New Report Examines How Actuaries Can Survive and Thrive in the InsurTech Age

By Carrie Kelley and Kiki Wang

Expanding Horizons, August 2021

InsurTech has been expanding rapidly in the life space over the past few years. However, far from being just a recent buzzword, it has a long history rooted in FinTech.

Our recently published Society of Actuaries (SOA) report, InsurTech: A Guide for the Actuarial Community, discusses the history and current landscape of InsurTech.[1] The report has a two-fold mission: (1) to provide a primer on InsurTech for the actuarial community and (2) to provide insights into how actuaries fit into the InsurTech space.

One of the challenges we faced in writing the report was determining how to define InsurTech. Eventually, we chose the following:

InsurTech is the use of emerging hardware, software and user interfaces to address inefficiencies or opportunities in the insurance value chain. It often involves technology, data and analytics. It targets the evolution/disruption of (a) the interaction between insurers and their customers, (b) the automation of processes, and (c) the modification of old/creation of new insurance products.

This definition is intentionally very broad. It can include start-ups that one might typically associate with InsurTech, but it also includes incumbents, such as traditional insurance companies or technology vendors that might not typically be thought of in this context.

While, for the purpose of our report, we had to place some boundaries around the areas of focus, it is important to recognize that InsurTech touches the industry in many ways. It is technology-driven innovation wherever people are coming to the table with open minds on how to use technology to address challenges and/or explore new markets.

A Framework for Finding Out More

The purpose of the primer section of the report is to provide a framework for how to think about and explore InsurTech. We hope that actuaries will explore the pieces of the broad InsurTech landscape that interest them.

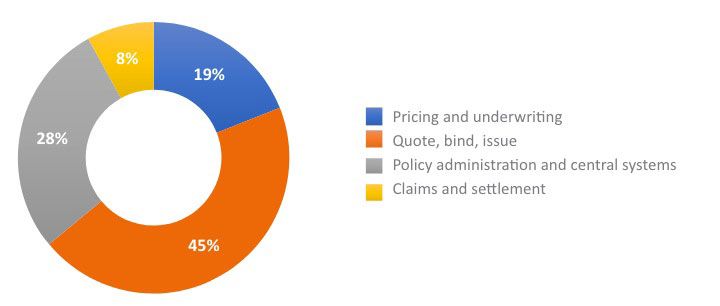

One method for helping review and understand InsurTech is to think about it based on various value chain propositions, as we did for our report. This creates a framework for trying to understand where an InsurTech proposition adds value. We attempted to break down the InsurTech companies according to this framework, as shown in Figure 1, but often companies may touch multiple areas of the value chain.

Figure 1

Breakdown of InsurTech’s Area of Focus in the Value Chain

Simplifying the Insurtech space in this way does not fully capture some of the more interesting conversations we’ve had with InsurTech practitioners. Such companies are envisioning completely new ways of tailoring existing products and launching new ones that fall outside of these tidy checkboxes.

Another way in which to view and categorize InsurTech is by the technology being used. The broad range of technologies employed in InsurTech include:

- Data, analytics and artificial intelligence (AI)

- Connected devices, IoT (Internet of Things)

- Digital and virtual customer engagement

- Enterprise, cyber and security

These technologies are used in a number of creative ways to improve the way insurance operates across the value chain previously discussed. More details and examples of their use can be found in our report.

Though the primer section goes into much more detail than this article, it is not and cannot be a comprehensive compendium of InsurTech. Our hope is that the primer piques your interest and provides a better foundation and vocabulary with which to further explore the InsurTech space and its relevance to your day-to-day work.

Exploring the Actuary’s Role in InsurTech

Our report also aims to demystify the opportunities available for actuaries in InsurTech. This is the focus of the second half of the report. As part of these sections, we interviewed 11 actuaries and nonactuaries in the InsurTech space to give their insights into the actuarial opportunities and challenges that exist. Some of them echoed the opportunities and challenges all actuaries currently face, but many were unique to the InsurTech industry.

Our conversations ranged from how actuaries can work directly in InsurTech to how actuaries in any role should be thinking about innovation and technology to keep moving the industry forward.

Some key strengths and potential avenues of development for actuaries included:

- Actuaries’ broad business understanding allows them to serve effectively in technical and nontechnical roles.

- Many interviewees felt that actuaries didn’t need to compete directly with data scientists or engineers in technical roles. Actuaries need to be adept at applying the outcome of this technical work to business problems.

- Actuaries in nontechnical roles can quickly add value to decisions from various aspects of the insurance process: claims, underwriting and marketing, as well as those linked to regulation and core actuarial concepts. This ability to see a problem from different angles is valuable in many roles.

- Finally, actuaries’ professionalism and ethics were seen as a strength by actuaries and nonactuaries alike.

While actuaries have a lot of strengths to leverage as they work in or interface with InsurTech spaces, the interviews also discussed challenges for those in the profession:

- Nonactuaries saw communication with actuaries as a current challenge. Most of the actuaries interviewed, however, believed this was an outdated stereotype.

- At its core, InsurTech is focused on innovation and, in some ways, disruption of the current industry. Actuaries have a reputation as the virtual poster children of the current industry. Nonactuaries see them as being slow to change and stuck in the current way of doing things.

- Some interviewees also did not agree with the assessment that actuaries bring a broad business skill set. They had impressions of actuaries as being narrow in scope and experience, with actuarial skills primarily being required and of relevance for setting reserves or pricing.

We also discussed with interviewees what the SOA could do to help better prepare actuaries to be involved in InsurTech and to fuel innovation. They provided insights on how we, as a profession, will need to broaden our education into other topics, including new technology, software and coding, behavioral economics and other areas that may be outside the traditional exam or continuing education milieu.

Rising to the Challenge

Overall, we learned it is up to actuaries to leverage their strengths and change perceptions in Insurtech. As InsurTech forces the industry to evolve, actuaries are at risk of losing their prominence if they do not adapt to or, better yet, embrace this change. To create opportunities, as one interviewee put it, “Actuaries need to realize that InsurTech is a good place to work, and InsurTechs need to understand they need actuaries.”

Carrie Kelley, FSA, MAAA, is the director of Willis Towers Watson. She can be reached at carrie.kelley@willistowerswatson.com.

Kiki Wang, ACAS, is a senior consultant at Willis Towers Watson. She can be reached at kiki.wang@willistowerswatson.com.