The Evolution of LTC/Life Combination Products

By Vrad Vodrazka

Product Matters!, August 2021

It is difficult to believe that long‑term care / life combination (LTC/life combo) products have been around for over 30 years. In all that time, a relatively small number of companies have braved the challenges of this product, with many preferring to stick with acceleration-only risk through chronic illness riders. Throughout the decades, various aspects of the product line have changed to address the evolving needs of the market and with the benefit of contributions from regulators, industry groups, and innovative product developers. This article delves into the more salient and contemporary developments, and provides a glimpse into potentials paths down which these products may soon be heading.

IRS Incentives

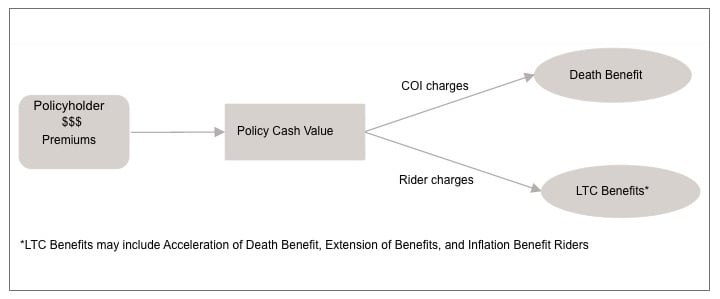

Just like any life insurance policy, death benefits paid to the beneficiary are also tax-free for LTC/Life combo products. In addition, qualified LTC benefits are tax-free up to the greater of actual expenses incurred and the HIPAA per diem limit.[1] The policy’s approach to funding LTC benefits impacts tax treatment of surrender benefits and policy premiums. Initial linked-benefit product designs (see Figure 1) funded the cash value with combined premiums. If a policyholder surrenders this type of policy, a taxable gain is created if the cash value exceeds the sum of paid premiums less cumulative LTC charges (taken out of cash value similar to COI charges).

Figure 1

Early Design

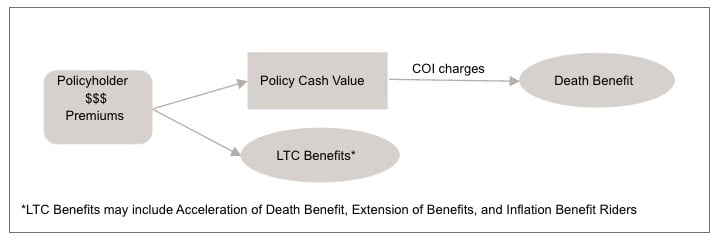

Carriers realized that charging separate premiums for each benefit (life and LTC) and having only the life insurance premiums fund the cash value minimizes the likelihood of a taxable gain upon surrender as there are no longer monthly LTC charges from the cash value to erode the cost basis (see Figure 2). A subsequent development was to recognize that LTC premiums could be funded with pre-tax money such as from an HSA[2] or deducted from taxable income,[3] which they were unable to do in the prior combined-premium design. Given the tax advantage and growing need for LTC protection, this could be an attractive option for employers to integrate into their executive benefits program.

Figure 2

Current Design

Assumptions

One can only imagine the challenge faced by the pioneer LTC/life combo actuaries in setting incidence rates and termination rates for the first combo products that entered the scene. The relentless downward trajectory of investment yields provided extra challenges for this asset intensive product. What about the key morbidity assumptions that drive product performance (incidence rates, termination rates, salvage/utilization rates)? There is a mountain of industry data for standalone LTC (SALTC), but only a tiny amount of data is available for LTC/life combo products. There are materially different behaviors witnessed with LTC/life combo policy owners relative to SALTC as the LTC/life combo owners are more likely to postpone claims to avoid reducing their cash value savings and/or the funds available to life insurance beneficiaries. Populating LTC/life combo actuarial models with SALTC experience data will likely generate conservatism and quite uncompetitive premiums. Only a few players in this space have accumulated meaningful credible data, and the rest have to make challenging judgment calls. New entrants often seek out the help of reinsurers or consultants experienced with LTC/life combo products to help them close assumption gaps and permit the pricing of sufficiently competitive and profitable products.

Underwriting

From a mortality perspective, the underwriting for LTC/Life products varies, ranging from traditional underwriting with paramed, labs, and medical records to a more modern approach applying a complete digital experience with an online e-application, an underwriting rules engine, and third party underwriting data. However, the PV of morbidity is generally more significant for these products than PV of mortality, and so underwriting innovation is weighted accordingly. Cognitive impairment claims comprise roughly a quarter of all morbidity claims (based on SALTC data), and so solid cognitive screening is imperative for ages 60+. Historically, cognitive screening tools have been conducted in person or by telephone. New AI predictive technologies claim to be very effective at assessing cognitive impairment, such as eye-tracking analysis and speech evaluation. The robust online visual comparison test is well suited for cognitive screening in an automated underwriting environment for life/LTC. In the last five years, many have incorporated third-party data with prescription history checks, historical lab data, and medical claims data, which could alert the carrier to undisclosed diagnoses, including signs of cognitive impairment. Electronic health records are available, but most carriers are waiting for data improvements and standardization for these to enhance underwriting accuracy and efficiency.

Traditional mortality products have seen companies implement wellness programs to incentivize healthy lifestyles, and the LTC/life combo products could gain traction here as well with potential improvements to both mortality and morbidity. Companies can further manage costs downward by providing resources that advise insureds on more comfortably aging-in-place to postpone facility care.

Product Features

The original products were on a universal life chassis. In today’s environment, companies are not thrilled in illustrating emaciated credited interest rates, and so they are exploring whole life and indexed UL as alternatives. The benefit of IUL is to push more of the investment risk onto the policyholder, which could be a win-win if the stock markets continue to outperform bond yields. More recently, a big market player announced a VUL platform for their combo product, which provides an even greater policyholder upside, but obviously attaches to greater volatility.

Companies have applied innovative development for inflation protection riders as customers worry about rising health care costs. IRS Code 7702B sets requirements on LTC/life combo products, one of which is the requirement to offer, at a minimum, inflation protection at five percent compounded annually. This is a very expensive option, and so companies have been experimenting with different ways to make inflation protection more affordable. Many now offer less expensive three percent compound and/or simple interest options. Some alternate inflation designs that have made their way to the market are:

- Allow electing different inflation protection for acceleration vs. extension.

- A cap on the maximum accumulated inflation percentage.

- Annual option to terminate future inflation accumulations.

- Indexed inflation growth.

One big selling point of LTC/life combo products was a guarantee that, one way or another, policyholders will get their money back, whether through death benefit, LTC benefits, or through surrender. For the latter piece, companies incorporated a return of premium (RoP) benefit for this sales pitch to work. Over time, companies realized that customers did not value the RoP benefit relative to the added expense, and so this benefit was subsequently diminished in exchange for a more affordable product.

Most of the early LTC combo business was comprised of single-pay targeted at the affluent market, and that drove very favorable mortality and morbidity experience relative to SALTC. However, the demand for continued growth led companies to offer a 5-pay option, then 10-pay, and now there are pay-to-65, pay-to-100 and lifetime-pay that make the products much more affordable, and thus reach broader markets. Companies should tread carefully as the emerging experience varies materially across these different markets.

A selling point that resonates with senior management as companies consider entering this space is the internal hedging generated from a healthy balance in mortality and morbidity benefits. However, more experienced companies have been introducing richer LTC benefits as they gain greater confidence in their morbidity assumptions. The most popular structure for distributing face amount plus LTC benefits is referred to as 2+4, which is a two-year acceleration of the face amount and an extra four years of LTC. In the a+b structure, the greater b is relative to a, the greater the PV morbidity relative to PV mortality. Additional morbidity leverage results from stronger inflation protection, and also with second-to-die joint life plans where LTC benefits are available to both insureds, but the death benefit is only paid on the second death. As morbidity leverage increases, the mortality diversification benefit becomes more diluted, and so caution is recommended for less experienced companies.

Modeling

Companies entering this space will be challenged with modeling accuracy and efficiency. The author’s employer began modeling with a combination of sophisticated Excel spreadsheets as most mainstream actuarial projection tools did not offer a LTC/life module. The company later moved the modeling to a mainstream actuarial modeling platform by developing the code, and auditing results using our previous projection tool. A subsequent leap was to use an R model to efficiently project cash flows with Monte Carlo Simulations (MCS). The move from Excel to an off-the-shelf actuarial modeling platform did not find any materially modeling deficiencies, but the move to the MCS model found meaningful discrepancies from previous simplifications. There are important considerations in tracking available benefits due to the benefit inter-dependencies. A MCS model also permits companies to look beyond the best estimate results, and analyze the plausible distribution of outcomes to capture any asymmetries, and determine if the risk profile is within a company’s risk appetite. Companies should take their time in getting the modeling right as hidden mistakes could end up being quite costly over the long run. Actuaries should review an appropriate set of sensitivities as the interdependencies of morbidity and mortality generate unique profit patterns relative to mortality-only or health-only products. Seeking a review from an experienced third party can be helpful in ensuring key complex modeling considerations have not been overlooked.

Conclusion

Innovation has been integrated within this product’s evolution since its introduction as companies are trying to fill the public’s need for life and LTC benefits, while trying to differentiate their products with unique bells and whistles. Likely, many more players will make this unique protection accessible to their distribution as surveys continue to demonstrate the market need for LTC solutions is multiples higher than the actual coverage in force, and there is a lot of appeal to the LTC/life combo products over SALTC with extra protections (rate guarantees, death benefit and access to cash value). COVID is another element that will require adaptation as we learn more about the short- and long-term ramifications. It is too early to tell how long-haul COVID will impact the financial projections of these products, but actuaries are paying close attention to the stream of knowledge that is slowly accumulating. One thing is certain, and that is the continued evolution of the product as consumer demographics change and demands arise for unique protections.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

Vrad Vodrazka, FSA, MAAA, is VP and actuary at Hannover Re. He can be reached at vrad.vodrazka@hlramerica.com.