Health Care Funding Report

By Susan Mateja and Shereen Sayre

International News, January 2021

The International Actuarial Association Health Section (IAA), Society of Actuaries International Section, and American Academy of Actuaries (AAA) are pleased to present their newly published report “International Health Care Funding 2020.” We present 36 countries. The report visually illustrates health care funding from population resources through government and private financing to providers of medical services. In most illustrations this will exclude veterans’ and government workers’ plans.

The IAA, the Society of Actuaries and the American Academy of Actuaries wanted to explore the difficult challenge of providing health care. As you will see, countries have unique mixes of funding mechanisms to meet the medical needs of their citizens. The purpose is not to compare how each country performs in terms of access, quality or cost of care, but rather to educate the public and to facilitate engaging, informed conversation within one’s own nation, business, and among global citizens about financing health care with limited resources. We hope that you find this resource helpful, and welcome you to share the link with others, actuaries and non-actuaries alike.

The project will be periodically updated longitudinally as well as in scope. For those interested in joining the International Healthcare Funding Project Team, please contact Shereen Sayre (International Actuarial Association Health Section Council project lead) at sjsayre@yahoo.com, Rachel Slader (Society of Actuaries International Section Council representative) at rslader@munichre.com, or Joe Allbright (American Academy of Actuaries Health Practice International Committee representative) at joe.allbright@willistowerswatson.com. Much thanks is given in recognizing our retired lead, Susan Mateja, for her tireless effort to keep the project in focus and on time in our delivery from 2019 and into late 2020.

BACKGROUND AND DESCRIPTIONS OF SCHEMES

All nations face difficult challenges in providing health care to their people. In early winter of 2019, some members of the Society of Actuaries International Section Council, American Academy of Actuaries (AAA) Health Practice International Committee and the International Actuarial Association Health Section decided to explore how the various countries were meeting these challenges. We wanted something simple and visual and current. We wanted an international perspective, not a U.S. focused viewpoint. We decided on exploring “How is health care being financed?” Little did we know that COVID-19 would make this work even more important. The world is shrinking.

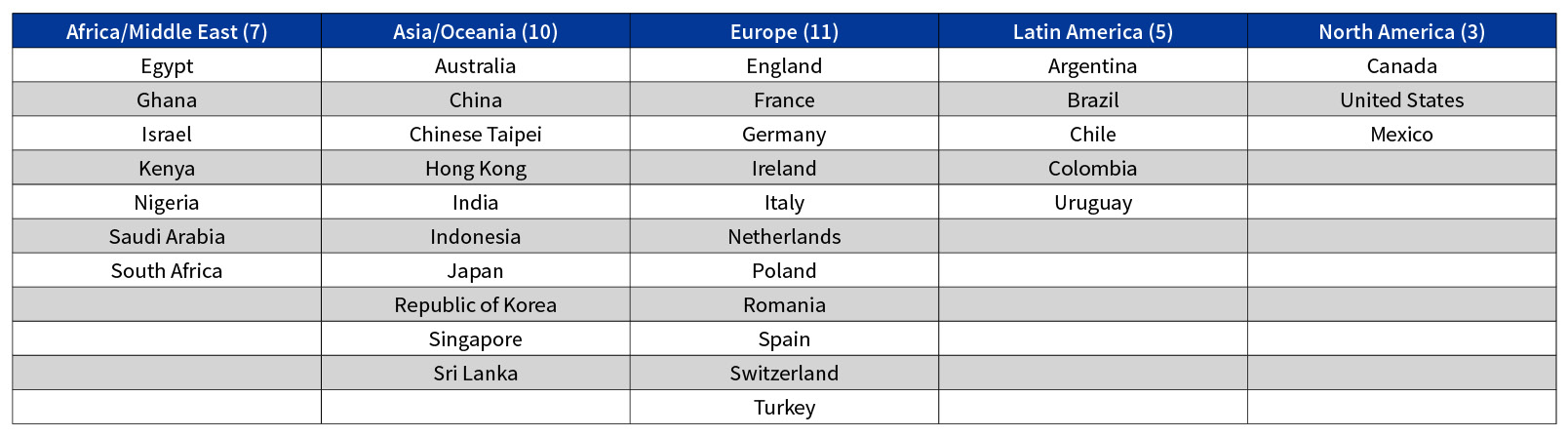

A year and half later, this endeavor resulted in an International Health Care Funding Report [1] which highlights 36 countries’ health care systems (see table 1). Health care experts were identified, and every continent is represented. This report is currently on all three organizations’ websites. This collaborative effort will continue as we learn from each other.

FUNDING CATEGORIES

We see that health care is being financed in many ways. To classify our systems, we chose the health accounting framework used by WHO (World Health Organization) & OECD (Organization for Economic Co-operation and Development). It is important to understand that all countries have their own unique mix of these schemes. None are “pure.”

Our first category is Compulsory/Government schemes.

- With government schemes, health care is predominantly paid for through general taxes and all citizens and residents are usually covered. Australia incorporates this type of scheme.

- Compulsory health insurance schemes include social health insurance (SHI) and mandatory private health insurance.

- Social health insurance raises its revenues from contribution payments by employees and employers, and often from transfers from the general government budget. Government units and private insurance companies may operate a social health insurance scheme at the same time. Chile illustrates SHI.

- In contrast, the Netherlands has a system of mandatory private insurance. Here compulsory private and voluntary insurance exist in parallel and follow two different types of regulation. For example, they must accept everybody under the compulsory health insurance but may apply risk related premiums and refuse individuals under the voluntary insurance.

- We also have the compulsory medical savings account (CMSA). Singapore introduced a system of medical savings accounts in 1984, called Medisave. Every employed citizen is obliged to pay 6 to 8 percent of their income, according to age, into an individual account managed by the state. Savings in the individual medical savings accounts are used to pay for hospital costs and certain selected outpatient costs.

Our second category is voluntary schemes.

This category includes all domestic pre-paid health care financing schemes where access to health services is at the discretion of the individual and authorization of the risk carrier. These schemes encompass many types of arrangements, including employer-based, government-based, community-based, enterprise-based, complementary & supplementary insurance, non-profit institutions serving households (NPISH) insurance, and health care provider schemes. Ghana’s voluntary schemes make up about 20 percent of its total health care funding.

Our third category is out-of-pocket schemes.

We can illustrate our third category, out-of-pocket (OOP) payments by looking at India. Out-of-pocket payments are defined as direct payments made by individuals to health care providers at the time of service. OOP expenditures show the direct financial burden of medical care for the household, which may have a catastrophic effect on its financial situation.

Our fourth category is the non-resident rest of the world financing schemes.

We really do not see this type of financing in the western hemisphere. The initial question is whether the scheme is based in the country or abroad. An example is a Donor Funding Program in the Fiji & Solomon Islands which is supported by Australia and NZ.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries or the respective authors’ employers.

Susan Mateja is a retired FSA with over 25 years of experience in Group Health and Life Insurance. Susan has co-authored several articles for the AAA’s Contingencies magazine, including a series of six articles, titled “International Corner.” She was a lead for the research project, International Health Care Funding Report. She has also spoken at various conferences, colloquia, and webcasts. She can be reached at susanlynnmateja@gmail.com.

Shereen Sayre is an Associate Member of the Society of Actuaries and a Member of the American Academy of Actuaries. She has worked within consulting firms on employee benefit plans, postretirement medical valuations, individual and group health and long term care as well as disability products. She was a member of the American Academy of Actuaries’ Long Term Care Principles Based Accounting work group and is currently serving within the Society of Actuaries’ Public Health Section. She is serving on the International Actuarial Association's Health Section Council and the Society of Actuaries Health Section Council with her terms ending in the fall of 2023.