Updated Life Expectancy and Distribution Period Tables: Final Regulations Issued for Determining Required Minimum Distributions

By Yaohua (Aria) Zhou

TAXING TIMES, August 2021

On Nov. 12, 2020, the Treasury Department and the Internal Revenue Service (“IRS”) published final regulations in the Federal Register[1]that updated the life expectancy and distribution period tables used for determining required minimum distributions (“RMDs”) from qualified trusts under Internal Revenue Code §401(a)(9). These regulations are also applicable to individual retirement accounts and annuities (§408(a) and §408(b)) and eligible deferred compensation plans (§457), as well as annuity contracts, custodial accounts and retirement income accounts (§403(a) and §403(b)).

The updated RMD tables (the Single Life Table, Uniform Lifetime Table, and Joint and Last Survivor Table) are set forth in Treasury Regulation §1.401(a)(9)-9 to reflect longer life expectancies than former tables. The tables in formerly applicable §1.401(a)(9)-9[2] were derived by applying mortality improvements through 2003 to mortality rates from the Annuity 2000 (“A2000”) Basic Table, and the rates of mortality improvement used for this purpose were the ones that were used to project mortality rates from the 1983 Individual Annuity Mortality Basic Table to those in the A2000 Basic Table. The life expectancy tables in the final regulations were derived by applying mortality improvements through 2022 to the mortality rates from the experience tables used to develop the 2012 Individual Annuity Mortality (“2012 IAM”) Basic Table and the rates of mortality improvement used for this purpose are the ones from the Mortality Improvement Scale MP-2018. The new tables are effective for distribution calendar years, as defined under §1.401(a)(9)-5, Q&A-1(b), beginning on or after Jan. 1, 2022.

Development of the Final Regulations

- Executive Order 13847[3] was signed on Aug. 31, 2018. It directed the Secretary of the Treasury to examine the life expectancy and distribution period tables in the regulations on RMDs from retirement plans to determine whether they should be updated to reflect current mortality data and whether such updates should be made annually or on another periodic basis. As a result of this review, the Treasury Department and the IRS determined that those tables should be updated to reflect current life expectancies.[4]

- On Nov. 8, 2019, the Treasury Department and the IRS published the notice of proposed rulemaking (“NPRM”) that sets forth proposed regulations[5] updating the life expectancy and distribution period tables in the regulations under §401(a)(9).

- Comments on the proposed regulations were submitted within 60 days after the NPRM was published, and a public hearing on the proposed regulation was held on Jan. 13, 2020.

- After consideration of the comments, the proposed regulations were adopted as revised in the final regulations published on Nov. 12, 2020.

Application of Mortality Improvement in Deriving Life Expectancy and Distribution Period Tables

Comment letters from two industry trade groups recommended that the final regulations should provide life expectancy and distribution period tables developed based on the mortality rates set forth in the 2012 Individual Annuity Reserve (“2012 IAR”) Table. The Treasury Department and the IRS reviewed the underlying data and methodology used to develop the mortality tables reflected in formerly applicable §1.401(a)(9)-9, as well as the 2012 IAM Table and the 2012 IAR Table, and did not adopt the comment. The Treasury Department and the IRS determined that using a table based on the mortality experience of purchasers of individual annuities for purposes of determining RMDs already applies longer life expectancies than expected for the general population. The Treasury Department and the IRS also concluded that mortality rates that are derived from the 2012 IAM Basic Table more accurately reflect empirical life expectancy data, and that using the 2012 IAR Table, which provides a margin for conservatism for establishing life insurance company reserves, is not appropriate.

Life Expectancy and Distribution Period Tables Update Frequency

Commenters also recommended to update the life expectancy tables regularly, with suggestions that ranged from four to ten years. Some commenters recommended to update the life expectancy tables no more frequently than every ten years to strike an appropriate balance between the benefit of providing updated tables and the administrative burden of frequent updates. The final regulations do not provide for automatic updates to the life expectancy and distribution period tables. The Treasury Department and the IRS currently anticipate that they will review the tables at the earlier of: (1) ten years or (2) whenever a new study of individual annuity mortality experience is published.

Effective Date

The NPRM provided that the updated RMD mortality tables would apply for distribution calendar years beginning on or after Jan. 1, 2021. Several commenters requested that the effective date of the final regulations be delayed to 2022 to allow administrators sufficient additional time to update systems for these regulations, as plan sponsors and IRA providers were also working to update their systems for changes made to §401(a)(9) by the Setting Every Community Up for Retirement Enhancement (“SECURE”) Act of 2019.[6] The Treasury Department and the IRS adopted the comment and extended the effective date to Jan. 1, 2022.

Transition Rule for Post-Death Distribution Periods

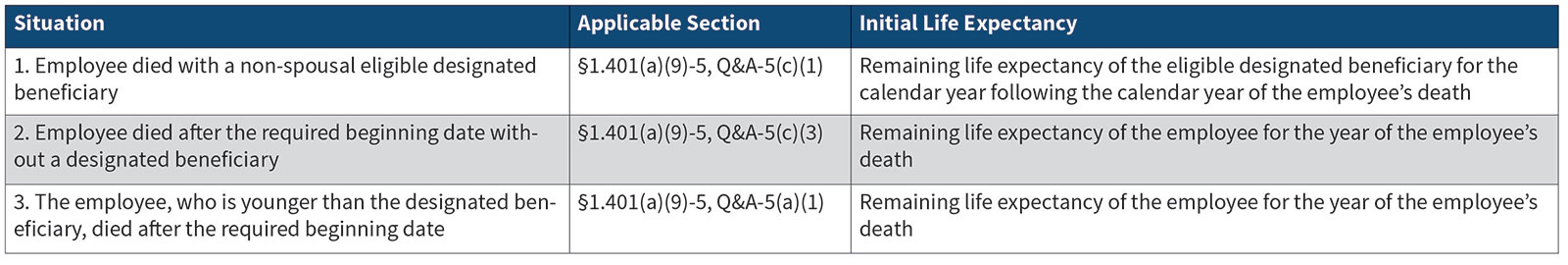

The final regulations retain the transition rule that applies in the situation where RMDs commencing prior to Jan. 1, 2022 (instead of 2021 in the NPRM) are determined based on a life expectancy that is not permitted to be recalculated under §1.401(a)(9)-5, Q&A-5(c). The transition rule provides that if an employee died before Jan. 1, 2022, the initial life expectancy used to determine the distribution period, as defined under §1.401(a)(9)-5, Q&A-4(a), is reset by using the new Single Life Table for the age of the relevant individual in the calendar year for which life expectancy was set under §1.401(a)(9)-5, Q&A-5(c). For distribution calendar years beginning on or after Jan. 1, 2022, the distribution period is determined by reducing that initial life expectancy by one for each year subsequent to the year for which it was initially set, except as provided under §401(a)(9)(H). The transition rule could apply in three situations:

Minimum Income Threshold Test (MITT)

RMD regulations require commercial annuities to pass MITT if they provide certain types of payments (or the possibility of payments) that are characterized as “increasing” under §1.401(a)(9)-6, Q&A-14(a) and (c). Commenters requested that the regulations permit the updated Uniform Lifetime Table to be used in applying MITT, subject to a 5 percent cap on scheduled benefit increases, to eliminate a significant barrier to life annuities imposed by the current MITT rules. These comments were not adopted in the final regulations because the changes were determined to be beyond the scope of the final regulations.[7]

Coordination with SECURE Act

The SECURE Act made fundamental changes to RMDs required to be made after Dec. 31, 2019, including two significant changes to §401(a)(9):

- The required beginning date was changed to Ma 1 of the year following the year the employee or IRA owner attains age 72 (previously age 70½).

- The RMD rules that apply after the death of an employee or IRA owner in the case of an eligible retirement plan described in §402(c)(8)(B) that is not a defined benefit plan were changed.

The Treasury Department and IRS expect to update the regulations under §401(a)(9) made by the SECURE Act, including new section §401(a)(9)(H). The life expectancy tables in formerly applicable §1.401(a)(9)-9 are still used in several numerical examples in §1.401(a)(9)-6 as of the time this article was written. It is expected that the examples will be updated as part of the broader update of the regulations under §401(a)(9) to address the SECURE Act.

SEPP Exception, Rev. Rul. 2002-62 and Notice 2004-15

§72(t) imposes a 10 percent additional tax on early distributions from qualified retirement plans under §401(a) or §403(a), annuity contracts and other arrangements under §403(b), and individual retirement arrangements under §408(a) or §408(b). §72(t)(2)(A)(iv) provides an exception from the additional tax for distributions that are part of a series of substantially equal periodic payments (not less frequently than annually) made for the life (or life expectancy) of the employee or the joint lives (or joint life expectancies) of the employee and designated beneficiary (the “SEPP exception”). Rev. Rul. 2002-62[8] provides that life expectancy tables set forth in §1.401(a)(9)-9 may be used for purposes of determining payments that satisfy the SEPP exception, using 3 methods (the RMD method, fixed amortization method, and fixed annuitization method). Notice 2004-15[9]provides that the guidance in Rev. Rul. 2002-62 may also be applied to non-qualified annuities, which are subject to a parallel SEPP exception under §72(q)(2)(D).

The preamble to the proposed regulations provided that if a taxpayer commenced receiving SEPP distributions before Jan. 1, 2021 using the RMD method, then the application of the updated RMD mortality tables will not be treated as a modification of the payments that would trigger a recapture of the additional tax with interest. The preamble also stated that the fixed amortization method and fixed annuitization method can be applied using the updated RMD mortality tables if a taxpayer commences receiving substantially equal periodic payments on or after Jan. 1, 2021. However, these provisions were removed from the preamble to the final regulations.

In addition, the preamble to the proposed regulations did not address whether payments commencing before Jan. 1, 2021 using the fixed amortization method or fixed annuitization method can be redetermined after that date using the updated RMD mortality tables. Also, the proposed regulations did not indicate whether the updated RMD mortality tables can be applied for purposes of satisfying the SEPP exception for non-qualified contracts under §72(q)(2)(D) similar to how they can be applied under §72(t)(2)(A)(iv). The final regulations do not address these issues either. However, the Treasury Department and the IRS anticipate issuing guidance that would update Rev. Rul. 2002-62. It would be helpful if there is also an update to Notice 2004-15 to clarify the application of the updated RMD mortality tables to non-qualified annuities under §72(q)(2)(D).

Next Steps

As the effective date of Jan. 1, 2022 approaches, having a system completely built and operational to apply accurate RMD calculations at the beginning of January 2022 is critical to financial institutions to provide accurate information to customers wishing to take RMDs. In addition to implementing the updated RMD tables, financial institutions should also pay attention to the transition rule under §1.401(a)(9)-9(f)(2) to make sure the initial life expectancy is reset at the appropriate time and rate.

Communications regularly sent to participants and IRA owners for illustration may also need to be updated to explain the new distribution tables, similar to communications sent to explain the SECURE Act changes. Financial institutions also need to be prepared to answer questions once communications start.

Financial institutions will also want to monitor future updates to be issued by the Treasury Department and the IRS, including any updates to Rev. Rul. 2002-62 and Notice 2004-15, and future Treasury Regulations relevant to the SECURE Act.

RMDs are regularly included in annuity pricing and corporate projection models, as well as some valuation models. Actuaries should consider implementing the new RMD tables into respective pricing, projection, and valuation models where appropriate to reflect updated partial withdrawal cash flows.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or Symetra Life Insurance Company.

Yaohua (Aria) Zhou, ASA, CERA, MAAA, is tax actuary at Symetra Life Insurance Company and may be reached at aria.zhou@symetra.com.

Endnotes

[1] 85 Fed. Reg. 72472 (Nov. 12, 2020)

[2] 67 Fed. Reg. 18988 (Apr. 17, 2002)

[3] 83 Fed. Reg. 45321 (Sept. 6, 2018)

[4] 85 Fed. Reg. 72472 (Nov. 12, 2020), at 72474

[5] Fed. Reg. 60812 (Nov. 8, 2019)

[6] Pub. L. 116-94

[7] The Securing a Strong Retirement Act of 2021 (H.R. 2954) and the Retirement Security and Savings Act of 2021 (S. 1770), both introduced in May 2021, would provide relief from certain aspects of MITT and make it easier to use commercial annuities to satisfy RMDs.

[8] 2002-2 C.B. 710

[9] 2004-9 I.R.B. 526