Majority of Latin American Consumers Worry About Financial Security in Retirement Yet Only 20% Have Done Any Planning

New study by Secure Retirement Institute and Society of Actuaries examines Latin American consumer attitudes and behavior about retirement security.

WINDSOR, Conn. and Schaumburg, Ill., Feb. 20, 2020—A new study conducted by Secure Retirement Institute® (SRITM) and the Society of Actuaries (SOA) finds 64% of Latin American adults expect to have significant gap in their retirement funds when they turn 60, and 52% don’t believe the income from their government-funded pension (Social Security) and their employer-sponsored pension will cover basic living expenses.

Retirement planning activities are low

The study finds almost half of Latin American consumers consider it their responsibility to plan retirement and do not want to depend on the government or family members. Yet 55% of Latin America adults do not work with a financial professional to help them with their households’ financial decisions. Researchers also found only 20% of adults in Latin America have undertaken at least one activity with regard to retirement planning and just under a third (30%) have a formal written plan to manage income, assets, and expenses during retirement.

“Prior SRI (formerly known as LIMRA SRI) research has shown that formal retirement planning is a key indicator of retirement readiness and leads to greater confidence in one’s financial security in retirement,” said Alison Salka, Ph.D., senior vice president and director of LIMRA’s research program. “This study uncovers there is an opportunity for financial services firms to reach these consumers through their employers. More than 7 in 10 say they would like their employer to provide more comprehensive information and advice on saving and retirement planning. Financial services companies can partner with employers to offer retirement savings information and planning services.”

Managing Health Care Costs Top Retirement Concerns

The study shows 83% of consumers in Latin America are worried about being able to pay for health care costs not covered by a supplemental health plan when they are in retirement. They are equally concerned about the cost of managing a chronic illness draining their life’s savings.

“Along with concerns about paying for health care costs, 8 in 10 Latin Americans worry about their governments reducing social pension benefits and health care benefits. More three-quarters of Latin American adults say they will rely on income from government-sponsored social pension programs for their retirement income,” said R. Dale Hall, FSA, CERA, MAAA, SOA managing director of research. “However, with the projected number of Latin Americans over age 60 expected to double by 20501, there is significant threat to the viability of the government pensions.”

Interest in Guaranteed Income Products

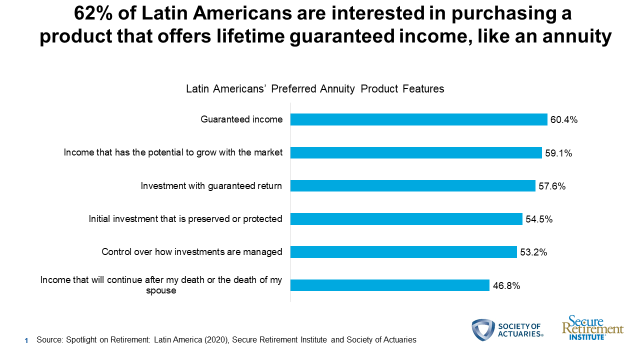

One way to mitigate longevity risk is through lifetime guaranteed income products. Similar to the LIMRA-SOA retirement study in Asia, the majority Latin Americans (62%) express interest in buying a financial product that would provide a guaranteed lifetime income, like an annuity. Younger Latin American workers showed a greater interest for an option to receive a guaranteed annuity or income that has the potential to grow with the market.

Approximately 60% of Latin Americans say the two most important features when purchasing an insurance product to generate income, regardless of cost, were guaranteed income and the potential for investment growth. A product that protects their initial investment or adjusts for inflation were also highly rated (chart).

SRI and the SOA conducted a survey of more than 6,000 consumers ages 30-75, across six markets in Latin America to examine the current state and future opportunity of the retirement market in Latin America.