T3: TAXING TIMES TIDBITS

TAXING TIMES, June 2022

IRS Tweaks Automatic Procedure for Changes in Basis of Computing Reserves under Section 807(f)

By Art Schneider and Mark Smith

Early this year, the IRS released Revenue Procedure 2022-14,[1] providing an updated comprehensive list of changes in accounting method to which the automatic consent procedures of Rev. Proc. 2015-13 apply. The new guidance includes expected revisions to the procedure for changes in basis of computing reserves under Internal Revenue Code section 807(f).[2]

Background

The Tax Cuts and Jobs Act of 2017[3] modified the treatment of a change in basis of computing life insurance reserves. In response, the IRS issued Rev. Proc. 2019-10,[4] which added such changes to the list of accounting method changes for which the IRS grants automatic consent. The IRS later included the provisions of Rev. Proc. 2019-10, with modest changes, in the next "mass automatic" revenue procedure that it published.[5]

The most recent revisions to the procedures for automatic changes in basis of computing reserves have been expected since 2020. Specifically, the preamble to final regulations under section 807[6] stated that the IRS would revise section 26.04 of Rev. Proc. 2019-43:

- To require netting of the section 481(a) adjustments[7] at the level of each item referred to in section 807(c), so there is a single section 481(a) adjustment for each of the items referred to in section 807(c); and

- To clarify the manner in which nonlife insurance companies implement changes in basis of computing life insurance reserves.

The Revisions

The first revision—regarding the number of section 481(a) adjustments—is reflected in section 26.04(2)(b)(ii) of Rev. Proc. 2022-14. The corresponding provision of Rev. Proc. 2019-43 referred to multiple changes “for the same type of contract,” and provided for a separate section 481(a) adjustment “for each type of contract.” Rev. Proc. 2022-14 uses similar language, but deletes the phrase “for the same type of contract” and changes “for each type of contract” to “for each item referred to in § 807(c).”

This change may affect the section 481(a) adjustment period if there are multiple changes in basis in a single taxable year. Assume, for example, that during 2022 a life insurance company makes two changes in basis of computing life insurance reserves described in section 807(c)(1)—one for universal life (UL) insurance contracts and another for annuity contracts. Assume further that the UL change in basis produces a positive section 481(a) adjustment of $100, and the annuity change in basis results in a negative adjustment of ($120). Under Rev. Proc. 2019-43, the $100 positive adjustment would have been included in income ratably over the four-year period 2022–2025, and the ($120) negative adjustment would have been deductible entirely in 2022. Under Rev. Proc. 2022-14, however, the net negative adjustment of ($20) is taken into account entirely in 2022.

The second revision—concerning changes by nonlife insurance companies—involves multiple changes in the language of section 26.04, but no change in substance. Consistent with the preamble to the final section 807 regulations, Rev. Proc. 2022-14 clarifies that, for purposes of implementing a change in basis by a nonlife insurance company:

- For the year of change, life insurance reserves at the end of the year of change with respect to contracts issued before the year of change are determined on the old basis.

- For the year following the year of change, life insurance reserves at the end of the previous year with respect to contracts issued before the year of change are determined on the new basis.

- Life insurance reserves attributable to contracts issued during the year of change and thereafter are computed on the new basis.

To effect these changes:

- The general rule of section 26.04(2)(a) regarding the manner of making the change in basis is modified to provide separately (i) for life insurance companies and (ii) for nonlife insurance companies.

- Two examples set forth in section 26.04(2)(iv) illustrate separately a change by a life insurance company and a change by a nonlife insurance company.

Both before and after TCJA, section 807(f)(2) requires acceleration of section 807(f) adjustments if a company taxed as a life insurance company no longer is taxed as such, and section 26.04 of Rev. Proc. 2019-43 incorporated this rule. Section 1.807-4(b)(2), part of the final regulations under section 807 issued in October 2020, provides that if a taxpayer that was taxed as either a life company or a nonlife company no longer is taxed as an insurance company (either life or nonlife), then any balance of section 481(a) adjustments for a change in basis of computing reserves is accelerated into the last insurance company taxable year. The balance of such section 481(a) adjustments is not accelerated if an insurance company merely changes tax status from a life to a nonlife insurance company, or vice versa. Section 26.04(2)(b)(iii) of Rev. Proc. 2022-14 incorporates this rule.

Effective Date

In general, Rev. Proc. 2022-14 is effective for a Form 3115 filed on or after Jan. 31, 2022 for a year of change ending on or after May 31, 2021. Because most insurance companies are calendar-year taxpayers, Rev. Proc. 2022-14 generally applies for 2021 changes in basis of computing reserves. However, if before Jan. 31, 2022, a taxpayer properly filed with the IRS in Ogden, Utah, the duplicate copy of Form 3115 required by Rev. Proc. 2015-13 (the so-called Ogden copy), but has not yet filed a timely tax return for the year of change, the taxpayer may implement the change under the terms of either Rev. Proc. 2019-43 or Rev. Proc. 2022-14. Although not likely to be a common occurrence, this transition rule could be of interest to companies that prefer the narrower netting rule set forth in Rev. Proc. 2019-43 for multiple section 481(a) adjustments for changes in basis.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers or clients. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors.

Art Schneider is a consultant for the ACLI. He formerly was chief tax officer at Transamerica Corporation. He can be contacted at artschneider7661@gmail.com.

Mark Smith is a managing director in PwC’s Washington National Tax Services. He can be contacted at mark.s.smith@pwc.com.

Endnotes

[1] 2022-7 I.R.B. 502.

[2] Section 807(f) applies if the basis for determining a reserve item referred to in section 807(c) as of the close of a taxable year (new basis) differs from the basis for such determination as of the close of the preceding taxable year (old basis).

[3] More precisely, § 13513(a) of P.L. 115-97, enacted Dec. 22, 2017 (“An act to provide for reconciliation to titles II and V of the concurrent resolution on the budget for fiscal year 2018”), hereinafter referred to as TCJA.

[4] 2019-2 I.R.B. 296. For prior coverage,

see Flum, Sheryl B., Matthew T. Jones and Robert S. Nelson. 2019. Rev. Proc. 2019-10: New Guidance on Changes in the Basis of Determining Life Insurance Reserves. TAXING TIMES, Vol. 15, Iss. 2: 22.

[5] Rev. Proc. 2019-43, 2019-48 I.R.B. 1107, section 26.04.

[6] Treasury Decision 9911, 85 Fed. Reg. 64386, 64388 (Oct. 13, 2020).

[7] Section 481(a) requires an adjustment in order to prevent the duplication or omission of amounts when there is a change in method of accounting. Section 807(f) requires a section 481(a) adjustment upon a change in basis of computing section 807(c) reserves on contracts issued before the year of change. The amount of adjustment is equal to the difference, at the close of the year of change, between the reserves computed on the old basis and the reserves determined on the new basis.

Life Insurance Companies Included in a Consolidated Federal Income Tax Return May Make a One-time Election for Foreign Tax Credit Purposes under Section 818(f)

By Surjya Mitra, Chris Riffle and Preston Pope

Section 818(f) of the Internal Revenue Code requires that a life insurance company determine its foreign source income for purposes of the foreign tax credit limitation by allocating certain items (policyholder dividends, reserve increases and decreases, and death benefits) ratably across all of the company’s gross income, both investment and underwriting. However, the statute does not address the application of section 818(f) when a life insurance company joins in the filing of a consolidated federal income tax return.

U.S. tax rules generally allow affiliated companies held by a common parent to file a consolidated federal income tax return. Life insurance companies that are part of an affiliated group that includes non-life or non-insurance companies may elect to file a life-nonlife consolidated federal income tax return.[1] However, the life and nonlife members of the group are considered part of separate life and nonlife subgroups to manage certain limitations, such as the use of losses generated in the nonlife subgroup against the income of the life subgroup. This is in contrast to generally-applicable consolidated return principles which largely take a single-entity approach.

On Jan. 4, 2022, Treasury issued final foreign tax credit (FTC) regulations[2] including a provision permitting a consolidated return group which includes a life subgroup to make an election with respect to expense apportionment methodology under section 818(f). While the final regulations require section 818(f) expenses to be allocated as if the life subgroup were a single corporation, a one-time election is allowed for use of a separate entity method (i.e., to allocate the items solely to the entity with the relevant items). Domestic life companies that are included in a consolidated return should determine if the election is beneficial to them. The election may be of special importance to life insurance companies with foreign branches.

Detailed Background

Generally, U.S. domestic companies are taxed on their worldwide income. The comprehensive scope of U.S. taxation of worldwide income raises the prospect of income being subject to income taxation both in the United States and in a foreign jurisdiction. To mitigate double taxation, taxpayers are permitted an FTC against U.S. tax for certain foreign taxes paid.

The FTC may offset only the U.S. income tax payable on net foreign-source income. Foreign-source income is a net income concept requiring a taxpayer to determine gross foreign-source income[3] and related deductions.[4] For expenses that are clearly linked to the generation of specific income, determining related deductions is relatively simple. However, other expenses, such as interest expense, are treated as fungible and must be allocated and apportioned between U.S.- and foreign-source income solely for FTC limitation purposes.

An insurance company typically has two major sources of gross income: premium income and investment income. Premium income from life and annuity business is sourced based on the residency of the persons whose lives are insured. Investment income, such as interest and dividends, generally is sourced based on the residency of the payor of the interest and dividends.

As noted above, income taxes are paid on net income, determined by reducing gross income by allowable deductions. In general, deductions are first specifically allocated to an item or class of gross income, and then apportioned amongst all items of gross income. However, section 818(f), provides that the deductions for policyholder dividends, increases in reserves and claims and death benefits are treated as items which cannot definitely be allocated to an item or class of gross income—and therefore must be ratably apportioned. The legislative history of section 818(f) suggests that Congress believed that certain insurance related deductions generally bear the same relationship to gross premium income as they bear to gross investment income, and that these deductions generally bear the same relationship to gross U.S.-source income as they bear to gross foreign source income. Accordingly, Congress believed that these deductions generally should reduce U.S.-source gross income and foreign-source gross income ratably in calculating the foreign tax credit limitation.[5] Similarly, Congress believed that reserve decreases generally should produce U.S.-source gross income and foreign-source gross income ratably.[6]

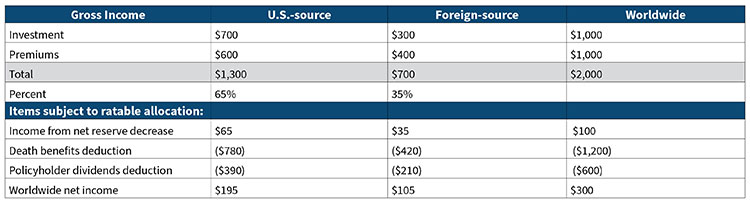

The expense allocation can be illustrated by an example that is included in the legislative history of the provision:

Example

A life insurance company has $2,100 of gross income from all sources (including $100 of income from a net reserve deduction) and $1,800 of expenses (consisting of a death benefits deduction of $1,200 and a policyholder dividends deduction of $600):

Expense Allocation and Apportionment to Affiliated Groups

Even after expenses under section 818(f) are identified, issues may arise as to the allocation and apportionment of section 818(f) expenses if the life insurance company is affiliated with other life companies filing a consolidated federal income tax return.

Section 864(e)(6) provides rules for apportioning expenses between members of an affiliated group when such expenses are "not directly allocable or apportioned to any specific income producing activity." For purposes of allocating these expenses, members of an affiliated group are treated as if they are a single corporation.[7] Therefore generally only expenses meeting the section 864(e)(6) definition would be allocated on a consolidated basis and, correspondingly, any expenses that do not meet this definition would be allocated by applying the general entity level rules of Treas. Reg. §1.861-8. As section 818(f) provides that policyholder dividends, reserve increases and decreases, and death benefits are treated as items which cannot definitely be allocated to an item or class of gross income, it raised the question how the general rule in section 864(e)(6) should be applied to these expenses in a consolidated context. This question is answered by the final FTC regulations.

One-time Election

The final FTC regulations require section 818(f) items to be allocated as if all members of a life subgroup were a single corporation. However, a one-time election is allowed for consolidated groups to use a separate entity method (i.e., to allocate to the entity that generated the relevant items). This election applies to taxable years beginning on or after Dec. 28, 2021, is binding on all members of the consolidated group, and can be revoked only with IRS consent.

This election may be impactful in some cases. Accordingly, domestic life companies that are included in a consolidated return, and particularly those with foreign branch operations, should determine whether the one-time election would be beneficial under their specific set of facts.

The views expressed herein are solely those of the authors and do not necessarily reflect those of PwC. All errors and views are those of the authors and should not be ascribed to PwC, the Society of Actuaries, the editors, or any other person.

Surjya Mitra is a managing director in PwC’s Washington National Tax Services. He can be reached at surjya.mitra@pwc.com.

Chris Riffle is a director in PwC’s New York International Tax Services. He can be reached at christopher.d.riffle@pwc.com.

Preston Pope is a director in PwC’s New York International Tax Services. He can be reached at preston.t.pope@pwc.com.