SOA Research: Learnings about Financial Priorities by Race and Ethnicity of Groups with Lower Levels of Retirement Security

An Interview with Alan Newsome, FSA, MAAA, board member of the International Association of Black Actuaries

By Anna Rappaport

Retirement Section News, January 2022

Foreword

The Society of Actuaries (SOA), as part of its consumer research on retirement, financial perspectives and well-being, recently completed a survey: Financial Perspectives on Aging and Retirement Across the Generations[1] (the 2021 survey), which is an update to Financial Risk Concerns and Management Across Generations[2] (the 2018 survey). The 2018 survey focused on how Americans at all income levels across generations view retirement and a variety of financial priorities, while the 2021 survey provides further insights on the effects of COVID-19 on the generations. A separate 2021 special report, Financial Perspectives on Aging and Retirement Across the Generations: Report on Race and Ethnicity,[1] shows the results by race and ethnicity. This article focuses on the race and ethnicity results and we are very pleased to have Alan Newsome, a member of the project oversight group, present his perspective on the results, some of their implications, and his views on retirement planning and finances.

Please note that the 2021 survey results on race and ethnicity included an oversample of Black/African Americans (Black), Asian Americans (Asian) and Hispanic/Latino (Hispanic) respondents. This article will deal primarily with the findings for the Black and Hispanic respondents. These are the two groups where the situation is such that there are disparities that lead to lower levels of retirement security.

Reflections on the Survey

Anna Rappaport (AR): In your view, what are some of the most important findings of the 2021 survey?

Alan Newsome (AN): The overall population can be broken into three groups that we can label the “financially fragile,” the “economically secure,” and the “middle income.” The 2021 survey and a plethora of research by the SOA and others tell very different stories for each group.

The financially fragile generally have low incomes, many have crippling debt, practically no savings, and in some cases, food and/or housing insecurity. As day-to-day survival requires significant focus, retirement planning is low priority. This group was represented by 24 percent of the overall survey group in 2021, up from 21 percent in 2018. This compares to Pew Research grouping showing 29 percent of Americans in the low-income tier in 2018.

In contrast, the economically secure have higher incomes, own homes, and have amassed significant financial assets. While these individuals still have some areas to improve in retirement planning, they are highly likely to retire comfortably. This group was represented by 45 percent of the overall survey group in 2021, down from 51 percent in 2018. This compares to Pew Research grouping showing 19 percent of Americans in the upper-income tier in 2018.[2]

The final group, which I’m calling “middle income,” is generally not saving enough for retirement, but compared with the financially fragile, may have advantages in both resources and access to savings opportunities. These advantages may enable them to capitalize on opportunities to personally improve their retirement prospects and overall financial security. This group was represented by 31 percent of the overall survey group in 2021, up from 28 percent in 2018. This compares to Pew Research grouping showing 52 percent of Americans in the middle-income tier in 2018.

AR: How do the sample groups vary by race and ethnicity?

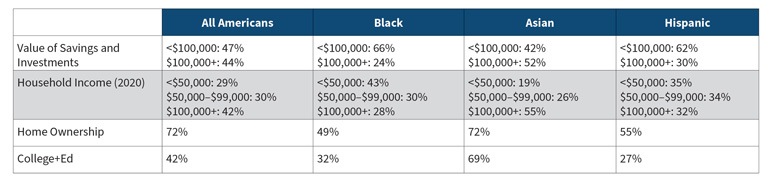

AN: The 2021 survey respondents differ in economic status, education and home ownership when separated by race. The economic status of the Asian respondents is better than the average for all respondents, which is the opposite for Black and Hispanic respondents. Overall, the Black respondents had the lowest income and assets while Hispanic respondents were hit hardest by COVID-19. (See figure 1)

Figure 1

Economic Status of 2021 Survey Respondents

Note: The values do not add to 100 percent because of “prefer not to answer” responses. Source: Financial Perspectives on Aging and Retirement Across Generations, Society of Actuaries, 2021.

AR: What are the major financial findings and issues for each race and ethnicity group?

AN: When it comes to the race/ethnicity results, Black and Hispanic Americans have more challenges than the overall population—and this study supports the overwhelming evidence of differences in starting points and outcomes associated with race/ethnicity. While this study doesn’t address the causes of these inequalities, there is ample research supporting the prevalence and impact of systemic racism today. Systemic racism has led to unequal education, wages, home ownership, home value appreciation, area of residency, employment status, treatment by the criminal justice system, morbidity, life expectancy, maternity rates, access to credit/financing, access to employer retirement plans, likelihood and size of inheritance, and so much more. All of these have led to lower earnings, assets, and opportunities for Black and Hispanic Americans.

While this article is about retirement plans and individual financial well-being, we cannot ignore how systemic racism continues to perpetuate unequal opportunity and outcomes related to financial security and retirement.

Consequently, there are significant differences in wealth and retirement preparation by racial and ethnic groups. The Survey of Consumer Finances (2019 SCF) is a major national study conducted every three years by the Federal Reserve Board.[3] The 2019 SCF discovered large disparities in wealth between white, Black and Hispanic families.[4] The SCF showed white families had the highest level of both median and mean family wealth: $188,200 and $983,400, respectively. Black and Hispanic families had considerably less wealth than white families. Black families' median and mean wealth was $24,100 and $142,500, respectively, which is less than 15 percent of the corresponding values for white families. Hispanic families' median and mean wealth was $36,100 and $165,500, respectively. Specifically related to retirement benefits and wealth, the analysis showed the wealth disparities exist throughout the life cycle:

- White families were much more likely to be homeowners at different points in the life cycle, and this is directly linked to lasting effects of residential segregation.

- White families were more likely to have individual retirement account (IRA) and defined contribution plan (DC) balances than Black and Hispanic families, but part of this is explained by higher access to employer retirement plans.

- White families were much more likely to have received an inheritance and other family support than Black and Hispanic families.

The ERISA Advisory Council testimony of Nari Rhee, Ph.D., provides additional context on how systemic and structural racism impact outcomes:

In addition to having less access to retirement benefits while employed, Black and Latino workers face a number of disadvantages that make it difficult to save for retirement. First, they consistently face higher rates of unemployment than White workers. They are also significantly disadvantaged in generational wealth, which is an important factor in wealth accumulation. Federal Reserve researchers found that White families were three times as likely as Black families and eight times as likely as Latino families to receive an inheritance. White families also received larger inheritances. They also found that the typical Black and Latino family has $2,000 or less in liquid savings, less than a quarter of the amount held by the typical White family. Limited liquid savings is an indicator of economic fragility and vulnerability to financial shocks. All of these factors constitute obstacles to saving for retirement in the context of a 401(k) plan.

Some highlights from the 2021 Generations Survey findings include:

- Black Americans have the most financial concerns, have the lowest income and savings, and are the most likely to give and receive financial support from family.

- COVID-19 had a negative financial impact on 37 percent and a positive impact on 13 percent of respondents.

- They are the least likely to work with financial professionals (but there has been an increase with younger generations).

- Debt is complicating the finances of 28 percent of them.

- About half own their home.

- Hispanic Americans were hit disproportionately hard by COVID-19.

- The impact of COVID-19 was felt hardest by older generations; 57 percent reported a negative financial impact.

- Fifty-five percent own their home.

- Debt is complicating the finances of 43 percent of them.

AR: Did any of the findings surprise you? Which ones and why?

AN: From a social standpoint, Black, Hispanic, and Asian Americans are more likely to both provide and receive financial support than the overall population, but they also say receiving this support is less critical than the overall population. For Black Americans, the support is comparatively higher from the older generations to the younger while it’s the opposite for Asian and Hispanic Americans.

A notable finding is when the savings rate for Black Americans includes their community financial support, the savings rate is not dissimilar from the average savings rate—and may even by higher. This supports that the wealth and retirement preparedness gap isn’t primarily due to higher saving rates of white Americans.[5] However, this survey is consistent with other research that shows that Black and Hispanic Americans invest more conservatively than the general population.

AR: What unique challenges did you see by generations?

AN: For millennials and Gen X, there are the challenges in planning for retirement primarily with defined contribution (e.g., IRA and 401(k)-type) plans compared to the older generations, who were likely to have defined benefit plans. Millennials are faced with saving for retirement while paying down student loans, building an emergency fund, and perhaps organizing a down payment on a house. Gen X seemed to have challenges that parallel those of millennials.

The boomers and silent generations are much more likely to be retired, and they seem to have fewer challenges. Consistent with other surveys, the older generations are less concerned about a variety of risks and they seem much more secure and self-confident—but that doesn’t mean they have everything under control.

*Here’s the link to Jamal Rashid Watkins’

testimony: ACHIEVING FINANCIAL

EQUITY INRETIREMENT (dol.gov)

AR: What suggestions would you give to insurance companies based on the findings? How can insurance companies be more effective in serving each race and ethnicity market segment?

AN: A multi-faceted approach is necessary to effectively address the retirement system issues of the Black and Hispanic populations. Compared to the general population, there is less trust in financial institutions based on a long history of experiences ranging from dehumanization (as enslaved Black bodies were accepted as a form of currency), to discrimination, and recommendation of inferior products despite similar financial situations to white counterparts. Additionally, the Black and Hispanic population tend to have lower incomes than in the total population in many cases, and insurance company offerings tend to lean heavily toward wealthier customers.

Solutions should focus on the business model, product design, messaging and distribution of the products and services. To gain Black and Hispanic customers, insurance companies need appealing products that align with the needs of this population. For instance, policies that have lower face amounts should offer comparable cost and value (which is counter to how product discounts and benefits are skewed to the largest purchases or investments).

Some specific areas for consideration include:

- Reassess compensation for advisors and sales staff to adequately reward sales of high-quality products to Black, Hispanic, and lower income customers.

- Explore new product designs that allow for group benefits that are shared across a family or community (as communities of color are more likely to have communal financial networks).

AR: What suggestions would you give to retirement plan sponsors based on the findings? What might employers do to effectively serve the retirement and financial security needs for each race and ethnicity market segment?

AN: Review plan designs to encourage the prioritization of savings—both current (emergency fund, down payment, etc.) and longer-term (i.e., retirement).

- With younger generations switching jobs more frequently, consider 100 percent immediate vesting.

- Include debt management (credit cards, student loans, etc.) services in financial security benefits.

- Address overall savings with other types of benefits like matching contributions to a short-term savings fund to encourage the development of savings habits.

- Include access to savings programs to part-time employees.

- Provide access and education to do-it-yourself tools. Sources of personal financial tools include employer-sponsored employee benefits, financial services companies, financial wellness programs, the Internet, government agencies such as the Department of Labor, etc.

- Seek financial advisors and others offering counseling to employees that have demographic profiles that are compatible with their workforce and community.

- Set up lending facilities that offer a borrowing option as an alternative to withdrawing from a 401(k) and possibly paying an early withdrawal penalty.

AR: What suggestions would you give to policymakers based on the findings? What should policymakers do to ensure that the needs of each segment are served?

AN: These findings aren’t new, and the majority of the issues are structural or systemic. To resolve them, we need broader solutions that address the underlying causes. Below are a few ideas for consideration.

Improve Social Security

As current projections estimate Social Security benefits will be cut about 25 percent in about 10–12 years, we need policymakers to act as soon as possible to correct this. There are a number of options that have been explored,[6] but a few obvious ones include increasing the retirement age, reducing/eliminating benefits for the highest income individuals, and raising/eliminating the cap on income subject to the tax. In addition, policymakers should explore improving the Social Security minimum benefits.

Address and Change how the Current Retirement System and Particularly 401(k)

Plans Allocate Relatively More Benefits to Higher Income Individuals The current retirement system depends on employers to offer and support benefits. Tax law defines the types of benefits that can be offered and helps drive the distribution of benefits by economic status. The current rules, particularly for 401(k), allocate tax expenditures heavily to higher income individuals. Options should be explored to reduce the disparity in retirement benefits by income and to restructure benefits so that there is a better balance by economic status. Options to be explored should include both defined benefit, defined contribution and shared risk models. Such models may require changes in law for implementation.

Set Up Non-employer Shared Risk Plans

Studies have shown defined benefit plans provide for better account value stability and higher net returns than defined contribution plans. They also involve a substantial amount of risk to the sponsor. Shared risk models can provide risk pooling but with a better sharing of risk between stakeholders. Since many individuals are not covered by employer plans, policyholders should explore ways to make such plans available. One possible model is for individuals to select from plans and then have the employer contribute. Another possibility to explore is a statutory mandate for a minimum employer-provided benefit in addition to Social Security, and identify what types of financial institutions could offer such plans and how they could be structured to be financially viable for all stakeholders. The minimum could be set up to phase-out at higher incomes.

Compensate Caregivers With Giving Credit for Working Years for Social Security Benefit Calculation

Women are likely to work fewer years as the majority of caregiving has historically fallen on them. They should not receive lower social security checks due to leaving the workforce to care for children or elderly relatives. I suggest that years of caregiving be counted as working years for Social Security benefit calculation purposes.

Federally Funded Financial Education

Federal funding should provide for required financial education, exposing all students as early as elementary school to basic household financial concepts. Topics should include budgeting, student loans, credit, retirement planning, education financing, etc., and should be addressed long before students pick and get settled in careers. This is especially important for the financially fragile.

AR: What suggestions would you give to advisors based on the findings? How can advisors be more effective in serving each race and ethnicity group?

Recommendations for advisors are a little more challenging from a retirement perspective as the vast majority of individuals in our survey can improve retirement security by using existing retirement vehicles (i.e., increase contributions to employer plans or IRAs). Personally, I would love to see a long-term savings product with low fees closer to what’s available with a passive index fund that also provides for uncapped returns with group investment risk sharing. Another option would be a product line with a lower face amount that didn’t have correspondingly higher fees.

Additionally, the advisor space would greatly benefit from being more diverse as many advisors are older and white. To gain access and the trust of these underserved communities, advisors need to build lasting relationships, which includes having the advisor base look like the target community. If the advisors are actually fiduciaries, this would likely make this process simpler.

AR: Are there other areas where you would like to see future SOA research?

AN: The SOA should consider how to factor in current societal issues and the impact of historical practices. Solutions that ignore the cumulative impact of prior generations on current and future generations can solve only part of the problem. Such an approach to developing a solution is often referred to as root-cause problem solving. Such an approach should be considered as it relates to addressing race/ethnicity disparities in retirement planning and overall finances.

Alan Newsome, FSA, MAAA, is an actuary employed by Mass Mutual with areas of expertise including investments, risk management, and financial modeling. He is a board member of the International Association of Black Actuaries, a trustee of Lebanon Valley College, and an active volunteer for the Society of Actuaries.

Anna Rappaport, FSA, serves as chairperson of the Committee on Post-Retirement Needs and Risks. She can be reached at anna.rappaport@gmail.com.