Pension Risk Transfer: Evaluating Impact and Barriers for De-risking Strategies

By Tim Geddes, Jason Gratson and Ivana Curguz

Retirement Section News, September 2021

Pension risk transfer (PRT) has been a hot topic among plan sponsors over the past decade as plan sponsors have struggled with the size, volatility, and cost of the pension programs. A few jumbo de-risking transactions occurred in 2012, which charted a course for other plan sponsors to follow. As a result, pension plan de-risking strategies have grown tremendously in the past decade. Following this initial increase in activity, the SOA published a research paper authored by a team from Deloitte Consulting in 2014, which developed a framework to determine “de-risking readiness” as well as provide overall background on de-risking actions. Given the changes in the market since 2014, the SOA published an updated paper titled “Pension Risk Transfer: Evaluating the Impact and Barriers for De-risking Strategies—Update” as an update to the 2014 study that includes current trends and recent changes in the de-risking market. However, it does not reflect the American Rescue Plan Act of 2021 as it was completed prior to the legislation. This article provides a brief overview of the report including key takeaways.

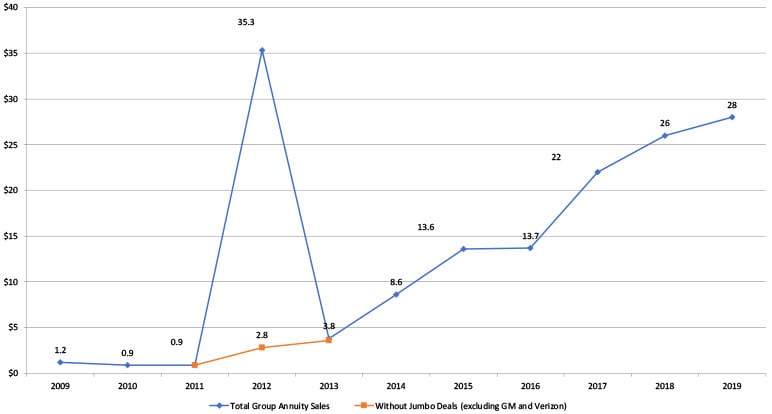

A major focus of the 2021 report was analysis of changes since 2014 including potential reasons the market moved in the directions it has. According to research participants, the PBGC premium increases enacted by Congress were a primary driver of the change in de-risking activity leading plan sponsors to consider pension risk transfer as a means of expense reduction rather than just risk reduction. The most significant trend since 2014 was the rapid increase in annuity buy-outs for in-payment retirees with small benefits who could produce the most expense savings. (see Figure 1)

Figure 1

Group Annuity Buy-Out Sales ($ in billions)

This increase in small benefit annuity purchases was a primary driver of the rapid increase in group annuity sales since 2014. The heightened sales volume enticed more insurers into the market, increasing competition for deals and leading to better pricing for plan sponsors. Insurers also sought to differentiate themselves from their competition by providing additional protection to participants through the use of separate accounts, multiple insurer arrangements or reinsurance, further leading to better options and outcomes for plan sponsors.

The insurance industry has also evolved dramatically over this time period as demand for group annuities has increased more than ten-fold. More insurers have entered the market, permitting firms additional degrees of specialization leading to a more segmented market for group annuities. This increased competition has led insurers to look for new ways to differentiate themselves. Insurers have added features to their products that were previously only available on the largest of deals, such as dedicated or commingled separate accounts, and reinsurance or multiple insurer transactions. Deal complexity has also increased over this time period as plan sponsors have looked for unique ways to meet their needs, such as through buy-ins, or asset-in-kind transfers.

While full plan terminations had historically been a major driver of pension risk transfer deals, the recent rise in small annuity purchases post-2012 largely overshadowed full plan terminations. As a result, many insurers were able to focus exclusively or almost exclusively on retiree-only deals that are much simpler and less time consuming. Recently, however, plan terminations have been trending upwards, as evidenced by data from the PBGC on standard terminations. Research participants agreed that full plan terminations are on the rise, and they expect this trend to continue. Multiple insurers and consultants noted that a significantly greater portion of their case load is due to plan terminations—for some more than 50 percent of total cases.

This outcome is to be expected in a mature market. As many plan sponsors have completed some of the initial, simpler, PRT transactions, they may be coming back to the market to complete more complex ones such as plan terminations, and the demand for such transactions is expected to increase. It was expected that while there was a brief slowdown due to COVID-19 in 2020, that demand for plan terminations should recover in both the short-term and long-term.

Some additional highlights from the paper include:

- A framework is provided to help plan sponsors determine de-risking readiness.

- Recent market drivers such as tax changes, PBGC premium increases and market volatility as a result of COVID-19 are discussed. The paper focuses on how and why the PRT market reacted the way that it did to each of these factors.

- A discussion of partial risk transfer data provided by the PBGC for 2015–2018 through their report, “Analysis of Single-Employer Pension Plan Partial Risk Transfers.”

- A forward-looking perspective on where the PRT market may be trending such as an increase in full plan terminations.

In addition to the study summarized in this article, readers will also find interesting a related SOA study published earlier this year, “De-risking Strategies of Defined Benefit Plans: Empirical Evidence from the United States.” This study evaluates a variety of defined benefit retirement plan de-risking activities for U.S.-based companies and assesses the relative impact of these strategies. It is focused on a data-based approach including using machine learning and other advanced statistical techniques. It makes an excellent companion for those looking to explore this topic with a further technical perspective.

Special thanks to the oversight group members recruited for this effort for their expert guidance in completion of the report: Gavin Benjamin, David R. Cantor, Edson Edwards, Kim Gordon, Cynthia Levering, Larry Pollack, Robert Reitano, Lisa Schilling, Barbara Scott, Faisal Siddiqi, Steven Siegel and Mary Stone. Their thoughtful feedback throughout the course of the work was invaluable.

We would encourage you to read the full report and contact the SOA with any thoughts you might have for future efforts in this area.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the newsletter editors, or the respective authors’ employers.

Tim Geddes, FSA, EA, MAAA, is a managing director at Deloitte Consulting LLP. He can be contacted at tgeddes@deloitte.com.

Jason Gratson, ASA, EA, MAAA, is senior manager at Deloitte Consulting LLP. He can be contacted at jgratson@deloitte.com.

Ivana Curguz, ASA, EA, is a specialist master at Deloitte Consulting LLP. She can be contacted at icurguz@deloitte.com.