A Fresh Look at IRC Section 7702: From a Technology Perspective

By Sheryl Flum, Alex Zaidlin and Drew Caulk

Taxing Times, March 2022

Recent developments in automation capability have opened the door to improvements in the way that companies are able to monitor compliance with Internal Revenue Code (IRC) Section 7702. Further automation of Section 7702 testing allows for less input, more policy testing, and significant reductions in manual processes and risks associated with them. As technology has improved, and computing power become virtually limitless, the insurance industry can take advantage of these new technologies to improve and enhance their 7702 capabilities. The result can be an easier, faster and more comprehensive processes that will be more scalable across products.

Insurance companies are required to monitor policies for compliance with either the Guideline Premium Test (GPT) or Cash Value Accumulation Test (CVAT). These methods take in a variety of inputs and carry out a significant number of actuarial projections and supplemental calculations to assess compliance of policies with Section 7702. Since the guidance was originally issued in the early 1980s, many systems and tools were developed at that time to assure compliance. Some examples of the types of tools currently in use today include:

- Legacy administrative systems, some still functioning in mainframe environments, that process policies and monitor compliance for policies that are being sold and administered;

- Supplemental tools or systems that can be employed to audit in-force blocks for compliance, many of these using algorithms written in Cobol and APL; and

- Spreadsheet tools that can be used to validate coding that is being developed or altered.

Improvements in technology can provide newer, more powerful tools to aid in this process, promote transparency in how the computations are performed, accelerate processes and calculations, and aid policy owners in managing their policy.

This article is written in the context of Section 7702 compliance, but the same principles discussed herein can also be applied to Section 7702A compliance.

Background

Section 7702 was added to the Internal Revenue Code in 1984[1] to further a process begun in 1982 to differentiate life insurance contracts from investment contracts for federal tax purposes. Life insurance death benefits are exempt from tax pursuant to section 101(a). Additionally, “inside build-up on a life insurance contract” is not taxed until realized. If the contract is held until the death of the insured person, the inside build-up is included as part of the death benefit and is excluded from gross income. Previously, almost any contract labeled “life insurance” produced tax-exempt death benefits and tax-deferred inside build-up. Some contracts, however, had significant investment features. Tax-exempt death benefits and tax-deferred (or, in some cases, tax-free) inside build-up were supposed to encourage individuals to purchase life insurance to support their families after death. These attributes were not intended to provide tax benefits where a contract functions principally as a financial investment rather than as insurance.[2]

There are two actuarially based tests in Section 7702: the cash value accumulation test (CVAT) and the guideline premium and cash value corridor test (GPT). A contract must pass one of these tests to qualify as life insurance for federal tax purposes. In addition, a contract must be considered a life insurance contract under the applicable law.[3] Applicable law generally refers to laws in the issuing jurisdiction that relate to life insurance.

In very general terms, the CVAT requires that, under the terms of the contract, the cash surrender value of a contract, at all times, must not exceed the “net single premium which would have to be paid at such time to fund future benefits under the contract.”[4]

Section 7702 requires that for the GPT the “the sum of the premiums paid under such contract does not at any time exceed the guideline premium limitation as of such time.”[5] This generally is the greater of the guideline single premium (GSP) or the sum of the guideline level premiums (GLP) to date. At a high level, this means that a policyholder cannot pay premiums that are greater than the amount necessary to fund future benefits. Also, the GPT requires compliance with the Section 7702(d) minimum death benefit requirement, where the death benefit under the contract may not be less than a specified multiple of the cash surrender value. This prescribes that cash value “any time is not less than the applicable percentage of the cash surrender value” and then provides the applicable ages and percentages.[6]

If a contract fails to pass the CVAT or the GPT but is otherwise a life insurance contract under applicable law, Section 7702(g) provides that the income on the contract “shall be treated as ordinary income received or accrued by the policyholder” during such tax year.[7] Pursuant to section 7702(g)(B), the income on the contract that must be recognized as taxable income for the tax year is the sum of the increase in net surrender value for the contract for the tax year and the cost of life insurance protection provided in the tax year over the premiums paid during the tax year. A death benefit received under a contract that is life insurance under applicable law, but fails both the CVAT and the GPT, will be tax exempt under 101(a) for the portion of the death benefit that exceeds the net surrender value.[8]

Periodic Review of Compliance with Section 7702 Testing

As originally enacted, determinations of net single premiums and guideline premiums under the CVAT and GPT, respectively, were based on the greater of fixed floor interest rates or any higher interest rate guarantees. More specifically, the prescribed fixed floors were 4 percent for CVAT and Guideline Level Premium (GLP) calculations and 6 percent for Guideline Single Premium (GSP) calculations. These rates could not be changed even if market interest rates are significantly higher or lower.

In December of 2020, as part of the Taxpayer Certainty and Disaster Tax Relief Act of 2020 (TCDTRA) as included in the Consolidated Appropriations Act, 2021, Congress amended Section 7702 to update the required interest rates. Starting with life insurance contracts issued in 2021, the prior floor rates of 4 percent and 6 percent interest rates are reduced to 2 percent and 4 percent, respectively. For contracts issued in 2022 and later, the interest rates will float with the market interest rates based on a prescribed methodology, but not to exceed the prior fixed floor rates.[9]

The implications of the 2020 legislative changes to Section 7702 offer an opportunity to review and update existing systems used to monitor compliance with the CVAT and GPT. Further, over the last two decades there has been an increasing migration of insurance business through mergers and acquisitions (M&A). Such M&A activity typically includes a review to validate the CVAT and GPT testing of acquired contracts based on the existing Section 7702 calculations.

The testing and auditing process can be complicated. Systems are set up, tested, and maintained by insurers to monitor 7702 compliance. Improvements and changes to those systems are typically triggered by an event such as compliance audits or M&A due diligence processes. Vendors provide compliance testing for 7702 within their systems. However, updates and enhancements to systems can be a difficult process, perhaps due to the specialized knowledge inherent in tax compliance and the significant upfront investment by the vendor. Mergers and acquisitions in recent years drove some of the modernization of compliance assessment systems as new owners required independent compliance testing.

Insurance companies have largely grown their compliance systems for 7702 internally, often using consultants and legal counsel to guide them. Further, the development of these systems reflects the technology of the time. Depending on what constraints the system may have, insurers may be required to perform additional tasks outside of the system to ensure compliance. Over time, as technology has improved, these constraints have become less cumbersome. As a result, there is not a uniform system-provided software available to insurers. Each insurer’s system will adapt to the software that they have.

Tax calculations and monitoring is a complex process. Creating such systems requires careful validation, often done by persons using separate tools such as spreadsheets with integrated macros. The ability to use such tools for auditing compliance can become a cumbersome process requiring a stream of inputs, projections and adjustments. Changes to policyholder tax calculations, such as changes to the underlying mortality and interest rates require insurers to update these systems.

Technological Improvements to 7702 Compliance Testing

As technology continues to evolve, insurers are increasingly turning to additional solutions that can optimize actuarial and other previously spreadsheet-based or even manual processes. Low-code/no-code applications have emerged in multiple areas of the technological enterprise, from front-office customer management tools to back-office data management and reporting, and they allow business units to develop and automate business processes without reliance on IT, complex database structures or having knowledge of programming languages. Low-code/no-code applications include automation tools, data transformation platforms and process orchestration applications that allow the user to build a sequence of pre-defined, yet customizable, events to streamline and automate processes. The intuitive technical design of these application allows for business units to streamline and automate their processes in a step-by-step manner with built-in decision trees and escalation procedures, similarly to how a human brain would structure a sequence of events. While the initial setup requires detailed knowledge of the process and detailed testing of the routines, maintenance of low-code/no-code applications is relatively marginal, as a result of dynamic nature and scalability of these tools. There are numerous advantages to these new low-code/no-code applications: they can take full advantage of the available computing power, are much more scalable and dynamic in managing data and working with databases, offer customizable structuring of routines and calculations, and handle large quantities of complex algorithms in an extremely efficient manner.

As for application of these tools to compliance testing—once a certain compliance testing routine is defined and tested, the same routine can be easily scaled up and repeated for virtually an infinite number of policies while summarizing testing results in a consumable graphical dashboard. Controls can be embedded within the routine to confirm that the routine executes as intended. The benefits of low-code/no-code applications are best illustrated through live demonstration or specific examples. The remainder of this article focuses on an example of Section 7702 compliance assessment on a small sample of insurance policies.

To illustrate the benefits of low-code/no-code technology for Section 7702 compliance testing, suppose an insurer purchased a book of business consisting of 33 policies—a small sample of policies for the purpose of this example. As previously noted, it is common practice for a prospective purchaser to perform a review of Section 7702 compliance as part of its due diligence efforts. If this review indicates material failures, the potential purchaser will no doubt perform additional due diligence to determine the cost of bringing the policies into compliance.[10]

If a review of in-force policies is performed relying on commonly used technology, for each policy an insurer would use a spreadsheet or other legacy system-based calculator that might require manual loadings of premium cash flows, anticipated cash values, risk charges, mortality and lapse assumptions, interest rates consistent with Section 7702 rules, as well as any rider information needed to reflect qualified additional benefits. Macros would be needed to calculate guideline premiums and cash values. If contracts are found that fail to comply, an entirely separate process would be required to validate the failure.

An alternative low-code/no-code application, however, can load in all policies simultaneously directly from the insurer’s database within seconds. These applications load all the data from the source into the computer or server memory, creating a dynamic dataset, therefore not having to retrieve each individual value from the input source for each calculation. All first-principles assumptions, premium cash flows and other supplemental information required for projections and calculations are loaded at the same time into the memory. A sequential analysis of each policy can be performed and aggregated, and the results tabulated into a dashboard reflecting a summary of policy information and test results (see Table 1).

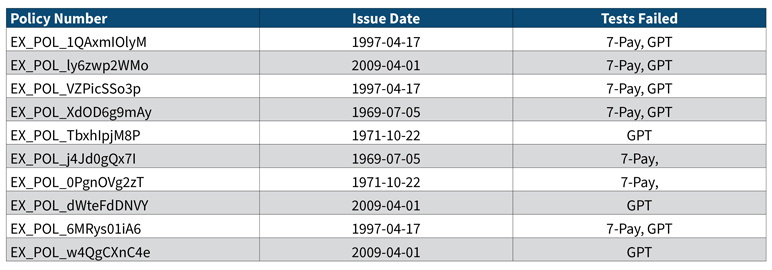

Table 1

7702 & 7702A Multi-Policy Compliance Results

Run Date: 2022-02-09 11:45:39

# of Records Evaluated: 33

Valuation Date: 2020-09-01

Failed Policies

10 policies failed a 7702 or 7702A test.

Policies that do not pass one of the tests are flagged as potentially failed and would require further investigation. Patterns and trends in potentially failed policies can be identified to analyze what issues arose to trigger the failure including possible indications of systematic or other issues with certain blocks of business.

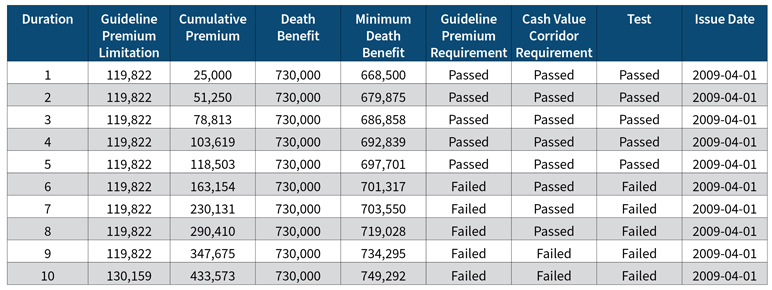

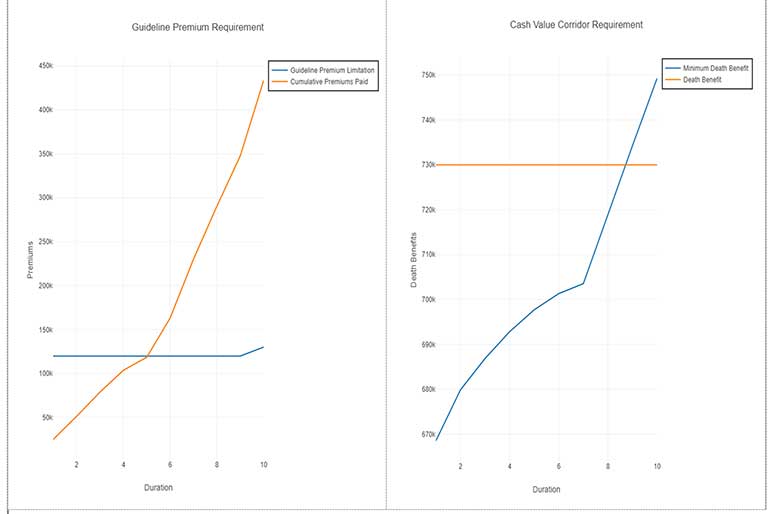

Within the same workflow, the amounts needed to remediate any potentially failing policies into compliance could be calculated, along with the corresponding tax toll charges and other costs adjustments to the current date. Such a dashboard can rapidly drill down into individual policies, displaying granular information such as the date of failure, amount of failure, and visual clues to understand the noncompliance more thoroughly (see Figure 1).

Figure 1

Guideline Premium/Cash Value Corridor Test Results

This policy failed the Guideline Premium/Cash Value Corridor Test at duration 6.

The cumulative premium paid was greater than the guideline premium limitation.

All of these calculations for this sample of 33 policies block take less than a minute to calculate and display. Results can be then communicated to management via graphical dashboards, summary grids or dynamic text in an email. Such rapid results are a notable improvement in Section 7702 compliance testing and offer a holistic view of a block with little adjustment required, providing insurers an unprecedented view into their books of business. Additionally, these tools can be triggered to run “in the background,” without human intervention on a routine basis—every time a policy extract listing is downloaded, for example. Therefore, human effort can be redirected away from tuning inputs and into understanding results, and noncompliance risk can be mitigated through the reviewing and understanding the transparent exhibits of results.

The illustration above is an example of tools becoming more commonplace in the life insurance market as a response to the evolving technological landscape that requires enabling greater transparency and information about 7702 compliance. The improvements that are possible with modern technology can assist insurers in monitoring compliance of their business with Section 7702.

The information in this article is not intended to be “written advice concerning one or more Federal tax matters” subject to the requirements of section 10.37(a)(2) of Treasury Department Circular 230. The information contained herein is of a general nature and based on authorities that are subject to change. Applicability of the information to specific situations should be determined through consultation with your tax adviser. This article represents the views of the authors only and does not necessarily represent the views or professional advice of KPMG LLP.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

Sheryl Flum is a Managing Director in the Financial Institutions and Products group of the Washington National Tax practice of KPMG LLP. She can be reached at sflum@KPMG.com.

Alex Zaidlin, FSA, MAAA is a Managing Director of KPMG LLP. He can be reached at azaidlin@KPMG.com.

Drew Caulk, ASA, is an Associate in the Actuarial Services practice of KPMG LLP. He can be reached at dcaulk@kpmg.com.