Recent Change to IRC § 7702 Interest Rates and Impact on Life Insurance Products

By Stu Kwassman

Product Matters!, February 2021

Introduction

As most product development actuaries are well aware, IRC § 7702 sets limits on premiums, cash values and death benefits for life insurance policies in order to qualify for preferential income tax treatment. In order to qualify to meet the “Definition of Life Insurance,” a policy must pass one of two tests so that death benefits are income tax free and so that the inside build-up of cash value is not taxable. The two tests are the Cash Value Accumulation Test (CVAT) and the Guideline Premium Test (GPT). The test is selected at issue and cannot be changed.

Under IRC § 7702A, a policy must pass the 7-pay test so that it is not categorized as a Modified Endowment Contract (MEC). If a policy fails the 7-pay test and becomes a MEC, the taxation of withdrawals under the contract is similar to that of an annuity, whereby taxable gain is withdrawn before cost basis.

Both the CVAT and the computations of the guideline premiums are actuarial determinations based upon interest rate assumptions. Prior to the recent change in the 7702 interest rate, the computation of the net single premium under CVAT uses an interest rate that is the greater of an annual effective rate of 4 percent or the rate or rates guaranteed on the issuance of the contract. Computation of the guideline single premium uses an interest rate that is the greater of a 6-percent annual effective rate or the rate or rates guaranteed on the issuance of the contract. Computation of the guideline level premium is made on the same basis as that for the guideline single premium, except that the prescribed interest rate is 4 percent instead of 6 percent. These same interest rates used for CVAT and the guideline level premium are also used in section 7702A.

Reason for the Change in 7702 Interest Rates

When section 7702 was enacted in 1984, interest rates were high. It was thus reasonable to assume that policies would be credited with at least a 4-percent (or 6-percent) interest rate over the life of the policy and, therefore, consumers could adequately fund their policies. In an environment of exceptionally low interest rates, the mandatory interest rate assumptions for the CVAT and GPT made it more difficult for consumers to maintain long-term life insurance coverage. Some products likely would not be offered in the future since the prolonged historical low interest environment, together with the current health and economic crises, made it much less certain that interest could be credited over the lifetime of a newly issued policy in excess of the 4-percent minimum rate. Other products may continue to be issued with lower guarantees, but the GPT limitation on premiums in combination with low interest rates could cause the policy values to be depleted long before the death of the insured, resulting in significantly increased costs to retain the coverage at older ages.

Recent Changes to the 7702 Interest Rate Assumption

At the end of December 2020, Congress enacted the Consolidated Appropriations Act, 2021, which included revisions to Section 7702. Effective for policies issued after Dec. 31, 2020, the fixed 4-percent and 6-percent minimum annual effective rates under these tests were changed to refer to a market-based rate called the “Insurance Interest Rate” (as described below). The comparison to the rate or rates guaranteed under the contract continues to remain in effect; in addition, the 4-percent and 6-percent reference rates were retained as a cap on the Insurance Interest Rate. Thus, in determining the net single premium and guideline level premiums under section 7702, and the 7-pay premium under section 7702A, the computation reflects interest at the lesser of the Insurance Interest Rate in effect when the contract was issued, or an annual effective rate of 4 percent, but not less than the rate or rates guaranteed at issue. Similarly, in determining the guideline single premium, the computation reflects interest at the lesser of 2 percent plus the Insurance Interest Rate in effect as of the time the contract is issued, or an annual effective rate of 6 percent, but not less than the rate or rates guaranteed at issue.

The Insurance Interest Rate is equal to the lesser of two alternative rates. The first rate is the Section 7702 Valuation Interest Rate, which is the prescribed maximum valuation interest rate used for computing statutory reserves for life insurance contracts with a guarantee duration of more than 20 years, as defined in the National Association of Insurance Commissioners’ Standard Valuation Law.

The second rate is the Section 7702 Applicable Federal Interest Rate, which is the average of the applicable Federal mid-term rates (as defined in section 1274(d) but based on annual compounding) over a 60-month period, rounded to the nearest whole percentage.

Changes in Insurance Interest Rate

For contracts issued in 2021, the Insurance Interest Rate is defined as 2 percent, which is the Section 7702 Applicable Federal Interest Rate based on the 60-month period ending in December 2018. This rate is lower than the Section 7702 Valuation Interest Rate in effect for 2020, which was 3.5 percent.

After 2021, the Insurance Interest Rate is redetermined only in an Adjustment Year. An Adjustment Year is the year after a change in the valuation interest rate. The Section 7702 Valuation Interest Rate is determined as that in effect for the calendar year prior to the Adjustment Year, whereas the Section 7702 Applicable Federal Interest Rate is determined with respect to the 60-month period ending 24 months before the start of the Adjustment Year.

Since any change in the valuation interest rate is known six months before it becomes effective, insurers will have 18 months advance notice of an upcoming Adjustment Year. It is interesting to note that once an Adjustment Year occurs, the Insurance Interest Rate is likely to remain in effect for some time. In other words, once a 7702 rate is set in an Adjustment Year, the rate will be “sticky,” since changes to the valuation interest rate only occur on average every eight to nine years. The last four changes were 1994, 2005, 2012 and 2021. This is helpful for insurers who, given the time and effort to reprice and refile contracts, will only have to do so for a significant change in the rates.

Since 2022 will be an Adjustment Year, the Insurance Interest Rate will be redetermined for that year and will remain at 2 percent (the lesser of the Section 7702 Applicable Federal Interest Rate based on the 60 month period ending in December 2019, which is 2 percent and the Section 7702 Valuation Interest Rate in effect for 2021 which is 3 percent).

Interaction of 7702 and the Standard Nonforfeiture Law

The Standard Nonforfeiture Law defines the method and basis for calculating minimum guaranteed cash values and paid-up insurance rates. The maximum mortality table used in the calculation is the CSO table in effect when the policy was issued. The minimum interest rate used in the calculation is equal to 125 percent of the standard valuation interest rate. This rate was floored at 4 percent to align with the 4 percent minimum interest rate in 7702. A recent change was made in VM-02 of the valuation manual so that this floor was modified (in case the 7702 rate was amended, which it eventually was) to remove the reference to the hard-coded 4 percent minimum rate and instead refer to the 7702 interest rate. With the minimum 7702 interest rate dropping to 2 percent, the maximum standard nonforfeiture interest rate is 3.75 percent (125 percent of the current valuation interest rate of 3 percent). For calendar year 2021, the minimum rate will reduce to 2 percent, while the maximum rate will remain at 4.50 percent (SNFL rate for 2021, since such rate would change one year after the effective date change of the SVL rate). The allowable interest rates for calendar year 2022 will be a minimum of 2 percent (i.e., 7702 interest rate) and a maximum rate of 3.75 percent (SNFL rate). Companies have until Jan. 1, 2022 to comply with the new lower standard nonforfeiture interest rate.

MEC 7-Pay Test

In order to pass the 7-pay test and remain a non-MEC, cumulative premiums paid cannot exceed cumulative 7-pay premiums during the 7-pay period. The 7-pay premium is a level premium paid for seven years to endow the policy at maturity, calculated at guaranteed mortality (2017 CSO) and guaranteed interest. The guaranteed interest rate is now the higher of 2 percent or the rate guaranteed in the contract. Seven-pay periods are the first seven years from issue, or the seven years following a material change (e.g., face amount increase). MECs are generally avoided to provide policyowners with the option of accessing the cash value if a need arises. As one would suspect, with the increase in the 7702 limits the MEC limits have also risen. However, the general rule that a policy can’t be paid up before 7-level premiums still applies.

Cash Value Accumulation Test

CVAT sets a cap on cash values relative to the death benefit. A Net Single Premium (NSP) is calculated at guaranteed mortality (2017 CSO) and guaranteed interest. The policy cash value cannot exceed the NSP multiplied by the policy’s Death Benefit. A lower CVAT interest rate would result in higher NSPs, thus higher allowable cash values, and a lower net amount at risk. Whole Life policies always use the CVAT to qualify as life insurance.

For Whole Life, a lower 7702 interest rate would result in:

- Higher guaranteed cash values;

- higher premiums to support those cash values;

- lower Net Amount at Risk (less mortality risk);

- pemiums and Dividends applied to buy paid-up adds would purchase less death benefit; and

- less risk to the company in a sustained low interest rate environment.

For flexible premium policies that utilize this test, there could be a smaller net amount at risk (i.e., smaller Death Benefit corridor) which may impact product pricing.

Lower 7702 Interest Rate—PUA Impact

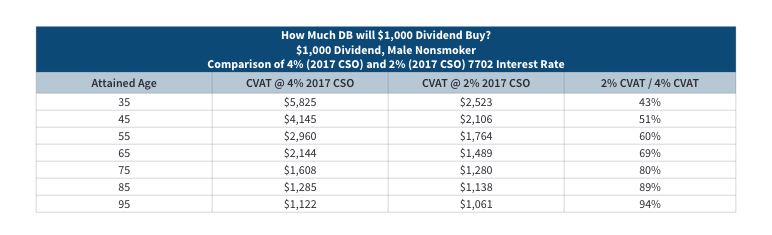

The reduction in the amount of death benefit purchased by premium or dividend is significant based upon a 2 percent 7702 Interest Rate product relative to a 4 percent 7702 Interest Rate product, as illustrated in Table 1.

Table 1

How Much DB will $1,000 Dividend Buy?

Summary of Impact on Guideline Premium Tested Policies

Effective Jan. 1, 2021, guideline level premiums will now be based upon the greater of a 2 percent rate or the guaranteed interest rate(s) of the contract, and guideline single premiums will be based upon the greater of 4 percent or the guaranteed interest rate(s) of the contract, and MEC Premiums will use the same rate(s) as that used in calculating the guideline level premium.

There are no changes to the cash value corridor factors, so the cash value to death benefit relationship remains the same. With the higher premium limits this corridor limit has the potential to come into play more often.

In summary, this will be a very busy year for life pricing actuaries, especially those who work on whole life insurance products. It will be even busier than 2018 and 2019 when we were all working on repricing to reflect a revised CSO table. Happy Modeling. Enjoy!

I would like to especially thank the ACLI for some of the technical information contained in this article.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries or the respective authors’ employers.

Stu Kwassman is life product management lead at Massachusetts Mutual Life Insurance Company. He can be reached at skwassman@massmutual.com.