The UK’s Post COVID-19 Mental Health Fallout and Implications for Insurers

By Monica Garcia

International News, July 2021

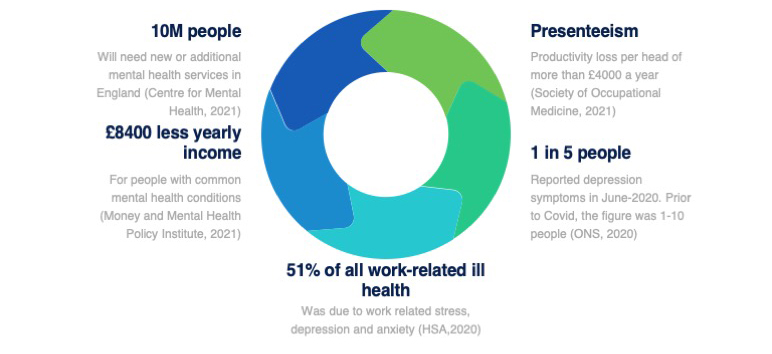

In one way or another, COVID-19 has affected everyone’s lives in the United Kingdom (UK), with increased evidence of the magnitude of the direct and indirect impacts on health and wellbeing becoming more widely available. Recently, it has been predicted that 10 million people will require new or additional mental health support services in England as a direct result of the pandemic, for the next three to five years.[1] That is almost 20 percent of the population. Unfortunately, these predictions are not surprising, given that mental ill-health prevalence was already on the increase before Covid—with the National Health Service (NHS) unable to cope with the high demand, meaning that long waiting lists for mental health support were usually the norm even before the pandemic started.[2] As in the case of other illnesses, delays in treatment often can cause a deterioration of symptoms, and as a consequence, the clinical presentation of mental health conditions might be more complex, due to the lack of early appropriate treatment.

Who is at Risk of Developing Mental Ill-Health?

Whilst for many, distress has been a reality during Covid, not everyone goes on to develop a diagnosable mental health condition. There are usually many bio-psycho-social factors at play, from individual predisposing biological, personality and coping characteristics, to factors related to the environment, including added stressors (e.g., financial pressures, and pre-existing or new ill-health). In addition, COVID-19 and the subsequent lockdowns experienced by the UK population also had a negative impact from a social support perspective. Many individuals were unable to access usual sources of practical and emotional support, which are well known buffers of stress, that help maintain psychological resilience,[3] adding further strain on everyone’s lives, but particularly affecting the most vulnerable.

Recently, modelling around population groups in the UK who are at most risk of developing mental health problems has been made available and included: individuals who survived severe COVID-19 illness, individuals working in health and care settings, those who experienced bereavement, and people who have been economically affected by the pandemic.[2] For example, we have been hearing reports of the risk of developing Post Traumatic Stress Disorder (PTSD) in frontline medical staff that have been exposed to significant emotional distress attending dying patients, whilst also reporting exhaustion due to long working shifts.[4] Although a call to action has been put forward to address the expected increase in demand of mental health services, there are concerns that not enough resources will be available.[2]

Implications for Insurers

From a disability insurance perspective, we have already seen an increase in the number of new claims for mental health as a primary cause, with a reported increase from 10 to 12 percent in 2020,[5] showing how Covid has negatively affected protection insurance customers. Mental health conditions also remain in the top three causes of Income Protection (IP) claims in the UK, together with musculoskeletal and Cancer cases. In addition, the delays reported in provision of treatment, are also likely to impact the severity of mental health symptoms, meaning that insurers might see more complex claims.

Because of the way in which the cause of claim is categorized and recorded (as a single diagnosis), current figures, do not reflect the fact that other health conditions are also likely to present with co-morbid mental ill-health. For instance, a claim for a common musculoskeletal disorder such as back pain might also have depression as a secondary diagnosis,[6] hence the prevalence of mental health conditions in disability claims might be much higher than it is currently reported.

With lifestyle related health problems increasing in the general population, it is also not uncommon to see the presence of diabetes, hypertension, heart disease, and obesity in disability claims, all of which, if not adequately managed can have an impact on activities of daily living including work. As such, the management of disability claims can be quite complex once they are admitted.

UK’s Mental Health Statistics

What Can Be Done?

From a claim management perspective, rehabilitation initiatives underpinned by vocational rehabilitation principles have become widely available within the IP market in the UK. Currently, most IP propositions have some form of early intervention rehabilitation programmes in place. Such interventions can be successful and cost-effective if appropriately implemented, particularly if done during the waiting period. Successful stories demonstrating the value of IP products beyond the financial benefit have gained traction recently, especially in a pandemic scenario where NHS pressures are so high and treatment support is subject to delays or simply not available. Common mental health conditions are a good example where insurers can put in place early support before symptoms deteriorate and other psychosocial factors kick in, such as loss of self-confidence, and even job loss, which can further perpetuate mental health symptoms and negatively impact the duration of a claim.

It is also key to ensure that claims teams are equipped with the up-to-date skills required to manage disability claims, which fall beyond technical aspects. For example, the identification of claims at risk of long-term disability, the appropriate use of rehabilitation interventions and “soft skills” to be able to engage with customers, whilst also setting up clear expectations on the management of the claim.

Moving forward, there is still a lot left to do to improve the stigmatization of mental illness. In the UK, people with mental health conditions are reported to earn £8400 less per year than the rest of the population.[7] This suggests that there is much to do in relation to workplace mental health, and although insurers can take some action to try and improve the return to health and work outcomes for protection customers, ultimately employers need to develop inclusive and supportive workplaces to enable workers fulfil their work potential and remain in work.

From an underwriting perspective, there is work being done at present to improve access to insurance, given that one in four people experience a mental health problem of some kind every year in the UK.[8] Looking at the role of psychosocial risk predictive factors will probably be an area where insurers can develop further, to reflect the current nature of disability risk.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

Monica Garcia BSc,MSc., is a psychologist and independent health and wellbeing consultant in the Life and Health Insurance industry. She can be reached at info@monicagarciaconsulting.com.