Many Hands Make Light Work: Interviews With Former SmallCo Section Chairs, Part II

By Michelle Grusenmeyer

Small Talk, December 2020

Editor’s note: This is the second of a two-part series of interviews with former SmallCo section chairs exploring their tenures, the future and final thoughts. Find Part I in the September 2020 issue of Small Talk.

In part I of this series, I mentioned I got the idea for this story during the evening reception of the Society of Actuaries (SOA) Leadership Orientation Meeting in November 2019. So much has changed in the world since that night, it is hard to believe it was just a year ago. While attending this year's Virtual SOA Leadership Orientation Meeting, I couldn't help but think back to that night when we were able to gather in the SOA offices in person. That is where I reconnected with past SmallCo section chairs Jerry Enoch and Don Walker who both introduced me to Sharon Giffen, another past chair. Thank you to the three of them as well as Mark Rowley for allowing me to share their stories. As in-coming SmallCo section chair, I appreciate the time they spent with me and the advice they gave.

WHAT ARE YOU MOST PROUD OF DURING YOUR TENURE ON THE COUNCIL/AS SECTION CHAIR?

Sharon told me she is proud of turning the corner on webcasts. She shared, "We were a little afraid because we didn't really know too much about what it would take, the work it would take to set up and if we would actually benefit or not." Sharon can't remember if she was vice chair or chair the year the section broke through in getting a little more modern. SmallCo had great monthly call attendance and enrollment as a section, but those things had already been good. Sharon said, "It was nice to start something new."

Mark is proud of all the ways SmallCo serves the profession, specifically small companies, with webinars, content, newsletter articles, meetings and podcasts. Mark shared a specific example of this work. He said, "When interest rates first tanked in 2008, we did some good work to do some research on the impact of low interest rates." This topic was important to all companies, not just small ones, so SmallCo really made a contribution to the industry by sharing their research. "SmallCo has also had benefits to me personally," Mark said. “It helped me do my job better and helped me serve my company better. I got involved in projects that did all of those things."

Don shared that when the SOA started allowing webinars, the section could generate revenue and were able to use it for research. Don is proud he was part of this. He said, “Mark, Jerry, Terry Long, Sharon all wrote articles for SmallCo on valuation challenges. We did more pushing for research on interest rates than anyone. We sponsored the interest-rate generator and got a research project together to dig into low interest rates. I think we had one of greatest councils and greatest leaders ever."

One year, Don was asked to write about his most interesting experience at an SOA meeting. Don wrote about a Valuation Actuary Symposium in Washington, D.C., when the SOA president led the attendees in the actuarial cheer. Later, none of the staff members remembered that, but this became a touchstone for small company actuaries. During that year's planning meeting in Chicago, Megan Weber handed out T-shirts with the actuarial cheer on the back. At the next section chair meeting, Don and Mark were asked to do the cheer. They wore their shirts and taught everyone the cheer. Don said they had a very good group back in those days. Don was nice enough to send me the cheer to share with you:

e to the x dx dy

radical transcendental pi

cosine secant tangent sine

3.14159

2.71828

Actuaries, actuaries, we are Great,

yay, Actuaries!

For Jerry’s proudest moment, he said, “I am most proud of the overall change that occurred in the council, from being one that felt powerless to a group that felt very much empowered and capable of working together to address problems." During the face-to-face meeting when Jerry was incoming chairperson, he led the council in a SWOT analysis to see who we are and see what motivates us. The group listed their strengths, weaknesses, opportunities and threats. The council was a bit surprised at the number of strengths identified in the discussion, and this exercise boosted morale, enthusiasm and a desire to utilize those strengths to get things done. The group referred back to this list for the next few years. The group worked together, and what happened could not have been anticipated.

"For a ‘Chairperson's Corner,’" Jerry said, "I wrote about a blue sky session held at a face-to-face meeting. During that meeting, Mark Rowley, who was new to the council, asked if the purpose of the council was to collect and disseminate information to the members. The group agreed with the statement and looked up the official purpose." They learned that the statement was consistent with SmallCo's official purpose, and the council kept that statement in front of them. They decided to pick a topic that met this goal, get a group of people together and see if they could fulfill this mission with one topic first. The low interest rate environment was their first topic. Jerry said, "It was easy to recruit a team to work on this. The team formed from council members and friends of the council, had monthly calls, gathered a lot of information and put out a number of publications. Our work was referenced by a number of other sections. We had no expiration date on the project, had great success and set the precedent for how SmallCo would address other issues in the future." He added, "SmallCo's teams have been one of the most fun parts of being a part of SmallCo." Jerry stressed that the low interest rate team, among other teams, as well as the webcasts, came from developing a different mindset.

SOA Editor’s note: The following background includes additional developments that occurred subsequent to the chairperson interviews. [Given the decline in SOA members who belonged to ANY of the 20 sections from 70 percent of SOA members in 2008 to 41 percent of SOA members in 2020, SOA leadership requested a review and creation of a new concept that has broad appeal to all members; especially SOA young professionals. A concept was developed, and a pilot of the concept will be conducted in late 2021 for one year, after which time the concept will be assessed and a recommendation of the pilot’s outcome will be considered by the SOA Board of Directors in late 2022. The new concept has a place for each section to continue to provide the great content they have been producing. All sections will continue as they are now until the conclusion of the pilot and an assessment of the pilot’s success.]

WHAT IS YOUR OPINION ABOUT THE NEED FOR A GROUP LIKE SMALLCO GOING FORWARD?

Mark said, “There is a huge need if you care about small insurance companies." He noted that a pretty low percentage of actuaries work for small companies. Much of the content that the SOA puts out is aimed at the larger company actuary because most members work for large companies. Mark explained, "Being a small company actuary is a big challenge because there are unique challenges for small company actuaries. Over time, SmallCo has helped fill the void by speaking specifically to the small company actuary." Mark believes, "SmallCo would be missed if it ceased to exist because the group has done some tremendous work with the content we have provided."

"There is a strong need for a group like SmallCo,” Jerry said, “both for the members and the SOA at large. Small company actuaries are different than the vast majority of actuaries. Most actuaries work in large companies and specialize in one thing. Small company actuaries are expected to have a broader range of knowledge and work with people at all levels of the company." He added, "Small company actuaries tend to be a little more action-oriented and take risks. As long as there are actuaries like that, they need a group that they can associate with, develop rapport with, commiserate with and discuss their own unique problems." Jerry also believes it is important for the SOA to be influenced by people with this kind of a mindset. "We talk about diversity. Diversity includes the kind of role a person has within an organization, and small company actuaries are a group that helps diversity to flourish." Jerry thinks SmallCo can fit naturally under the Life Community in the proposal he's seen.

Don was passionate when he shared his opinion and stated, “I have lots of friends in the Financial Reporting and Product Development sections, but these sections do not take a small company perspective. They focus on accounting systems that small companies don't even use. They don't write articles about the things that small companies do!" Don believes, "SmallCo needs a voice. The power of being on SmallCo is that you finally get contacts that understand your issues."

According to Sharon, "I feel I significantly benefited from this group. Whether this form or a different form, this group is still needed. Small company actuaries will get together somehow and I will strongly support that." Sharon feels that small company actuaries are not pigeon-holed by line of business or expertise, but they have shared experiences. She said, "There is value to a group like SmallCo, and I can't imagine we will not find a way to go forward."

IS THERE ANYTHING ELSE YOU WANT TO SHARE WITH ME ABOUT SMALLCO?

Jerry shared, "There is one important thing about SmallCo, and it’s that it is people having fun working together addressing issues. A lot of relationships have been formed and strengthened in this group. All of this camaraderie should continue in some shape, form or fashion going forward."

"In fall 2009, we were deep in recession," Don remembered. "The SOA asked me if I would go to Washington, D.C., to talk about qualifications with the [American Academy of Actuaries]." The SOA was considering bringing on property and casualty actuaries, and the academy was concerned about actuaries working outside of their practice area. The SOA looked to small company actuaries to share their experiences in having to do it all. Don said, "I joined a couple of other small company actuaries to talk to the academy about being a jack of all trades in our roles."

Mark said, "It has been a lot of fun!" Through his involvement with SmallCo, Mark has had a great experience and made great friendships. He counts his involvement as a win. Mark gave a recent example of where things all came together. He said, "I coordinated the Illustration Actuary webcast earlier this year because I wanted to learn more about the topic. I recruited people that knew a lot more about the topic than I did." Mark stressed that you don't have to be an expert to coordinate a webinar or meeting session. Mark also emphasized the importance of repurposing content to reach more people. From the Illustration Actuary webinar content, Mark is also writing an article for Small Talk and developing SmallCo's first vodcast (video-cast).

Sharon reiterated, "Networking is incredibly important to actuaries, and it is a thing that we generally collectively don't like to do." She advised, "Whether it is a local club or with the SOA, get involved. If it is tied to a topic, it makes it easier to get involved." When Sharon was on the section council, it never would have occurred to her to run for the SOA Board of Directors (she ran for, and was elected to, the SOA Board last year). The connections she made back then contributed later to giving her confidence that she knows how to run a meeting and get people to volunteer for things. Sharon believes that being involved with something as a volunteer is a really valuable grounding.

THANK YOU

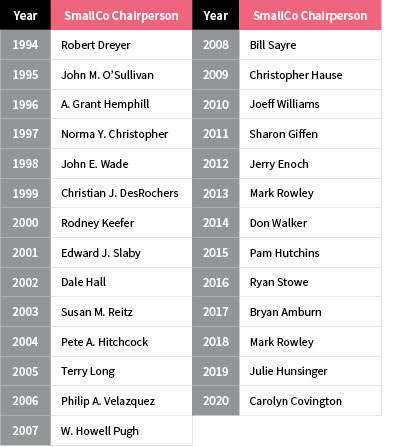

I had no idea when I recruited this group to be interviewed that they had all served on the council together. While all but one of this group are now retired, all four remain active volunteers with the SOA. I believe if you look over the list of former section chairs in Table 1, you will see several familiar names, including SOA staff and SOA board members (former and current). I am proud to be a part of this group with such a rich history and that continues to play an important role in the industry. I want to thank all the SmallCo volunteers that have laid the foundation for the good work that has been done and continues to this day and beyond.

Table 1

Past SmallCo Section Chairs

Michelle Grusenmeyer, FSA, MAAA, is vice president and senior client manager at Swiss Re. She can be reached at Michelle_Grusenmeyer@swissre.com.