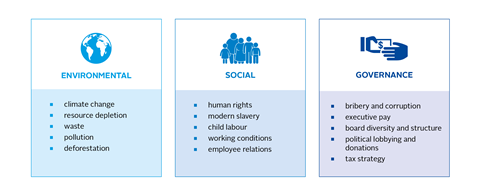

Figure 1: Examples of ESG Considerations (source; PRI)

Francisca Quinn (FQ): Both business and investors understand that environmental and social factors and corporate governance can influence companies’ future risks and opportunities. ESG investing means to systematically identify and consider them in the investment process.

PR: What is driving this growing momentum in ESG?

KL: First off, many investors are aware that ESG factors can have a financially material impact on their investments. In fact, the investor may not even call it ESG; rather it is just “good investment disciple” (e.g., good corporate governance, health and safety standards, etc.).

But recent momentum is driven, in my view, by three broad trends:

- The shift from “shareholder primacy” to “stakeholder capitalism”—There is a growing recognition that the negative environmental and social impact of the corporate sector are unsustainable. As Larry Fink said in his 2018 letter to CEOs “society is demanding that companies, both public and private, serve a social purpose ... companies must benefit all of their stakeholders.”

- The Paris Agreement and the Sustainable Development Goals (SDGs)—These two global agreements (both reached in 2015) set the global goals and development agenda for society and all its stakeholders; including investors. Future risks and opportunities will be different than they have been in the past.

- The urgency of the climate crisis and resulting net-zero commitments—The Paris Agreement goal is to keep the global average temperature increase to well below 2 degrees Celsius above preindustrial levels and aim to limit the increase to 1.5 degrees Celsius. The 2018 Intergovernmental Panel on Climate Change (IPCC) “Special Report on Global Warming of 1.5°C” stresses that the impacts between these two warming levels could be profoundly different, and demonstrates the urgent need to aim to limit warming to 1.5 degrees Celsius, and reaching net-zero greenhouse gas emissions by 2050. In recognition of the science, the number of net-zero commitments has doubled in the last year.

FQ: Driven by pension plan legislation and beneficiary expectations, pension plans and other long-term asset owners believe that ESG factors will materially affect future risks and returns. Hence, they expect investors and asset managers to incorporate these in the investment decisions and report back. It does not necessarily mean that certain assets, sectors or regions are excluded or favored in an ESG investing approach. It simply means that ESG is considered in risk analysis and pricing.

PR: How did you get involved with ESG investing?

KL: About seven years ago, I had an informal coffee with one of my Mercer colleagues, Jane Ambachtsheer, who at the time, was Mercer’s global leader on responsible investment. I didn’t know Jane at the time, but was curious as to what she did. Before meeting Jane, I was frankly oblivious to the global environmental challenges, particularly climate change. It was a bit of a “wake-up call” for me. As a result, I became more interested and involved. I joined Mercer’s responsible investment team in 2017 and that led to my current role at Canada Post. I joined here in December 2019.

FQ: Having started my career as a strategy consultant at Oliver Wyman, in 2006, I had an opportunity to join the Carbon Trust, a leading UK think tank on the impacts of climate change. There I worked both with companies and investors on mapping climate change risks and opportunities. I realized the inherent link between ESG factors and shareholder value and decided to build an expertise in supporting integration of ESG in corporate strategy. Over time it has evolved to supporting both companies, and private and public investors in building associated business processes and metrics.

PR: How would you address the US Department of Labor’s (DOL) fiduciary concern with ESG investing?

KL: In some respects, the debate about the recent DOL rule change is a symptom of a broader debate underway regarding the modernization of the fiduciary duty concept. As currently interpreted, fiduciary duties do not require a fiduciary to account for the sustainability impact of their investment activity, beyond its financial performance. In other words, fiduciary duties require consideration of how sustainability issues affect the investment decision, but not how the investment decision affects sustainability issues.

That said, the financial relevance of certain ESG issues can be dynamic as market conditions change (e.g., changing consumer preferences, policy changes, evolving societal expectations, etc.). This is the concept of dynamic materiality.

A new generation of responsible investors are beginning to measure, account for and integrate the real-world sustainability impact of their investment activity. Specifically, some investors are considering “impact duties”—such as decarbonization targets, commitments to quality of life, gender equality or integrating the impact of their investments on wider society. In 2019 the PRI and the United Nations Environment Program Finance Initiative (UNEP FI) launched a project—A Legal Framework for Impact—which seeks to understand and analyze how investors can manage dual duties (their fiduciary duty and sustainability impact duties) and what happens if they are in conflict.

FQ: I think it is problematic for pension plans. As mentioned before, long term investors realize that ESG factors can impact company success and that systemic issues such as climate change is material. Discouraging pensions to consider these could jeopardize future financial security. It will especially set back smaller plans that do not have resources to look into the ESG issues in detail and call out ESG in manager mandates.

PR: In closing, do you have any predictions for the future or messages you would like to share regarding ESG?

KL: I predict that investor focus on the impacts and outcomes of their investments will increase. While there are many drivers for this, it will be supported by the PRI reporting framework, a key objective of which is “to drive positive change in the investment market.” In 2021, the PRI reporting framework will include a set of voluntary questions related to sustainability outcomes that will start to capture what outcomes target signatories may have set on ESG issues; how they are using levers of influence—like stewardship and asset allocation—to reach those targets and progress made on them. This process will facilitate sharing of learning and evolving practices.

FQ: In 10 years I think we will see most investors using ESG in portfolio allocation and strive to meet ESG benchmarks. For example, we will see certain percentages of assets move toward green and social bonds, low-carbon asset classes and impact companies. Investment managers will be compensated for their ability to reduce portfolio carbon footprints and achieving sustainable development outcomes.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries or the respective authors’ employers.

Patrick Ring, ASA, volunteers as a member of the SOA Retirement Section Council’s Communications Team. In addition, he assists the SOA in fine-tuning and optimizing the Retirement Section’s webpage on SOA.org. He can be reached at pringactuary@gmail.com.